Left: Frédéric Bastiat (1801-1850), French political economist

It was Bastiat who created the rationale for Usury as put forward by Austrian Economics today: the lender should be compensated by the borrower for the time during which the former could not make use of his capital. However, as the Transparent Unicorn shows, this argument is inconsistent with Bastiat’s own, original, thoughts on economics.

By The Transparent Unicorn for Real Currencies and The Transparent Unicorn

A sometimes forgotten strand of Libertarianism flourished in 19th-century France, one that represents an important link between 18th-century English free-market economists such as Adam Smith and the classic Austrian school founded by Carl Menger. One of the most illustrious representatives of this French school of laissez-faireeconomics, and certainly the one most closely associated with Libertarian views, was the economist, politician, and polemicist Frédéric Bastiat (1801-1850).

Bastiat’s writings are worth reading for their clear-headed and prescient debunking of Socialism and Keynesianism avant la lettre. Moreover, Bastiat’s witty and concise style is more enjoyable than, say, Ludwig von Mises’ often stodgy prose.

Bastiat’s famous essay “Ce qu’on voit et ce qu’on ne voit pas” (What is seen and what is not seen) is rightly regarded as a masterpiece which anticipates many tenets of modern Austrian economics. By focusing on the unseen “third party”, Bastiat shows that State intervention and lawmaking only displace money or otherwise direct the transfer of wealth, but do not create new wealth.

Similarly, in Capital and Interest, Bastiat’s justification for interest evokes the time preference theory later put forward by Menger and Eugen von Böhm-Bawerk. In “Maudit Argent!” (What is Money?), Bastiat also makes a key distinction between what he defines as useful wealth, referring to things that directly contribute to our well-being (such as food, clothing, and housing), and money, the latter being only a symbolic representation of real wealth, and goes on to show how a lack of awareness of this distinction can lead to terrible economic blunders.

Of course, Bastiat, as a proponent of the Illuminati deception that is Libertarianism, mixes a small amount of subtle but poisonous disinformation with a good deal of truth. It should come as no surprise to learn that Bastiat was a high-ranking Freemason, like his contemporary and political nemesis, the noted socialist theorist Pierre-Joseph Proudhon. Indeed, the fact that Proudhon and Bastiat, who debated fiercely in the French National Assembly, probably took part in the same occult rituals only adds to the mounting evidence that the elites control both sides of the socialist/capitalist dialectic.

One of the most cherished lies of the Austrian School is its defense of usury. Indeed, interest is one of the main tools by which bankers have enslaved humanity, and over the last few centuries they have recruited the best economists to justify this practice condemned by all Abrahamic religions. In this article, I propose to debunk Bastiat’s justification of usury, with the additional twist that I will do so using Bastiat’s own methodology for the most part.

Capital and Interest: Bastiat’s justification of usury

Bastiat’s essay Capital and Interest is based on a series of examples through which he makes the case that the lender should be compensated by the borrower for the time during which the former could not make use of his capital. This argument, which is essentially the same one advanced by later Austrian economists, can hardly be disputed: indeed, there would be absolutely no economic reason for James to lend his tool to William for a year if he is not compensated in some way. Furthermore, this is a voluntary transaction, which William may evidently refuse if he does not think it is advantageous for him; thus, as Bastiat remarks, James’s compensation is “naturally limited” by William’s self-interest.

So far, so good. But Bastiat then points out that, whereas most people will agree that such a compensation is perfectly just in the case of the lending of tools or materials, many will object that in the case of money, which does not produce anything by itself, it is immoral. However, since money is merely a symbolic representation that functions as a transitory substitute for real values (as explained in What is Money?), Bastiat argues that it is pure sophistry to treat interest differently in the latter case.

There are, in fact, at least two important distinctions to be made between physical capital (useful wealth such as tools and materials) and financial capital, which is monetary credit advanced to a borrower, but Bastiat ignores them, and therein lies the essence of his subtle but deadly deception about usury.

Let us review these distinctions, one at a time.

No justification for charging interest on financial capital

Bastiat’s examples always involve physical capital whose creation (or accumulation) require a significant amount of work. Whereas it is logical and just for the lender to be compensated in such cases, it is difficult to justify why a monetary loan, which in the modern banking system is created at the time it is loaned by punching a few keystrokes on a computer, should be compensated. The bank is essentially crediting the borrower based on his reputation and ability to pay back the loan. In fact, we can say that it is the community which is crediting the borrower, and the bank is merely an intermediary providing a service. The “time preference” justification is hardly valid in this case, since the bank is not really loaning its own capital and a fair compensation should merely cover the bankers’ administrative charges and salaries.

It may be argued that Bastiat’s experience under the gold standard was different and that the banks would have been, in fact, risking their own capital in a “hard money” system. However, this would be only partially true under a fractional-reserve banking system, which was already prevalent at the time. In any case, 20th-century Austrian economists, aware of the perceived inequities associated with modern banking, have addressed these issues by proposing a return to a gold standard. Essentially, the idea is to bring back the symbolic representation of money into the physical world: by basing the currency on a commodity such as gold which is scarce and difficult to extract, it is easier to justify charging interest on monetary loans.

But Bastiat himself tells us that money is only a symbol, not to be confused with useful wealth. If this is the case, why are Austrian economists trying to confuse the issue? Moreover, using gold (or a similar scarce commodity) leads to an artificial scarcity of credit: the amount of money loaned is restricted by the amount of gold available. Austrians would make the case that this is preferable to human control of the money supply. To be sure, a monopoly on the issue of a symbolic currency leads to all kinds of abuse, as can be seen with our modern fiat currencies. But it does not follow from that observation that it would be advantageous to tie the money supply and the economic activity of a community to the amount of gold available. The only entities that would benefit from this situation are those that own most of the gold.

What is not seen: the third party in the lender-borrower transaction

In order to justify interest as a just compensation to the borrower, Bastiat insists that the loan is a free voluntary transaction between two mutually consenting parties. But what about the third party, the one Bastiat claims is always forgotten by classical economists in What is seen and what is not seen? Austrian economists will object: there is no third party directly involved in this transaction, so they should not have a say. But is this really the case?

If, as in Bastiat’s examples using physical capital, William borrows a tool from James, and James accepts an additional wood plank as compensation, then indeed one can hardly claim that the community is affected by this transaction. In fact, society may potentially globally benefit from the increased efficiency of labor brought by the loan of a tool, a benefit which Bastiat is right to point out.

But when a) the only thing exchanged is a symbol of wealth, whose only value resides in its being accepted as a means of exchange within a community, and b) this symbolic representation of wealth can only be created by one economic actor (for instance, in a currency monopoly), or at most a few participants (such as private banks), and furthermore c) the time compensation, or interest, must also be paid using this monetary symbol, then yes, the rest of society is indirectly involved in such a transaction, because society at large has now involuntarily become the “third party” from which the monetary units necessary to pay the interest must be extracted.

If he were true to his own principles, Bastiat should therefore remind us that the community, the third party in this transaction, does not necessarily benefit from a transaction involving the lending of financial capital: in fact, the borrower’s incentive to capture some additional monetary units to pay the interest simply leads to a heightened competition for the monetary units circulating in the community. In the end, the lender gains, and the borrower may gain (if he calculated properly and used his loan shrewdly), but these gains are necessarily made at the expense of the rest of the community.

Even if the loan eventually leads to an increase in productivity (for instance, if the borrower uses the money to acquire new machinery), it will still bring, as a side effect, an increased competition for the monetary units in circulation, and an unwanted transfer of wealth from society at large (the third party) to the lender. Would a community consent to such a transaction, if it were allowed to express its opinion? Probably not, if it could see the effects of this transaction.

At the very least, a third party which is aware of the unseen effects of interest paid on a monetary loan would likely want to know what the borrower intends to do with the loan and whether it could also indirectly benefit from that loan (for instance, with a gain in productivity). Indeed, it is probably a growing societal awareness of the unseen effects of usury on symbolic wealth that led to the universal prohibition of usury observed in Abrahamic religions, as well as to some of the principles governing Islamic banking.

Conclusion

Bastiat’s dishonest justification for usury ignores two valuable concepts that he introduced himself, namely that money is only a symbolic representation of wealth, and that we should always keep in mind the “third party” and the unseen effects of an economic transaction. By taking into account these concepts, we have shown that, contrary to Bastiat’s claims, interest on a monetary loan has much broader implications for the community than interest on purely physical capital such as tools or materials, and that there is hardly any valid justification for compensating the lender of a symbolic currency created effortlessly.

Let us heed the words of Frederick Soddy, the Nobel prize-winning chemist who emphasized this distinction between “real” and “virtual” wealth:

“Debts are subject to the laws of mathematics rather than physics. Unlike [real] wealth, which is subject to the laws of thermodynamics, debts do not rot with old age and are not consumed in the process of living. On the contrary, they grow at so much per cent per annum, by the well-known mathematical laws of simple and compound interest … It is this underlying confusion between wealth and debt which has made such a tragedy of the scientific era.”

The Transparent Unicorn is a long-time commentator on issues related to Money Power and the New World Order conspiracy.

Related:

[youtube=http://www.youtube.com/watch?v=qYwWmDOtLW8&feature=plcp]

How do we know this?

Consider a mortgage. We borrow $200k, and after 30 years we will have paid about $500k. So we pay $300 thousand dollars interest over the loan.

What would happen with our purchasing power, if we only needed to repay the principal? It would mean we would have 10.000 per year more purchasing power during the 30 years we repay the mortgage.

Our credit would greatly improve, because our liabilities would be much smaller.

Interest is paid to those who have money, and paid by those who don’t, and therefore need to borrow.

Interest is therefore a wealth transfer from poor to rich. Margrit Kennedy, a German monetarist, has quantified this wealth transfer in Germany. Her conclusions: the 80% poorest Germans pay 1 billion euros per day (365 billion per year) in interest to the richest 10%. The next richest 10% pay about as much interest as they receive.

Also, with in the 10% brackets the same wealth transfer is happening: so the poorest 8% of the richest 10% pay interest to the richest 1%.

It stands to reason that the situation is more or less the same everywhere. This means, that the poorest 80% Americans pay about 1,5 trillion dollars per year to the richest 10 percent.

This is the key driver centralizing wealth in the hands of the plutocracy.

Another problem with interest is, that it is not transparent who pays what. The strange thing is, that even if you don’t have any debts at all, you will still lose up to 45% of your disposable income through interest.

Producers incur ‘capital costs’. They pass these costs on to their customers. The amount of interest they pay on the loans to finance their production differs per sector. But it transpires that on average 45% of the prices we pay can be related to cost for capital.

Now, back to the debt.

Is it reasonable that one should be able to get a mortgage? Is their something intrinsically wrong with the debt?

It is probably quite useful for the large majority of the people to be able to get a mortgage. Most people would not be able to buy their own homes if they were not able to go into debt.

Another important aspect is, that in the case of a mortgage the creditor incurs no risk at all: he has the house as collateral.

And who is the creditor? In most cases a bank. A bank basically is a credit facility. However, the bank has made us believe that it is their credit, that we are borrowing their money.

This is not the case. Credit is the result of collateral and future income. A person has about 30 to 40 productive years and it that timespan an average American will make about 1 or 2 million dollars.

This future income is what makes the bank provide the credit.

But this future income is not the Bank’s, it’s the individual’s income. It is therefore their credit.

So banks capitalize the credit of the population.

We know that in the current construct all this interest is being raked in by the banks by creating the money at the time the money is loaned out. Through Fractional Reserve Banking.

We consider it unfair that the bank has the right to create money. Therefore a full reserve gold standard is propagated. Not only taking away the iniquity of money creation, but also the nasty habits of banks going broke by overleveraging themselves.

But if we take out a mortgage in a full reserve gold bank, we would still pay 500k for a 200k home. We would still lose 45% of our disposable income through interest passed on in prices.

To further the above points I’ll leave you with a little thought experiment.

What would happen if………

We would nationalize all banks. This would not be unfair, they are all busted and they already needed 16 trillion in Federal Reserve handouts. They are still all under water.

We would weed out all the BS. Derivatives would all be canceled, all the funny financial products gone.

We would maintain real debts by businesses and consumers, mortgages, and the national debt.

But we would cancel all interest payments from now on. Of course, savers would also no longer receive interest, but keep in mind that the average American loses far more in debt service than he gains in interest on his savings.

If debts are repaid, the money supply deflates, to maintain a stable money supply we would give out as much new credit as there are loans being paidoff.

What would this mean? A direct end to the depression, because enormous purchasing power in the economy would be released. Consumers would be twice as rich, prices would collapse because capital costs are gone.

The credit of the people borrowing from the banks would massively improve, immediately putting an end to solvency problems of these banks. There would be no more bailouts.

The Government would have an immediate windfall of 700 billion per year, which is what it currently loses on debt service. But the Government, too, loses half of it’s disposable income to capital costs through prices. Not to mention the increased tax income from an exploding economy. So it is likely that without any austerity the deficit would disappear quite soon.

The banks would be reorganized, many people, especially the expensive ‘traders’ and ‘investment bankers’ would all be gone. All that would remain are the people running day to day banking services. Therefore the costs of these banks would be much lower. These costs can (and must) be passed on to debtors, but they would be low.

I believe that managing a risk free loan like a mortgage should cost no more than max. 10% over thirty years, so you would pay maybe 220k for 200k home.

There would be no more bailouts, no more bonuses. The wealth transfer from poor to rich would end over night.

All these benefits would go to Main Street. It would imply a major decentralization of economic power, which is also a key point.

Of course, it would disown the Trillionaires, but hey, I say enough is enough.

Now, I’m not saying that this what we should do at this point. This is just a thought experiment.

It shows it is not debt that is the problem, but interest. It shows that it is not a full reserve gold banking system we need, but interest free credit.

Of course, with this analysis we have not addressed inflation, which is strongly on the minds of most proposing full reserve Gold backed currency. We will deal with that next time.

This article was written for Activist Post

Related:

On Interest

Budget of an Interest Slave

Usury: why we don’t build Cathedrals these days….

Debt Repudiation or an Interest Strike?

The ‘Alternative Media’ is dominated by the ultra right with its Rotschild Gold Standard. Thankfully there is now a news aggregator sharing real information on monetary reform.

Earlier this year we analyzed how the alternative media really is a bunch of Gold dealers plugging their specie. Especially the fact that Interest Free currency is not represented on the main aggregators is worrying.

Former host of the GCN show, ‘Crash! Are You Ready?’ George Whitehurst-Berry is now filling that vacuum. He recently also kindly commented at Real Currencies.

Go have a look at www.subotaisbow.com to see what he’s up to!

Related:

Recovering Austrians

Hate the State, buy Gold and all will be well: an Alternative Media in crisis

One of the nasty tricks the Austrian Mind Controllers spring on their unwitting followers is the notion that fiat money is fiat money. It’s all paper, so it’s all bad, it all requires heavy handed state violence. Not unlike several other propositions of Austrian Economics: nothing could be further from the truth.

So here’s a short introduction to the main systems.

1. Fed Notes, Euro, Yen

The current system. This fiat money is created through fractional reserve banking by private banks. Every dollar in circulation, except for actual paper notes and coins, were created by somebody going into debt with a bank. The bank creates the new money the minute it is lent out. Mind you: the entire loan is created when taken out: a bank needs deposits, but it does not lend the deposit! It creates new money next to the deposit.

They then rape their customers by slapping interest on this freshly printed money. This is the system everybody hates and of which all in their right mind want to get rid of.

2. The Greenback

The Greenback was neither debt free, nor interest free. However, that is what most people mean when they use the term Greenback: paper printed debt free by Government and spent into circulation by Government.

It would be better to call it the Continental, George Washington’s money. Or Colonial Scrip, because the colonies also printed their own units in this way.

3. Public Banking, Hamiltonian Banking

This would continue the same way of creating money we have today: interest bearing, fractional reserve banking. But the banks would be owned by the Government and not by the private banking cartel. The Government would get the interest. Of course, one would have to assume Government is a different entity than the Money Power, which is not a foregone conclusion, although not entirely irrational either.

4. Social Credit

Social Credit is a debt free unit printed by the Government, but handed over to the populace, the same amount for every individual, to have them spend it into circulation. It would amount to a basic income. While printed by Government, it clearly does not empower Government but the individual. Such a scheme also would not require heavy handed laws, simply because the populace would have a great incentive to accept this unit: they would get paid to do so!

5. Regional Currencies

Most Regional Currencies in Germany (e.g. the Chiemgauer), England (e.g. the Brixton Pound) or the US (e.g. the Berkshare) are simple euro/pound/dollar backed units. Usually 1 Regional Unit = 1 euro.

But when buying them, one usually gets one for maybe 95 cents (providing an incentive to pay with them) and when converting them back to euro, one gets only 95 cents (providing an incentive to spend them, instead of converting back and taking them out of circulation).

Regional currencies on this basis are always provided by private market players. Participants simply agree to use them, based on the value they add. No coercion necessary.

6. Mutual Credit

Mutual Credit comes in many guises. Well known are Mathematically Perfected Economy (MPE) and BIBO units.

Also the famous Swiss WIR is based on Mutual Credit, as are most ‘barter’ (a misnomer, they use their own Mutual Credit based units to pay, just not national currencies. So it’s not really barter) networks worldwide.

Mutual Credit is used to create non-state (MPE is a proposal to implement it as a Government unit) interest free credit based units. As with Regional Currencies no coercion is necessary, all participants join of their own choice.

Mutual Credit is just simple bookkeeping. When opening an account one gets a credit line and can start spending by going into debt. When doing so, the unit is created. It is so mindblowingly simple it boggles the mind how the banks have gotten away with their silly antics for so long.

Mutual Credit is undoubtedly the unit of the not so distant future, although Social Credit may be a good alternative for Government units.

Conclusion

These are the basic architectures that hold sway today. As can be seen they are very different beasts altogether. Hamiltonian banking and the Greenback empower Government. Social Credit, Regional Currencies and Mutual Credit empower the commonwealth and the people.

Private banking, either based on gold or fractional reserve banking favors the Money Power and the ultra wealthy.

Related:

Mutual Credit, the Astonishingly Simple Truth about Money Creation

The Swiss WIR, or: How to Defeat the Money Power

Social Credit

Bitcoin, Impressive, but Flawed

Regional Currencies in Germany: the Chiemgauer

Ellen Brown’s Public Banking

Amazingly, our sistersite Recovering Austrians, which syndicates debunking material on Austrian Economics and Libertarianism, has made it to the Commodity HQ Top 40 of Austrian Economics blogs!

While fiercely critical of Austrian Economics, this was not a problem, the good people there simply stated:

“Recovering Austrians: This blog actually focuses on dispelling the thoughts behind Austrian Economics, giving you a view from the other side.”

Recovering Austrians is on place 31.

Needless to say we are very happy with this recognition!

Related:

Launching Recovering Austrians

left: Abe Lincoln, yet another Money Power stooge sold as a man of the people.

“If this mischievous financial policy (the Greenback), which has its origin in North America, shall become endurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous without precedent in the history of the world. The brains, and wealth of all countries will go to North America. That country must be destroyed or it will destroy every monarchy on the globe.” –Times of London

This famous quote, a classic in the Greenback movement, has been debunked: it’s not in the Times of London archives.

Lincoln is way overrated by the conspiracy scene. In fact: Government printed interest-bearing cash is a Money Power operation. Just like with Marxists nationalizing all: the question is who owns the state.

By Anthony Migchels, for Henry Makow and Real Currencies

It aches my heart to admit it, but for the longest time I thought Lincoln was a Prince of the People, until I got re-educated in no uncertain terms by Name789, the man behind the wonderful website www.yamaguchy.com. Most of the information in the article, and then some, can be found in this post by his hand.

Here’s some of the (finagled) wisdom I learned from him.

To begin with, there is this urban legend that the Rothschilds tried to force 30% Gold upon Lincoln. This is total nonsense: anybody with good credit could borrow at 6% at the time:

”I simply wish to say to the chairman of the Committee on Finance [Mr. Fessenden] that any merchant in the United States with good securities can to-day borrow $1,000,000 at six per cent. I can, with good securities; and so can my friend from Maine.” Senator Chandler in the Senate February 13th 1862, during the greenback debate.

The Urban Legend then continues with the story that Abe Lincoln was instructed by a Colonel Dick to print his own currency and that Abe was much relieved by this alchemy.

More nonsense: at the time the Treasury routinely circulated debt free Treasury notes. The ins and outs of this tool was common knowledge among senior politicians, of which Lincoln, who had been in Washington for 30 years, certainly was one.

Furthermore, throughout his career Lincoln had been agitating for a (privately owned) ‘National Bank’, the Nicholas Biddle kind of operation that Andrew Jackson (despite his many faults) heroically busted. Already in 1839 Lincoln is on record as saying in the House:

“Again, as to the contractions and expansions of a National Bank, I need only point to the period intervening between the time that the late Bank got into successful operation and that at which the Government commenced war upon it, to show that during that period, no such contractions or expansions took place. …… We do not pretend, that a National Bank can establish and maintain a sound and uniform state of currency in the country, in spite of the National Government; but we do say, that it has established and maintained such a currency, and can do so again, by the aid of that Government; and we further say, that no duty is more imperative on that Government, than the duty it owes the people, of furnishing them a sound and uniform currency.”

Lincoln was a ‘national Whig’. As such he favored Central Banking and the truth is he would have signed the Federal Reserve Act any time.

The Greenback

The main problem with the ‘interest-free, debt-free Greenback’ was that it was….neither debt-free, nor interest-free.

What was the Greenback? There were $450million non-interest-bearing US notes, backed by $500million bonds bearing 6% interest (the 5/20s) and there were ~$1,000million Treasury notes bearing 6-7.3% interest.

Worse still: Lincoln’s hand-picked Secretary of the Treasury and the whig crew in Congress weren’t finished; the people who gave us greenbacks intended to give us permanent national debt; so, 1,000million currency obligations were turned into 40-year gold bonds.

There you have it: the ‘debt-free’ paper they circulated as Greenbacks were backed by bonds at 6%, while they were later turned into 40 year gold bonds.

Lincoln was a useful idiot at best

He accomplished everything for the Money Power: (permanent) national indebtedness, strong central government, national banking system, national currency based on this indebtedness; everything that Henry Clay in 1841 couldn’t.

Please note in particular: strong central Government, ‘National’ Banking System, ‘National’ Currency.

The Money Power was behind this agenda, which destroyed classical American decentralized political power, individualism and State rights.

Many people in the alternative media believe this is a boon: it is not, one knows a tree by its fruit and the American Empire has been an incredible scourge to the world. To many Americans even today the Government seems not too bad, but just ask the dozens of nations who have been decimated by the Government, from Germans, to Koreans, Cambodians, Vietnamese, Iraqi’s, etc. In all these wars the US was the Money Power’s Golem: doing their bidding as their, dimwitted, brutish goon.

So why was he murdered? Nobody knows. Perhaps his work was finished and he did seem to have resisted certain even more extreme measures. Name789: “Between 1866 and 1868 Senator Doolittle said many times that Lincoln would not have gone along with radical reconstruction (to “reduce States to the condition of territories and citizens[whites] to the grade of vassals”). That would have been a lot more plausible reason for wasting him.”

It’s the same with Garfield, who was also murdered and later made into a hero of the people, while during his life he was a reliable spokesman for banker bonds and Gold.

The War

The Money Power always owns both sides of the conflict and the Civil War was no exception. They wanted the war and they got it. It gave them everything they wanted, including eternal indebtedness, their main hallmark.

Of course it had nothing to do with slavery, which would have ended anyway, as it did throughout the civilized world without war.

Lincoln declared war without consulting Congress and creating ‘facts on the ground’, which has done immeasurable damage to the rights of Legislative. The Executive has been getting away with this kind of nonsense ever since: up to this very day Presidents start phoney wars all over the place, unhindered by an emasculated Congress.

During the war Lincoln had tens of thousands of people in the North arrested for opposing it. During riots throughout the country he had the Army repress them by shooting the protesters en masse.

In short: he was a tyrant of the worst kind.

Conclusion

Lincoln was a Money Power Agent. He accomplished everything the Money Power wanted: permanent indebtedness, power centralization in Washington and a ‘national’ (central banking) currency plus ‘national’ (privately controlled) banking system.

Clearly this has important ramifications for how we believe the opposition and its monetary agenda should look like.

The main lesson is that centralization of power is an eternal tell-tale of the enemy.

“In a word, knowing by the experience of many centuries that people live and are guided by ideas, that these ideas are imbibed by people only by the aid of education provided with equal success for all ages of growth, but of course by varying methods, we shall swallow up and confiscate to our own use the last

scintilla of independence of thought, which we have for long past been directing towards subjects and ideas useful for us.”

Protocol Nr. 16

“The Power of Ideas will prevail!”

Ron Paul

Intellectual dishonesty is the hallmark of the leadership of Austrian Economics. Nowhere is this more palpable than with their disingenuous, dishonest and destructive defense of deflation. Now that we are facing the greatest deflationary bust since the Great Depression, with the worst still to come, Austrian Economics rises as the main defender of the Money Power’s onslaught.

Time to dispel their lies and misrepresentations concerning deflation point by point.

One of the key weaknesses of Austrian Economics as a philosophy/pseudo science is its reliance on deductionism. However, while this may be a weakness in terms of truth-seeking, it is major asset in terms of its real purpose: mind controlling the masses, wearying of Keynesian gatekeeping. With fuzzy ‘logic’, which by its nature suffers from the bullshit in, bullshit out dilemma, it is easy to obscure the obvious. Mind Controllers are fully aware that the brutish Goyim mind is not interested in facts and careful observation. It is interested in the power of ideas. And when one idea fades in the face of practice, it easy to conjure up a new one to keep the antfarm busy.

Harsh words? Extensive experience in debating Austrian Economists have shown time and again that they are absolutely not interested in promoting learning. They are interested in promoting their case. A case, as Real Currencies and others have documented extensively, the Money Power created out of nothing solely for its own purposes.

Considering the fact that defending deflation amounts to nothing less than defending the Money Power’s obvious attempts to create an uprecedentedly severe world wide depression, there is every reason to reject their inane ‘theories’ vociferously.

The more so, because history clearly shows that depressions like these are used by our self declared masters to soften up resistance against large scale ritual murder, also known as World War.

So scolding Austrian Economics and its leaders does not imply disdaining the many people who have found the courage and the independence of thought to reject the obvious failures of Mainstream Economics. They are the seekers, inadvertently walking into the trap that the Money Power prepared for them with great effort and discipline.

Let’s hope that debunking Austrianism helps them to seek further and others to avoid falling for it altogether!

So what again is deflation? There are two definitions: a contracting money supply and declining prices.

The first definition is the classical one and best. Declining prices often are a result of a contracting money supply, but not per definition.

The real issue is the contracting money supply itself, which is associated with busts. Every major recession or depression in recorded history was associated with a contracting money supply.

And yes: Austrian Economists try desperately to obfuscate this fact, as we will see.

What the Austrians ignore and don’t want you to know

1. Reality

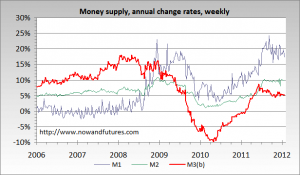

Of course! It’s the power of an idea, it has little do with facts based in real life. Just imagine: defending deflation in the face of the destruction in Greece, where the money supply is contracting at a rate of 10% per year and the economy with a whopping 7%. And while Greece is probably the worst case for the time being, it’s happening all over the West, including in the US itself. Real unemployment in the US is at 20%. Why? Because the money supply is tanking:

This is the simple truth, but all the Austrian Economists and Gold Dealers parading as the ‘alternative media’ have been scaring us to death with their hyperinflation fearmongering.

So this is the reality of deflation. Defending it means defending Greece. Few would do that, if they realized what they were actually doing.

2. During deflation, the value of debts increase in real terms.

Does that sound like a good idea when the whole planet is swamped in debt? Of course, the problem is compounded by the fact that interest payments also rise in real terms.

Debtors are the great majority of the population. Creditors the small minority. Austrianism is famous for defending the rights of creditors and capital in general. This shows in their defense of deflation also. Only the rich benefit from deflation.

Their outright lies

1. Deflation is declining prices. Great, right?

This is a lie, not because this definition is not fairly widely used, but because Austrian Economists define inflation as a growing money supply. So this is a clear ‘inconsistency’, but just a little too comfortable for them not to be considered an outright lie.

Often those mentioning this will say: prices decline because of technology. Rothbard was famous for this nonsense. Sure they sometimes decline because of technology. For instance cell phones and computers. But that has nothing to do with deflation in the real sense of the word and Austrian Economists know it. How do I know they do? Because they continue this nonsense, even when corrected.

2. Depressions are not associated with deflation

This is so incredibly stupid it hardly is worthwhile mentioning it, but it is a good example of how far these people actually go in hiding the obvious. Not only does it fly in the face of what has been common knowledge for ever, most certainly in the United States, their proof is most telling. They offer this study….by the Federal Reserve.

Now consider this: they made a name for themselves by exposing the Fed’s and Mainstream (Keynesian) Economics’s downplaying of inflation and the associated manipulation of volume, and then, when it comes to deflation, they use a study by the Fed ‘proving’ there is ‘hardly a relation between deflation and depression/recession’.

3. Their ‘misunderstanding’ of the business cycle

Yes, Austrian Economics is wrong about the business cycle, their main pride. Their heroes Mises and von Hayek noted that busts usually were preceded by booms. Booms caused by ‘too lax’ credit by the banks. This results in overinvestment, or ‘malinvestment’ after which a corrective bust is unavoidable.

In this way Austrianism actually makes people call for the bust to happen as soon as possible: the longer it is postponed, they say, the worse it will get. This is not entirely untrue, but considering the easy way deflation can be managed, it amounts to having people call for their own destruction unnecessarily.

Also, with this explanation they igore the fact that an interest bearing money supply MUST grow, to finance ever higher interest costs to society, fueled by the growing money supply itself. Or, as with a Gold Standard, face structural depression, due to ever smaller money left for real trade because the money supply cannot grow.

This is the famous P + I > P formula as put forward by Mike Montagne, where P is Principal and I is interest. It explains why money is always scarce when taxed with interest.

Worse still: despite this inherent flaw of interest on the money supply, the real problem is that the Banking Fraternity manipulates the volume willingly and knowingly. The Boom/Bust cycle as we know it is a completely artificial phenomenon, that would even occur, would the Money Power stop charging interest. The point is that during a deflation they are the only ones with cash, enabling them to buy everything up that the populace at large is selling at fire sale prices in a desperate attempt to get out of debt.

By hiding this fact, just like Mainstream Economics does, Austrian Economics just exposes itself as controlled opposition.

Conclusion

In the face of the horrible destruction that the Money Power is visiting on the entire world with its ‘credit crunch’, its valiant knights known as Austrian Economists keep the gates against the real opposition clamoring for reflation.

Reflation of the economy, not by handing over trillions to busted banks, but by an interest strike or even just handing out interest free credit or debt free money to the population (which is Social Credit) would easily solve the depression overnight.

But that would be ‘inflation’. With fiat money! Statist violence! Oh horror of horrors! That would certainly rob the rich of the CHOICE, LIBERTY and FREEDOM to choke us by withholding credit! How dare we!

Related:

Why Gold is so strongly deflationary

The Inflation vs. Deflation Dialectic

(left: Clifford Hugh Douglas, the brilliant economist who invented Social Credit)

Social Credit is one of the main achievements of the 20th century in terms of monetary innovations. It solves poverty and depressed economies and provides a basic income to all. It reclaims the currency monopoly in the hands of the banking cartel, without centralizing power in State hands.

By Anthony Migchels for Henry Makow and Real Currencies

Social Credit was developed by Major Clifford Hugh Douglas, who penned a book with the same name in 1924.

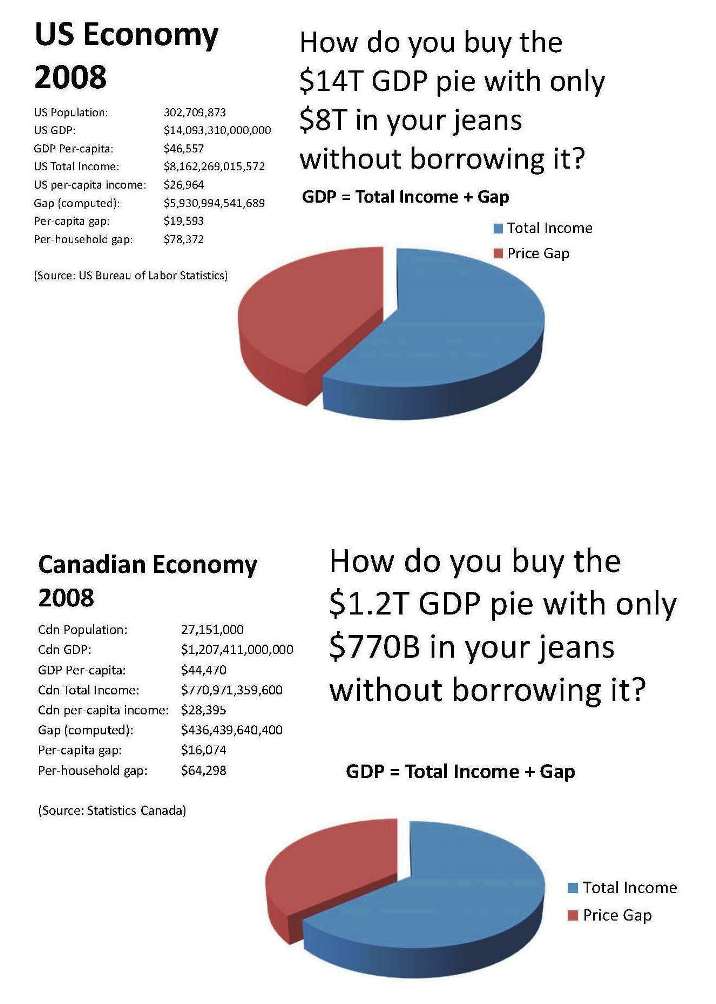

Its major breakthrough in terms of economic understanding is the so called ‘Gap’ or the A + B theorem. This refers to the gap between total income and total value of production. The latter being always higher than total income. As a result, society never has enough income to mop up all of its own production. Not only does this lead to depressed economies and to ever mounting debt to compensate for this lacking purchasing power, it also creates a strong incentive for corporations to look for markets elsewhere.

The Gap is a crucial notion. It is undeniably true that there is a structural lack of purchasing power in the economy. This is fundamental part of structural unemployment, for instance. Please see the diagram below the article for quantification of the gap.

Douglas also noted another trend in the economy: automation. He foresaw a time when many people were basically no longer necessary in the production process. These people are called the useless eaters by our masters, but Douglas, being a real human being, understood that production serves consumption and that the economy exists to feed the people, not the other way around.

To solve the problem he came up with an eminently practical and simple solution: let the Government print debt-free money to be spent into circulation by the people. Everybody should get an equal amount of money, whatever their income or asset position. The amount of money to be printed should equal the lack of purchasing power in the economy. If this is done correctly, it could be done with stable prices: the inflation in terms of a growing money supply would serve to buy up production for which there are insufficient funds available and thus would not lead to price pressures.

In this way Social Credit is associated with a Basic Income or National Dividend, both of which, incidentally and surprisingly, were supported by Mont Pelerin Alumni von Hayek and Milton Friedman.

Social Credit gained a lot of attention in the 1930’s, throughout the dominions of the British Empire (the white colonies) and the Axis powers. Ezra Pound favored it, wrote about it (in ‘What is Money For‘, an excellent primer for the unitiated) and discussed it with Il Duce at some point. In Japan it was highly regarded and gained a lot of traction. Also the Catholic Church, for instance the Michael Journal, promoted Social Credit as a solution to Usurious Usurpation.

Social Credit compared to the Greenback

With the Greenback I mean a debt free paper currency spent into circulation by the Government. Recently it has come to my attention that this is not actually what Abraham Lincoln did. I intend to come back to that at a later stage, but for now we’ll stick with the common notion that people have when talking about Greenbacks.

Social Credit is vastly superior to the Greenback as a way for Government to provide currency.

The fact that the cash is handed out to the populace to be spent into circulation not only ends poverty and solves the problem of the Gap, it also prevents the massive power centralization with the State that is associated with the Greenback.

When Government can print its own cash, not much good can be expected from it. True, it’s much better than letting a private cartel do it, but most people suggesting the State should print its own money equate that with the notion that the people would be printing their own money. This, to my mind, requires an extraordinary leap of the imagination.

Government is not the People. If kept small and in its cage it can be of use. But it is a threat always. It’s hard to think of a Government in human history that was not owned lock stock and barrel by the Plutocracy behind the scenes.

The simple fact is that Social Credit is probably the closest we will ever get to the notion of ‘the People printing their own money’, as they can spend it themselves. It truly is THEIR money.

The US Government, equipped with a debt free dollar would undoubtedly be an even worse threat to the world at large than a deeply indebted one.

Also, if Government can spend its own money into circulation, it would have a very strong incentive to badly inflate the money supply. This is what seems to have happened to the Chinese Emperor’s units and also to Washington’s Continental.

Social Credit, the Gap and Interest

Although the Gap, in terms of insufficient purchasing power, is a very important issue, it also in some ways obfuscates the real problem: the Gap is mainly debt service. Cost for capital: Usury.

It is not for nothing that the size of the Gap as calculated in the diagram below is about 53% of GDP. This is similar to the 45% of prices that Margrit Kennedy famously calculated to be related to cost for capital (interest).

And while Social Credit compensates the people for usurious financing of production, it does not end it. Corporations and people will still need banks to provide credit and these banks will have to be capitalized by savings. Both imply interest.

People insufficiently understand that Interest is per definition a wealth transfer from the poor to the rich. The rich have money and lend it out (or own the bank), while the poor must borrow money and thus pay interest.

Worse still, only very few people see the horrible truth: that eventually ALL the interest ends up at the very top of the food chain. Slowly but surely interest payments move up the ladder as even the very rich pay interest to the Money Power: the banking families at the very top. This is Usurious Usurpation.

This is how Rothschild has come to own the entire world.

So compensating for interest is not enough: interest itself must end. We can cannot allow the eternal wealth transfer to continue.

Of course we can not outlaw interest. But we can make it irrelevant: nobody is going to pay interest if he can get an interest free loan. Therefore Social Credit must be combined with Mutual Credit, which provides interest credit at cost price, which is a fraction of normal interest rates.

While many still have a hard time grasping how nefarious usury really is, it must be understood that we can easily do without. Just imagine: why should we be paying $300k interest over a $200k mortgage when we can easily have an interest free one? Only the richest ten percent of society gain with interest. The rest are paying more interest than they receive to the rich. They stand to gain from universal interest free credit.

Conclusion

Social Credit undoubtedly was a major breakthrough. Its analysis is sound. Its solution provides a basic income to all, ending poverty and wage slavery. It does not empower Government, but the people.

It may be the best way for Government to provide currency. It certainly is the best debt-free unit there is. But it still is not comprehensive: it does not allow for interest-free credit. In its classical version, that is, because modern Social Crediters have proposed combinations with interest free credit.

Of course, a money supply based entirely on interest-free credit also looks like a very viable option.

Also, Social Credit, while decentralizing economic power, still assumes a Government Currency Monopoly. This monopoly will have to go just like all the others, but that is a different story altogether.

Related:

Interest-Free Economics

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Reassessing the Greenback and other Alternative Monetary Systems

On Interest

Usury: why we don’t build Cathedrals these days….

More and more people are calling this whole Credit Crunch Charade an insolvency crisis.

What nonsense.

By Anthony Migchels for Henry Makow and Real Currencies

The latest example is this article by the American Dream’s Michael Snyder.

Here’s how he puts it:

“Well, the truth is that this is not a liquidity crisis. If it was, the central banks could flood the system with money and solve the problem.

No, what Europe is facing is an insolvency crisis. There is way, way too much debt in the system and it is inevitable that an “adjustment” is going to happen.”

What nonsense!

In the first place, all the major banks own each other. They also control or outright own the Central Banks. Even BIS is a private corporation.

It’s just one massive monopoly.

So we ask: if my right hand owes to my left and he can’t pay up, do I go to my neighbor to bailout my right hand? Or do I, as the owner of both, just cross off this debt?

Huh? Get it?

Secondly: the problem is not debt, it’s Interest.

All these banks create all the credit through fractional reserve banking. Most of the money out there was created the moment a loan was taken out. This is an almost zero cost operation. If you don’t build massive palaces all over the place, anyway, and pay your people twice what normal employees earn, let alone what you fork over to your vampire ‘traders’ and ‘investment bankers’.

If we call an interest moratorium, the depression would be over tomorrow.

Conclusion

Nothing to conclude. This is just one massive charade, aimed at causing depression while raping us for untold trillions in the process. The only thing that makes it hard to see is the sheer scale of the whole thing.

The bigger the lie, the easier to sell.

The sooner we wake up to the blatantly obvious, the sooner we can put all these bozos to rest.

Related:

Understand that the Banking System is One

The Few Banks that Own All

The Problem is not Debt, it’s Interest

The Wolfson Prize, I win!

Debt Repudiation or an Interest Strike?

The Case for Regional Currencies

Regional Currencies are an integral part of comprehensive Monetary Reform. Areas like the United States and Euroland are far, far too big for one monopoly unit. Not only does it allow irresponsible and dangerous power centralization in the hands of those that control the currency, the Euro crisis shows another forgotten problem: regional imbalances.

For most in the United States the dollar seems an inevitability. But it was only in the aftermath of the Civil War that Lincoln’s Whig party got what they had been aiming for for decades: national currency. Up to then all sorts of currencies had circulated. First the various scrips of the colonies, later competing banking currencies. Then already the main aim of a ‘national’ currency was not well being, but centralizing power in the hands of a few.

However, it relegated the more remote areas of the United States to eternal depression.

Regional imbalances

As we have seen with the euro crisis, in large currency areas regional imbalances are inevitable. Greece imports more from the North than it can export to its suppliers. As a result it has a negative balance of payments and loses euros to Germany, Holland and a few other countries. This means deflationary pressures (a dwindling money supply) that can only be solved either by going deeper and deeper into debt to maintain a healthy money supply, or structural redistribution from North to South through Brussels. The latter, of course, was the plan of the Eurocrats when they implemented the Euro. But while the Germans like importing Euros from Greece, it does not like giving them back. And who can blame them? They delivered goods and services for them.

This pattern is clearly recognizable in Europe through the Euro crisis and at the time it was predicted by a number of economists. But few realize this is always going on any national economy that is more than a city state.

For instance: the economy of the small nation of Holland is basically centered around the West, where Amsterdam is still at the heart of it all, complemented by a number of lesser cities. However, the North and South have forever known depressed economies, with difficulty getting full employment and structurally lower price levels. It is exactly the same issue: negative balance of payments with the core, in this case the West of Holland, net outflow of money (earlier Guilders, now Euros) and deflationary pressures as a result.

In every economy, even in a mature currency area like that of the United States, every region still generates most of its production through trade with regional partners. Yes, under the pressures of globalization and the ongoing onslaught of Transnationals against local economies, less and less is regional trade, but it still is quite substantial. There is basically no reason why this trade should not be financed with regional currencies. It basically is completely unnecessary and actually insane to allow these economies to wither away just because they cannot cope with (inter)national competition and as a result have too little money circulate locally to finance its regional economy.

The same is going on in the US where regions like Arkansas and rural States are under-developed and often actually quite poor.

Economists and bankers will explain ‘structural adjustments’ are necessary: people must give up natural rights to accommodate international corporations so that they can compete with core areas. Labor markets must become ‘flexible’, meaning lower wages, fewer worker rights. Of course, in the minds of these people, regions exists to provide optimal return on investment for capital.

But the simple truth is that economies only exist to provide the people with what they need for a decent life.

Centralization of Power

The Civil War delivered a death blow to State Rights and local independence and paved the way for the American Empire. National Currency, created and controlled by Washington, instead of by the States, was instrumental in this. As we know today, the Federal Government is corporation, owned by its shareholders in London and has very little to do with the American People.

The same thing is now going on in Europe. With typical banker logic the debtor nations, to be saved, must first be destroyed. They must give up control over their budgets and all fade away in the grandiose idea of Europe. Otherwise they will marginalized by the USA and China. We must all compete, of course, or go down. It has nothing to do with what the people really need. Nobody is interested, except some Eurocrats and other megalomaniacs.

The trend is clear: the Euro was a major step forward to World Currency. Where the US could still be plausibly, though not factually, be presented as one Nation, in Europe this is impossible. Power is being centralized at ever higher levels, in ever fewer hands.

Regional Currencies

Regional currencies come in many guises, with many different monetary architectures, but by their very nature they only circulate in a regional area and are controlled by people actually living in the region.

So they both decentralize power and end regional imbalance. Local trade can always be financed, there is no dependence on (supra)national scarce currency.

If something goes wrong, through either mismanagement or abuse, the controllers will have to answer to their neighbors, instead of hide behind a police state.

This is not to say governments or even international bodies cannot create their own units. In fact, monetary stability is closely linked with the presence of different units: if one fails (usually because of corruption) than the others continue. Why should the economy be destroyed if the money men mess up? It just makes no sense.

Besides Regional Currencies there is also much scope for international cybercurrencies. Bitcoin is an example, although still rather primitive from a monetary perspective.

What would happen if Facebook created its own unit? I think everybody can answer this question for himself. The only reason it has not happened is because Facebook is part and parcel of the control grid.

Conclusion

The monopoly on currency must go. Why offer dozens of brands of crisps at a supermarket and call that ‘consumer choice’, while insisting on one size fits all currency controlled by those proven guilty?

The good news is that there is no legal monopoly. There are only legal tender laws. These give Fed Notes and the Euro its power, but it is not a monopoly. And well managed private party currencies of all sorts have managed to find a place under the sun.

We don’t have to wait for either the banks or the government to clean up their act. They never will.

Comprehensive monetary reform requires local and regional units, to combat imbalances associated with too big currency regions, while ending excessive power centralization.

Dedicated people can create fully viable currencies chipping away at the Money Power’s domination and interest slavery.

Related:

Take your Money out of the Bank NOW! (Video)

Bitcoin, Impressive, but Flawed

Regional Currencies in Germany: the Chiemgauer

The Swiss WIR, or: How to Defeat the Money Power