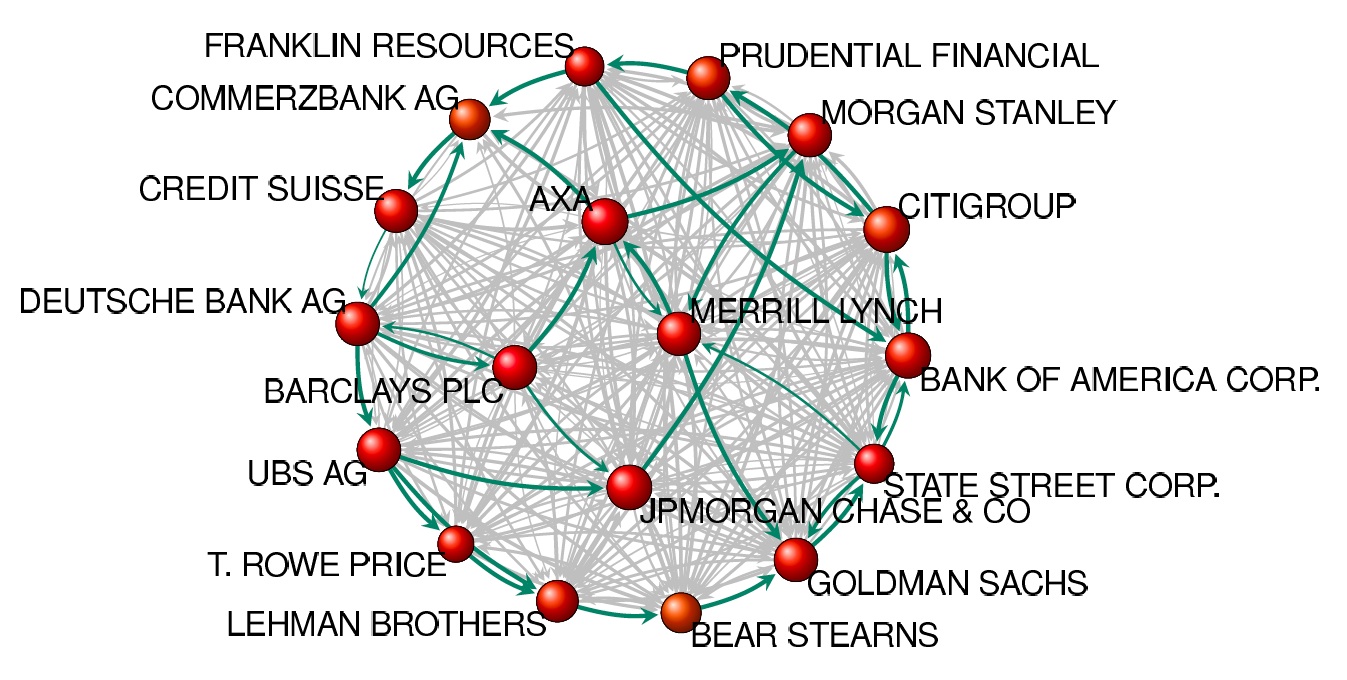

In the autumn of 2011 an already legendary study by a number of Swiss scientists revealed that a small number of banks controlled a decisive stake in the globe’s economy. The idea that the banks are a cartel and that this cartel controls the economy is now a scientifically quantified matter of record.

By Anthony Migchels for Henry Makow and Real Currencies

The study, called ‘the Network of Global Corporate Control’ was done by Stefania Vitali, James B. Glattfelder, and Stefano Battiston, in Zurich, Switzerland. The method was datamining the Orbis Marketing Database 2007, with data on more than 30 million economic actors (companies and investors) worldwide, including asset positions.

The study was published in the New Scientist, a highly respected outlet of mainstream science.

The results were interesting, although basically predictable.

Massive centralization

It transpires that there are about 43,000 companies that are Transnational according to the OECD definition.

There is a top 1,318 of them that seem to be at the center of it all. This core group has three important characteristics.

1. Between them, they generated 20% of the world’s income.

2. They own each other.

The Orbis database clearly showed that most shares of these corporations were owned by other members of the group of 1,318. This means that the biggest, most profitable and influential corporations in the world all own each other and are basically one massive cartel, or even monopoly. They are competing only nominally. Competition is sin.

3. The core owns all the other biggest 43,000 Transnational corporations.

These companies generate another 60% of the entire world’s income. So not only is the top of the business world one major cartel, it controls or outright owns all of its lesser brethren, confirming the idea of one incredible monopoly owning the entire world.

Besides these three issues with the core of 1,318, there are two more shocking observations:

4. 80% of the total control was in the hands of an even smaller group of 737 corporations.

5. And last but not least: at the very top, only 147 corporations directly control 40% of the total wealth.

Conclusion

See the top 50 of this list below the article.

As you can see from that list, they are all banks or other financial institutions.

So no, it’s not a hyperbole to say the Banking System is One. We’re not overstating the case when we say it’s just one massive cartel. That the banks own everything, including all the major industries. Oil, Weapons, Pharmaceuticals, Food, Telecom and IT, etc. It’s all one massive monopoly. Controlled from the top down.

The Money Power is real and these Swiss gentlemen have done us a favor by crunching the numbers.

Questions remain. How do the CAFR’s of US Governmental pension funds and the like fit in this picture? How are the companies controlled if they all own each other?

However, the last few years we have seen conspiracy theory getting validated more and more everyday. People are still surprised, but that is only because they don’t understand human nature. People conspire to do just about everything. It would have been really surprising had there not been a conspiracy to rule the world.

Related:

Understand the Banking System is One

Liebor, the Biggest Scam in History?

Take your money out of the bank NOW! (with video)

For this article I am indebted to David Wilcock.

Tonight I had an interesting chat with Faux Capitalist’s Jason Erb. We discussed the backgrounds of Austrian Economics and Libertarianism and what to do about it.

The interview can be found here. Go to about 30 minutes for the interview.

Recently a lot of highly reliable commentators have pointed at the possibility of a false flag attack at the London Olympics. Undoubtedly these predictions have merit, but they do create a dynamic of their own: when they work, in the sense that they prevent the attack, they were wrong as a prediction.

By Anthony Migchels for Real Currencies

Peter Eyre, Henry Makow (through a guest writer) and Rixon Stewart, whose psychic friend tells us the elites are ‘pissed off’ because of the predictions, are among those warning the public. Truth be told, rock solid evidence of a false flag has not been offered, but there is indeed a wealth of circumstantial evidence, some of it highly intriguing. And it clearly would fit with our master’s modus operandi and their agenda in the Middle East.

The obvious problem with correctly predicting a false flag attack is that the perpetrators will most likely decline to push through the planned event. In that case the prediction was highly successful, but nobody will ever know. And after a few of such events, the public may wary of such warnings. The Mainstream Media will start ‘exposing’ the ‘fearmongering’. The boy that called wolf syndrome starts to operate.

And the next time, the Powers that Be will be able to pull it off anyway, notwithstanding the warnings of the Free Press, with the MSM saying: ‘well, they had to be right at some point, and this time happens to be it.’

Conclusion

It takes courage to make such predictions in the face of inconclusive evidence. It must be done, even when risking to be wrong. Too much is at stake. But the tactic for the opposition is predictable and although I can’t offer a strategy at this point, it is useful to discus it nonetheless.

The LIBOR scandal, called LieMore by a witty commentator, involving the manipulation of LIBOR rates by Barclays Bank is only beginning to have an impact, but already some have dubbed it the biggest scandal in the history of finance. So is it?

By Anthony Migchels for Henry Makow and Real Currencies

LIBOR (London InterBank Offered Rate) is the index of interest rates banks charge each other. It used to be one of those highly relevant, but completely unknowns, until it became a concept of household fame in 2008. At the height of the Credit Crunch in the fall of 2008 a peak in LIBOR showed banks were unwilling to lend to each other, forcing first the financial and then also the real economy to a grinding halt.

LIBOR is set every day by the world’s biggest banks. They call in to report the rates at which they borrow from each other. The highest and lowest 25% of rates are discarded and the rest are used to calculate the average. This number is then used as a benchmark for interest rates all over the world. For instance, almost 60 percent of prime adjustable rate mortgages, and nearly 100 percent of subprime ones, were indexed to LIBOR in 2008. One estimate has it that 350 trillion worth of loans and derivatives are indexed to LIBOR.

So when a couple of bankers decide to manipulate this rate, it has immediate and profound consequences worldwide. Just one basis point (one one-hundredth of a percent) difference would mean 35 billion to be paid more or less on a yearly basis.

As a result, it is said, the banks involved face an existential threat: class action suits will follow and clearly the sums involved will quickly overwhelm the banks.

Whether this is so, remains to be seen. BP destroyed the Gulf, but just coughed up 20 billion and never looked back. It is well known that banks are really, really very important to us. We couldn’t exist without them, that’s why we have to cough up trillions upon trillions to bail them out.

Right?

The scandal breaks

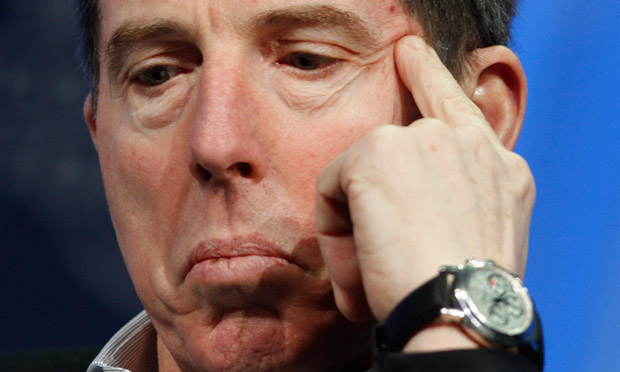

The story broke, when Barclays was fined 450 million by regulators in America and London. Their boss, Bob Diamond, initially shrugged it off and declared business as usual. The same idiot declared before the Treasury Select Committee in January last year: “There was a period of remorse and apology for banks and I think that period needs to be over.” I must have been elsewhere when this period actually happened.

In Holland, when a single mum on the dole rips off the system for a few thousand, she’ll be tossed into jail for a few months and she’ll be paying back everything. With interest.

Clearly, Bob Diamond, and a great number of other bankers too, should have been incarcerated a long time ago, but here too, he gets away with resigning.

Now the blame game is beginning. Yesterday Diamond declared that the Bank of England’s second in command Paul Tucker made him do it. LIBOR was so high, the creditworthiness of the banks was being doubted. This was badly exacerbating the Credit Crunch and Tucker proposed a simple solution. He, in turn, was pressured by influential Whitehall types.

Meanwhile, JPMorgan, Citibank, Bank of America and probably most other banks involved in LIBOR are being investigated and are undoubtedly involved. This goes to the heart of the banking cartel. Barclays was named as being at the epicenter of the small group of firms that a fascinating study discovered to own most companies in the world, a few years back.

But in a classic case of double think, Diamond simultaneously declared it was ‘just a group of 14 rogue traders’.

Conclusion

The whole system is involved. All the major banks, BoE and the British Government are already implicated. But undoubtedly the FED, the ECB and and a number of Governments were at least aware of what was going on.

The Banking System is One and involves all these players, including the press and the academic world. By shifting blame amongst each other they distract us from this simple truth. If they are all to blame, none are to blame.

So is this the biggest scandal ever?

Finance itself is the scandal. That $200k mortgage that we are paying $300k interest over in thirty years was printed the minute we took out the loan. The 450 billion the taxpayer is sweating to cough up each year to service the National Debt while the Government could easily print some interest free credit or even debt free money is another side of this coin.

This is just the umpteenth banking scandal, but people simply cannot yet get their head around the fact that bankers are insane vampires per definition. That the banking system is one cartel ruling the entire planet and owned by a small group of centuries old families known as the Money Power or Illuminati.

That we should be getting our money out of the system now, lock up all these disturbed maniacs and print some interest free cash.

Perhaps this particular little scandal will help them understand. But I’m not holding my breath.

Related:

Understand that the Banking System is One

Take your Money out of the Bank NOW! (Video)

“Panta Rhei” Heraclitus

“Lay not up for yourselves treasures upon earth, where moth and rust doth corrupt, and where thieves break through and steal” Yeshua

As we have been discussing extensively on these pages recently, money is a means of exchange, and not a store of value. But there is the age old human desire to maintain wealth for future use, instead of current consumption. So how should we go about it? And is storing wealth a good idea to begin with?

It’s useful to note that there is a profound difference between a good investment and a good store of value. A good store will maintain value, a good investment is expected to generate value.

There are two kind of investments. One is productive, the other is ‘financial’. The productive kind is using some of our wealth to cut costs, or increase productivity. By buying machines. Or improving our education. Not only our own wealth increases, but also that of the community that we belong to as a whole.

The financial kind is exploitative. It does not create wealth, it redistributes wealth. To the community it is a zero sum game. The basic driver of ‘financial investments’ is the lack of cash of the multitude. Financial ‘services’ and ‘investments’ exist to ‘help out’ those who are strapped for cash. With a loan, for instance. Or ‘insurance’.

Economists call this ‘the optimal allocation of capital’. But a cursory glance shows that it really reallocates capital from the non-haves to the haves. Many of the 99% are often busy looking to share in the proceeds of this rigged game or they try to explain it is all normal and desirable. But they shouldn’t, since they’re the ones providing the return that ‘capital’ is so eager to obtain.

By far the majority of people would be served best by an immediate end of all financial ‘services’, but clearly this is not a popular proposition. Most people still hope to beat the casino at some point and strike it rich themselves. And the Money Power has always been very apt at swinging the carrot in the face of the many, which are called ‘unsophisticated investors’ by the insiders. A recent example was the Facebook IPO. Banks have a long tradition of floating much overvalued stock, it goes back centuries, but still many people fall for it and still the con men behind these schemes are on the A-list of metropolitan society.

The blinding glitter of gold

Another example is gold. By selling a few ounces to those realizing something is brewing, the Money Power not only creates momentum for the coming Gold Standard, it also disables potential opposition by buying them off with a small part of the massive windfall it stands to gain when gold becomes money again.

Gold, of course, is plugged as the ultimate store of value. That’s why our misguided brethren of the Austrian persuasion believe it is the only ‘Real Currency’.

Nowadays the Gold dealers will tell us gold was only at $200 per ounce a decade ago while currently at $1600. “Now that is storing value!” they will exclaim.

Clearly it is not: if it were a good store of value, it would buy the equivalent of $200 2002 dollars. In reality gold has been a good ‘financial investment’. And who have been paying for the gains of the gold owners? Well…….those that didn’t buy gold. Or better: that only just bought some.

Gold is not a good store of value. Simply because it’s value is not stable. It rises and declines. It has been appreciating over the last decade because of broad speculation, fueled by the Money Power itself, that it will be money again. More and more countries non-aligned with the American Empire are looking to gain independence from the dollar by creating gold based units. Even America itself seems to be moving toward a Gold Standard of some sorts.

This won’t last long. A Gold Standard will create the deflation the Banking Fraternity seems to want. And when the masses will have risen, creating the havoc our masters seem to be aiming for, and do away with the horribly deflationary Gold Standard, killing economic growth and horribly raping debtors, gold will be relegated to the 2002 $200 dollar per ounce territory once more. Sure, this is still quite some time off, and it will go up before it goes down. Way up, actually, if this scenario indeed comes to fruition.

“But gold still buys the same amount of wheat as 5000 years ago!”, we hear the gold dealers clamor. Sure, in the long run gold has shown to be reasonably stable. But, as it has been said: “in the long run, we’re all dead”. Meanwhile, people buying gold on the top of its price, hoping to ‘store wealth’ will be holding the bag when it comes down to its natural price again.

If not gold, then what?

So if storing cash is not the way and buying gold is not saving, but an exploitative ‘financial investment’, then what?

The crucial thing to understand is that storing wealth is not about ‘liquidity’, but about ‘net asset position’. It’s not about the cash in one’s pocket (or bank account), it’s about the assets on the balance sheet. For millionaires this is a total no brainer but most people are financially illiterate, so it’s worth while mentioning this.

Another thing, cliche or not, to keep in mind is, that it’s always good to have more than one egg in the basket.

The first thing I’d suggest is to pay off debt. The financial wizards have skewed the system so badly that they can nowadays somewhat plausibly claim debt is actually favorable in many cases. Forget about that. The least we can say is that being in debt increases the wealth transfer to the Money Power through interest. It’s a bind that makes us vulnerable to all kinds of shocks. Dump all your cash in paying off debt, it saves interest payments too, so in terms of your net asset position and net income stream it is always a decent proposition.

Investing in local businesses, your own perhaps, or your education, new tools, new skills. These are all very worthy ways of disposing of cash while improving one’s net asset position.

If there is no debt left, or investments are available, start paying in advance. Our local shopkeeper certainly will be interested, as it constitutes an interest free loan to him. He might even give a discount in return. This is a serious mutual win-win. In fact, local business men should be far more proactive in developing such schemes. It allows them access to capital they desperately need and it also is an excellent way of committing their customers to their business.

To local people it is beneficial, because it strengthens their local economy tremendously, in this way a fist can be made against the combined onslaught of Wal Mart and non-lending banks.

The spiritual laws governing this issue

But even paying your taxes in advance is better than sitting on your cash. Money must flow, it must circulate. Even if it is not directly beneficial to one’s self, it still is a wise way of dealing with money. It makes you tap into the abundance of Providence.

As is written in ‘God Calling‘, January 5th:

“Do not be afraid of poverty. Let money flow freely. I will let it flow in but you must let it flow out. I never send money to stagnate – only to those who pass it on. Keep nothing for yourself. Hoard nothing. Only have what you need and use. This is My Law of Discipleship.”

Saving money stagnates the flow of abundance. I know this is hard to digest for many people, but it is worth mentioning nonetheless.

And the final issue is this: storing wealth, accumulating wealth is vastly overrated. In fact, it is highly risky. Jesus was not kidding when He warned us we cannot serve two masters. Accumulating wealth leads to poverty of the Spirit. This is a Law of Nature.

We can own what we need and use, all the rest is simply a hindrance. It requires care and attention. It must be maintained. It can be stolen. We become defensive (because) of it. It distracts us from our main priorities in life. Long before Jesus, Buddha was already explaining this.

First and foremost: the desire to store wealth is a sign of fear. Fear for the future. Fear of want. Anything driven by fear leads us astray. It is uncalled for. Providence provides. We can really trust on that. We must shed the fear of want and we must shed our desire to measure our ‘standard of living’ by the norms of our neighbors. We should not be working hard to create wealth, but to learn how to live in tune with the One Volition, to do His will, because that is the real source of everything.

Yes, the Old Testament tells us to be frugal, work hard and create wealth. But that is the Old Covenant. That is Law. Christ brought the New Covenant, based on Grace. The gospels clearly are very outspoken on hoarding and wealth accumulation. Most (but certainly not all) people will agree wealth is of lesser import than family, let alone our own life, but Christ implores us to even shed the fear of losing them:

“If any man come to me, and hate not his father, and mother, and wife, and children, and brethren, and sisters, yea, and his own life also, he cannot be my disciple.” (Luke 14:26)

So we can hardly be surprised to read a few verses later:

So likewise, whosoever he be of you that forsaketh not all that he hath, he cannot be my disciple. (Luke 14:33)

Conclusion

To many people these matters may seem abstract. They are not. They are fundamental, simple and to the point. All they require is a little contemplation and appreciation.

Hoarding cash is obstructing the flow of life itself. Wealth accumulation is a very low priority and can easily overwhelm our perception of our real priorities.

Economics, if it is to be a sacred science once more, must be in accordance with the simple laws of the Spirit.

Related:

Don’t hoard the Means of Exchange! (part 2)

Don’t hoard the Means of Exchange! (Part 1)

How about Wealth Preservation?

Phoenix Rising, the Return of the Gold Standard

I highly recommend two little books:

God Calling

God at Eventide

They are two wonderful, inspired texts that provide essential keys to living in and with the Spirit, including the matters we have been discussing here.

The full texts can be found at:

http://www.twolisteners.org

here’s Lori Harfenist saying it all in two minutes:

[youtube=http://www.youtube.com/watch?v=4gsKA8OixHM&]

Having been exposed as a banker front and squarely beaten on all the issues that Austrianism is famous for, the Daily Bell seems to be making a last ditch effort to reclaim lost fame….

In Q1 of this year Real Currencies got involved in an all out discussion with the Daily Bell, which was quickly picked up by the indefatigable Memehunter. Our series of articles on the lies and obfuscations of Austrianism and the way it was built by the Money Power as the other side of the dialectic with Marxism was inspired by this intellectual war. Henry Makow, who had been exposing Libertarianism for years, gave us the platform needed for this kind of effort.

Memehunter, meanwhile, made the incredible effort of waging the war in the Daily Bell’s comment section for months on end. Facing four powerful ‘elves’.

In all fairness: the Daily Bell not only continued to allow this, they took him on all guns blazing. They could, of course, have denied him further access, as is quite common when people deliver unwelcome feedback.

But they lost. Ignominiously. They tried everything, every trick in book was used to misrepresent Memehunter, to make him look ridiculous and basically to just wear him down. But he hung in there and four professionals, payed well with the proceeds of usurious usurpation, eventually simply gave up.

They closed their comment section and Faux Capitalist (who had been on the DB’s case earlier on a number of controversial issues) reported:

“….its Alexa ranking has tanked, showing that by May 27, it had a one-month ranking of 106,899, a 7-day ranking of 96,710, and a 3-month ranking of 71,591. (at their peak they were hovering around 30,000, AM)

Once its three-month ranking falls below 100,000, it will no longer warrant Alexa’s daily compilation of in-depth statistics. I see that it has fallen so far that the confidence factor of the visitor demographic information is down from a high level of confidence to only medium.”

Since then their readership has been plummeting even further, and as Faux Capitalist predicted, they are trying to put a strategy together.

With the medieval slogan ‘memento mori’, and Anthony Wile’s concept of the ‘Internet Reformation’ they are trying to regain lost favor. They will also reopen their comment section, but only for registered users. Even to read the comments, one will have to register. This does not bode well: such barriers are not popular on the Internet.

Also they have come up with a rather ‘interesting’ logo:

The skull refers to the memento mori slogan, the clock at 5 to 12 speaks for itself. The roses refer to the people spreading anti-Nazi propaganda in Germany during the 1930’s under the name ‘White Rose’. How this relates to the blatant Nazi colors (red, black and white) of the logo, combined with the strangely Germanic font remains an open question.

For the time being, it seems, the real supporters of freedom from Money Power suppression do not need to be overly worried by the Daily Bell’s efforts to reinvent itself after being so horribly exposed.

Related:

Discussing Gold and Interest with the Daily Bell

Daily Bell: wrapping up

The Daily Bell tolls for another round in the debate

How the Money Power spawns Libertarians

(left: Michael Unterguggenberger, the man who ended the Great Depression in Wörgl)

The velocity of money is a badly neglected aspect of monetary theory. It is far more important than people realize and both in past and in the present depression, sluggish circulation played a major and negative role. The most obvious way of increasing the velocity of money is Silvio Gesell’s demurrage, a negative interest rate, in effect a tax on holding money. This is not just theory. There is a famous case in which it was implemented. The Wörgl experiment showed truly extraordinary results and is legendary in Interest-Free Economics.

It’s relevant today too, with the Danish Central Bank this week setting a negative interest rate for the first time in history.

Wörgl is a small town in the Austrian Tyrol that would be completely inconspicuous, were it not for an amazing event that transpired almost 80 years ago.

At the height of the Great Depression some 4500 people lived in the village. It was suffering badly from the catastrophic policies of the Austrian Central Bank, which had brought down the money supply from 1067 million Schillings in 1928, to 997 million in 1932 and 872 million Schillings in 1933. Unemployment stood at 1500 and 200 families were completely destitute.

The town owed 1,3 million Schillings to the Innsbruck Savings Trust and had to pay 50,000 per year in interest over that debt. The council was owed 118,000 in taxes, but it was all but impossible to get at it, with the result that the town was lagging on its own obligations to the regional government.

Meanwhile, there were plenty of public works that needed to be done. Roads had to be repaved, Street lights were necessary, water distribution needed to be extended and trees had to planted along the streets.

Enter Michael Unterguggenburger, the burgomaster (mayor) of Wörgl. He had been studying economics for the better part of his life and lived through the difficult times of the 1907 depression, the Great War, the associated inflation and now this massive deflation. He believed in Socialism’s big idea of ‘ending exploitation of men by men’, but not in their methods, most certainly not their nationalization of the means of production.

He did however read Silvio Gesell’s book ‘the Natural Economic Order‘.

In this work Gesell introduces his ideas about the circulation of money and how to improve it: through demurrage. A tax on holding money, a negative interest rate.

And Unterguggenberger, desperate at the situation in his town, decided to give Gesell’s ideas a shot. He created ‘Certified Compensation Bills’, in denominations of 1, 5 and 10 Schillings. These would devalue at a rate of 1% per month at the end of the month, and those holding the bill at the time devaluation needed to buy a stamp of 1% of nominal value to extend it.

(One of Unterguggenberger’s certificates. On the right the stamps representing the hoarding fee)

Quoting from Fritz Schwarz, who originally documented the Wörgl case:

“On the 31st of July 1932 the town administration purchased the first lot of Bills from the Welfare Subcommittee for a total face value of 1000 Schillings and used them to pay wages. The 1000 Schilling official money paid to the Welfare for the Bills were deposited at the local “Reiffeisenkasse” (where they were held until someone offered the bills to convert them back to Schilling, which could be done at any time at a cost of 2% of the nominal value of the bills, AM).

The first wages paid out, to the amount of 1000 Schillings, returned to the coffers of the community almost on the same day. Taxes were being paid! On the third day somebody came running and shouting, “Mr. Mayor! Our Bills are being counterfeited. We have only issued 1000 Schilling so far, but the amount of overdue taxes paid with them has already reached 5,100 Schillings! Somebody must have counterfeited the Bills!”

The Mayor smiled forgivingly. He knew that bigger men would make the same mistake. Even Professor Dr. Bundsmann, lecturer of macro-economics at the University of Innsbruck and honored with the Austrian title of “Honorary Civil Servant” would call the success of Wörgl with its fast circulating money a hoax, because he could not understand how 5100 Schilling in taxes could be paid from an issue of only 1000 Schillings. That was beyond the expectancy of the Mayor himself. But every Schilling coming as Bill was re-circulated right away to pay an invoice, and was back and out again in short order, because this money attracted a penalty when idle. At that time the National Bank of Austria kept in circulation a constant amount of about 914 million Schillings for a population of some 6 million, or 153 Schillings per person. At the issuing peak, the value of Wörgl Bills was 7443, less than 2 Schillings per person. But these 2 Schillings gave more income and profit to each person than the 153 Schillings of the National Bank. Why? Because they were designed to entice people into using them, which is what money is for: to pay, to do business, to exchange. A. Hornung, who was against this “free money” and the whole experiment, reported grudgingly: “The issue of relief money was back in the coffers of the municipality within days. From there it could be re-used for payments. The total average in circulation was: August 1932 3675 September 3375 October 3525 November 6350 December 5725 January 1933 5450 February 5650 March 5625 April 5750 May 5675 June 5875 July 5800 August 5825 September 5825 Average: 5,294

How ludicrous is the thought of people with no inkling of the importance of money’s velocity of circulation for the economy.

AM: the total amount of trade financed by the certificates amounted to the equivalent of 2,5 million Schillings. While only about 5,500 worth of certificates were circulating on average. Meaning that the small demurrage of 12% made the certificates circulate at least a hundred times faster than the Schilling.

An eye witness report by Claude Bourdet, master engineer from the Zürich Polytechnic.

“I visited Wörgl in August 1933, exactly one year after the launch of the experiment. One has to acknowledge that the result borders on the miraculous. The roads, notorious for their dreadful state, match now the Italian Autostrade. The Mayor’s office complex has been beautifully restored as a charming chalet with blossoming gladioli. A new concrete bridge carries the proud plaque: “Built with Free Money in the year 1933.” Everywhere one sees new streetlights, as well as one street named after Silvio Gesell. The workers at the many building sites are all zealous supporters of the Free Money system. I was in the stores: the Bills are being accepted everywhere alongside with the official money. Prices have not gone up. …… One cannot but agree with the Mayor that the new money performs its function far better than the old one. I leave it to the experts to establish if there is inflation despite the 100% cover. Incidentally price increases, the first sign of inflation, do not occur.”

Aftermath

As a result of the incredible success of Unterguggenberger’s experiment, hundreds of Austrian towns planned on implementing the scheme. As a result the Austrian National Bank panicked and forbade the experiment. Vienna crushed the resentment with the threat of military intervention. Within a short while Wörgl was suffering again.

Famous men noticed the experiment. John Maynard Keynes and Irving Fischer payed homage to Gesell. French Prime Minister Edouard Daladier visited the place to check the experiment for himself. And Ezra Pound visited Unterguggenberger twice, the last time just before the good Burgomaster died in 1936.

Conclusion

To this day the Wörgl case stands out as the classic example of the need for monetary reform. It vindicates Silvio Gesell’s powerful analysis of the monetary and his demurrage.

A notable aspect of demurrage is that it offers a clear incentive for interest free loans. Sitting on it would lose value, value maintained by lending it out.

The simple fact is that even today a demurrage instead of interest on the money supply would radically transform our economies overnight.

Related:

Don’t hoard the Means of Exchange! (Part 1)

Don’t hoard the Means of Exchange! (part 2)

Regional Currencies in Germany: the Chiemgauer

Here is in interesting interview with FOFOA on the differences between the store of value and means of exchange functions of money. He offers a number of interesting insights (Thanks Transparent Unicorn):

Interview with FOFOA

Afterthought on Sluggish circulation

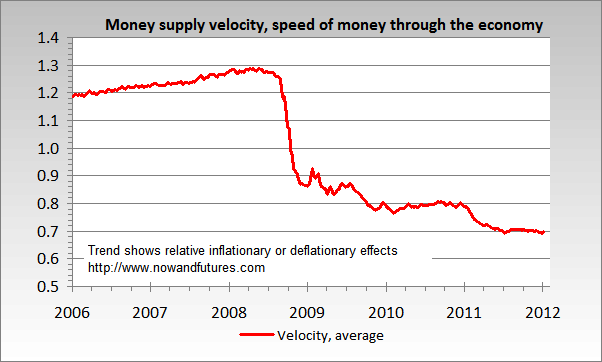

It seems that deflation is closely linked to sluggish circulation. Consider, for instance, this graph:

Quite a catastrophic decline in circulation and good proof that hoarding cash is detrimental. And also that a deflationary crash is closely related to hoarding. This is not an attack on those who save money. In the way the system works, it’s rational behavior. It just shows that the system is not working properly.

Although I don’t have figures about the velocity of money in the thirties, Michael Unterguggenburger most definitely assumed that hoarding was the problem, because he had this printed on his certificates:

“To all whom it may concern! Sluggishly circulating money has provoked an unprecedented trade depression and plunged millions into utter misery. Economically considered, the destruction of the world has started. – It is time, through determined and intelligent action, to endeavour to arrest the downward plunge of the trade machine and thereby to save mankind from fratricidal wars, chaos, and dissolution. Human beings live by exchanging their services. Sluggish circulation has largely stopped this exchange and thrown millions of willing workers out of employment. – We must therefore revive this exchange of services and by its means bring the unemployed back to the ranks of the producers. Such is the object of the labour certificate issued by the market town of Wörgl : it softens sufferings dread; it offers work and bread.”

Part 1 of this (short) series generated a major discussion and proved to be amazingly controversial. So before moving on to the intended next part, I’ll first clarify a number of items.

In the first place, there is a clear distinction to be made between wealth and money. People tend to mix these two, often subconsciously. They are not the same. So when an article is called ‘don’t hoard the means of exchange!’ it is not saying one is not entitled to generate and/or store wealth. Later we will see I’m not too impressed with wealth accumulation either, but still this is a very important distinction.

Secondly, people clearly have very strong feelings about their ‘rights’ when it comes to money. They focus solely on their individual ‘rights’, but they don’t understand that the money they hold is valuable because it is used by the other people in the community as a means of exchange. They have difficulty accepting that holding on the money (‘saving’) is damaging the interests of the other users of the means of exchange, which can’t use the money as long as it is held by the saver. By saving they are basically deflating the effective money supply, with all the problematic consequences that deflation entails.

Money basically is a public utility. Even when it is provided by market players. A part of the Common Wealth. It is provided to facilitate exchanges. When we make use of public space it is quite normal to expect responsible behavior, in line with the needs of other users of the space. We can expect a similar attitude when it comes to money.

Third, people joining the discussion ignored a key premise of the article: that money is primarily a means of exchange and not a store of value. The value of the money is result of the agreement to use it for trade, not for storing wealth. This shows how strongly held the prejudice is that money is necessary for savings, but still it is a wrong premise.

Fourth, I didn’t include alternatives to hoarding cash, but they are plenty. As I said previously, anybody fearing inflation has a very simple solution: buy some Gold. Or invest in your business, education, pay your suppliers up front, invest in cost cutting measures, things making you more independent from Transnational suppliers.

Fifth, another key issue is that of course in a sound monetary system nobody is going to send in the SQUAT teams to traumatize you and your loved ones if you hoard cash. The system must be designed in such a way it rewards ‘positive’ behavior. So saving will never be outlawed, it will just be made unattractive. Either by a demurrage, inflating the money supply or just by providing interest free credit based units: without interest on one’s holdings and with interest free credit available for all who need cash (as long as they have assets as collateral) saving money will not be a very attractive proposition anyway.

Conclusion

Many assumptions about money need a closer look. Strong emotions are involved when discussing these matters. But future non banker currencies will NOT be stores of value, but depreciating, rapidly circulating and cheap fiat units. Their success will not be measured by the mistaken notion of ‘price stability’, but by economic growth and wealth creation as opposed to wealth preservation. Preserving wealth can be done in many, much superior ways than hoarding the means of exchange.

One of the most deeply rooted misconceptions about money is that it is a store of value and that hoarding it is a viable way of maintaining wealth for future use, also known as saving.

Few things could be further from the truth.

Many economists, both of a Mainstream or Austrian persuasion go even further and say money can only be a credible means of exchange if it has stable value. Stable value, they claim, is necessary for people to accept the money.

This is complete nonsense as practice shows in three different ways.

First there is Silvio Gesell. He destroyed the store of value function in his units with his ‘demurrage‘. A tax or interest on holding money, as opposed to owing it, typically between 12 to 20% per year.

The result?

Greatly enhanced circulation.

Many more transactions and booming (local) economies.

The Worgl is of course the most famous example, but also today’s Chiemgauer (and most other German Regional Currencies) are equipped with it.

Another important observation is ‘Gresham’s Law’. Bad money drives out good money. The unit depreciating quickest (with multiple units circulating simultaneously) will be used to pay with. The others will be hoarded.

And third there is the issue of inflation, which is linked to economic growth, exactly because people fear hoarding the means of exchange because it is losing value. Deflation, on the other hand, is associated with depression, because people sit on their cash instead of having in it circulate.

So clearly practice does not confirm the proposition that money must be a good store of value to be a good means of exchange. Quite the opposite is true. A good store of value is a lousy means of exchange and a unit losing value sees enhanced means of exchange functionality.

So what do we want from our money. Does it need to be a store of value, or a means of exchange? Because we can’t have both. Not in one unit, anyway. And the answer is easy: there are many reasonable substitutes for money as a store of value, but it is indispensable as a means of exchange.

In fact: the designation of anything, any commodity, to be a means of exchange makes it money!

The modern definition of money is: ‘anything agreed upon by the community to be used as a means of exchange’.

Money derives its value exactly from this agreement. It is not because of its value that it is money. It’s clearly wrong to say a means of exchange needs to have (stable) value to be called money. It’s the other way around: by agreeing it will be money, it becomes valuable.

Just think of the Fed notes. Pieces of paper with ink slapped on it. And it’s not the State’s ‘extortion’ that makes it valuable either. No State power could force a community to accept money it didn’t trust. But people will accept every unit that they will be able to spend viably.

So it’s not ‘law’ that gives money its value, but the (tacit) agreement by those using it.

This, incidentally, is proven in practice by the thousands of free market units that circulate world wide in countless forms. From LETS to Regional Currencies or large scale ‘barter’ organizations using their own units that are created on a ‘Mutual Credit‘ basis.

All this is even true of gold. Having lingered at $200 per ounce for two decades it started appreciating in the aftermath of 9/11 on mounting speculation it would be money again after demise of the dollar and the American Empire. This is the key driver behind its relentless march over the last ten years, not a non-existent ‘inflation’ threat.

So while economic textbooks usually quote the three classic functions of money as being a means of exchange, store of value and unit of account, we can see clearly now that this is wrong.

It is wrong by definition and both monetary theory and practice show that for something to be called money it must be a means of exchange.

Period.

Even the unit of account function is not necessarily part of it. Many units exist that use other units of account. For instance, most barter units and Regional Currencies use the dominant national unit as the unit of account. By saying, for instance: 1 Berkshare = 1 dollar.

Detrimental effects of hoarding cash

Not only is money not meant to be a store of value, using it as such hinders it as a means of exchange.

After all: to exchange is to circulate. Circulation is the antithesis of hoarding. Hoarding the means of exchange hinders circulation. Less money is available for trade. The economy stagnates or more of the means of exchange must be made available.

Therefore, modern monetary systems should actively discourage hoarding.

Gesell’s demurrage is just one way of doing this.

Interest on the money supply, incidentally, clearly favors the store of value function of money and therefore hinders its main aim. Astonishingly, Mainstream economists will actually claim interest will increase circulation. Obviously it will not. If you gain by putting your money in a bank account, you will be less inclined to pay with it. You have, for instance, a clear incentive to postpone paying your bills.

In the omniscient Protocols (no 20.) we find this instructive quote on the matter: ‘On no account should so much as a single unit….be retained in the State’s treasuries, for money exists to be circulated and any kind of stagnation of money acts ruinously on the running of the State machinery, for which it is the lubricant; a stagnation of the lubricant may stop the regular working of the mechanism‘.

Libertarians should read ‘economy’ where it reads State. In the megalomaniacal dreams of the writer these are the same.

Savings and inflation

The classic case made for a strong store of value function in money is of course the perceived desire to store wealth. Individuals are encouraged to save for a rainy day or old age. This is considered prudent and common sense. We will consider the veracity of this idea in part two of this essay, but for now we will point out that there is no reason to hoard cash if one wants to maintain wealth for future use.

There are many alternatives and we have mentioned them before. Considering the negative implications for the other users of the money it is clear that the desire of the individual to hoard is of lesser priority than that of the community to use it for trade.

Just like it is considered common sense that when using a road, the need for safety for other users is considered more important than individual’s desire for speeding.

And yes, it is easily forgotten that money derives its value from the fact that our brethren agree to use it as a means of exchange along with ourselves. Meaning we are not alone in this and we have clear responsibilities to the other users of the money.

Also, using money to store wealth makes our wealth vulnerable to manipulation of the volume of the money supply, also known as inflation. The classic approach to this problem has been to try to organize a system that was invulnerable to this kind of manipulation. But in a sense this is a strange approach, especially for libertarians, who tend to stress personal responsibility.

The idea that the individual has a ‘right’ to a stable unit does not withstand critical scrutiny. It has also proven to be impractical. It is simply unwise to put too much faith in the controllers of the system. Whether they are bankers, politicians, or even well meaning monetary reformers.

So it is easy to conclude that saving money for future use is simply an unsound approach, both from the perspective of the community and of the individual.

But don’t we need savings for investments? Many Austrian and Mainstream economists are on record claiming this is the case.

But as has become well known over the last few years, the banking system creates all the money in circulation through fractional reserve banking. A rather inefficient, unstable, obscure and basically fraudulent way of going about the simple way of money creation.

This state of affairs exists to hide the simple truth in plain sight: that no reserves are required to create all the money we will ever need.

The notion ‘we need savings for investments’ is to maintain the illusion banks need capitalization.

In a rational monetary system, based on mutual credit, no reserves are necessary, nor the need for the illusion that they are. All credit is created from scratch, just like in the current system. Interest-free, that is.

So capital in the real sense of the word, meaning real assets belonging to real people, will provide the backing for all the credit, for all the investments we will ever need.

Conclusion

Money is a means of exchange. It is defined as such. It only has value because we agree to use it as such. So to use it as a store of value is simply abuse. To say it is a store of value is simply a mistake.

Related

Don’t hoard the Means of Exchange (Part 2)

On Inflation, Saving and the Nature of Money

Mutual Credit, the astonishingly simple truth about money creation

Why Gold is appreciating

On Interest

The more we look at Ron Paul, the more we wonder why so many people ever believed this guy in the first place. Here are five more reasons why.

by Anthony Migchels for Henry Makow and Real Currencies

1. Doug Wead is his ‘senior campaign adviser’

Doug Wead has been a highly influential adviser of many Republican Presidents and hopefuls, going back all the way to Ronald Reagan. His main sponsors, however, have been the Bush Family. He has worked for them between 1984 and 2000. His most senior position was that of Special Assistant to President Bush Sr.

Time magazine called Wead an insider in the Bush family orbit and “the man who coined the phrase ‘Compassionate Conservative.’ (wikipedia)

On june 5th Doug Wead wrote on his blog: “What was behind the broken bones, hysteria and bruised egos at last weekend’s Louisiana State GOP Convention? Why the attacks on legitimately elected Ron Paul delegates? Don’t the Romney folks get it? Don’t they want to win in November? Don’t they want and need the youth vote? Hispanics? Independents? Even, the Democrats, that Ron Paul is attracting to the party?”

In short: the Paul Campaign is a Republican Campaign masquerading as ‘Liberty Movement’ and attracting the disenfranchised into the party for Romney. According to the highly influential GOP insider and Paul Campaign Adviser Doug Wead, anyway.

2. Ron Paul willingly and knowingly allows massive vote fraud.

The scale of this fraud is massive. It’s so bad it might have actually cost him the nomination.

According to Dave Hodges on Farm Wars, “Even the New York Times admitted that the Republican Primaries in Iowa and Maine were stolen away from Ron Paul. Ron Paul was undoubtedly winning the Republican Primary in the early days. However, as the nomination continued to be stolen, and the will of the people was being usurped, Ron Paul remained silent to this grand theft of the nomination process. Even in Louisiana, as Ron Paul was winning, the Louisiana Republican leadership, controlled by Mitt Romney minions, stole the Paul delegates and gave them to Romney and then proceeded to beat up and evict the Ron Paul delegates when they protested. Meanwhile, Ron Paul chastised the dissenters and admonished his followers to be polite.”

Considering the enormous momentum that the Paul rallies showed, there is every reason to believe that Paul was actually the front runner in these primaries. Why did he allow the blatant and massive vote fraud? Why did he avoid the risk of winning?

3. Why do people say Paul is a ‘Peace Candidate’?

Not only is he lying through his teeth about 9/11 and thus enabling the Empire in the Middle East, we can see how he feels about the Empire through his budget. Just look at his Restore America budget. Therein you will find, out of a trillion dollars worth of cuts, a paltry 15% will be taken from the pentagon, while 63% cuts will be made to food assistance, and 35% medicaid or — 22% to life sustaining entitlement cuts across the board overall. Clearly, Paul values the financial viability of the empire’s war apparatus more than he does for “useless eaters” (thanks for this pm).

He will do away with food stamps for the poor during a depression with 22% unemployment, as a mere statist corruption of the free market, but he will continue the 500 billion Raptor Stealth fighter and all the other insanity that the US Army is feared for. It is exactly this kind of thing that gives Libertarians a bad name.

4. The Romney betrayal was planned long ago.

Analyses of the GOP debates show that in 20 GOP debates Ron Paul attacked Romney’s rivals 39 times while never assailing Romney even once. http://thinkprogress.org/politics/2012/02/27/432664/ron-paul-never-attacked-romney/?mobile=nc

The above quote by Doug Wead is another case in point.

Just a month ago “Former Ron Paul staffer Lew Rockwell says that talk of an alliance between Mitt Romney and Ron Paul is an “establishment trick” to smear Paul by making him appear as a sell out.”

http://www.infowars.com/insider-says-talk-of-paul-romney-alliance-is-establishment-trick/

Yet many people out there still cannot believe the obvious: they have been taken for a ride.

5. His ‘free market for currencies’ nonsense

People still don’t get that it is all about currency. Our masters are bankers after all, they rule through control of money. How many have ignored Paul’s Gold Standard, even if they knew better, because of his ‘constitutionalism’ and (unreal) stand for peace? In this way they have supported a Trojan Horse.

Ron Paul has always favored a Gold Standard, ever since the days he wrote a ‘minority report’ with Lehrman on the Reagan’s Gold Standard commission.

A year ago Paul Krugman said “Gold bugs have taken over the GOP.” That was the main goal of Ron Paul.

Paul owns five million in assets and it’s all sunk in Gold assets. This makes him a special interest candidate. If his colleagues own stocks in Merck while they want to force vaccinations on us, do we say they are putting their money where their ideas are? Of course not. Paul has profited massively from the rise of the Gold price over the last few years and few have been in a position to stimulate this price rise more than he was. Exactly the kind of behavior we hate politicians for.

The whole ‘free market for currencies was just invented to make the utterly disgraced Government Gold Standard more palatable for the somewhat more aware proponents of Austrian Economics. Discredited or not, his erstwhile colleague, and buddy Lehrman is promoting the classic one and according to Steve Forbes he will get his way after the Bilderberg anointed Romney moves into office.

Ron Paul has been paving the way for this for more than 30 years and even though he won’t be around to see the results, he has been indispensable in this long term Money Power operation.

Conclusion

The more we look at him, the more we see Ron Paul is just another utterly blatant and transparent Money Power change agent.

The really sad thing is to see how people are still trying to make the obvious go away.

Afterthought:

Isn’t all this a little TOO blatant? Did the Pauls really miscalculate, or is this a provocation? A stab at the hearts and minds of the ‘liberty’ community? Alex Jones detractor David Chase Taylor sees a clear pattern in Jones’ methods of blaming the US Govt for Zionist crimes, with the idea of goating Patriots into attacking their own Government, not only suiciding, but providing Leviathan with the excuse to implement Martial Law.

Is it possible that there is more to Paul’s incredibly ugly, albeit transparent, betrayal than meets the eye?

Related:

the Austrian ‘Free Market for Currencies’ Hoax

Hate the State, buy Gold and all will be well: an Alternative Media in crisis

The Ron and Rand Paul Betrayal

Thanks pm and Faux Capitalist