A large number of monetary reform proposals include Full Reserve Banking. However, the Money Power will continue to control the money supply in this scheme. The problem is not credit creation, but who’s in control and what is he doing with that control. Getting rid of Usury is the main issue.

The Greenback, Social Credit, Positive Money, Austrian Economics, the Chicago Plan and undoubtedly many more propose full reserve banking. There is a general dislike of Fractional Reserve Banking. The idea is, that money through bookkeeping is unfair.

We have always believed that we borrow from savers. Because of this programming, we instinctively want to ‘repair’ the situation by making it what we always thought it was.

And this is a grave misunderstanding: the problem is not credit creation, it’s interest.

When we calculate that a mortgage at 5% over thirty years costs 150% of the principal in interest, we can easily see that this has nothing to do with ‘costs’ for the bank. Managing such a risk free loan over thirty years should never cost more than 10% of the principal.

Interest on mortgages which are created by bookkeeping are wholesale plunder. The bank doesn’t risk anything anyway, since there is the house as collateral. To say housing is under water today is not a valid argument: the banks create the boom-bust cycle themselves. Rational monetary management would not know sudden changes in prices, save for massive disaster. Only a few hundred years ago, when Usury prohibition was already on the wane, a combination of collateral and interest was unheard of. It was either the one, or the other.

But to say then, that we will solve it by ending double entry bookkeeping? Shouldn’t we just end the usury on the bookkeeping and let the credit facility take a small one off percentage as a handling fee to cover its costs?

Double entry bookkeeping knows credit and debit by nature.

The key issue to understand is that it is not the bank’s credit, it’s ours. We give each other credit. The credit is mutual. We allow each other to buy now and pay later. The bank only does the bookkeeping. In the current paradigm the bank has usurped this credit and is extorting us through interest on it.

Consider it for yourself: would you prefer to continue to pay $300k interest over a $200k mortgage to savers and a bank, or would you prefer to pay 0% interest to a credit facility?

Case closed.

The Money Power is comfortable with Full Reserve Banking

Of course the right to create credit must be taken away from the Money Power and its banks. We cannot allow them continued control, even without Usury. They’d continue to boom/bust the hell out of us.

That’s another problem with Full Reserve Banking: it’s still, well, banking. We need to get rid of banking altogether. This in itself is an important point. No real monetary reform is thinkable while leaving the Banks alive: a vampire will not lose its tricks. It was bred to suck blood. It will always look to reassert domination.

This problem shows also with Full Reserve Banking: the banks would regain full control over the entire money supply in a short while.

Should we replace our current money by spending into circulation a batch of debt free money, the Money Power would quickly get a hold of a sizable chunk of that batch. Both through its own wealth and income of its Transnationals. It would then start lending this money out at interest in her banks that have switched to Full Reserve Banking. It would then continue to not spend, but lend their profit through interest back into circulation. Thus, through compound interest, the entire money supply would end up again with the Plutocracy within a few years.

The Money Power cares not whether it gets its interest through Fractional Reserve Banking or Full Reserve Banking. It cares not whether it is paid in paper or in coin.

The Money Power cares about the Trillions in interest it rakes in yearly.

Conclusion

The IMF is discussing it openly and positively. Gold based full reserve banking is the classical Austrian approach. Why? Because it is does not touch Usury.

That’s why the talking heads of the Mainstream are always talking about debt, debt, debt. They even talk about burning creditors. But never about stopping interest payments. While even Greece could pay off its entire national debt in 20 years just with what it loses to debt-service now.

Usury is the heart of the matter. Full Reserve Banking does not end it. Interest-Free Credit by bookkeeping does.

Related:

Full Reserve Banking Revisited (discussing the IMF’s paper on the Chicago plan)

The Problem is not Debt, it’s Interest (with Video)

Gary North’s Bluff: the Lie he’s been sitting on for 50 years

Debt free money alone does not solve compound interest

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Usury is the original sin in the economic sphere and the root cause of all our economic problems. It causes unfathomable suffering. It is so pervasive, so normalized, it seems unavoidable.

The truth is we have everything we need to create an interest-free money supply and eradicate usury and associated rent-seeking completely from our economic and social lives. A Usury-Free economy ends poverty and brings abundance to the many. It will save our souls in the process.

By Anthony Migchels for Henry Makow and Real Currencies

The love of money is the root of many evils. Usury is the weaponization of the love of money. It feeds the avarice of the usurer. It forces ever more debtors into ever more immoral behavior. It replaces love with commerce. It corrupts commerce, which becomes ever more exploitative to pay off ever higher interest charges. It is the foundation of rent-seeking. It rips apart the fabric of society. It makes a mockery of any kind of social contract.

It causes hunger. Bankruptcies. Intense stress in families. Weighs especially heavily on the poor and leads to all sorts of excesses at the top. Billions of people live in abject poverty all over the world because of it. Entire communities, nations are gutted to pay the interest to the opulent. Nobody counts those dying prematurely from its effects. They are billions.

The many pay to the few. The poor pay to the middle class, who pay to the rich, who pay to the opulent. Poor countries pay ten times more interest on their foreign debts than they receive development aid.

Even when not in debt, forty percent of our income is lost to interest passed on in prices by producers. The many pay anywhere between five and ten trillion per year to the wealthy. All other rents ultimately are based on cost for capital and would hardly exist without usury.

It is the ultimate centralizer of power and it is global. It has been growing for centuries at compound interest rate speed, and now it is such an incredible cancer it is ready to swallow the remains of the host it has been feeding on.

The European nations put up $4,5 Trillion in handouts, easy credit and guarantees to ‘save’ their banks and the euro. The Fed provided an unimaginable $16 trillion dollars in easy credit to its banking buddies. Much of it was never repaid. This is ‘necessary’ because without banks we would not have money. So the West put up $20 trillion to have some bits and bytes and paper and coins circulate to exchange goods and services.

Surely the end of our civilization is near, when we allow such rapacious plunder to be sold with such a stupendous lie. While we simultaneously say there is no money to save the poor from starvation and the Earth from pollution.

The whole thing is totally senseless

We think: “without interest there will be no credit! I would not lend if I didn’t get anything back.”

But the Money Power doesn’t lend anything!

Money is just bookkeeping and credit is an automatic result of double entry bookkeeping, which by its very nature knows debit and credit.

The problem is not the creation of money! Quite the opposite: it’s marvelous that we never need to have a shortage of money.

The problem is when the bookkeeper starts raping the debitor with interest for no other reason than the associated minus. And takes all this interest himself. Just for the service of bookkeeping!

We pay $300k in interest in thirty years for our $200k mortgage which was created by entering some numbers in a computer bookkeeping application!

Gold solves nothing

We don’t want to pay $300k interest in coin! We want bookkeeping at cost-price! Interest-free!

Even in ancient times Gold and Silver were circulated by private parties. This is touted as a wonderful free market operation. But who circulated the specie? Those owning the mines, of course!

They circulated the metal by lending it out at interest and manipulated the volume from day one.

Today nobody knows how much Gold there is. All the Gold mines are owned and controlled by the Money Power. Those owning the mines are the Money Power, that’s how it all started. Vast amounts of Gold are in their vaults, ready to be unleashed onto the market through usurious lending, aiming to create asset bubbles, only to stop lending a little later to create a deflationary crash when people pay off their loans.

It is exactly the same way they create the boom-bust cycle with paper based money.

Just look at what they are doing to Gold today. They have been doing this forever.

The Golden Calf is the archetypal symbol of avarice, the Money Power is unthinkable without it.

We want Interest-Free Money!

Jesus admonished us to lend freely, expecting nothing in return. The Vedas abhor usury. Moses forbade it. Half of the Q’uran is Allah threatening severe punishment for those taking Usury.

Money is bookkeeping. We don’t need interest for savers. The bank doesn’t need savers. Debit and Credit are the two sides of the coin in bookkeeping. They are automatic.

Yes, the volume must be managed, but that is unavoidable. No monetary system can exist without managing volume. The problem is not management, it is allowing vultures to do it.

The reason we have a boom-bust cycle is because we allowed private parties, banks, to manage the volume in their own interest. They set up Central Banks to create the illusion of ‘officialdom’.

Saying ‘the market must do it’ is saying the Plutocracy has been doing a good job over the last 5000 years.

We want interest-free mortgages, no income tax, no poverty. We want abundance, good will, a cultural rebirth, fairness and the end of Plutocracy.

Kill Usury!

Related:

On Interest

Budget of an Interest Slave

The Problem is not Debt, it’s Interest (with Video)

Meet the Real Deal: Michael Hoffman on ‘Usury in Christendom’

The Fight against Usury by Juri Lina

Why we need Monetary Innovation by Margrit Kennedy

A transformation of awareness of money is necessary and possible. How to get the message out there? Wayne Walton is showing the way.

When Wayne opened up to the Usury issue, he wondered why interest-free money was not yet the norm. And he came up with an answer: marketing.

To create new units and market them properly, that is his mission.

He managed to create not only his own Mountain Hours, but helped initiate a number of other similar initiatives throughout the country.

His communication is great, he’s a good orator, knows his stuff and really passionately puts forward the usury free case in a most comprehensive way.

He’s also absolutely great with videos. Here’s a very powerful one, getting right to the heart of the matter:

Walton brings people together around his themes. He seeks the common ground. And what could be more beautiful than interest-free money? Because he’s actually doing it with his Hours, people love it.

One of his themes is Jubilee. Here’s a typical and wonderful video showing all this:

He used to toy around with Austrianism, before being exposed to Sacred Economics. This helps in bringing them on board also.

Here’s Adam Kokesh, with a good and very enthusiastic analysis of the Mountain Hours. True, their monetary architecture is not the greatest, but it is all being developed as it goes.

[youtube=https://www.youtube.com/watch?v=b8DVvpWO-QI]

He’s revolutionizing the promotion of usury free living. He radically posits the problem, quoting Jesus, Moses and Mohammed, and offers direct solutions: Jubilee and Hours. He does so in a way as to really touch people.

Wayne is very active on Facebook too.

There is another way. We don’t need to exploit to survive. We can have abundance. Usury is the original sin, the ultimate cause of our economic and social woes and the ‘conspiracy’ and its nasty tricks are simply retribution. The suffering it causes worldwide is unfathomable. As always the solution is simple: quit sinning and start interest-free money.

More power to Wayne Walton.

The Truth Movement is probably the biggest problem the Money Power dealt with in a long while. But it is being attacked from all sides and from within. Libertarianism and the End the Fed crowd are a Trojan Horse and the most insidious threat the Truth Movement faces. It happened because we still have not come to grips with ‘the dismal science’, economics, and we must pass the final frontier in truth-seeking: Usury.

The Truth Movement rose in the aftermath of 9/11. The Internet allowed the few mavericks in the know out there a platform and the trauma of the 9/11 attacks gave them an audience. It became the cause truth-seekers from all over the world rallied around.

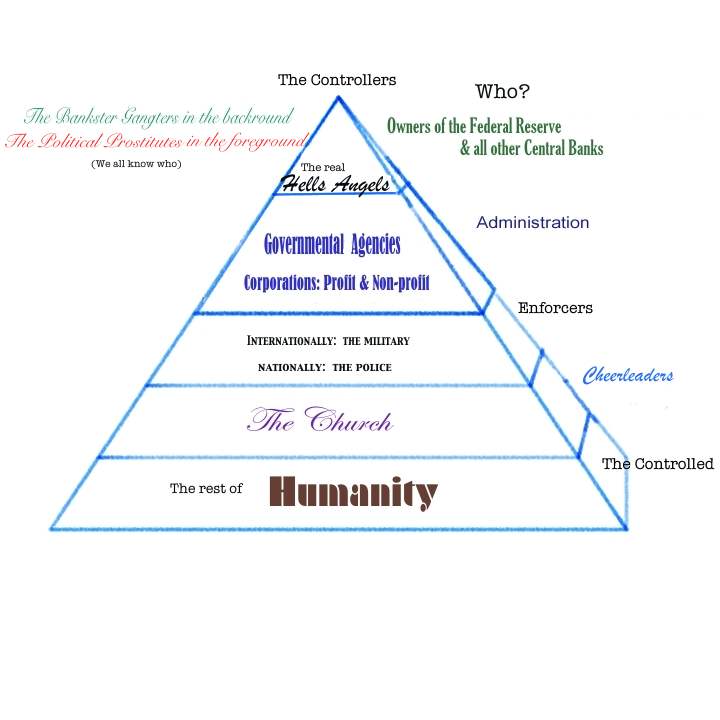

Not only were the perpetrators, the Zionists and the Neo-Cons led by the Bush clan, quickly established, but also a larger picture arose. Zionist and US Empire conquest of the Middle East. And behind that murderous alliance an even more sinister force became widely visible: a cult building World Government, World Currency and World Religion.

It originated in Babylon and spread through the world via Jewish Supremacism. It hides within Jewry and behind other proxies, most notably Freemasonry and the Vatican. And of course the Banking Cartel, which is a global, monolithic bloc. Through banking it also controls all major industries. This power base allows them to control every Government and every Nation on the Globe and they are looking to externalize the Hierarchy in a New World Order.

The Money Power

They are the Money Power and American Populists called them thus because they rule through money. They control the money supplies of the world. First by controlling Gold, which has been in their possession since ancient times. Later through fractional reserve banking and credit by double-entry bookkeeping.

They use this control to centralize power through three basic tools: Usury, the boom-bust cycle and the power to finance those they control or want to control, while choking the rest.

Usury is by far the most important. Usury distributes wealth from the poor, who don’t have money and must borrow, to the rich, who have money to spare and make more through interest-bearing loans.

The poorest 80% of the population pay more interest than they receive to the richest 10%. Within the richest 10% bracket, the poorest 8% pay more interest to the richest 1% than than they receive from them. And even within the top 1% a similar redistribution of wealth to the very most opulent occurs.

This means that eventually all the interest ends up with the very richest men on the globe.

All in the Truth Movement have at some point come along the estimates of the Rotschild family fortune. Nathan Rothschild owned 50 million in assets in 1817. At 5% per year (a most conservative percentage) the Rothschilds would now be worth a cool Trillion. At 8% it would be an unfathomable 250 Trillion. This is compound interest. Usury at its very worst.

Usurious Usurpation.

Libertarianism, Austrian Economics and the End the Fed movement

Libertarianism goes back all the way to the Jesuits of 17th century Salamanca, Spain. The Jesuits were simultaneously developing proto-communist models.

Free Market fundamentalism and Marxism are an evil twin. The dialectic is much older than Hegel.

Even today the Jesuit influence is palpable, with Father Sadowsky training both Murray Rothbard and Tom Woods. Catholic economic science, which always was against Usury and put together a very profound and utterly undefeatable case against it, was thus subverted from within.

Libertarianism itself is ‘economically conservative’ and ‘socially liberal’.

Austrian Economics is the economic arm of Libertarianism. It was built by the Volker Fund, who picked up on von Hayek, Mises and a little later employed Rothbard and Gary North to disseminate their ideas to libraries and other centers of knowledge. It also provided the theoretical framework for the think tanks with which they littered the entire globe.

Austrian Economics is the most unashamed defender of the parasitical class. It defends Usury. It promotes the disasters of deflation as the natural cure to excessive credit expansion. It ignores the monopolistic tendencies of capital and blames the State for monopolies and cartels. It defends property rights, even if they are clearly irreconcilable with natural law, as for instance is the case with Land.

‘Socially Liberal’ is a fancy label for Cultural Marxism. Libertarianism defends every degeneracy known to man: feminism, homosexuality (including same-sex marriage), abortion, pornography, drug abuse, mass immigration, all the way to a free market for children where debtors can liquidate their last assets.

Conservatives fall for this crap, because they reason once they allow Cultural Marxists to do their thing, they won’t bother people looking for a Christian, conservative family oriented life style.

Pure defeatism. And foolish too. Cultural Marxism is a disease that must be combated vociferously for it will never stop until everybody is as far gone as they are themselves.

All this is sold with the wonderful slogans of Liberty, Freedom, Choice and voluntary contracts.

In reality it is the Liberty of Banks to monopolize currency. The Freedom for the usurer to bribe politicians to enforce all those wonderful voluntary contracts that the poor chose to underwrite to avoid starvation.

Enter ‘End the Fed’

According to Tom Woods the ‘End the Fed’ movement is a natural result of ‘free market economics’. It certainly is, that’s why it’s so worrying, considering this utterly corrupt lineage.

The ‘End the Fed’ movement was until recently run by Ron Paul, who maintains Arabs did 9/11. Rand Paul recently did the obligatory sucking up at the Wailing Wall and Yad Vashem. Both of them preferred losing obviously rigged primaries to exposing Diebold. They never attacked Romney even once during the elections, proving that they never intended to win and were only in it to get the Truth Movement to vote Republican without splitting the vote on the right. And to guarantee a good future for Rand in Washington.

It promotes the nonsensical idea that the problem is Central Banking while defending commercial banking. While everybody knows that the banks created the CB’s to begin with. It promotes a Gold Standard, claiming bankers hate Gold, while everybody knows Rothschild and his buddies made their fortunes controlling Gold and lending it to Sovereigns throughout modern history.

So how did these obvious liars become the darlings of the Alternative Media?

It would have been impossible without Alex Jones. Alex Jones maintains Arabs own Hollywood. He blames Hamas for resisting the Gaza occupation. He’s on record admitting his family is CIA. He’s married to a Bronfman Jewess. He’s always talking about ‘the elites’, ‘Nazis’, ‘the New World Order’, while slyly inserting Libertarianism into the Truth Movement. He is setting up the patriots and the militias for civil war, which will destroy them while hiding the real enemy.

His big break came by giving Ron Paul a platform in the Truth Movement. Destroying it from within and disabling the real opposition in two crucial elections in 2008 and 2012.

People say Alex Jones did a lot of good and helped a lot of people wake up. What rubbish. We all know disinformation cannot exist without some truth and that’s Jones’s game. He’s the most blatant Cointelpro operation since Rosa Parks.

Conclusion

What is the Synagogue of Satan if not the church of self? Its fundamental belief is ‘do what thou wilt’. And that’s why Libertarianism is Satanic to its very core. That’s why Anton LaVey said he only had to add some ritual and magic to it to create the Church of Satan.

We can have an ‘End the Fed’ Movement, or we can have a Truth Movement.

If we choose the latter, we must get to grips with Usury, because without ridding ourselves of that cancer, we will never get rid of the Money Power.

It’s about time we made up our minds.

Afterthought: I must make clear that I of course heartily support killing the Fed. I don’t believe in nationalization. An organization like the Fed cannot be reformed. The problem is what will replace it.

The Money Power is looking to move on and it is done with the Fed so Libertarianism is simply promoting policy.

Related:

The Daily Bell: Usurious Commercial Banking is Freedom, Interest-Free Government Money is Tyranny

Usury and its effects on Rome and Early Christianity (Eduardo)

The Fight against Usury by Juri Lina

H. von Creutz: The Money Syndrome (the original studies that Margrit Kennedy popularized)

the Money Myth Exploded by the St. Michael’s Journal. Money explained to kids.

The Bible on Usury, by John Turmel

Why we need Monetary Innovation by Margrit Kennedy

Interest-Free Economics (all the problems of Interest AND the solutions)

Faux Economics (doing away with Libertarianism, Austrianism and its main mouthpieces)

The Daily Bell is indeed back: trying to reframe the debate once more. Saying Government money printing is always bad because the Money Power controls the State. There is some truth in this but as always evades the real issue. The elves passionately defend commercial banking while not wasting a single word on usury. But Usury is the ultimate Centralizer of Power.

Morphing the classical Marxist vs. Capitalist dialectic into public vs. private, the elves recently have been trying to regain some lost ground (see here and here). Their latest effort is ‘Real Evil: Attributing Money Creation to the State‘. Money Power controls the State, they correctly note, while ‘forgetting’ the Money Power is the Banking Cartel they are simultaneously defending as ‘free market banks’.

And ‘t is true: the fact that the Government creates a monopoly, only to hand it to the Money Power to milk the masses and start World Government just shows how utterly subservient to the Money Power Governments all over the world are.

Here’s the power pyramid again, it helps to keep a clear view of what is actually at stake.

The Protocols do not promote a free market Utopia. They want an all powerful World State. All its proxies see strong states. Nazism, which is a typical Money Power system, strong State, one Fuehrer, collectivist. Marxism, with its omnipotent State.

The Protocols do not promote a free market Utopia. They want an all powerful World State. All its proxies see strong states. Nazism, which is a typical Money Power system, strong State, one Fuehrer, collectivist. Marxism, with its omnipotent State.

The free markets of Capitalism, aka the Money Power Transnational Monopoly, are just a ruse, it’s all one big block. Both Capitalism and Marxism are monopolies.

It is a common and grave mistake to equate Government with the Commonwealth. If it were not for the Money Power, a national Government, China, Russia or the US would have ruled the world. It would not be much more pleasant.

Anything centralizing power in State hands is Communism.

The reason we promote State money is because at this point it would devolve power from the top to the next layer. But when the State bears down on further decentralized money (like the Austrian CB closing down the Wörgl, or indeed as the Dutch Central Bank did with the Gelre), we resist that vociferously as fascist.

The issue is the centralization of power. This is the Money Power game and usury, with its 5 to 10T yearly wealth transfer, most of which ending up with the 0,0001% is the ultimate centralizer of power.

Public Banking

Public banks are better than private ones. The interest ends up with Government instead of the rich. Public Banking also allows reasonable financing of the national debt.

But: Public Banks have been typically used by the Money Power to build up nations. Just look at China these days. But also Germany after the war, Russia today and the other BRICS, most of them have public banks. Even in the USSR and its client states one had public banks who lent at interest.

This is also their main problem: they don’t end usury, at least not for the people. As a result, the poor will lose more than the middle class, who can compensate the interest drain with rents they get from the poor. The usury will concentrate power in the hands of the state. And of the monied classes, as they will continue not to face real competition in the marketplace because the many are burdened with cost for capital, while Transnationals are not.

So we should have interest-free public banks. That would still not be entirely ideal, but it would end the Money Power as we know it.

Classical populist proposals still don’t properly address the interest issue. They liberate the State of interest, but not the people. For instance Greenback proposals combined with usurious full reserve banking. However, modern thinkers on both the Greenback and indeed also Social Credit (which also is classically combined with usurious full reserve banking) are moving on: many of them are starting to see that credit creation is too simple not to do it. The problem is not money creation, it is raping the public with interest on it.

A grave concern with Public Banking reform at this point is, that the growing support it rightfully enjoys is easy to co-opt for the Money Power. My hunch is that they would want to nationalize a number of banks anyway, mainly to unload their ‘balance sheets’ on an unwitting taxpayer. Once Government has sorted through the multi-trillion damage they could again be privatized.

Banking is One

While impudently playing the private vs. public dialectic, ignoring whether power is devolved or usurped by the State, let alone usury, the Daily Bell show their real colors as the great defenders of Wall Street. It’s all a matter of statist Central Banking, according to the Elves, but also Ron Paul and all the others. Hence the ‘End the Fed’ mantra. These bad CB’s do the money creating and mess up the very fair free market operations of the banks.

But Memehunter has completely dispelled that myth. The Fed manages the volume, but the money creation itself is private: 97% of the money creation is done by the commercial banks.

Of course the Daily Bell doesn’t like fractional reserve banking anyway: we will all feel much better when we can pay interest in Gold. That’s really sound money, according to the elves, Gary North et alia. Honest.

Moreover: Banking is One. What use is it to talk about Money Power if we don’t understand the Money Power is the banking cartel? There is no competition between banks. Money Power Gold Banks in a ‘free market for currencies‘ is just a bad joke.

We all know the CB’s were built by the banks, not the other way around. The banks own the Fed outright. They nationalized most other CB’s because private CB’s got a little too obvious due to Hitler. Originally they were lenders of last resort, maintaining stability in the system, necessary to maintain control of the money supplies of the world.

The Daily Bell and all the others would have us believe there is too much regulation, the Marxists tell us there is not enough regulation.

But the problem is banking itself. Too much usury. Too much deflation. Usury and Banking are One. Deflation and Banking are One. They will always look for freedom and the choice of voluntary contracts, preferably enforced by the State. But they don’t mind hiring some Blackwater mercenaries either.

Banking is One and it cannot be regulated, nor can it be reformed. Banking is the issue that has swept through the ages. It was conceived in iniquity and born in sin.

Silver daggers and garlic are what we need.

Further decentralization

Looking at the pyramid we see that Usury free public banking would go a long way, but it still leaves some money power with the State, for instance the power to decide who will get credit or not. There’s also danger of inflation or even the boom-bust cycle, although it would be much less than we have now.

Social Credit, combined with demurrage (REN’s proposal) or usury free, full reserve JAK Banking or Mutual Credit Facilities, is one way. It would almost entirely devolve money power to the people and the market. The money creation would be debt free, all the seignorage will be with the people themselves and usury would be eradicated. The State would still print it, but it would gain nothing from it. It also would not gain from manipulating the volume, which would be very hard to do anyway. It could only really inflate, but the people would be fully compensated for this inflation, because they would get the inflating money themselves.

Or we could have a fully interest-free credit based money supply, through Mutual Credit. It would probably still need some Social Credit to fix the gap, the difference between total demand in the economy and total output. The State could provide the Social Credit, the market would provide MC Facilities. They’d finance themselves with handling fees.

The case for regional currencies remains: large currency areas are intrinsically unstable, as lesser competitive regions would have structural capital outflow, with deflationary pressures in the regional economy. This must be fixed and regional MC based units seem ideal for that. This also further devolves money power.

And we should of course forget about monopoly and legal tender. If a currency can compete it has something to add. It should be allowed to thrive. Cyber units come to mind. MC based units would dominate any free currency market. Gold would be useful only for store of value purposes. Gresham’s law demands it and nobody will borrow Gold at 5% if he can get credit at 0%.

This would leave us with a financial industry with a maximum of 1% of GDP. A GDP that would be much lower, as many activities would be demonetized. Finance would be a boring and simple trade, just what it should be. Rent seeking would again be considered tasteless and unbecoming.

Conclusion

The decentralization the Austrians promote with their wholly bogus ‘free market for currencies’ is useless: it ignores Usurious Usurpation. It hides behind a phony public vs. private dialectic.

Devolving money power means getting it to lower levels of society. At this stage Government should most definitely grab back the monopoly, simply because it devolves power. Further decentralization through free market units and lower level Government (State, County, City level) is crucial.

But first and foremost we must address usury. No monetary reform without ending usury is real. Nothing that does not address the 5 to 10T per year wealth transfer of which at least 1 to 2T in the US alone can be seriously considered. Both Public Banking and the Greenback at least provide the State with interest-free money, saving $450 billion per year in debt service in the US alone. But they don’t fully end usury.

Interest Free public ‘banks’, we need another name, or private Mutual Credit Facilities would both be fine. Social Credit remains important.

Meanwhile, Government reform is way beyond the horizon. Discussing it now mainly serves to analyze possible faux-reforms that are inevitable and to get a clear picture of what we want.

That’s why free-market units are so important. We don’t have to wait.

Getting rid of the Banks and openly declaring them the main enemy is definitely not yet a popular message in the Alternative Media. Classical populists never took their thinking to its logical conclusion.

But the Banking Cartel with its centralization of power through usury and deflation are indeed what we are up against.

Related:

The Daily Bell tolls for another round in the debate

Reply to the Daily Bell: Gold porn, lies, and misrepresentations (Memehunter)

Understand that the Banking System is One

The Few Banks that Own All

Reassessing the Greenback and other Alternative Monetary Systems

A Primer for Recovering Austrians: the many systems behind ‘violent statist fiat’ currencies

the Austrian ‘Free Market for Currencies’ Hoax

The Daily Knell (Memehunter’s splendid disassembling of many Daily Bell Memes)

Left: Tom Woods complaining about lack of MSM airtime

Recently the Austrians have been aiming some firepower at the ‘Greenbackers’ again. As we have documented extensively, Austrianism was developed mainly to organize the opposition against the current monetary order and to mind control it into cheerleading the reinstatement of the Gold Standard, which the Money Power has been planning for decades now. Not much new under the sun, but since they insist, let’s have some more fun with their silly antics.

Tom Woods has 34k likes on Facebook, is asked by friends to run for the Senate, is clearly groomed to play a major role in Libertarianism in the future and looks like the Heir Apparent to Lew Rockwell’s ‘Catholic arm of Libertarianism‘. Certainly an influential fellow and he recently opened up a page on his site called ‘Why the Greenbackers are wrong‘.

As we know, the Greenbackers are the sworn enemies of the Austrians. They don’t like to talk too much about them, lest they would get unwarranted attention, and they usually reserve their gall for the Keynesians. But in fact, the Greenbackers are their ‘raison d’être’, to usurp the real opposition against the Money Power’s control of the money supply. So it’s probably necessary, even if a tad boring, to rebut this 5100 word screed.

Let’s keep in mind what is at stake

We could print enough debt free paper money to pay off the National Debt. This Debt is entirely credit based, for every debt free dollar we print, a credit based dollar would go out of circulation. Meaning: no inflation. After the operation we would have no national debt and the Fed Govt would be spared $450 billion per year in interest payments. This is the Greenback and this is not something the Money Power is going to allow and stopping this is what Austrianism is all about.

This would end the Fed, at least as we know it, and it would nationalize money. This, according to Tom Woods, would mean more socialism. You see, it is clearly better when a private banking cartel prints money, slaps interest on it and a few Trillionaires rake in this $450 billion per year. That is, after all, the ‘free market’, a great example of ‘human action’ by the Rothschilds, certainly not to be interfered with.

As we have analyzed in ‘Libertarianism’s main fault: Blaming the State while ignoring the Money Power‘, the Money Power, which sits at the top of the international power hierarchy, owns all the money supplies in the world, including that of the US. It uses it to enslave us with interest and the boom-bust cycle.

It can do this, because it forced sovereigns in the past to create de facto currency monopolies through legal tender laws and then hand these to the Money Power.

So reclaiming this currency monopoly actually devolves power from the summit (the Money Power) to one level lower, the Government. In short: less socialism than we have now, not more.

And the Greenback is not even the ideal solution. With the current level of Interest-Free Economics it’s probably the least of the acceptable solutions. But the Greenback would be a major step forward and undoubtedly set back the Money Power agenda for decades. It would end the depression and halve the deficit over night. It would bust Wall Street profits, which is a great relief for Main Street paying for these profits through income tax.

Violent Statist Fiat Currency

This is an issue that never ceases to amaze me, when dealing with the Austrians: they’re completely clueless about the different proposals around. They all lump it together in the ‘Greenbacker’ label, that they try to make into something derogatory. That’s why I put together ‘A Primer for Recovering Austrians: the many systems behind ‘violent statist fiat’ currencies!‘, it concisely explores the main propositions at this point.

Of course, we must not forget that it is in the Austrian interest to keep it all neat and simple, so they can keep hammering away at the ‘statist fiat’ nonsense. How annoying, then, that interest-free, free-market units have been turning over untold billions per year for decades.That there are highly developed proposals out there even more powerful than the Greenback, devolving money power even further to the commonwealth and individuals.

The ‘Paper vs. Gold’ meme now sweeping the Alternative Media is just another pleasant Keynesianism vs. Austrianism dialectic, both ignoring the paper based interest-free alternatives like the Greenback, Social Credit and Mutual Credit.

End the Fed

Woods opens up his hitpiece with the now almost universal Libertarian rechristening of the Truth Movement, that erupted after the 9/11 attacks, to the ‘End the Fed’ movement.

Of course, most Libertarian leaders, in unisono with their dialectical brethren of the left like Noam Chomsky, say Arabs attacked New York.

The Austrians like to slap down ‘conspiracy theories’, just like the MSM do. The only conspiracy they see is the State, but of course ‘free market’ players are just wonderful people in it for ‘enlightened altruism’ Ayn Rand style, aka wholesale profiteering and rent seeking, all ultimately for the greater good.

Murray Rothbard made a few highly amusing cases in the typically deductionist Austrian way, meaning utterly disconnected from practical observation, ‘proving’ cartels in the market are impossible without the Government. Really funny stuff, highly recommended for comic relief.

Of course, as we know, the Bush administration was up to its eyeballs in this Mossad attack. So it’s actually a little weird the Austrians have so much difficulty coping with this rather blatant Government conspiracy.

Woods says the ‘End the Fed’ movement sees some people who don’t understand, because they are Greenbackers.

But it is clear that in the Truth Movement we have some Austrians who don’t understand because they are Money Power goldites.

There is no ‘End the Fed movement’ other than a wholly bogus controlled opposition effort, enabled by Alex Jones who certainly should know better, and some other stooges, disabling the patriots out there.

The Money Power is ready to dump the Fed and Austrianism is here to make sure they both get that and their coveted Gold based new currency order. It’s certainly not for nothing that Alan Greenspan is probably the most famous Austrian out there.

Tom Woods explodes the myth of elite financing of Libertarianism

He doesn’t really want to go into it, because it is such nonsense, but he did ask Mises biographer Guido Hülsmann to comment. Who then goes on to confirm the Rockefeller Institute sponsored Mises. How could he not?

Of course, he completely ignores the Volker Fund, Jesuit involvement in Libertarianism, Ayn Rand doing a Rothschild when she was writing Atlas Shrugged, the billions the Koch brothers poured into Libertarianism, after their father co-founded the Birch society (another bunch of good friends of Tom Woods, by the way) and Atlas Foundation strongman John Blundell explaining how they were ‘littering the world with ‘free market’ think tanks’.

He also tries to dispel this notion with the idea that Austrianism is fringe and thus financing failed. No students hear about Austrianism in college, he says.

Well, compared to the Mainstream, Austrianism is certainly small, although growing very rapidly. Ron Paul educated the masses on the wonders of Gold and deflation and many of them are all for it now. Ed Griffin on Fox, Napolitano all over the media, Peter Schiff and all the others. Compare that to what Populism and Interest-Free Economics receive in airtime.

Let’s also not forget that the Mont Pelerin guys (who are behind the Austrian theories) got eight economic ‘Noble prizes’ (no such thing actually exists, of course) during the last few decades. Not bad for a suppressed opposing system the elite so profoundly fear.

Obviously, as controlled opposition against the Main Stream Austrianism’s time had not yet come. It is only now that the Money Power is ready to kill the dollar and move on to a new currency order that Austrianism has become important.

But we don’t want to tease Tom too much: all these bribes are certainly a bit tasteless a conversation in polite society. Too conspiratorial, I’d say.

On Usury

Most of the article is just one massive diatribe explaining where money comes from and how paper money must always be forced upon the public by the State, for it could not exist otherwise and Gold is the only money that will ever emerge from the free market. They always do this. You will not believe how many Austrians have been explaining ‘that first we bartered, but that was cumbersome and we needed money’.

The whole thing is dazzling, I’m still not sure what he’s actually saying, but it sure does not suggest great clarity of thought. Perhaps he was just scaring people away, I don’t know.

In the first place he attacks the notion that Interest plus Debt cannot be repaid. I’m not going into his reasoning, simply because he makes the case in the worst of ways: others have done so much better. There is some merit to it. But not much. Recently I penned a slightly revised appreciation of the situation and I’d be most interested to hear if any questions remain in this regard.

The debt can never be repaid, period.

Eternal growth of money is guaranteed with paper, eternal deflation guaranteed with Gold because of this issue.

Much worse: Usury costs the poorest 80% of the globe’s populace 5 to 10 trillion per year. I’d certainly be interested in Tom’s comment on this situation. Or any Austrian’s comment, I might add. Never heard anything about it from their side.

As said, Woods also claims Gold has historically been the only money coming out of the free market. Complete crap. The first Gold coins were minted by sovereigns, not by the market. Furthermore, ancient money was actually credit based: receipts for supplies stored in centrally controlled warehouses. This goes back all the way to Hammurabi.

Austrians, as does Woods, have a very fuzzy understanding of what money is. They will often say it’s ‘the most marketable commodity’. Or they’ll cite ‘marginal utility’. Maybe. But what is more marketable than promissory notes? What could have more marginal utility? Perhaps that’s why there are so many interest-free paper based free-market units out there, could be.

But let’s just stick to a simple definition: money is whatever we agree upon as a means of exchange. Even our friends at the Daily Bell have seen the light there.

Woods really takes fuzziness to the downright insane in this video. In it he says that if Greenbackers like debt-free money so much, why don’t they like Gold? Because, Woods explains, Gold is mined, coined and then spent into circulation. So Gold is debt-free!

Excuse me? Does he actually believe this, or is this just propaganda for more feeble minded consumption?

Gold mining adds maybe 1% to known reserves yearly. The rest is safe in Central Bank vaults. Does Tom really believe they will spend these reserves into circulation? Or will it be LENT into circulation, at interest?

As a final note, when dealing with a self-declared Catholic making a career of whitewashing Usury, it’s obligatory to mention that Anton Lavey is on record stating his satanist ‘religion’ is just ‘Ayn Rand’s philosophy with ritual and magic added’.

‘Nuff said.

Concluding

The level of thinking that these people promote is actually quite insulting to the public. Who, in turn, show how desensitized to outlandish nonsense they really have become, considering the sweeping ascent of Austrianism in the last five years or so.

However, considering the careful long term Money Power strategizing behind it all, we must not bear too harshly on the public and personally I’m very grateful for the ongoing opportunities Austrianism offers for pleasantries as the above.

Related

Faux Economics

Answering Tom Woods

Debunking Tom Woods’ ‘Catholic’ Austrian Economics (Memehunter)

How the Money Power spawns Libertarians

Greenbackers vs. Goldbugs, by Eric Blair (Activist Post)

Addendum: Meanwhile, the Daily Bell cannot let go either. The last few months they have taken the ‘Public Banking and the Greenback are fascist’ line. Because Hitler took money power away from the City and printed his own, everybody doing the same is now a Nazi. Rather predictable, in fact, we did predict this would happen. It’s called ‘Guilt by Association’ and is just one more of the logical fallacies Austrianism is famous for.

Just a few days ago they sighed with relief that “the apparent creation of bought-and-paid-for websites has diminished along with the eruption of fury against those who have the presumption to discuss freedom.”

They are so happy they declared victory by naming the article ‘Mises has won’. Apparently they miss our regular outings dealing with their monetary quackery. My good friend and close ally Memehunter tired a little bit of nurturing the smoldering ruins of Daily Bell credibility at the Daily Knell, focusing on more pressing priorities.

But don’t push your luck guys, he came out of retirement once, he’ll do it again should you get on his nerves with all too blatant manipulations of the debate…..

For years now, the collapse of the dollar has been in the cards. Recent developments show mounting pressure on the dollar’s reserve currency status. With a major international deflation going on, the threat of inflation through money printing is unreal. However, should the dollar’s reserve currency status end, the repatriation of trillions of petro- and eurodollars could lead to a strongly inflationary scenario.

The roles of a reserve currency are to finance international trade and to function as a store of value for Governments. Until the second world war it used to be the British pound, but with the demise of the British Empire, the pound lost its international relevance and was overtaken by the dollar. This was formalized in the 1944 Bretton Woods system. All other currencies were fiat currencies, but pegged to the dollar, which in turn was pegged to Gold at 40 dollars an ounce and redeemable for international trading partners.

The Eurodollar

With the dollar as the reserve currency, the US had to export dollars. In the early years after the war especially for Europe, the famous Eurodollars. This sounds great: print money and buy whatever you like. But with the Gold window it was also risky: overprinting could mean excess dollars would be exchanged back to Gold, depleting US Gold reserves.

This was also a weakness that those annoyed with American Hegemony could exploit. In 1967 the leftist press mogul Jean-Jacques Servan-Schreiber penned a famous screed called ‘le défi Américain’ (the American challenge’), arguing Europe was being colonized economically by superior American competition.

France, at the time, was run by de Gaulle, who never was impressed with Anglo-American supremacy. He made a point of exchanging every dollar he could lay his hands on as a means to undermine it.

In the late sixties the situation got badly out of hand because of the Great Society and the Vietnam war, very costly projects that were deficit financed, leading to serious inflationary pressures. Inflation that the US tried to export, leading to an excess of dollars abroad. Especially the resurging Deutschmark’s appreciation became untenable. The Europeans started pressuring the US to fix its deficits, provoking the US Treasury Secretary John Connally famous cry ‘the dollar is our currency and your problem’.

But the situation had become unsustainable and Nixon was forced to close the Gold window to stop the depletion of US gold. This was the end of the Bretton Woods system and from then on the major currencies were floated freely in the international currency markets.

The Petrodollar

But it did not end the dollar reserve currency status, as the Empire had been found another basis for it: they reached an agreement with the House of Saud, to accept only dollars for its oil. The Sauds agreed to invest their dollar wealth on Wall Street, making the deal even more powerful for the Empire. Saudi Arabia controlled OPEC and the dollar was saved: international oil trading is financed with dollar only. Since then we have been on an informal Black Gold standard, known as the petrodollar.

This situation was better than before, because overprinting of the dollar for international trade or to finance all sorts Empire projects could no longer be punished by depleting Gold reserves and would result only in rising prices.

In the last decade the problem of over printing was solved by artificially raising oil prices through the Peak Oil hoax, and ending Iraqi oil production. It must be understood that the Empire is not looking for more oil production. There is so much oil in the world that should it be drilled for freely, it would end the Money Power’s energy monopoly. The Iraq invasion and the quest for control of the Middle-East is to keep a lid on oil production. Saddam’s suicidal decision to accept euro for his oil only hastened his demise.

Even today Iraqi oil production is not even half of what it was before 1991. With the Western Oil companies now in charge, it will most likely never fully recover.

By raising the price for oil, the oil market has mopped up excess dollar supplies, which are now needed for the oil trade. As a result, the dollar has remained relatively stable in its value. Of course, it fits well with the agenda of decapitating the middle classes and under this agreement higher oil prices also means ever more oil profits invested in Wall Street.

Of course, the great boon of this for the Empire is that it can pay with worthless paper for real goods. It can eternally finance a major trade deficit.

Trade deficits are incorrectly understood as problematic.

From a nation’s point of view, the goal of trade is not to export, but to import. We export to give back for what we need from others. If you run the reserve currency, you don’t need to export as much as you import, because you can partially finance your imports with money printing. For all other nations this is impossible and trade deficits are lethal in the long run, as it leads to net capital outflow.

But the US Empire is in trouble. Its infrastructure is crumbling, its manufacturing base gone, it’s badly over extended. It needs ever more virulent threats to coerce the nations into dollar submission and just like Connally failed in 1971, the US is failing today. The Money Power is done with the Empire and the dollar and it is moving to the next phase. The dollar will have to step back and we are seeing a realignment.

The new currency order

China is moving towards a Gold backed yuan that will be very powerful in the international arena. Recently Australia, which is already completely dependent on China, with 30% of its exports going there, is preparing direct convertibility between the yuan and the Australian dollar, meaning they will no longer use US dollar to finance bilateral trade. This means less US dollars are needed in its reserve currency role.

In 2001 Goldman Sachs executive Jim O’Neill invented the BRIC’s. South Africa was later added, representing Africa and emphasizing its globalist agenda. Russia and China, as two powerful neighbors, obviously have long standing and important bilateral relations. But equally obviously, have little in common with Brazil, India and South Africa. India and China are actually sworn enemies. However, in 2009 they organized a first summit. Just a week ago we all of the sudden hear the BRICS are planning to open up a competitor to the IMF. They’re still working out the details and it’s not a done deal yet, but the move looks very serious.

And there is of course the euro, which, make no mistake, is in great shape. True, Eurocrat legitimacy is suffering because of the euro crisis, even in Germany the currency is losing support. But the euro crisis is purely for internal consumption, to sucker the nations into surrendering budget responsibility to Brussels. This is the final frontier for a full blown EU federalist Super State. While the euro is deeply hated, this is not really a problem for the Money Power: it isn’t in this business to make friends and it does not mind a big fight. It only fears real alternatives and these are nowhere to be seen. There is nobody proposing anything real, people are just letting off steam. Once they get their fiscal union, the crisis will quickly end. People have a short memory.

The euro was designed to be eventually backed by Gold and the ECB has enough of the stuff to be ready for the coming transition.

Conclusion

We are seeing the advent of the new currency order. There will be a number of more or less equal blocks: a dollar zone, a Yuan/BRICS zone and the euro, with the Yen and the Pound as lesser entities. These will later be able to converge to even more ‘cooperation’, in the Money Power’s relentless march towards World Currency.

These units will be at least partially Gold backed, implying long term deflationary pressures. Central Banks are buying Gold in major quantities, creating the interesting question why Gold prices have not risen in the last 18 months.

The problem for the United States will be to manage the transition. Trillions of dollars that will no longer be needed will have to be repatriated and this will lead to very strong inflationary pressures at home. It is unclear how the Fed is going to deal with that. It probably can’t. Furthermore, the US is probably in the worst of positions to deal with a new Gold standard. They claim to have 8,000 tonnes of Gold in Fort Knox, but nobody really believes that.

The hyperinflation scare that the Austrians have been promoting because of ‘money printing’ is ridiculous: we are in a stagflationary depression and prices are rising because of speculation, not because of excess money. But when the dollar loses its current status, long term price rises will become the norm.

The Greatest Depression has only just started.

Afterthought

Here’s a highly recommended post by Roberts, the Assault on Gold. It makes a plausible case for massive Fed bullion busting. As discussed in ‘why is Gold not Rising?‘, the ascent of Gold was a carefully orchestrated operation, but it probably got out of hand in 2011. Since then the Fed has been very active on COMEX again. With CB’s and market players buying massive amounts, it’s the only logical explanation for stalling bullion. The fall of COMEX and the fall of the Dollar are basically an evil twin, they will happen simultaneously and because of each other.

Related:

Why are we hearing of the ‘Triffin Dilemma’ all of the sudden?

Why is Gold not rising?

Is China part of the New World Order?

The US Empire is Not the Money Power!

The Euro Crisis

Phoenix Rising, the Return of the Gold Standard

This week three banks, ING, Rabo and SNS, simultaneously suffered major computer malfunctions, leading to a temporary closure of their on-line facilities. Their problems were ‘unrelated’. It is completely unprecedented. The chances of a coincidence are close to zero. For years some in the blogosphere have speculated that ‘computer problems’ might be a good excuse for the Money Power to call a bank holiday and ‘reorganize’ their system. This looks like a drill.

By Anthony Migchels for Henry Makow and Real Currencies

ING’s problems were the worst, it’s off-line again today. ING is one of the biggest banks in Europe with a trillion plus balance and one of the living dead. It’s a zombie bank, propped up with massive credit lines from the ECB and handouts and guarantees from the Dutch taxpayer. It has 40 billion of Spanish debt on its books and it needs to write off untold billions, maybe as much as hundreds of billions, from its commercial real estate portfolio. Obviously this would vaporize the Dutch economy over night, should it have to bail out ING.

The Dutch economy is one of the worst in the world in terms of debt. All the nonsense about ‘lazy Greeks’ and ‘thrifty and frugal Dutch’ is just that: complete baloney. We have a usurious debt based monetary system. However hard one works, eternally growing debt and interest charges are inevitable, it has nothing to do with character.

Meanwhile, the economy is being destroyed with ridiculous austerity, 45 billion was taken out of the budget over the last two years. The Government loses 80 cents in income due to falling aggregate demand in the economy for every euro it takes out of the economy through taxation or austerity. Same thing that destroyed Southern Europe. It’s incredible that this kind of insanity can happen in the modern age.

Considering the situation in Cyprus and depositors now knowing they are fair game, it seems clear that the Money Power is organizing a bank run to further the depression it wants so badly.

However unpleasant it is to be on the same side as these vultures in this case, the advice remains the same: get your money out of the bank now. The advice is now not just correct because of moral imperative, it is becoming a matter of personal financial survival. True, it is becoming harder and harder to find safe havens, but the bank is absolutely not one of those, that’s for sure.

Why is the Money Power busting its own banks? They don’t really care: all the major banks own each other. 100% market share remains guaranteed, even if some of them drop. Also, the smaller banks go first and they are gobbled up by the big boys, often with ECB/Fed/taxpayer financial support. So this crunch is also a major consolidation effort by the Money Power. Busting the banks is a good way to plausibly sell the many that the good days are over.

So what does this computer malfunction mean? It’s an exercise. And probably not for Holland itself. The Dutch economy is midsized and a good place for a drill for something bigger. Like the US, which is the real target here. Two weeks ago, Chase Manhattan had some problems too: accounts were suddenly drained and set to zero. Interestingly, this was also going on with ING.

The US has been coasting relatively unscathed through the crunch up to now. Because the Fed printed like crazy, all in all some 16 trillion were lent out to its buddy insider banks worldwide to prop up their balances. This money never enters the real economy, because it used as capital to replace losses to the Mortgage Backed Securities scam that popped in 2008. Hence no inflation.

But this is coming to an end and in the next round of the crunch something major is going to go down.

Conclusion

We have the funniest stockmarket boom ever, bankers resigning all over the place, Cyprus, and now this.

Something’s on. And it’s big.

Addendum: I forgot (but Henry didn’t) to mention ABN-AMRO, another one of the Dutch Big Five, who two weeks ago let their customers know they would stop physical delivery of Gold and that all those with a Gold account would be paid in Euro if they liquidate their account. I’m sure most readers connected this dot, though. This certainly adds to the notion that there is some kind of trial run going on in the Netherlands.

Related:

The Few Banks that Own All

Take your Money out of the Bank NOW! (Video)

High Noon in Nicosia: what really happened in Cyprus?

At long last: savers will pay for their folly of trusting banks

The elegant P<P+I equation points in the right direction but it is incomplete and needs further analysis. Not only does it ignore the velocity of circulation, but also the question whether the interest is spent back into circulation. The issue is important, both in terms of truth-seeking and Austrians and the Mainstream subverting the argument.

Can all debt be repaid in a usurious credit system? The P<P+I (P=Principal, I=Interest) equation suggests it cannot. For the longest time we have been maintaining that the principal is created, but not the interest and thus eternal indebtedness is part of the system. A closer look shows the problem is more complicated and the original proposition not per se correct.

Interest-Free Economics has always assumed that P=Money Supply (MS) if the money supply is debt-based. This ignores the crucial factor of velocity, the number of times the money supply changes hands in a given time span. The effective money supply (r(eal)MS) is Principal x Velocity: rMS = P x V.

Another vital issue is the question whether the interest is spent back into circulation. If it is not, it is bound to cause problems.

Here’s an analysis of the implications of these two overlooked factors:

A: slow circulation.

Let’s say P=100 and I=10 and velocity is 1. We are in an economy of two players. Let’s say the loan is for a year and that it has to be repaid at the end of the year. My partner gives me the loan so we don’t need a third party.

We pay the other participant 100 at the beginning of the year. Velocity is 1 and P=MS, so he’ll buy something worth 100 from us at the end of it. It’s easy to see that at the end of the year we will have 100 income to pay off the principal, but we will have to borrow an extra 10 to pay off P + I.

So in this example the original proposition is correct.

B: Good circulation, interest not spent into circulation.

Now let’s see what happens if velocity is 20. I go into debt, pay my supplier and he buys with me. I save 1 because I know I need to pay interest at the end of the year, so I buy 99 worth with him. He buys 99 with me and I save another 1 for the interest payment. In the final transaction, I have saved 9, my partner buys 91 with me and I collect the remaining 1 for the interest payment. I have the interest, but only 90 for the principal.

It matters not, whether I save to settle the interest payment at the end of the year, or whether I pay the interest immediately, while the lender does not spend it. If the interest is not immediately circulated, no matter the speed of circulation of the remaining money supply, there will be a shortage of money. I will not have enough to pay off P + I.

Again: P < P + I still stands.

C: Good circulation, interest spent into circulation.

Now let’s say I pay the interest immediately and my partner spends the received interest back into circulation. Velocity is again 20.

So I buy 99 worth + I pay 1 interest. He buys back 100 worth of goods. I again buy 99 worth + 1 interest. Etc.

In this example, after 20 (10 buys and sells each) transactions, I will have paid off the interest during the year and at the end of the period, I will have 100 to pay off the principal.

The conclusion is, that if velocity is high enough and the interest is immediately spent into circulation, the P + I > P equation does not mean that debt plus interest cannot be settled with only P as the money supply.

However, these are two big ifs. In fact: they both don’t fly.

Getting to the bottom of the issue

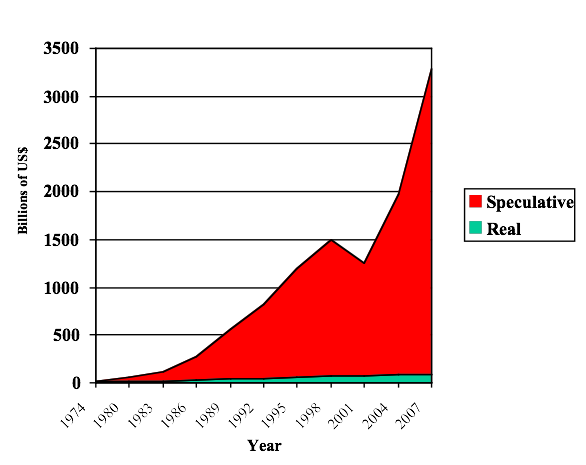

In the first place, velocity. As it happens, Usury is a key factor in destroying velocity of money. It greatly encourages hoarding, especially in the current banking system. Postponing paying your bills nets you income through interest. So Here’s a graph, courtesy of wiki, the green line shows velocity, the left axis shows the relevant scale:

As we can see, velocity is very low in the economy, money changes hands a little more than once every two years. It went down even further during the last few years, because of the depression. Considering the the example above, it is clear that velocity is far from sufficient to allow interest payments on the money supply, meaning we have serious deflationary pressures because of interest payments.

Then the other issue: is the interest spent back into circulation? The answer is: far from all the interest payments are spent back into circulation. Sure, the banks pay their people massively bloated bribes (‘bonuses’) for their handiwork and to control their conscience, and they build major citadels (‘office buildings) everywhere, but banking is an incredibly profitable business and this profit is not spent back into circulation.

In the first place, banks use profit as capital reserve requirements for more lending. Basically this means the money is lent back into circulation, not spent. Because it is lent back into circulation, even more money is needed for interest payments, aggravating an already grim situation.

Secondly, there is the two loop economy. I discussed it in an article on stagflation. There are two economies. The real one, where we operate, actually producing all sorts of stuff. Then there is the financial economy. A large part of it is accessible only to insiders and the financial industry. Normal people can access it only via the Stock Exchange, where their assets are disowned through insider trading. Turnover in the financial economy dwarfs that of the real one. Most of the money out there is in the financial economy. This, I venture to suggest, is another reason why velocity is so slow: in the real economy money circulates much quicker, but most money is in the financial economy which is not counted in the GDP figures. Meaning only a small percentage of our money supply is used to finance the real economy. Here’s a graph of the financial economy:

Make no mistake: the two loop economy is real. Recently insider Mark Faber actually mentioned it, it’s the first time I ever saw it mentioned in the media.

The financial economy is where the big bucks are being made by the vampire class. Their derivatives, forex, insider trading. It’s where all their gains from the stock market and other fleecing of the non-sophisticated investors is going. Unfortunately for them they cannot really use this money in the real economy, because it would cause an immediate hyperinflation, but it does give them full control over the real economy and it is an important part of their domination. It also explains why QE1, 2, 3, x have not led to rising prices: There was a massive deflation in the financial economy as a result of the busted Mortgage Backed Securities hoax and Bernanke slyly fixed only that, while not adding any money to the real economy, which needs to be strangled with austerity, sequestration, the fiscal cliff and whatever tool they have to aggravate the depression.

The point is: much of the interest is siphoned off to the financial economy. Meaning it is not circulated back into the real one. Meaning usury does deflate the money supply and interest + debt can never be settled.

Conclusion

It’s an important issue. The Mainstream and the Austrians have been getting to terms with the original P + I > P equation. The argument in its original form is no longer operable. More importantly: we owe it to ourselves and the people we talk with to get to the heart of the matter and take both truth and their arguments seriously, if they have merit.

In an ideal scenario, when velocity is sufficient and the interest is spent back into circulation, principal plus interest can be repaid.

But for other reasons, the basic problem still is the same: velocity is very low in practice, making it impossible to pay for both and the leaking of money to the financial economy, the ‘upper loop’ is probably even worse.

I hope this article can lead to further discussion, perhaps the experts can shoot a hole in it, making it irrelevant or better. I’m not a mathematician, and I’m pretty sure people like Gauvin, Turmel or Montagne would put it more elegantly, but I hope to have made the point clear.

Please comment if you have anything to add and share this article with those you know are into this line of thinking.

Related:

We are in Stagflation

Debt Free Money alone does not solve Compound Interest

Why the Economy MUST Grow

Dick Eastman is the main thinker on the two loop economy, a phrase he coined. Unfortunately he does not operate a website, so he cannot be found on the web and there are no archives of his previous work to be searched. But Dick is one of the most outstanding economists out there, and he sends out emails on a daily basis, you can contact him at oldickeastman(at)q.com if you want to get to know his work.

Social Credit with Demurrage

(Left: Sylvio Gesell, the man who devised demurrage and popularized Georgist thinking in Europe)

The easiest and most transparent way of migrating to a usury-free economy is by simply replacing the usurious credit based money supplies of today with interest-free credit. In this way we would be able to do exactly what we always did, but better. However, demurrage is an equally viable way. It may be a little esoteric for most Americans, but demurrage money mimics the ways of the ancients who built the wonders of the world in Antiquity and the Cathedrals in the Middle Ages.

Ross Noble is well known here at Real Currencies as REN for sharing his wisdom generously. He has been creating an approach based on debt-free money, spent into circulation by the people, basically Social Credit. The problem with Social Credit is that it does not end Usury and Noble suggests a demurrage to achieve that.

A demurrage is a negative interest, a tax on holding money. This strongly discourages hoarding cash. This is a hard concept for many people to get their heads around. But the fact is that hoarding the means of exchange has negative implications for others using the money. Hoarding cash hinders circulation and this is a fundamental monetary problem.

Saving should be done through assets, not cash.

Money is not wealth, it’s a means of exchange. It derives its value from the agreement to use it as such. The ‘store of value’ function is a result of the agreement, but the agreement does not have the purpose of creating a store of value.

Demurrage is based on the idea that money should perish as does produce. It is because money does not perish as quickly as produce (and other products), it is used to store wealth. But using it to store wealth destroys its use as a means of exchange, which needs unhindered circulation.

In older times, farmers stored their harvest at central warehouses. They got a receipt in exchange. This receipt was used to pay others. But because the receipt represented decaying goods, it lost value over time.

The great boon of demurrage is that the negative interest is a clear incentive for those holding money to lend it out interest-free. Better still, it would greatly encourage paying in advance. This is even better, because it diminishes the need for debt. Many investments would become viable without any debt at all, simply because consumers would pay up front for much of the production of what they need.

It is important to understand that the cost of society to the demurrage (negative interest) is a tiny fraction of the cost of usury. The reason for this is that the money supply is very small, because it circulates very quickly, up to a hundred times faster than usurious units. As a result the demurrage is typically not even enough to finance the operation of the monetary system, let alone as a tool of plunder.

Ross has been so kind as to work out a number of the details and issues related to his proposal, you can find them below.

I post this purely for discussion purposes. It is an unfortunate fact of life that most monetary reformers are very much in the box of their own preferred system. Most interest-free crediters hate demurrage. But they simply don’t understand it and I’m convinced it’s equally viable as interest-free credit.

The more I think about Ross’ proposals, the more I like them. I hope the points below will enhance the discussion and awareness of Interest-free economics and help diminish the tunnel vision that I believe is badly damaging monetary reform in general.

Related:

Don’t hoard the means of exchange! (part 1)

the Power of Demurrage: the Wörgl Phenomenon

Social Credit

Social Credit with Demurrage (SCD), a non-usurious economy

Ross Noble (REN)

The objective is to outline flow paths and design features for SCD.

The new money unit described thus far is an abstract accounting identity, a bearer instrument, controlled by legal fiat. All U.S. dollars carry an information date stamp, which is updated as the demurrage is paid. Abstract accounting identities are numbers in a computer, or on a ledger. In our current bank money system, 97% of the U.S. economy is abstract bank money, carried as numbers in a database.

Physical representation of money must have high carry costs or some other negative attribute making it undesirable. Making all money coins, making them large, and possibly limiting them to $20 will incur carry costs thus propelling people away from money’s tangible form. Another alternative is to recall small denomination tangible paper notes on a regular basis, making them a hassle. The undesirable nature of physical money needs to exceed the negative attributes of demurrage money. The abstract intangible form of MA bearer money (U.S. dollars) as numbers in data bases, can easily jump from ledger to ledger at computer speeds, so actual costs are very low despite the high velocity transaction rate.

The monetary authority uses demurrage as the heart pump to propel money into circulation. In the unlikely event Government doesn’t do its fiscal policy job with appropriate taxation on land and market rents, the monetary authority may operate an inflation escape valve by injecting new money into households. Household, Government, and Business sector loops will tend to balance, money supply is recycled at the drain rate. Foreign loops are also in balance as hoarding is discouraged via the holding tax. The money supply maintains its volume with little turbulence.

Advantages:

Disadvantages