Who in his right mind wants more State? More politicians? More bribes for politicians? More fines, more law, more prison? More Bush, more Hillary, more lies, more war?

Time to wake up people! Regulation is what Big Business lobbies for all the time: it’s killing small and medium business, who don’t have the resources to comply.

80 Years of more regulation, more welfare has done nothing to end Plutocracy. 1% owns 43% of all assets! 50% of Americans have net zero assets or less!

Marxism was invented to consolidate Plutocratic control of the economy in the State, a World State, ultimately. Regulation is their tool.

Now consider this:

– Usury redistributes up to 2 Trillion per year from the poorest 90% to the richest 10% in the US alone.

– Even if you have no debts, you lose 40% of your income to Usury passed on in prices.

– The Federal Reserve handed out 16 Trillion in easy credit to International Banks in 2008/2009. It cannot account for 9 Trillion of these.

– The Federal Reserve is handing out 1 Trillion a year to the ultra rich in exchange for their busted derivatives.

– Because of this ALL economic ‘growth’ of the last five years has gone not to the 1%, not to the 0.1% but to the 0,01%.

– Banking crises have happened and happened again for centuries now.

– Capitalism started in Amsterdam with the Amsterdamsche Wisselbank, the first major Central Bank in history. Its owners moved to Britain, where they founded the BoE in 1694, through which they ruled the world for centuries. Bretton Woods saw the migration of that class to the US.

– Interest-free credit is a total no-brainer. YOU can have an interest free mortgage tomorrow.

– Banks are the main sponsors of both the Dems and GOP. The left is no better than the right.

– All major banks own each other and most Transnationals. It’s one massive, global cartel that owns all Governments.

So: if we have such a bleeding heart for the poor, when are we going stop palliating their wounds, caused by interest on loans of money, and actually DO something about their plight?

When are we going to tar and feather these maniacs in Wall Street and beyond?

When are we going to man up and relinquish our childish political affiliations of our younger years?

When are we going to circulate local currencies? Reform the monetary system?

Interest-Free Mutual Credit Now!

Related:

Rationalizing Usury: the Time Value Hoax

Babylon = Usury! We want Interest-Free Money!

Ten Atrocities that would not exist without Usury

The Few Banks that Own All

More on Mutual Credit

(Left: Thumbs up for Mutual Credit!)

We need credit and that’s why a credit based money supply is so attractive. It catches two birds with one stone. It’s probably its simplicity that makes it so hard to digest. It solves money scarcity, the boom/bust cycle, Usury and decentralizes credit allocation as much as is humanly possible. In short: it meets all requirements of comprehensive monetary reform.

Mutual Credit in its purest form is peer to peer credit by double entry bookkeeping. I think the phrase was first coined to describe LETS, Local Exchange Trading Systems, which were proposed by Michael Linton.

LETS was designed to facilitate exchange between normal people. It is Hour based, which is not something I’m overly fond of. Not because Hours are not a good unit of account, but because nobody at this point knows what an Hour is worth. This hinders price transparency. It creates complications for businesses, because they don’t know how to price their services in Hours, and because they need a second ledger to keep their books.

The problem of money is not its unit of account function. Yes, we need just weights and measures, in money too, but just weights and measures are stable and predictable. It does not matter what they are, as long as people know what they can expect.

At this point the Dollar (or Euro) provide a reasonably stable unit of account and everybody knows what they are worth. Therefore I suggest not complicating the issue and just settle for the ‘1 unit = 1 dollar’ agreement. This is how most regional currencies and professional barters work. On a national level this would also facilitate an as simple as possible transition. We can simply replace the current usurious dollar with an interest-free one.

In its simplest form, everybody gets the same credit limit and the money supply is always equal to total outstanding debt. No credit facility is necessary.

For this reason, some resist the idea that for instance a major unit like the WIR is Mutual Credit: there a strong central credit facility, the WIR bank, decides who can borrow how much and charges service and handling fees and nowadays, sorrily, even some interest.

But to me WIR is still Mutual Credit, because while the fundamental peer to peer nature of it is slightly obscured by central management, it’s more about the process of credit creation than anything else. It is low cost because of mutual acceptance.

As we have been discussing extensively, credit can be interest-free if it’s mutual. Nature unfolds as a process between two only seemingly opposing forces: the binary opposition of Yin and Yang. Debit and Credit are its equivalent in money. The one is not better than the other. By accepting the credit of the other today, we are allowing ourselves to finance our home and business ventures tomorrow.

Society is served by our well-being and we have a direct interest in the well-being of our brethren.

The Difference between Fractional Reserve Banking and Mutual Credit

While both create money by double entry bookkeeping, Mutual Credit is vastly superior, simply because it’s so much more simple. It does away with the need for reserves.

Fractional reserve banking was designed to hide the fact that the banks don’t lend deposits. It began as a scam, where goldsmiths lent out up to ten times more Gold than they actually had. Later the process was redesigned: every bank could lend 90 cents on every dollar in deposits, this seems to have been the situation when the Federal Reserve Bank opened up shop. Nowadays it’s very hard to get to the bottom of it all. It does seem that the banks just lend whatever they want.

They are officially ‘restrained’ by ‘capital reserve requirements’. This is then used by the Bank of International Settlements, which is the apex of the global banking cartel, to manage the global volume of money: if they raise the capital reserve requirements from 3% to 4%, the banks can ‘only’ lend 25 times more than they can ‘back’, instead of 33 times more. This chilling effect on their capacity to lend leads to a contraction of money, which in turn will lead to depression. This is the game they play, late 2012 BIS ‘expected’ (made clear that they were going to create) the next round of bank busts and a deepening of the depression. “But hey, we need stable banks, no?” The wide eyed banker/magician tells us.

It’s all complete baloney. We don’t need reserves. Management of the volume of money should not be based on the stability of the credit facility! Nothing could be more absurd, volume must be managed to safeguard stable prices while maintaining stable access to credit.

So this is the great beauty: we don’t need a cent to create all the money we will ever need. We don’t need ‘savings’ for investments. We can restart from scratch at any given moment.

The credit facility can never go bust. If a loan goes sour and collateral cannot be liquidated (an extraordinary situation) the debt just circulates as unbacked money and the credit facility can take it out of circulation at its leisure by passing on the cost for this in the service and handling charges it passes on the users in the system. Just like we have Mutual Credit, we have mutual insurance against default.

Credit allocation

Only one question remains: how do we allocate credit? In the current system, the banks lend as much as they can and demand is limited by interest rates. Low rates encourage demand and facilitate booms. Higher rates dampen demand and thus the volume of money and thus growth. High rates will precipitate depression. As for instance happened in the late seventies, when Volcker ended chronic inflation by driving rates up to 13%, plummeting the West into years of stagnation and decline. The economy never really fully recovered, although that was also to a large extent due to the neo-liberal (libertarian) policies that became the norm. This resulted in chronic lack of demand in the economy because of ongoing austerity and decline in real wages.

As we have discussed extensively in regard to Mathematically Perfected Economy, a highly advanced Mutual Credit system, 0% interest rates will lead to a demand for credit that is greater than the economy can handle: it would create so much structural demand in the econonmy that there would simply not be enough productive capacity in society to meet it and prices would start to rise. Asset bubbles are to be expected, both in commodities and real estate. A vicious circle of growing asset prices and growing demand would seem to guarantee this.

The interest-free crediters have not been able to explain why 0% rates would not see the same bubbles as the banks have been blowing for centuries through easy credit.

Credit allocation should be based on rights. We participate in the system and thus have basic rights to credit. I propose a truly radical solution to the question how to allocate the available credit: let’s share it equitably.

Equitably is not equally. Some people have a greater need for credit: not all of us are going to be businessmen, for instance. If we have greater income, than we probably will have a greater need for credit too: more affluent people will probably want to live in bigger houses, for instance.

We can create basic algorithms to facilitate fair sharing. A couple of parameters are important. The money supply must remain stable. It grows when new credit is allocated and shrinks when debts are repaid. It’s a dynamic process. Because the demand for credit is greater than what we can supply (given the need for stable money), it is in everybody’s interest that loans are repaid as quickly as possible.

Borrowing 300k and repaying it in five years has a similar impact on the money supply as borrowing 150k and repaying it over ten years.

Hence, people who can repay more quickly, have access to more credit.

Another rule should be that young people who are starting out in life, coming together to create a family, should have preference over people who already have had an interest-free mortgage.

It’s all not completely clear cut and it will have to be worked out in more detail, but the direction is clear: there is a certain amount of interest-free credit available, and we all have a claim to a part of it. Our individual rights must be balanced with the common need for stable money.

The Credit Facility

We all love peer to peer and personal sovereignty. We are sovereigns without subjects. This is the truth and our money must harmonize with that. Perfectly ideal would be private issuance. For instance the promissory notes of MPE. Wayne Walton is also strong on issuance by the sovereign.

But because of the need to allocate credit to manage volume (and to insure repayment), I think we cannot do without a credit facility to manage the whole thing. The books must be kept. Volume managed. Defaults handled. While there are many responsible individuals in society, we must also allow for the fact that we not all are completely capable of meeting our commitments without some gentle guidance.

But the understanding must be that the credit is ours. It is not the facility that creates credit, it’s our mutual agreement and the facility only exists to manage its day to day implementation. We are not going to face stern technocrats who are weighing us up to see how much they can get out of us. They are only going to check whether we can meet our commitments.

Credit facilities should have clear charters along these lines.

The credit facility covers its costs with real service and handling fees. A mortgage should cost no more than 10% of the principle and perhaps even less. A useful rule of thumb is that the financial sector should not account for more than 1% of total economic activity.

The Monetary Authority

In a major national economy, there will be plenty of credit facilities scattered around the country. The total volume of money must be managed centrally and this is then the Monetary Authority.

This central body indexes economic activity and makes sure the money supply develops accordingly. If the economy grows, the money supply grows equally and if the economy is facing a downturn for real, structural reasons, than the money supply must shrink accordingly.

The Monetary Authority oversees total credit allocation and makes sure individual credit facilities don’t overextend.

It should be independent from taxation and spending in Government. Otherwise a dangerous powerglut emerges and Government would have a strong incentive to subvert its operations for its own ends.

Considering the crucial issue of volume, there is well warranted distrust of any central control, but on the other hand it is very hard to see how all central coordination can be avoided.

As the wise men throughout the ages have told us, ‘the price of ignorance of public affairs is being ruled by evil men’. The dimwittedness of the masses and their blind trust in Government has been humanity’s bane for as long as there has been recorded history.

Therefore the Monetary Authority should also have the duty to make sure the populace is well educated in monetary matters.

As we can see all this is not brain surgery. Far from it. It is not the complexity of money that has made it such an elusive subject. It has been the Money Power’s subversion of public thought and its subtle manipulation of our greed and sense of insecurity, its exploitation of Stockholm Syndrome, that has made monetary reform so incredibly difficult to implement.

But now that the banking cartel has been exposed, now that a rational discussion of money is ongoing and a real chance at getting it right is slowly materializing, all the nonsensical ‘complexities’ are swept away.

Education is fundamental to achieve reform and it’s even more vital to secure it permanently. Every able bodied man should know the Monetary Authority’s charter and understand its basic operations.

All decision making by the Monetary Authority should be completely transparent. No oracles with bizarre language obscuring reality. No ‘need’ for ‘discretion’ to ‘placate markets’ and sundry nonsense.

We’re all grown ups, this our society.

Conclusion

Where we can talk endlessly about Usury because it’s so pervasive and this innocent looking 5% per year has such profound and unexpected implications, Mutual Credit is simplicity personified.

The reason that Mutual Credit is so incredibly attractive is that it is so close to our current experience. The only thing that changes is our perception: we don’t ‘borrow’ from the bank, we exercise our right to our fair share in the available credit. Therefore it is interest-free.

This familiarity also greatly helps the transition to a usury free economy.

This does not mean that Mutual Credit is the only way forward. The goal is the end of usury, not the implementation of Mutual Credit. But it’s hard to think of a more simple and understandable approach. It is immediately implementable.

Sure, the change will be profound and it’s difficult to fathom all the implications. But considering the stark choice we face, ongoing servitude and Plutocracy vs. freedom and justice, this is the most simple and straightforward approach available at this point.

It is the transition itself that is most risky and we will further discuss the implications of ending usury on credit in a future post.

Related:

Mutual Credit, the Astonishingly Simple Truth about Money Creation

How to Manage the Volume of Money in Mutual Credit

The Goal of Monetary Reform

The Difference Between Debt-Free Money and Interest-Free Credit

In a short and forceful vid he calls for a Conference and promises a follow up vid to declare who should be there.

https://www.youtube.com/watch?v=KFiDiLb1ZZ0

Brother Nathanael Kapner is a very strong voice reaching many people. He is at the heart of the Truth Movement, which is so profoundly affecting global public opinion.

And the Truth Movement simply cannot do without a solid agenda against the banks.

Recently Alex Jones also for the first time started talking some sense, mentioning interest rates, predatory banking and State Banks that could do a great job financing economic development at low cost.

This is a marked improvement over his previous atrocious Austrian Gold position and obviously anathema to Ron Paul.

Nevertheless, both not yet really focus on the Usury issue. They focus on nationalizing money. And this an evasion that could easily result in fascist tendencies if not managed well.

Nationalism is not the same as empowering this Federal Government. We want to empower the People. The commoner. With interest-free mortgages and business loans. Not wage slaves in big corporations, but strong small and medium business. Much less stress, much more free time. Time to think, to study, to build. To heal.

We are proud of our nation but we want to be free men.

However, this is both the coup de grace to Austrianism and a major step forward.

Related:

What happened to Brother Nathanael and his U-Turn on Ron Paul and Monetary Reform?

Austrianism is Dying! Truthers Unite!

The Public vs. Private dialectic or: Money as part of the Commons.

The bickering of the right and the left looks more hopeless everyday. The eternal Capitalism vs. Marxism dialectic is alive, but is it still well?

As we know, the Money Power directs history through dialectics. By creating two camps with a narrative that both suit our masters, they co-opt opposition.

Both sides of the coin always have some good points and some very bad ones. Because people feel forced to make a choice, they are seduced into the evil/lesser evil kind of thinking that is so symptomatic of the Dark Side. By polluting an in itself worthwhile position with other nasty ones, they get what they want anyway.

Crucial to the dialectic is that both camps ignore the true issues, or are in tacit agreement about them.

Capitalism and Marxism both are fundamentally materialistic ideologies. They deny Spirit. That’s why it’s so atrocious that self styled ‘Christians’ defend Capitalism, or that the lefties try to claim Jesus for themselves, because of his love for the poor. This truly is a war against God, ultimately.

The other key issue is, of course, Usury. Capitalism is the idea of ‘return on investment’ and this is unthinkable without Usury. Marxism was designed to co-opt opposition against Capitalism and its banking by claiming private control of the means of production is the probem, instead of this private control being consolidated in ever fewer hands through Usury.

So let us analyze two typical, current examples.

Walter Block and his ruthless attacks on the poor

Block recently made some waves by claiming Black families were doing better under slavery than under the welfare regime of the Great Society.

Here’s an interview with RT:

http://www.youtube.com/watch?v=jEl7BJVNFq4

Everybody fell over him for this and that was probably the idea.

But it cannot be denied that his basic point is fair: welfare creates dependence. It also creates a class of people that will vote for even more Government, more taxation, more detailed management of our lives, more fines, more jail. And worst of all: more civil ‘servants’ and politicians.

Of course, the demise of the family is not only, or not even mainly caused by welfare: the welfare state has been in decline since the early eighties and the demise of the family is only accelerating. The not-so-gay lobby, sexual ‘liberation’ and feminism are more important. But, these (Government sponsored) social engineering outrages are explained away by Libertarianism as ‘Freedom’.

Also note that Block in this video mentions other issues that are bad for the working class, like getting rid of the minimum wage, while spending one second on corporate welfare, which has a far larger impact on the Budget than programs assisting the poor.

This is the same trick as the New York Times uses: reporting an outrage they support in one paragraph on page 42 and then claiming they’re not ignoring it.

Walter Block and his buddies must do this, of course, since it is big bucks from big banking and big business that finance their think tanks.

And how about the Left?

In this short and forceful vid Robert Reich connects the dots in the war against the poor. A minimum wage in decline in real terms, slashing food stamps, medicare, not rebuilding crumbling infrastructure, which could solve the massive unemployment and inactivity all over the States and another few issues.

Is he right that there is a virulent war against the poor? He sure is. As Buffett put it: “There’s class warfare, alright, but it’s my class, the rich class, that’s making war, and we’re winning.”

But while this war against the poor (and the middle class too) is real, Reich is defending patches. He’s not at all pointing at the true cause of poverty: Capitalism and its Banking and Usury.

By ignoring the root cause of the problem, he is relegated to defending ‘solutions’ that clearly disempower many people. Who wants to live from food stamps? Who wants to pay for them? Nobody of course.

Yes, it’s ghoulish to take them away, especially with the ‘high minded’ ‘it’s all for your own good in the long run’ rhetoric of the Libertarians.

But because he’s not looking deeply enough into the economic realities, he must deny the good points the right makes. He must sell his patches by saying it’s better than have people starve. And while I’m with him on this and feel much closer to the left on these issues (while deploring their Cultural Marxism), statist intrusion to our lives is the fundamental Marxist mindset.

Conclusion

40% of what we pay for the goods we buy are usury passed on in prices. It’s even 50% of taxation. All this usury goes to the rich, we’re talking up to $2 Trillion per year in the US alone, far outpacing economic growth even in good times.

And people wonder why the US’ income distribution is at Haiti level?

What use is it complaining about welfare with this massive hand out to the rich? What use is it promoting welfare while ignoring the cause why people need it?

Let us end the dependency of the rich on the poor for their usurious income. Let them find a job or start a business, instead of just milking the credulous masses under State protection.

Interest-Free Money Now!

Rationalizing Usury: the Time Value Hoax

Babylon = Usury! We want Interest-Free Money!

Ten Atrocities that would not exist without Usury

The Problem is not Debt, it’s Interest (with Video)

Left: Gottfried Feder, the intellectual powerhouse that gave Hitler the anti-usury agenda he needed to get to power. But he was sidelined by Schacht and never got the opportunity to implement his ideas.

Clearly far from all were convinced by the analysis that Hitler’s finances were not at all interest-free. But recently some key quotes from Schacht’s memoires have come to my attention. They completely validate the basic premises of the article.

As a reminder, the article pointed out a number of key issues. Hitler did not really reform the German monetary system. The Reichsmark, created by the Weimar republic, continued to be the national unit. The banks continued their operations, based on usurious fractional reserve banking. Their ownership did not change. Germany did have a national debt under Hitler. In 1938 it stood at 18 billion Reichsmark, quite a sizeable sum.

Gottfried Feder was the one behind Hitler’s very strong anti-usury stance during his rise to power. But already in 1931 Hitler’s industrial backers wanted him to reign in Feder and he was completely sidelined in the aftermath of the night of the long knives.

Hjalmar Schacht, aristocrat, mason, top banker, who studied Hebrew to further his career and who was a close friend of Bank of England Chief Montague, became Reichsbank president, in charge of the economy. He solved the depression, which was caused by capital scarcity due to deflation, through the MEFO bills, that circulated between industry, banks and the Reichsbank. But he did not at all solve, or even address usury. Quite the opposite. He was the one who made sure it was business a usual for the banks.

The quotes from his memoires, ‘the Magic of Money’, posted here below, completely corroborate this analysis. He points at Feder and Strasser and interest was the issue. Feder’s interest-free money was ‘nonsense’ and his fight against private banking ‘destructive’.

It also transpires that the MEFO bills came with a 4% interest rate.

Hjalmar Schacht was the man that controlled the German economy and allowed Hitler what the Money Power wanted him to do: build an army against Russia.

Below are the quotes and as an extra the relevant paragraphs from Zarlenga’s ‘the Lost Science of Money’. Interestingly, Zarlenga links Feder to Georg Knapp, who wrote ‘the State Theory of Money’ in 1905. Knapp’s thinking is known as Chartalism and later morphed into Modern Monetary Theory. I will be coming back to MMT at a later stage, it’s making a come back, but unfortunately it does not really solve usury either.

Knapp was probably the link between American Populism in the Greenback wars of the 19th century and Europe’s anti-usury movement.

This truly was a crucial junction in humanity’s struggle against the Money Power’s Usury.

Many thanks to Mark Smith, who got to the bottom of this.

Related:

Hitler’s finances, the Myth of Nazi Anti-Usury Activism

Hitler’s finances, a Response to my Critics

Below the quotes, but first this interesting little detail:

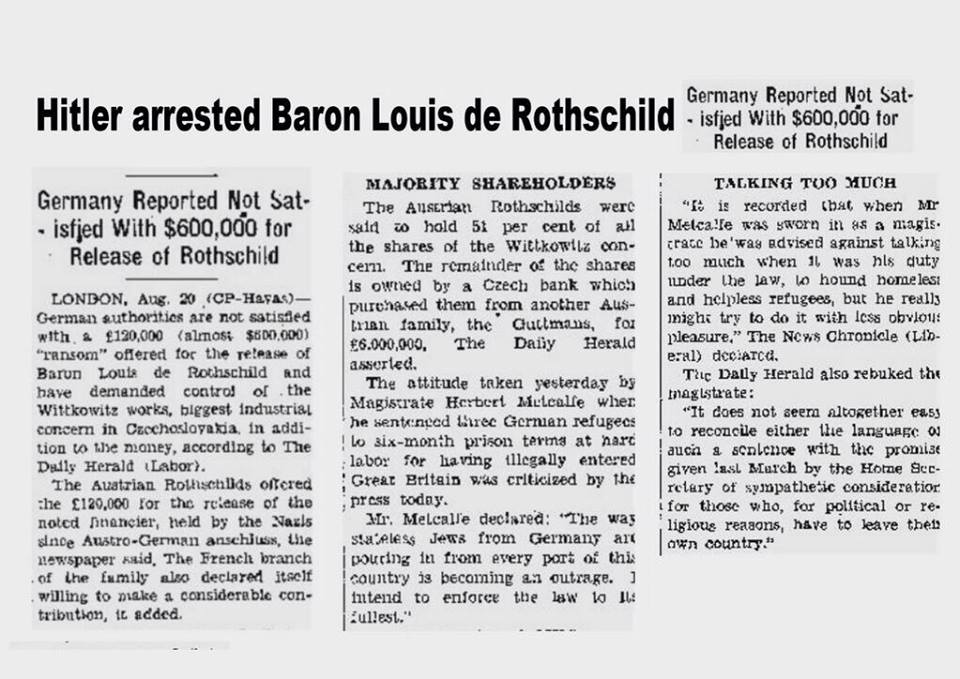

This is an old newspaper snippet, concerning the arrest of Louis de Rothschild in the aftermath of the Anschluss, when Germany and Austria were united, something both countries strongly desired.

This arrest is, understandably, construed by Revisionists as proof that Hitler was working against Rothschild.

But Louis de Rothschild was the owner of the Vienna based Krediet Anstalt, that went bust in 1931. This was a shock that was felt all over the world, quite similar to Lehman’s demise, which left a $700 billion crater in the heart of the financial system.

At the time, like today, bankers were used to getting away with this kind of stuff, and Hitler did well to arrest him.

But it was for a specific reason and cannot really be seen as particularly, let alone comprehensively, anti-Rothschild.

Extracts from Hjalmar Schacht’s 1967 book ‘The Magic of Money’

The bank supervisory authority owes its existence to a law which I instigated when I was Minister of Economic Affairs in 1934. National Socialist agitators led by Gottfried Feder had carried on a vicious campaign against private banking and against our entire currency system. Nationalisation of banks, abolition of bondage to interest payments, and introduction of state Giro ‘Feder’ money, these were the high-sounding phrases of a pressure group which aimed at the overthrow of our money and banking system. To keep this nonsense in check the president of the Reichsbank called a bankers’ council which made suggestions for tighter supervision and control over the banks. These suggestions were codified in the law of 1934, which was strengthened in 1957 by increasing the powers of the bank supervisory authority. In the course of several discussions, I succeeded in dissuading Hitler from putting into practice the most foolish and dangerous of the ideas on banking and currency harboured by his party colleagues. – Hjalmar Schacht: The Magic of Money p 49

…by the end of March, 1933, Hitler had explained to the Reichstag ‘In principle, the German government will safeguard the interests of the German people, not by means of a state organised bureaucracy, but by means of the greatest possible furtherance of private enterprise and respect for private property’. Adolf Weber commented that ‘parts of this and some other utterances sometimes recall almost word for word the “fundamentals of German economic policy” which Schacht had promulgated a year previously’. – Hjalmar Schacht: The Magic of Money p 49

It referred in this context to the financial methods which I had used to reinvigorate the German economy when in 1934 I was re-appointed president of the Reichsbank. I shall come back to this method, here I will only say that it consisted in the discounting by the Reichsbank of bills which granted industry credit over a term of five years. The Reich itself guaranteed repayment. – Hjalmar Schacht: The Magic of Money p 50

National Socialist agitation under the leadership of Gottfried Feder was directed in great fury against private banking and against the entire currency system. Nationalisation of the banks, liberation from the bondage of interest, the introduction of a state ‘Feder’ giro money, these were the catch phrases by which an end was to be made to our monetary and banking economy. I had to try to steer Hitler away from these destructive conceptions. – Hjalmar Schacht: The Magic of Money p 154

Adolf Weber was asked to make a report by the plaintiff in my denazification process before the Ludwigsburg court. In this report he showed how I succeeded in bringing Hitler to his senses where questions of banking and currency were concerned. At the end of March, 1933 Hitler declared in the Reichstag ‘In principle, the German government will safeguard the interests of the German people, not by means of a state-organised bureaucracy, but by means of the greatest possible furtherance of private enterprise and respect for private property’. And a little later he said to his party leaders ‘It is wrong to get rid of a good economist provided he is a good economist because he is not yet a National Socialist, at least not if the National Socialist who is to take his place knows nothing about economics’. – Hjalmar Schacht: The Magic of Money p 155

The second method was the building of the autobahns, and already in the summer of 1933 work began with the building of the stretch connecting Frankfurt/Main with Darmstadt. As the number of employment opportunities grew perceptibly, the Reichsbank began to. grant direct loans for both these activities. A milliard was made available for the Reinhard programme, and 600 million for the autobahn. Both amounts were later paid back into the Reichsbank. The third method was the defence programme. The building of barracks and the equipping of troops brought orders to concerns spread over the entire country. As the cost of this part of the programme to secure employment for everyone was so great and the repayment period so long, the method by which credit was granted directly to the Reich could not be used here. There was too great a danger that the Reichsbank, in granting direct credit, would lose control of currency policy. A way had to be found which would ensure that the Reichsbank was able to restrict and limit the amount of money in circulation. It took us in the Reichsbank a year and a half to find a system which was suitable, and would still enable us to pursue a responsible currency policy. The provision of money for defence did not therefore begin until the late summer of 1934.

The system worked in the following way: a company with a paid-up capital of one million Marks was formed. A quarter of the capital was subscribed by each of the four firms Siemens, A. G. Gutehoffunungshiitte, Rheinstahl and Krupps. Suppliers who fulfilled state orders drew up bills of exchange for their goods, and these bills were accepted by the company. This company was given the registered title of Metallforschungsgesellschaft (Metal ResearchCompany, ‘MEFO’ for short), and for this reason the bills drawn on it were called MEFO bills. The Reich guaranteed all obligations entered into by MEFO, and thus also guaranteed the MEFO bills in full. In essence all the Reichsbank’ s formal requirements were met by this scheme. It was a question of financing the delivery of goods; MEFO bills were therefore commodity bills. They rested on a threefold obligation: that of drawer, acceptor and Reich. This provided the Reichsbank with every justification for discounting the bills, and, although it was put to every test by the Reichsbank’ s directorate in collaboration with the country’s best legal brains and economists, they agreed unanimously that it was valid. The Reichsbank declared itself ready to prolong the bills, which true to the form laid down were drawn on three months’ credit, to a maximum of five years if so required, and this point was new and unusual. Each bill could thus be extended by a further three months, nineteen times running. This was necessary, because the planned economic reconstruction could not be accomplished in three months, but would take a number of years. By and large such extensions by themselves were nothing new with the Reichsbank; it was quite common to prolong agricultural bills, but an extension over five years, together with a firm declaration that such extensions would be granted, that was most unusual.

One other aspect was even more unusual. The Reichsbank undertook to accept all MEFO bills at all times, irrespective of their size, number, and due date, and change them into money. The bills were discounted at a uniform rate of four per cent. By these means the MEFO bills were almost given the character of money, and interest-carrying money at that. Banks, savings banks, and firms could hold them in their safes exactly as if they were cash. Over and above this they proved to be the best of all interest-bearing liquid investments, in contrast to long-dated securities. – Hjalmar Schacht: The Magic of Money p 113

Had it not proved possible to arrange things in such a way that a large part of the issued bills would be retained by the market and thus not presented to the Reichsbank, then an excessive use of the bank-note printing presses would have been unavoidable. This danger was avoided by making the bills rediscountable at any time, and by paying four per cent interest on them.

It is foolish to neglect the positive results and achievements which the German people brought forth even under Hitler’s tyranny. This is true above all in the fields of social and economic policies. The placing of the interests of Germany as a whole before those of the provinces or municipalities, the abolition or at least reduction of class distinctions not only in monetary but also in humanitarian matters, full employment, the optimum use of leisure time, the social services, maternal and family welfare, the battle against waste, all these remain worthy of our consideration and deserve further development even if in some cases we are dealing only with a cumbersome attempt to learn by trial and error. The fact that they were instigated under National Socialist auspices does not detract from the noteworthiness. This applies particularly to the economic policies prosecuted in the ‘thirties. Adolf Weber said of them ‘all in all the economic policy of this period was thoroughly constructive. Nay, as an economist who has made a thorough study of the world’s economic problems I find it incumbent upon me to state: in all the long years between the two world wars no one in any other part of the world carried out so constructive an economic policy as we did between 1933 and 1935’. Weber made this observation not in the Hitler era, but in 1948. – Hjalmar Schacht: The Magic of Money p 82-83

“Since the bills carried four per cent interest and could be exchanged for ready money at the Reichsbank at any time, they took the place of ready cash, so to speak, and earned interest into the bargain.” – Hjalmar Schacht: ‘My First Seventy-Six Years’ p 316

Zarlenga, ‘the Lost Science of Money’

In Mein Kampf Hitler wrote:

When I listened to Gottfried Feder’s first lecture on breaking down the thralldom of interest [in June 1919], I knew at once that here we had a theoretic truth which will be of immense importance for the future of the German nation.23

Feder’s captivating ideas were about money. At the base of his monetary views was the idea that the state should create and control its money supply through a nationalized central bank rather than have it created by privately owned banks, to whom interest would have to be paid. From this view was derived the conclusion that finance had enslaved the population, by usurping the nation’s control of money.

Feder’s monetary theories could easily have originated from the work of German monetary theorists such as George Knapp, whose book The State Theory of Money (1905) is still one of the classics in the monetary area. Right on page one, Knapp nails it:

Money is a creature of the law. A theory of money must therefore deal with legal history.

Knapp describes the invention of fiat money in these terms: “the most important achievement of economic civilization.” For Knapp, the determination of whether something was money or not was: “our test, that the money is accepted in payments made to the state [i.e., government] offices.”24

Near the end of that book, Knapp casually mentions how German monetary theorists of his day, and earlier, would study and discuss American monetary theories. Thus the ultimate source of Feder’s viewpoint was probably the American Populist movement of the 1870s and the ideas that movement promoted to establish a permanent greenback system.

When the National Socialists came to power, Schacht was reappointed head of the Reichsbank, partly to reassure German big business and foreign bankers. Schacht ridiculed Feder’s monetary views:

Nationalization of banks, abolition of bondage to interest payments and introduction of state Giro ‘Feder’ money, those were the high-sounding phrases of a pressure group which aimed at the overthrow of our money and banking system. To keep this nonsense in check, [I] called a bankers’ council, which made suggestions for tighter supervision and control over the banks. These suggestions were codified in the law of 1934… In the course of several discussions, I succeeded in dissuading Hitler from putting into practice the most foolish and dangerous of the ideas on banking and currency harbored by his party colleagues.25

Konrad Heiden noted that:

Industry did not want to put economic life at the mercy of such men as Gregor Strasser or Gottfried Feder, who, marching at the head of small property owners incited to revolution, wanted to hurl a bomb at large-scale wealth. Feder announced that the coming Hitler government would create a new form of treasury bill, to be given as credits to innumerable small businessmen, enabling them to re-employ hundreds of thousands and millions of workers. Would this be inflation? Yes, said Walter Funk, one of the many experts who for the past year or two had advised Hitler – an experienced and well-known finance writer, collaborator of Hjalmar Schacht and, in Hitler’s own eyes, a guarantee that big business would treat him as an equal… Hitler decided to put an end to the public squabble by appointing Göring to [oversee the questions].

Feder’s faction was then given the four-year plan, to keep them busy.26

Feder quickly lost the battle with Schacht and the German business establishment. Perhaps he was in over his head monetarily. He wrote of his monetary plan: “Intensive study is required to master the details of this problem… a pamphlet on the subject will shortly appear, which will give our members a full explanation of this most important task…”27 But this was 1934, which means he hadn’t clearly reduced the problem to written form since 1919, over 15 years.

“When the time comes, we shall deal with these things in further detail…” Feder wrote, but indeed his party was in power, and the time had come.

Feder was put out to pasture by the National Socialists, serving as an under secretary in the Ministry of Economic Affairs, later to be transferred to commissioner for land settlement and then completely sidetracked as a lecturer at the Technische Hochschule in Berlin. Hitler and the National Socialists came to power on January 30, 1933. Germany’s foreign exchange and gold reserves had dropped from 2.6 billion marks in late 1929, down to 409 million in late 1933 and to only 83 million in late 1934.28 According to classical economic theory, Germany was broke and would have to borrow. But classical economic theory is not very accurate.

After five years of Bitcoin, the verdict is out: it is a ‘free market’ Globalist dream, paving the way for a global cashless currency.

For HenryMakow.com and Real Currencies

It’s impact is quite stunning, there is little doubt about that. It started trading in early 2009 at just a few cents. Late 2011 1 Bitcoin was worth $6 and now people pay about $650. A little while back it actually reached $1000, when Chinese buyers started weighing in. It then took a big hit when the Chinese Government clamped down on it, citing ‘lack of consumer protection’. Bitcoin has crashed a couple of times on the way up, but has continued to rebound.

Major retailers all over the world are now starting to accept it.

But while this remarkable appreciation is the key to its perceived success, it is actually symptomatic of its main problem: it was designed to be scarce. Its rising price shows there is greater demand than supply.

When money rises in value, all other assets decline. It is good for those holding money, bad for those offering labor or goods and services, i.e. the real economy. In this way it behaves very much like Gold, which is also infamous for its deflationary nature.

Because it is appreciating so strongly, hardly anybody is paying with it. While the total outstanding value of Bitcoins is now somewhere between five and ten billion dollars, real trade is minimal. Who is going to pay with Bitcoin, when it is going to be worth another hundred times more in two years?

To be effective in servicing real trade, the money supply must grow and shrink with economic activity, allowing stable prices.

As it stands now, Bitcoin is a wholly bogus speculative item, with no real economic significance at all.

And it’s a pure ponzi scheme, of course. Later adapters pay for the gains of those helding Bitcoin from the early stages. As long as there are new buyers, it’s party time, but it’s ultimately unsustainable.

Money Power Control

Money Scarcity is, together with Usury, the hallmark of Money Power control. This week the story broke that Wells Fargo is now considering offering Bitcoin services. Undoudbtedly they’d be interested in offering saving and lending ‘services’.

The CIA’s In-Q-Tel investment arm was involved with Bitcoin from the early stages and while it’s speculation, I’d be willing to bet a fiver the market has been cornered already.

Bitcoins are ‘mined’: computers must solve complex algorithms to acquire new Bitcoin. Clearly this is a rather irrational way of creating money, again mimicking Gold. Every new Bitcoin comes with a more complex algorithm, requiring more computing power. At this point only major players (like banks) have the computing power to mine new ones.

Clearly there are better things to do for supercomputers than such an artificial procedure. The more so since we can create abundant, interest-free money through bookkeeping.

A few weeks ago it transpired that JP Morgan filed a patent for a Bitcoin like architecture.

But already in 1998 the NSA wrote an extensive report, ‘predicting’ (or planning) a peer to peer electronic unit, quite similar to Bitcoin.

Bitcoin’s appreciation is of course an excellent marketing gimmick: the Libertarian techies who picked up on it early are now rich and are a good fanbase to build on. There is a vibrant Bitcoin community, keeping the dream alive. This is quite similar to what happened in the Bush years, when the Money Power controlled potential opposition by selling them a few ounces of Gold, creating a large base of faithful pseudo-opposition clamoring for the ‘reform’ they want anyway.

The Mass Media have welcomed Bitcoin. Sure, in the early stages there was some bewilderment and scepticism, but we have seen huge media coverage for Bitcoin from the word go. Had it been a threat, it would have been ignored and if that hadn’t worked, attacked.

Bitcoin is not anonymous, although many believe it is. All transactions are publicly logged. While it’s possible to operate discretely, if the community sees a problem, they tend to find out quickly who’s who. Centralist control of its use is thus possible, notwithstanding its peer to peer character.

And Bitcoin is a global phenomenon, which obviously is very pleasant for our globalist masters.

Conclusion

Bitcoin is driven by greed, it’s in no way a rational solution to our monetary problems. It’s global, scarce, cashless and soon the first banks will provide usurious lending.

The lesson is: as long as we hope to breed money from money, not realizing it’s usually our own labor that breeds money for those holding a lot of it, we will be fooled by units like this.

Money must be cheap (interest-free) and plentiful, but stable. Only then can it be a good medium of exchange, allowing the producers of society the benefits of their labor, instead of the providers of capital.

Bitcoin offers none of these features.

It has the Money Power’s fingerprints all over it.

Related:

Is the National Security Agency behind Bitcoin?

Baffling Bitcoin

Bitcoin, Impressive but Flawed

Cause and Effects of Money Scarcity

Left: (Ron Paul promising to destroy the economy with austerity and explaining that taking food stamps from the poor will solve the depression.)

Eighteen months after his legendary betrayal, Ron Paul is still worshipped like a saint.

As it transpired, Ron Paul never wanted to win the elections. He never attacked Romney once, during the debates. His campaign advisor Doug Wead, a close friend of the Bush family, openly explained they were just making sure the kids would vote Republican, in exchange for a good position for Rand.

Paul suppressed all dissent in his own camp regarding utterly blatant Diebold manipulation. He was winning all along, which was obvious from the massive turn out for his campaign speeches.

He’s a masonic Republican, far more worried about splitting the vote on the right than actually doing something about anything.

Even much worse were his policies. He’s a globalist, supporting all sorts of ‘free trade’ agreements, resulting in the outsourcing of the US manufacturing base. Lest we forget: “There’s nothing to fear from globalism, free trade and a single worldwide currency” (Paul in Congress, 2001).

His 1 trillion austerity drive would have destroyed the United States. In the purely ruthless libertarian fashion, he was intending to kill all foodstamps, while hardly denting the Pentagon budget. We would have seen starvation in the US, similar to the Great Depression, when millions died of hunger.

That’s the real Ron Paul. But people don’t want to know. He was for freedom, not? The Constitution! Choice and Liberty man!

He blames Central Banking, claiming JP Morgan, Goldman Sachs etc, who actually own the Federal Reserve Bank, are wonderful free market operations.

The Austrian Economics he promotes has been exposed as a multi billion, decades old mind control operation of the most blatant kind. Meanwhile, Ed Griffin, writer of ‘the Creature of Jekyll Island’, promoting Austrianism, now admits that the bankers own all the Gold. He admits the bankers are in it for the Usury. If even he has now seen the light, can we finally put this meme to rest?

The New World Order is nothing else but a bunch of families that started saving with compound interest a couple of centuries ago. We all know the power of compound interest, not? Just do the math: Rothschild held 50 billion in assets in the middle of the 19th century. These people are now ripping us all to bits with the trillions that they are raking in with this stupid scam.

Through usury they bought up everything they could lay their hands on: they own all banks, 80% of the transnational corporations, most land and its associated resources. Capitalism is one giant global monopoly.

We call it the free market.

A Vacuum

Thankfully Ron Paul won’t run again. He has managed to disable the real opposition in the Truth movement, notwithstanding his ‘Arabs did 9/11’ stance, for long enough now. But unfortunately, the love affair between him and the sheeple, one sided as it always may have been, is far from over.

When a man like Brother Nathanael awakes from his stupor and starts denouncing him for his Austrianism (Austrian Economics = Jewish Economics, Jews were always hated because of their…………..Usury!!), his followers pounce on him and he takes down his vids and forgets about the whole thing.

Meanwhile, he’s one of the very few who has shown the courage to move on new information, while most of the Alternative Media remains in limbo.

Recently the story broke that now 46% of Americans consider themselves neither Republican nor Democrat, but independent. The left-right divide is crumbling Half of Americans no longer buy the official 9/11 conspiracy theory.

The question is: who is there to represent an awakening public? And is the public actually awakening, or is the Alternative Media just a completely innocuous bunch of thrill seekers, enjoying themselves with spooky conspiracies?

Considering the fact that monetary reform is still a complete non-issue, one would think so.

Still, the situation looks dire for the Money Power, because while there is no real Populist candidate, there is nobody to replace Ron Paul for them either. What kind of election is 2016 going to be when nobody below fifty is going to vote? Perhaps they were hoping Rand Paul would do the job, but I really can’t see it happening. He lacks all credibility, I don’t see any serious people storm the barricades for this guy.

But the simple fact is: they have always been very, very adapt at directing the mob and it is most likely they have a plan. And on our side? Well, there is Ellen Brown, who is running for Treasurer in California, with the aim of opening a Public Bank to refinance usurious State debt interest-free and to allow interest-free investment.

This is great news and I sincerely hope that her candidacy will help raise awareness on the all important monetary issue. While her Public Banking solution does not comprehensively end usury, it does seriously diminish the interest drain to the Plutocracy and would allow interest-free investment in infrastructure, ending the depression. It would decentralize real power to the State level.

Conclusion

The Truth Movement’s impact on global political awareness has been immense. But to come of age, we need an agenda, based first and foremost on the end of Usury.

Nothing could be more simple than opening up a few interest-free credit facilities and allowing people and small and medium businesses to refinance their mortgages and business loans there. This would kill the banks overnight, end the depression and Globalism. Transnationals would fade away, as they would be hammered in the market by small and medium business, no longer restrained by scarce and expensive capital. Wage slavery would end and self-employment would become the norm. A working week of max 20 hours would suffice and the standard of living for normal people would vastly improve.

It is the exact opposite of what Ron Paul was promising.

Related:

The Ron and Rand Paul Betrayal

Five more reasons Ron Paul was a phoney all along

The Ron Paul Challenge: 10 reasons why the Alternative Media is failing this test

Rationalizing Usury: the Time Value Hoax

The Few Banks that Own All

Ellen Brown runs for Treasurer in California!

What happened to Brother Nathanael and his U-Turn on Ron Paul and Monetary Reform?

Ed Griffin admits the Bankers own all the Gold and that Usury is the issue

Austrianism is Dying! Truthers Unite!

End the Fed: a Trojan Horse destroying the Truth Movement from within

Ellen Brown, author of ‘Web of Debt’ and the ‘Public Banking Solution’, is running for Treasurer in California, aiming to create a State Bank.

She’s with the Green Party, which takes no corporate funding.

I’m elated with this news. Just today the story broke that a whopping 46% of American voters consider themselves ‘independent’, instead of either Republican or Democratic. These people are simply waiting for someone who will actually put the axe at the root of our problems.

Ron Paul has left a huge vacuum and there is simply no one out there to fill it. While it will undoubtedly be an uphill struggle to get the job, such a campaign can much help to get the monetary reform debate on the agenda. With Austrianism dying in the Truth Movement, this is a real opportunity.

Ms. Brown will implement legislation to charter a Californian State Bank, based on that of North Dakota, as described in her book ‘the Public Banking Solution’.

While her Public Banking approach will not provide interest-free credit to the commoner (and thus does not comprehensively address usury), there is no doubt that this will enable California to extricate itself from a nasty position, with a major depression ongoing and State finances in shambles.

A State Bank is also a great way of reasserting real State autonomy vis a vis the Federal Government’s ongoing marauding of State rights.

Followed up with a Public Works program that can be financed interest-free, it would end the depression and allow California a return to full employment and a massive boom based on real production. If done well, by financing the production chains for these investments interest-free also, these projects could be implemented at a much lower cost than is now common. Capital intensive industry, and none is more capital intensive than construction and machinery, is, by its capital intensive nature, heavily burdened with cost for capital (usury) and stripping production of this unnecessary burden would be nothing short of revolutionary.

For instance, some serious investment in modern public transportation comes to mind. This is much needed all over the US and in California in particular and it would of course fit well with a Green Party agenda.

Furthermore, State Debt could be refinanced interest-free, ending the completely ludicrous plundering by Wall Street through wholly fraudulent ‘Government debt’.

Ms. Brown is very, very knowledgeable, also on the Usury issue and she actually has a heart, which is a nice change compared to the usual bunch running for office. She knows what we’re up against and that is also a big change with what we expect from politicians.

Finally someone people in California can vote for with a clear conscience!

Let’s wish her well and hope that the Alternative Media will endorse her with the same enthusiasm as the unfortunate Dr. Paul!

Here’s Bill Still interviewing her about her plans:

Related:

Ellen Brown’s Public Banking

Austrianism is Dying! Truthers Unite!

Margrit Kennedy, the world leading authority on interest-free economics, has passed away at the age of 74.

The news is already almost two weeks old: she died December 28th, from cancer. She is survived by her husband Declan Kennedy (from Ireland) and her daughter Antja.

Kennedy was an architect, a professor at the University of Hannover and an environmentalist who set out to understand why humanity is destroying its own habitat. Her path led her to the monetary system, usury in particular.

Usury is the great driver behind growing debt, growing money and hence the need for perpetual economic ‘growth’ at whatever cost. It is the need to pay off eternally growing interest charges that forces debtors into ever more atrocious behavior, including rapacious plunder of Mother Nature.

It’s hard to think of anybody who has done more to expose the ravaging implications of Usury. Margrit wrote several books on the issue, the defining one being “Interest and Inflation Free Money: Creating an Exchange Medium That Works for Everybody and Protects the Earth”. Her last one is “Occupy Money“.

Her main source of inspiration was Helmut Creutz, whose work she tirelessly promoted. Creutz is the one who established that the poorest 80% pay more interest than they receive to the richest 10%. He also found out that 40% of prices we pay are cost for capital passed on by producers.

She was one of the key players behind the rise of dozens of Regional Currencies in Germany after the Euro was implemented. She travelled all over the world to spread the word. She was in Iceland to advise the Government during the default.

I remember meeting her a couple of years back in Amsterdam, where we were both speaking at a big rally for monetary reform. During the diner beforehand I was sitting next to her and without further ado she glanced at me and asked: “so, when did you first see it?”. Referring to that defining moment in a life when we suddenly see what Usury is.

I am glad I then had (and took) the opportunity to tell her how important her work was for me.

The global monetary reform movement has lost a leading light. A huge thought leader. But she has influenced many, many people and her thinking will continue to grow through them.

It is only in the years and decades ahead that the true impact of her efforts will be properly appreciated.

Thank you for everything Margrit. Rest in peace.

Bill Still remembers Margrit Kennedy:

Tom Kennedy honouring a pioneer ‘UsuryFree Creative’.

Related:

On Interest

H. von Creutz: The Money Syndrome (the original studies that Margrit Kennedy popularized)

Positive Money and the Chicago Plan

Positive Money is undoubtedly one of the leading monetary reform organizations in the world. Their analysis of our monetary problems and proposed solutions are basically the Chicago Plan. But the Chicago Plan does not address Usury.

Positive Money, headed by Ben Dyson, is based in the UK and is a spin off of the New Economy Foundation. It’s a not-for-profit corporation and is financed by a number of social justice foundations and grassroots supporters. Total income last year was 135,000 pounds.

They have a powerful presence on the web. A well designed website, with an accessible narrative. They are very active on Facebook, where they have more than 20,000 likes, which is very substantial for monetary reform advocates. And this number grows quickly too, a testament to both their efforts and the growing general awareness of the issue.

Their communication is well thought out and professional. They break down the problem as they see it in concise videos and memes (pictures with a few sentences, which can easily be shared on Facebook). They churn out these memes regularly and they are continuously shared by many people who have an interest in monetary reform. By providing them they enable these people to promote the issue and this in turn gives Positive Money a strong voice in the debate.

Here’s a short video outlining their basic take:

They have a number of unofficial sister organizations abroad. For instance Sensible Money in Ireland and ‘Ons Geld’ (Our Money) in the Netherlands.

Recently they scored a nice success, when the British Green Party included Positive Money’s monetary agenda in their own program.

The Chicago Plan

Positive Money basically promotes the Chicago Plan.

In an effort to address the causes of the Great Depression, a first draft of this plan was circulated March 16th 1933 by a number of economists from Chicago University. It ultimately resulted in a paper called ‘a Program for Monetary Reform‘.

Irving Fisher was the most notable of these economists. At the time his plan, while appreciated by his colleagues, did not gain the attention it undoubtedly deserved, for the reason that his reputation had been severely damaged by his blindness to the bubble that preceded the depression. Only three days before Wall Street’s historic crash in October 1929, he predicted that stocks had reached ‘a permanently high plateau’.

It was an honest mistake, a lesson many continue to have to learn the hard way: he was heavily invested in stocks and really believed in the nonsensical stories that people make up during these, easy credit fueled, booms. He had been a wealthy man, but lost a very substantial part of his fortune in these weeks.

This blunder not only severely diminished his fortune, it was also a great bust for his reputation as a leading economist and it’s perhaps understandable that people at the time gave more credence to Keynes’ analysis of the situation. Keynes, after all, had already written ‘The Consequences of Mr. Churchill’ in 1925, after this Rothschild agent had reinstated the Gold Standard at their behest. Keynes predicted that this move would lead to a depression, undoubtedly one of the key reasons the Austrians always hated him so much.

However, Keynes claimed that depressions were caused by falling ‘aggregate demand’ in the economy (without pointing at the monetary reason: deflation) and suggested that the Government should compensate for this with anti-cyclical spending: borrowing money for investments for infrastructure and the like.

Fischer, perhaps exactly because he had learned the hard way, was much closer to the truth. He correctly stated that booms were caused by credit expansion and busts by deflationary debt deleveraging. What is more: he blamed the banks for this and squarely pointed at Fractional Reserve Banking.

His solution was to end Fractional Reserve Banking and force the banks to lend only what they had in deposits. Money creation should be left to the State, who should have the Central Bank print debt free money.

This then, is also what Positive Money prescribes as an antidote to our current problems.

The Goals of Monetary Reform

The New World Order is basically a group of banking families. They own the banking industry and through it the money supplies of the world. They use this control to suck up the wealth of the nations through Usury, which redistributes, ultimately everything, from the many to the very richest. Compound interest makes it unavoidable that these families owned the world within a few centuries after starting their lending operations.

Their second major tool is the manipulation of volume. Usury and racketeering cause money scarcity and associated permanently depressed economies, which has been the norm throughout the West for most of modern history. Alternating inflation and deflation causes the boom/bust cycle.

The third main issue is that the banks control who gets credit and who doesn’t. They finance those they own or want to own and starve the rest. There is zero democratic control of credit allocation, let alone a recognition of the fact that the credit they create through Fractional Reserve Banking is in fact our credit, to which we are naturally entitled.

The Chicago Plan was devised to solve problem number two: the manipulation of volume and the associated boom/bust cycle. Positive Money correctly states that money must be only printed in good times with low inflation. This is indeed a reasonable formulation of how volume should be managed.

Under the Chicago plan outright bankster racketeering aimed at creating deflation would be more difficult, although not entirely ruled out.

It would probably also to a large extent solve money scarcity. But not entirely, because money scarcity is implicit in a usurious environment. Interest plus debt will always be bigger than the principal.

While solving problem two, the Chicago plan does not even address point one or three. Banks would continue to rake in the interest and pay out to the rich (‘savers’) and the poor would be paying. They would continue to decide who gets credit and for what.

The Money Power and the Chicago Plan

There is little reason to doubt Fisher’s (let alone Positive Money’s) intentions. It fitted well with the thinking of these days.

But on the other hand, the Chicago Plan is not very threatening to the Money Power either.

It is more than noteworthy that we see the same thing with the Chicago Plan as what has become the fundamental conclusion of our discussion of NSDAP monetary policy after they came to power: Schacht solved the depression by providing the economy with some extra liquidity through his MEFO bills, but he vehemently opposed and managed to shut down Feder and the Strasser brothers and their anti-usury movement.

For the Money Power it’s a given that volume is under discussion. Their Austrianism is a typical example. It’s the redistribution through the monetary system that is the taboo.

Some highly amusing anecdotal evidence for this statement was recently provided by a friend, a notable monetary reformer from the Netherlands, who told me that at some convention he was invited by a well known Dutch economics professor to join the wholly innocuous ‘New Economy Transformers’, centered around ex-World Bank chief Herman Wijffels. The good professor had no qualms off handedly adding “but you will have to stop talking about the wealth transfer through the system all the time”.

Another issue is that leading Money Power outlets, including the Financial Times and the IMF, nowadays routinely positively discuss matters in a very similar vein to the Chicago Plan.

Is it worthwhile limiting oneself in the discussion to the boundaries of thought that the Money Power itself sets?

Full Reserve Banking

Until about six months ago, they didn’t mention the Usury issue at all. They reasoned (and basically still do) that Usury is too big an issue and getting it on the agenda, let alone rid of it, impossible.

But the growing momentum and ongoing feedback on their Facebook page made them change course and they produced a number of their typically high quality vids and memes exposing the hundreds of billions per year the British banks are raking in through Usury and the wealth transfer from the 90% to the 10% through this process and Usury in general.

But they frame it in such a way as not to disturb their proposed solution of Full Reserve Banking. They claim private money creation is the problem.

But ultimately it matters not who creates the money. What matters is what it costs and whether volume is stable. What matters is who gains by money creation.

We have already discussed Full Reserve Banking extensively in this article. Suffice it to say that the Money Power will quickly reestablish full control over any ‘debt free money’ and will continue to reign supreme through interest-slavery.

A 200k mortgage would still cost 300k in interest. The opulent would still rake in most of the money.

The conclusion is that the Money Power is comfortable with proposals that end the depression based on the correct analysis that they are caused by deflation. Sure, while implementing depression, they combat these plans, but they are no existential threat and in fact are used by them to solve depression when they have achieved the goals they were aiming for in creating them: they provide the necessary paradigms for the public to ‘understand’ what is going on.

But can we really avoid the Usury issue, considering the myriad profoundly dishonest and destructive implications? Its supreme importance to the Money Power?

The more so since such reasonable ways to do away with it are readily available?

Conclusion

Positive Money and the Chicago Plan are close to Public Banking and the Hamiltonians. And even more so to Zarlenga and the American Monetary Institute. Modern Monetary Theory also fits in this group.

The main difference between the Hamiltonians and the others is either private or public fractional reserve banking with interest vs. private full reserve banking.

Their common basic idea is that the problem is that control of money is private and that it should be nationalized. They either nationalize money creation or the banks (which automatically means the money too).

They all avoid the crucial Usury issue and enforce the State. They do not really accept the commoner’s fair share in it all. The fundamental need to end interest slavery.

But to the common man it matters little whether he is paying interest to the State or to private banks. Governments are not the commonwealth and history shows less is more.

So while Positive Money is doing a wonderful job getting monetary reform on the agenda, their proposals are simply not comprehensive and are co-optable for the Money Power.

Related:

The Goal of Monetary Reform

Forget about Full Reserve Banking

Full Reserve Banking Revisited

The Difference between Debt-Free Money and Interest-Free Credit

Austrianism is Dying! Truthers Unite!

More on Mutual Credit

Hitler’s Finances, Schacht in his Own Words