[youtube=http://www.youtube.com/watch?v=0dJg_EYk3cE]

Listen to it all, it’s short and powerful.

Great going Rys2sense! Thanks man!

Are they for real?

Instinctively I don’t like their V for Vendetta thing. That’s just a Hollywood symbol. Haven’t we gone passed that stage of adolescent movie hero worship?

I saw that film a few years ago, but the only thing I really remember is that the ‘hero’ was torturing his girlfriend in his basement.

However, I don’t mind that much, every positive operation fighting the good fight can use whatever symbols they like, for as far as I’m concerned.

I think they did a good thing finding out about this lunatic.

This cop will have had a bad day. I assume these girl’s husbands, dads and brothers have payed this joker a visit by now and put him on disability leave for a few weeks. After the job was done they provided each other with an alibi and all the rest is history.

This we will need more: all ‘law enforcement’ personnel should be closely monitored, so we can have justice.

Also, I underwrite their motto, ‘we will not forget, we will not forgive’. I used to underwrite this long before Anonymous appeared, it’s not very original either, just like the mask.

However, I have a serious problem with this. Anonymous says it will conduct a Denial of Service attack at the NY Stock Exchange.

Wait a minute….. Say what? They are going to ‘erase the NYSE from the internet’?

Isn’t that an act of Cyberterrorism?

It is in my book.

And why attack the Stock Exchange? Isn’t it absolutely, completely clear that if people object being fleeced by the Global Bank’s trading programs they should simply not ‘invest’ there?

Or is there some God Given right for that I have missed that allows us to fleece others, but to get angry when we get fleeced ourselves? The Stock Exchange is just a wealth transfer mechanism. People go to the Stock Exchange for a free lunch and are disappointed when it transpires it does not exist. Or better: that the free lunch of the Stock Exchange has already been served, with us on the platter.

No, if people want to exploit, or want to be exploited, they should be free to go the NYSE and eat their or somebody else’s heart out.

There is a very easy way to avoid all that: don’t invest there.

This, by the way, is also the easiest way to get rid of all the problems: don’t invest with these banks! Don’t put your money there! Don’t buy at Wal Mart!

And if you do? Then shut up. You’re a big part of the problem. Don’t come clamoring for someone to bail you out. You start sounding like a banker.

This stunt, if it is to go forward, is most unwise at best. It will give Super Congress the excuse they need to reign in free speech on the internet.

To be honest: this whole thing looks like a false flag 2.0: attack ‘in the name of the people’ and then let the people suffer the blowback.

Don’t fall for this one: Anonymous stinks.

Update: Anonymous released a statement, the whole thing was a hoax.

When looking at what is going on at this point, this probably sounds like a bizarre question. It seems more opportune to wonder how the Euro managed to survive this long.

Clearly the imbalances between Germany and its satellites (the Netherlands, Denmark, Austria) and the rest of Europe are not sustainable. The South imports tens of billions per year more than it exports to the North. It needs to be able to devalue its currencies on a regular basis to keep the capital outflow under control.

The bailouts of Greece and the other nations is nothing more than a repair of these imbalances. Not to mention the fact that it is not Greece, but Deutsche Bank and Société Général that are being bailed out, at the cost of the Greeks.

(I’m reposting this, because it is somewhat older and only few read it. It’s more relevant than ever, though….)

Recently New York’s Public Advocate Bill de Blasio released a very important study about Wal-Mart’s effects on local communities. It represents a major step forward in the understanding of the effects of Big Business.

These effects are insufficiently understood, because scholars have degenerated into spin masters for Big Business, simply because it is Big Business that controls their budgets, allowing only studies explaining how wonderful they are. It’s the same process that led medical ‘science’ to the conclusion that Mustard Gas is beneficial to human health.

However, correctly directed science is indeed capable of coming to useful and even truthful conclusions and the mentioned report is a case in point. I recommend studying it, the offered link leads to a compact 10 page executive summary with all the main conclusions. It is indispensable ammo for community leaders of good faith.

Although the report investigates Wal-Mart in the USA, it is clear its conclusions can be extrapolated to the European situation. Just fill in Aldi, Lidl, Ahold, Carrefour, Sainsbury or Tesco, depending on your local situation.

The Di Blasio Report

The main conclusions are shocking and to the point and make clear what damage Wal-Mart actually managed to do to the American economy. The two most fundamental conclusions are these:

1. Wal-Mart store openings kill three local jobs for every two they create.

Wal-Mart is the biggest employer in the USA, with 1,4 million ‘associates’. The conclusion is, that Wal-Mart alone has killed about 700.000 American jobs. Only Wall Street can boast greater destruction to the American labor market.

2. Chain stores, like Wal-Mart, send most of their revenues out of the community, while local businesses keep more consumer dollars in the local economy: for every $100 spent in locally owned businesses, $68 stayed in the local economy, while chain stores only left $43 to re-circulate locally.

This means Big Business have a deflationary effect on local economies. And this in turn explains why Big Business destroys both employment and business.

These two conclusions are more than sufficient to make the study worth while, but I’ll give a few more, just to further the point.

3. Stores near a new Wal-Mart are at increased risk of going out of business. After a single Wal-Mart opened in Chicago in September 2006, 82 of the 306 small businesses in the surrounding neighborhood had gone out of business by March 2008.

4. Wal-Mart’s average annual pay is $20,774. Below the Federal Poverty Level for a family of four. In fact: ‘a Wal-Mart’ spokesperson publicly acknowledged in 2004 that ‘More than two thirds of our people…. are not trying to support a family. That’s who our jobs are designed for.’ ‘

So Wal-Mart is an effective accomplice in the social engineering campaign of our bosses, isolating people and consciously attacking the family unit.

The above makes abundantly clear that Wal-Mart and Big Business in general have a profoundly negative impact on economies, both locally and nationally.

So why do people shop at major Retail Chains?

Of course it is useful to have the figures. But then again: we already knew this. We know Big Business is just destroying smaller and medium sized businesses and we also know that these smaller businesses are the backbone of our economy.

Sure, these stores offer a certain convenience, usually having a larger assortment of goods. Why go to four shops if you can get everything at one? We don’t have the time!

But we don’t have the time, because we need three jobs to maintain the illusion of a middle class status. And we need these jobs because we are accomplices in the plundering of our communities and neighbors.

And of course Big Business is often cheaper. At least: until they have destroyed the local competition, after which they start their monopoly pricing operation.

So we make decisions that damage our neighbors, favor ourselves in the short term, but eventually make us and our kids go begging for a $20,774 per annum job.

Are we just stupid? Yes, we are, we know we are. But there is also the ‘prisoner’s dilemma’.

The prisoner’s dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so. It was originally framed by Merrill Flood and Melvin Dresher working at RAND in 1950. Albert W. Tucker formalized the game with prison sentence payoffs and gave it the “prisoner’s dilemma” name (Poundstone, 1992).

A classic example of the prisoner’s dilemma (PD) is presented as follows:

Two suspects are arrested by the police. The police have insufficient evidence for a conviction, and, having separated the prisoners, visit each of them to offer the same deal. If one testifies for the prosecution against the other (defects) and the other remains silent (cooperates), the defector goes free and the silent accomplice receives the full 10-year sentence. If both remain silent, both prisoners are sentenced to only six months in jail for a minor charge. If each betrays the other, each receives a five-year sentence. Each prisoner must choose to betray the other or to remain silent. Each one is assured that the other would not know about the betrayal before the end of the investigation. How should the prisoners act? (Source)

The problem is, that most people don’t trust their peers to do the right thing and therefore they just take the short term gain themselves. This is a major trump in the hands of Big Business and basically explains why they are so successful in enslaving us. It is interesting that this behavior is defined as ‘rational’ in economic game theory.

Solutions

So we are the victim of a classic ‘prisoner’s dilemma’. What can we do?

Individually

In the first place: individuals can transcend the prisoner’s dilemma by just deciding to not play along. Especially when we are not facing the kind of prison sentences as in the example. All we stand to lose is a little discount here and there. And why are we allowing ourselves theses discounts when we know we are dealing with the devil anyway? We are being mind-controlled into believing cheaper is better, but anybody giving it a little thought must realize that this is simply hogwash. Our decisions should be made on far more profound grounds than just price.

We needn’t worry about the idea we would not be acting ‘rationally’ as defined in game theory, because not all people are as stupid as most economists and Douglas Hofstadter decided to call players doing the right thing in the prisoner’s dilemma ‘superrational’. And right he is: people benefit from cooperating and taking the long term into account (as long as the short term isn’t immediately lethal) is clearly rational behavior.

We should also take into account that we lead by example. It is a common human trait to wait for others to do what is necessary. It is this trait that got us here anyway. The simple fact of the matter is, that it is a thousand times more powerful to put our money where our mouth is, than it is to forward this article to everybody we know. We can only change ourselves and however difficult this may be, the good news is, it inspires others.

Once we realize what we are dealing with, we must be able to understand we need to quit shopping at Big Business outlets and start patronizing local businesses. For our own sakes and for that of our neighbors.

Systemically

Not only do Regional Currencies (RC) make us less dependent on the nefarious banking system, they also profoundly strengthen us in the struggle with Big Business. Most Regional Currencies don’t allow Transnationals to participate (and usually Big Business is not interested to do so either). This means RC’s can be spent only at local shops and businesses.

It is clear that this is a very useful aspect of these currencies: they increase the competitiveness of local business, because people owning some of the currency can only spend them at local enterprises.

Even if you patronize local business exclusively, it still makes sense to pay with an RC, because the shop owner can only spend the money at his or her colleague’s businesses. So even after you have spent your money, you still positively influence the local economy. If you pay with a dollar, there is a higher chance your local supplier will spend the money outside your own region.

Concluding

Big Business is destroying our economy and we are accomplices in this process by shopping at their outlets.

We should immediately quit doing so. A rational appraisal of the situation leaves us no other choice.

Regional Currencies, beside their other useful benefits, exclude Transnationals and enhance the local economy by strengthening the competitiveness of local businesses. Even if we do the right thing by shopping locally ourselves, it is still useful to pay with them, because we strongly encourage our local suppliers to shop in the neighborhood as well.

This article was written for, and posted by, Activist Post. It can be found permanently here.

Related:

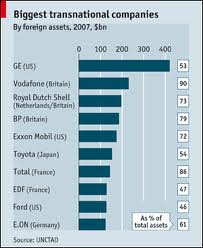

Why Transnationals Thrive

I just read this at Rense’s:

- In 1923, who was:

- 1. President of the largest steel company?

- 2. President of the largest gas company?

- 3. President of the New York stock Exchange?

- 4. Greatest wheat speculator?

- 5. President of the Bank of International Settlement?

- 6. Great Bear of Wall Street?

- These men were considered some of the world’s most powerful and successful of their days.

- Now, 80+ years later…here they are and here is what ultimately became of them

- The Answers

- 1. The president of the largest steel company.

- Charles Schwab, died a pauper.

- 2. The president of the largest gas company,

- Edward Hopson, went insane.

- 3. The president of the NYSE,

- Richard Whitney, was released from prison to die at home.

- 4. The greatest wheat speculator,

- Arthur Cooger, died abroad, penniless.

- 5. The president of The Bank of International Settlement,

- Leon Fraser, shot himself.

- 6 The Great Bear of Wall Street,

- Cosabee Livermore, also committed suicide

- However, in that same year, 1923, the PGA Champion

- And the winner of the most important golf tournament,

- The US Open was Gene Sarazen.

- What became of him?

- He played golf until he was 92,

- Died in 1999 at the age of 95.

- He was financially secure

- At the time of his death.

- The Moral:

- Screw work.

- Play golf.

Cool list.

But the moral is quite mistaken. It should not read ‘Screw Work’.

It should read: Screw Evil.

- In 1923, who was:

- 1. President of the largest steel company?

- 2. President of the largest gas company?

- 3. President of the New York stock Exchange?

- 4. Greatest wheat speculator?

- 5. President of the Bank of International Settlement?

- 6. Great Bear of Wall Street?

- These men were considered some of the world’s most powerful and successful of their days.

- Now, 80+ years later…here they are and here is what ultimately became of them

- The Answers

- 1. The president of the largest steel company.

- Charles Schwab, died a pauper.

- 2. The president of the largest gas company,

- Edward Hopson, went insane.

- 3. The president of the NYSE,

- Richard Whitney, was released from prison to die at home.

- 4. The greatest wheat speculator,

- Arthur Cooger, died abroad, penniless.

- 5. The president of The Bank of International Settlement,

- Leon Fraser, shot himself.

- 6 The Great Bear of Wall Street,

- Cosabee Livermore, also committed suicide

- However, in that same year, 1923, the PGA Champion

- And the winner of the most important golf tournament,

- The US Open was Gene Sarazen.

- What became of him?

- He played golf until he was 92,

- Died in 1999 at the age of 95.

- He was financially secure

- At the time of his death.

- The Moral:

- Screw work.

- Play golf.

These days it is common for people to look for ways to express themselves in positive ways. Meaning they try to articulate what they want, instead of what they want to get rid of. For instance, they say ‘I want to be healthy’, instead of ‘I don’t want to be sick’.

This is a useful trend, because traditionally people have been expressing themselves negatively, emphasizing problems, instead of visions and solutions.

While I agree that it is important to have a clear picture of what we want, it is also necessary to understand and express what we don’t want. I’ll give a few examples of why this may be relevant. Read more…

This article was published at henrymakow.com

Since the official start of the Credit Crunch in September 2008 a fierce debate has been raging whether we would be facing deflation or inflation. We can now establish that we will have a very toxic combination of both, known as stagflation. Read more…

In this day and age of feminists in the West clamoring for minimum quotas of women in office and upper management it is relevant to ask whether this would really serve society and whether women have the capacities needed for leadership.

It is well known that men are physically stronger. Feminists have had their go at explaining this away with a number of rationalizations, but none of them worked because of the obviousness of the fact. So now it is being ignored as irrelevant. Women these days don’t need strong men, because they have lesbians in the police force protecting them from male oppression and sexual harassment. Or so they think.

However, less clear is the fact that men are also intellectually dominant. Clear proof of this statement can be found in the chess world. I’m very familiar with that sport, having been an avid tournament player for years, president of one of Hollands leading chess clubs and member of the board of the Dutch Chess Federation.

Chess is a clearly intellectual sport. It requires brainpower, energy and good health. A chessplayer can use as much energy during a 6 hour ‘game’ as a soccerplayer can use in a 90 minute match. However, no physical strength is required, so it is a very reasonable testing ground for intellectual prowess.

And the fact of the matter is: men totally dominate chess.

In chess strength is expressed in Elo rating. You gain Elo points when you win, you lose them when you lose.

The best chess player in the world at this point is Magnus Carlsen, who has an Elo rating of 2826. Elite players have an elo rating of 2700 plus.

The best female player in the world is Judith Polgar, who at this point has an elo rating of around 2680. She is the only female player in the Top 100. Her sister is Susan Polgar, who was at some point Woman World Champion. She never crossed the 2600 threshhold though. In fact, besides Judith there is only one woman who ever managed to get a 2600+ elo rating.

But Judith is an anomoly, because she was raised by a Hungarian psychologist who published a book before she was born entitled ‘How to create a Genius’. And that is what he set out to do. He succeeded with her, but the fact of the matter is, he was unlucky to have only daughters. Had his son been Vishy Anand, Magnus Carlsen or Vladimir Kramnik, they would probably have ended up with a 3000 elo rating.

Of course there are strong women and a strong woman will beat a weak man. But a strong man will always beat every strong woman.

The few women that have the capacity and will to work at (near) top level should be able to do so.

But the fact of the matter is, that very few women can really compete with men.

Nature has its paradoxical ways of asymmetric justice. Yin and Yang are opposing forces. Yin is the water that erodes the toughest rock. Women give birth to men and women alike. They nurture their offspring, literally. Women have been fooled to dismiss this invaluable contribution as unworthy. It is the strangest of things.

Both men and women have their role to play in this world. The way feminists try to usurp the male role is not based in fact and pathetic. To have second rate women lead first rate men is a disgrace and unacceptable to real men. Which explains to a high extent the ever larger number of young men dropping out of school and employment.

Let men be the head of the household and women its heart. That is a reasonable and truthful way of organizing ourselves as a species.

Many people seem to connect Gold to God. They despise Fractional Reserve Banking and the bankers running the printing presses. They reason: Gold cannot be printed. Or even better: God Himself printed the Gold Supply and we’ll just have to do with it.

Perhaps they believe the Bankers a little too much, who printed ‘In God we Trust’ on their Gold coins.

But people, let’s face it: Gold as Currency is not possible without interest. And in all three Books dealing with Abraham and his offspring usury has been expressly forbidden.

And just ask yourself: where does it say in Scripture that we should use Gold? Where does Scripture advise the hoarding of cash?

Gold is said to be a good store of wealth, but storing wealth is not a high priority for real Christians, i.e.: people following Christ, which is not the same as, and quite often the opposite of going to your local Church.

Do not store up for yourselves treasures on earth, where moth and rust destroy, and where thieves break in and steal.

But store up for yourselves treasures in heaven, where neither moth nor rust destroys, and where thieves do not break in or steal; for where your treasure is, there your heart will be also……….……..No one can serve two masters; for either he will hate the one and love the other, or he will be devoted to one and despise the other. You cannot serve God and wealth.

We are not looking for a good store of wealth, we are looking for a good medium of exchange. Interest free, meaning free from exploitation. Enabling equitable exchanges between brothers and sisters, children of the One.

In the Bible and in all other Sacred Texts it has been made clear that attachment to property is a major symptom of spiritual disease.

The Bible actually equates Mammon to the Adversary.

Gold is not a symbol of God.

It is the main symbol of spiritual darkness.

I’ve noticed lately that one of the primary reasons for people to cling on to usury, even if they are all for a non-interest-bearing money supply, is to encourage saving. However, one cannot make money by saving interest-bearing money.

I want to discuss a more advanced appreciation of money and credit. If you need to get up-to-speed on the current issues facing our monetary system, you’ll find Ellen Brown’s recent article on money as credit quite useful.

The below is far from complete, but my goal is to invite new thinking which we badly need in our search for an equitable, efficient, and effective monetary system. Read more…