Left: Robert Triffin

Recently many commentators have been starting to talk about the Triffin Dilemma, which states that there are dangers for the dollar in her role as international reserve currency.

Triffin formulated this issue in the 1960s, when the dollar was still backed by Gold. It’s no longer relevant these days. It is circulated as a meme to further the agenda of the dollar’s demise and the advent of a new currency order.

Wiki: “This dilemma was first identified by Belgian-American economist Robert Triffin in the 1960s, who pointed out that the country whose currency foreign nations wish to hold (the global reserve currency) must be willing to supply the world with an extra supply of its currency to fulfill world demand for this ‘reserve’ currency (foreign exchange reserves) and thus cause a trade deficit.”

The basic rationale is clear: Triffin says the nation offering the reserve currency must allow a trade deficit to export its currency to those who need it.

This is indeed the case under a Gold Standard, as was the case back then, when the US Dollar was convertible to Gold. For foreigners only. The whole idea of a Gold Standard is to have a constant supply. It cannot be printed and what is exported cannot be used at home.

The Triffin Dilemma is basically an explanation for the fact that the US was bled dry of its Gold in the post War years, until Nixon finally ended the one sided transfer.

However, today’s dollars are printed at will and the Fed most certainly does not have any problems providing all the dollars the world will ever need. Quite the opposite, actually: the day is not long before trillions of dollars that are no longer needed (because the dollar is losing its reserve currency status) will be repatriated. It will be interesting to see how the Fed intends to mop those up.

Furthermore, the Triffin Dilemma automatically assumes that a trade deficit is the only way of getting the money into international circulation. But this is nonsense: the Fed is well capable, and does so routinely, of ‘lending’ out massive sums to its international banker buddies, who see to it the money leaves the US asap.

So the Triffin Dilemma does not look very relevant these days. Why then this sudden mini hype? The answer is in the same wiki entry:

“In the wake of the financial crisis of 2007–2008, the governor of the People’s Bank of China explicitly named the Triffin Dilemma as the root cause of the economic disorder, in a speech titled Reform the International Monetary System. Zhou Xiaochuan’s speech of 29 March 2009 proposed strengthening existing global currency controls, through the IMF.

This would involve a gradual move away from the U.S. dollar as a reserve currency and towards the use of IMF special drawing rights (SDRs) as a global reserve currency.

Zhou argued that part of the reason for the original Bretton Woods system breaking down was the refusal to adopt Keynes’ bancor which would have been a special international currency to be used instead of the dollar.”

It is hard to imagine a more outright and blatant promotion of world currency than this one by China’s Central Banker.

Here we see why we were earlier discussing that ‘the US Empire is not the Money Power‘.

The Money Power owns the dollar and through it the US Empire. But it’s done with the dollar as reserve currency and with the Empire too.

Zhou is doing their bidding by resisting the Empire, while promoting world currency, while his ‘national interest’ (in Machiavellian terms) would be to promote the Yuan as an alternative.

Conclusion

Wiki goes on to report on how the Triffin Dilemma meme was picked up by ‘economists’ and promoted by CFR outlet ‘Foreign Affairs’ and the rest is history.

This story certainly fits the wider picture of how the dollar’s status is changing rapidly. Yesterday we discussed several other memes that are promoting the same agenda. Here’s an article by Ambrose Pritchard-Evans, I linked to it earlier, but this guy is an important framer of the debate and he’s basically saying the Gold Standard is a done deal and that it’s just a matter of working out the details. He’s also talking about the Triffin Dilemma.

The future is today and it seems things are moving even faster than we may think.

Related:

Bloomberg, the dying Fed and the birth pangs of the new Gold Standard

The US Empire is Not the Money Power!

Germany, the Money Power’s Golem in Europe

Left: Michael Bloomberg, smirk ‘n all

A few days ago, Bloomberg published a chart that has been well known in the Alternative Media for years, showing how the Federal Reserve Bank debased the dollar since 1913. They had been on the Fed’s case before. Bloomberg’s efforts mimic those of the Alternative Media and perfectly serve the wider agenda: the Money Power’s efforts to get rid of the Fed and move to a Gold Standard, which is being erected as we speak.

There are a number of interesting things about Bloomberg. It is owned by Michael Bloomberg (Blumberg), who became one of the richest men in the world according to the official lists. He’s also the Mayor of New York and as such one of the most influential politicians in the US. Bloomberg was financed by Merrill Lynch to found Bloomberg L. P., a publishing powerhouse mainly aimed at the financial information ‘niche’, a market worth about 20 billion per year of which Bloomberg takes about 30%. All this is on Wiki.

Bloomberg is one of the few Mass Media Empires that is actually doing well. It’s growing quickly, and opening up all sorts of new branches, like Bloomberg Law, Bloomberg Government and Bloomberg View (opinion). Not bad, in the middle of a Great Crunch and not quite the death spiral that most of their colleagues seem to be in.

Bloomberg is basically the only Mainstream outlet that has been fairly consistent in its mildly critical approach of the Fed since the credit crunch began. Its main ‘achievement’ was forcing the Fed to disclose at least some of its lending to the big banks during the crunch. They hammered through a Freedom of Information request after months of litigation.

And now there is this chart. Here’s the YouTube vid:

[youtube=http://www.youtube.com/watch?feature=player_embedded?v=cikT5DdvGj4]

Of course, both ‘disclosures’ by Bloomberg are completely innocent, in the sense that they do not give up any secrets. Both before 2011 and today it was and is well known that the Fed had been handing out massive amounts to insider banks and the chart in the video is a cliche in the Alternative Media.

But it is remarkable how the commentator in the video automatically relates that it all started when we went off the Gold Standard and the Fiat Empire began. Doesn’t get more Austrian than that.

Since Bloomberg is so clearly a leading insider media outlet, it is interesting to wonder what’s up with this, albeit ultra mild, Fed ‘bashing’.

It certainly fits with the incredible impact Ron Paul has had. With the help of mainly Alex Jones, he managed to take over almost the entire ‘Truth Movement’ and his stooges are now renaming it the ‘End the Fed Movement’. During the primaries, several Republican candidates, including New Gingrich, started calling for the reinstatement of a Gold Standard, which is the implied automatic alternative to the Fed. Mitt Romney actually promised a Gold committee to study the proposal, should he be elected. As we know, Paul was instrumental in getting Romney the ticket.

It does really look very much like the Dollar (in its current form) and the Fed are end of life and the only real question seems to be how long they will last. At this point they still look viable, but pressures build up and at some point they break through, surprising us while we were waiting for it to happen.

All this is of course integrally linked to the Empire itself, which is built on the Petro-Dollar. Because oil must be paid in dollars, which can be printed at zero cost and be spent into circulation by the Powers that Be. Which is the reason we had 9/11 to begin with, because they needed to physically grab the oil, mainly to keep it in the ground as long as possible, to back their Dollar hegemony. And to consolidate Zionism, or better: to set up the final clash of civilizations.

Conclusion

Much more can be added to the equation, but we can see that all sorts of Money Power outlets and stooges are working in the same direction. Bloomberg is clearly part of the greater scenario. The Dollar in its current form and with its current status is toast and with it the Federal Reserve. A new system is in the works. As one of the leading, highly connected, presstitutes on this issue, Ambrose Pritchard-Evans puts it: a new Gold Standard is being born. Nobody knows yet exactly what it will look like, but the dollar will play a much smaller role and several supra-national units, not unlike the Euro, will emerge. Perhaps with a fixed exchange rate managed by the IMF as portal to World Currency.

Of course, the Fed itself is completely irrelevant in all this. It’s just a vehicle for control of the money supply. Gold is about the most controlled stuff around, so the Money Power is always eager to use it as the tool of choice for their usurious plunder.

In fact, the previous Great Depression was caused by the reinstatement of the Gold Standard in 1925 and it seems likely that the weaponization of Gold as currency, to create even more deflation, is a key element of their strategy.

As we know, it’s not the vehicle (the Fed) that matters, or even the kind of money, be it gold or paper. What matters is who controls it. Whether he can tax it with interest or not. We simply cannot win without interest-free money.

All this ‘freedom of the press’, ‘opposition’ and the ‘End the Fed’ movement certainly is a wonderful textbook case of Money Power control and implementation. Its fit with the greater picture is exemplary. They always have the sheeple call for what they have planned anyway. The greatest thing is that everybody is ‘awakened’. This is what Michael Hoffman calls the satanic mockery, ridiculing of us. In a sense, it’s even funny to watch, just imagine how these people behind all this must feel.

And as a final note: since Gold’s renewed lease of life as currency has been the main driver for its rise in the last decade, and since more and more major players are getting a hold of what’s theirs, it continues to look like a bull market.

Related:

Phoenix Rising, the Return of the Gold Standard

The US Empire is Not the Money Power!

Many realize these days that Jewish Supremacism and the Money Power are intricately linked. As a result Nazism is making somewhat of a come back. But are Socialism and Hitler worship really the answer to Money Power and the Jewish Question?

Recently Gordon Duff insulted some self declared Nazis by claiming that some of their outlets, including www.ratfacedjews.com and www.thejewishproblem.com were owned by the ADL. Typically, he offered no proof whatsoever.

Duff is an interesting fellow. He’s undoubtedly upset by the many atrocities of The Powers That Be. He’s also a well connected intelligence operative, with ‘extensive experience in international banking’. According to his bio ‘Duff currently serves on the boards of the Adamus Group, one of the world’s largest energy technology firms and of a private financial institution participating in the Federal Reserve Banking group‘.

As Faux Capitalist’s Jason Erb observes: is this bio satire?

Duff also claims to lie about 40% of the time, because he otherwise would be dead. My rule of thumb usually is that good disinformation is about 90% correct. Clearly Duff is either a well managed plant, or a loose canon out there to add to the ever mounting confusion.

Does this mean he’s wrong about those sites? I don’t know about the ADL owning them. It’s possible and they do it all the time, as we know. Most ‘anti-semitism’ must be organized by our bosses, because there is so little of it out there. But when looking at www.ratfacedjews.com, run by Mike Delaney of Prothink.com fame, there are a number of items that are interesting.

The moral high ground of ‘anti-semitism’

‘Anti-Semitism’, the word the Money Power created to label opposition to Jewish Supremacy and Money Power itself, is really an interesting position to take. It’s so politically incorrect, that it’s actually thrilling to break through it. Once you feel the inner liberation of accepting that Jewish Supremacism is real and an integral part of the ‘New World Order’ created by the Money Power, it’s exciting to become candid about it. There is a certain pleasure in the shock it generates in the non-initiated. This is just one of the little perks that come along with living truth.

However, as with all earthly pleasures, it’s easily overdone.

Being ‘anti-semitic’ together on Stormfront creates a pleasant ‘esprit de corps’, quite similar to that of Jewry itself: a sense of superiority for knowing and the enjoyment of power by speaking ‘truth’, even if it is not really truth and not really helping either.

And this is the case with many people opening up to the real world: they go overboard, saying the problem is exclusively Jewish. That all real culprits are Jews and that all Jews are culprits.

However, in the real world everything is decided by numbers: a gentile billionaire is more valuable than a poor Jew. If he plays along, that is.

Furthermore, there is the issue of bloodlines: not all of them are Jewish, although the Black Nobility and Finance Capitalism (the ‘international Jew’) seem to have fused long ago.

Third, there is the issue that many believe that the 10 lost tribes of Israel are in fact the English speaking world. People like Elizabeth II seem to believe this. Implying they consider themselves Israelites: the ‘real’ Jews. The fact is: we don’t even really know who ‘the Jews’ are…..The British, the Khazars, the Palestinians, you tell me.

And let’s not forget the Masons. True: Freemasonry is basically Kabbalah for Gentiles and indeed: the Freemasons are not to survive the Revolution they work so hard to create, as they found out both in Russia and under Nazism. But still: hundreds of thousands of ‘elite’ gentiles are actively furthering the agenda.

Is there really anybody out there who believes the Plutocracy cares about Jews? Of course not. The Jews as a nation/race/religion are just another bunch of easily manipulable idiots, just like the Gentiles. You tell them they are unique, the Chosen Ones and that they are hated because they are so splendid. True: this modus operandi was probably invented by the handlers of Jewry, but nowadays it’s just common practice.

Look at the US for a good example. The City on the Hill, the land of the Brave and the Free, the One Indispensable Nation, so hated because of their freedom! And lo and behold: the 99% take up arms against a sea of troubles to defend the ‘Free World’, all the while making the world even more safe for Goldman Sachs and Exxon. Hitler did the same to Germany and even here in puny Holland we tend to believe we live in the best country in the world.

We see in the living conditions of the poor in Israel how much the Money Power cares. A better example still is the way Zionism promoted the ethnic cleansing of Europe, maintaining ‘a cow in Palestine is worth more than a child in the US’.

It seems quite clear that part of the plan is to destroy Zionism (in the modern sense of a homeland for the chosen people, Zionism in reality is about the conquest of the entire universe) and to finally get their offering to their Gods of 6 million sheep.

No, not all Jews are assholes and not all assholes are Jews. It’s just common sense.

And no, I’m not naive about what’s taking place in the Synagogues and other cozy Jewish get-togethers.

However, bona fide nazi sites like www.ratfacedjews.com do have a comfortable position within the ‘truth movement’, because they at least have the guts to call a spade a spade. The politically correct euphemisms avoiding the annoying truth that we are run by money and that money is run mostly by Jewish bankers and that Jews are overrepresented in many of the higher echelons of society, are becoming staler by the day. For those trying to hide behind them while claiming they are opposing evil, it is becoming harder and harder to maintain credibility.

Our Eternal Leader

Foulmouthing Jewish Supremacism and its lackeys, however pleasant and even necessary, is in itself not enough to have much of an impact, other than divisiveness. The problem is real, but analysis never solved anything: it’s action that counts, based on a solid program. And Nazism as a program……are we serious?

Looking at some of the articles at www.ratfacedjew.com it is clear that the thinking there stopped at about 1939.

To begin with, there is this silly Hitler worship. Clearly, Hitler is not the big bad ogre that was created by British and Soviet propaganda. When listening to Hitler’s speeches, or reading his Mein Kampf, clearly a major revision of the Second World War is necessary. It’s certainly true that Stalin was about to invade Europe when he was surprised by Hitler and also that Chamberlain and Churchill did everything in their power to sucker Hitler into war.

People like Mark Weber have done successful work on that.

However, while Hitler was just another dictator, not more demonic than Churchill, Roosevelt or Stalin, he was also working for the same people that brought us most other tyrants. Makow is one of those who have done much to expose this fact. For which he is much maligned by our Nazi friends.

According to the Nazis, ‘Anyone who denies the greatness of our eternal hero, Adolf Hitler, is either a fraud or a brainwashed idiot’. But this is of course nonsense. International Finance paid for Hitler’s rise, as Sutton and others have documented. Also, Hitler’s decisions during the war are so pathetic, he must have been a traitor. Many in his High Command thought so, anyway.

Here’s just a short list of the kind of issues any clear headed analysis of Hitler must explain:

– In Mein Kampf Hitler perfectly analyzed Marxism and Bolshevism to be enemy hoaxes. But he also believed Britain was a bunch of Aryan brothers to be enlisted against the Marxist threat. Apparently Hitler was oblivious to the fact the City of London (the archetypal HQ of International Finance) actually owned and ran the British Empire. So how credible is that?

– He did the stupidest thing possible when attacking Russia: his invasion was weakened by lack of a clear target. Instead of directing one massive pincer at Moscow, which would have certainly succeeded, he screwed up by sending large parts of his army both north and south. The result was Moscow held late 1941 and the Wehrmacht got bogged down first by the mud, then by the cold.

– His refusal to build the Bomb. Because he thought it was too brutal……

– His refusal to occupy Gibraltar and thus controlling the Mediterranean and closing the Suez Canal.

– His suicidal ‘hold every inch of occupied territory’ while while being forced out of Russia, refusing his Generals a rational deepening of their lines and exposing his men to Russia’s main strength, its artillery.

– The fact that Bormann, Hitler’s secretary (handler), was most likely the one sending German High Command secrets to Moscow.

– How he let Britain’s best escape from Dunkirk. This was the core of their professional army. Without it the British would have had to build a conscription army without experience, which would have been a horrible handicap.

The Nazi Program

So what exactly is the Nazi program?

According to Mike Delaney, ‘those of us in the real truth movement are promoting a working people’s Fascist movement – populist, collectivist socialism which places the state as the core power of society, rather than promoting inhuman industrial forces to this position – as an obvious means to bring justice to our society’.

Interestingly, this quote is preceded by a withering attack on Libertarianism as ‘Jewish Free Market Capitalism’. Fair enough: this is just a good example of the dialectic at work. Of course we don’t want ‘Jewish Free Market Capitalism’. No. we want a big strong state. We are talking national SOCIALISM. Much different from ‘normal’ socialism, I guess. The question remains the same: who owns the State?

As we know, Hitler ruled through a coalition with Germany’s leading industrialists, who were to make a bundle first from reconstructing Germany and then in the war. Gottfried Feder, who was the leader of the Nazi ‘left’ and famous for his fight against Usury was sidelined in the late thirties and from then on Nazism was fully connected to the industrial powers that be. And through that, to International Finance. For instance: IG Farben, Germany’s leading chemical powerhouse, merged with Rockefeller’s Standard Oil in the thirties. In fact: the synthetic fuel that the Nazis generated from coal to keep their war machine going was a Standard Oil patent.

Nazism, as a form of socialism, is about making the individual small and the State big. It is about making people cogs in the great machine. It is about taking our children through the Hitler Jugend (a much superior education awaits them there!) and making good soldiers out of them.

Remember: the goal of the Protocols is a grandiose Despotism with the Omnipotent State as the source of everything and all.

It is reminiscent of the old Rabbi adage ‘some call it Marxism, I call it Judaism’.

So we can conclude without a shadow of a doubt, that National Socialism is just one more collectivist ruse of our Mind Controllers.

Conclusion

The problem is not Jewry. It’s not even Usury. It’s Ego. This is a spiritual war. The forces of self vs. those crucifying self.

The ultra rich and their ‘New World Order’ only exist to show us what happens if we worship the false gods of Power, Sex, Money, Fame, Security, Nationalism, etc. Not that there is something wrong with any of these. It’s about identifying with them, being attached to them. To believe: I am my power. My money. My Nation. My body, thoughts or feelings. The women I sleep with.

Resistance is about first and foremost starting to understand we are part of the problem. Because we identify with ‘self’, instead of God. This is not to say we want theocracy. We don’t. The only question that creates is, who owns God?

God lives within us all. By crucifying self and shutting down the endless blathering of mind, senses and emotion, we can connect to the Great Architect (just kidding) Himself.

From there we can devise plans that are real. Real because they balance the individual’s needs with those of the Common Wealth. Real because they don’t exploit people, but elevate them. Because they are about sharing, instead of monopolizing.

The alternative is to succumb to what the ‘Jews’ want. To what Satan wants: an eye for an eye, a tooth for a tooth. This is what Hitler succumbed to and we all know what price the Germans paid for falling for it.

It is Love that overcomes. And not the degenerate kind of ‘oh we’re all so ok and really sparing each other’s feelings, right?’.

“Greater love hath no man than this, that a man lay down his life for his friends.” (John 15:13)

When there is no self, there is no fear of death.

When self has died, Life has begun.

Evil cannot be beaten. You don’t fight darkness, you turn on the Light.

Related:

Demystifying the ‘Conspiracy’

Yes, the Money Power is Jewish

Is Anti Usury Activism Antisemitic?

The Conspiracy is Spiritual in Essence

Michael Hoffman is undoubtedly one of the leading thinkers on the Money Power. His analysis of Talmudic, Rabbinical thinking is brilliant. To see him now come out with all guns blazing against Usury is really very good news for all anti-Usury activists out there.

Hoffman does not mince words, is a formidable academic, is keenly aware of both the Jewish aspect of the Money Power and how it destroyed Catholicism and the papacy and does not fear stating God’s case short and simple as it is. In short: he’s our man.

His site is ‘On the Contrary’ at revisionistreview.blogspot.com and his latest book is called ‘Usury in Christendom’ and is a virulent attack against Usury, the Money Power and ‘Christians’ going along. He is forceful, scathing, to the point and incredibly well informed. Below you’ll find a short presentation by him on his latest book, including a transcription of his most vital points.

But I certainly want to highlight this familiar point that Hoffman makes: ‘…freedom from interest on money, is essentially the battle for freedom from the Money Power’. This is the key message. The Money Power rules through control of the money supply and its main tool of domination is Usury.

All the pundits out there that ‘valiantly battle the NWO’, but either ignore or deny this are just fools or worse. This is one of those lithmus tests that immediately show you who know and who don’t.

Since Hoffman, in the video below, doesn’t mind taking a direct shot at Thomas Woods and the von Mises institute, I’ll also add this: exposing Usury and Usurers for what they are in itself is a pleasant task when it comes to people like Bernanke, Rothschild, Trichet and the like. Everybody hates them.

But since the ‘Alternative Media’ is dominated by Libertarians, we have shown discomfort in being associated with them too and this has not always generated the same kind of sympathy as when we play a little with the bankers themselves.

But if you consider the truth as so powerfully put forward by Hoffman in his book, and you compare this to what Gary North has to say about interest and Christians, clearly something big is going on.

Here’s how Gary North summarizes his findings on usury in the Bible in his massive 20 volume ‘Economic Commentary on the Bible’

“I have good news and bad news. It is OK to deposit money in the bank and earn interest. That’s the good news. It is unwise to borrow money to buy anything but investments and to meet emergencies. That is bad news for most Christians.”

So Gary North simply says you can rape your brethren with usury, but you are sinning if you are allowing yourself to be raped.

This is the typical, purely satanic great turn around. Blaming the victim and whitewashing Usurious Usurpation.

It is not important that Thomas Woods is a nice guy. It is not important that Gary North’s ‘grumpy old man’ persona is really funny.

What is important is that these men are consciously lying from highly paid positions, and not only about usury. They are usurers, liars, hypocrites, thieves and enabling murder, just like the idiots of the Mainstream. They are our enemies. And yes, when we aim to serve Christ we must love our enemies. But love comes in two kinds: soft love and tough love. Tough love is when you discipline your child when it is damaging stuff or endangering himself or others. Here’s some tough love by Jesus, when dealing with the Pharisees (Matthew 23):

13 But woe unto you, scribes and Pharisees, hypocrites! for ye shut up the kingdom of heaven against men: for ye neither go in [yourselves], neither suffer ye them that are entering to go in.

14 Woe unto you, scribes and Pharisees, hypocrites! for ye devour widows’ houses, and for a pretence make long prayer: therefore ye shall receive the greater damnation.

15 Woe unto you, scribes and Pharisees, hypocrites! for ye compass sea and land to make one proselyte, and when he is made, ye make him twofold more the child of hell than yourselves.

Is it reasonable to quote this in a ‘normal, rational debate about economics’? It is very reasonable. Economics has been hijacked by Money Power agents of many persuasions, and they have turned it into a soulless pseudoscience dealing with scarcity. But it is in fact the simple, yet sacred, science of tapping into God’s abundance by sharing it equitably. And Usury is not part of that plan.

I’m not one to say ‘the Bible is the word of God and that’s the end of it’. The Word is the Logos and the Logos is within us all. Or better: we are all within the Logos. The Logos has different words for the same things in different eras for different people and the 21st century needs its own paradigms describing equitable sharing, just as we no longer are satisfied with Genesis 1 to explain the creation of the Universe.

But the simple truths when it comes to economics are still the same as back then in Jesus’ time, and it’s a sacred science, that’s why the Bible and other holy books talk so much about it. They all condemn Usury as a mortal sin. People, ‘economists’, explaining Usury is grand are heretics keeping people from the path. When they parade as Christians, they must be exposed. Just as when we patiently, yet vehemently, oppose their false ‘theories’ explaining how Usury benefits everybody in the long run.

Conclusion

We’ll have to stick to tough love. People keeping the Kingdom from us by explaining us that theft through Usury is no longer theft are both heretics and pseudo scientists.

I, for one, am relieved to find myself in the camp of such a powerful Christian, philosopher, historian, theologian and economist as Michael Hoffman.

Related:

Debunking Tom Woods’ “Catholic” Austrian economics

What Gary North is not telling you about Interest

Here’s a short presentation by him on his main points:

[youtube=http://www.youtube.com/watch?feature=player_embedded&v=jT0grvk16NI]

And here are just a few of his points transcribed for those who hate looking at a 33 min video when it can be read in two (although you’d miss his very powerful presentation):

Cicero equated usury with murder.

Usury is interest on money, not ‘excessive interest’, which is the modern Orwellian Newspeak for Usury, but interest on money as it was always defined, until the Money Power got in control and then falsified it.

Interest on money was condemned as a mortal sin. It was put on a level at least as theft and sometimes compared with murder. And this was the consistent opinion of the church for at least the first millennium.

What we’re dealing with here is gradualism. There is no way the Money Power could have come in a truly revolutionary manner, at least until it captured the papacy. Once it captured the papacy, then you began to see the footprints of the revolution…..And then you came at the papacy of Leo X, the first of the Medici popes, and only then did you see this revolutionary gnawing away at Usury laws.

Nowadays you have these so-called ‘Catholic libertarians’ like Thomas Woods who openly say Usury isn’t a sin.

This redefinition of Usury as ‘excessive interest’ is necessary for our modern mentality, which is immersed in money-getting, and in greed, it’s a part of all of our lives, it’s woven into our corrupt society, it’s the root of all evil, and we can’t even conceive of a society that says ‘interest on money’, the breeding of money from money, is a mortal sin that will damn your soul to perdition.

Jesus said in Luke 6:35 to lend freely, expecting nothing in return.

The exception in the Old Testament (on Usury prohibition) is because interest on money is so destructive, so damaging, so predatory, that God said you can use it against His enemies.

If we are deceiving ourselves, it is because we need to deceive ourselves. It’s because our lively-hoods depend on interest on money. Or because we believe greed is a lesser sin than lust.

……when we are conspiring with priests, and preachers and ministers and popes in deluding ourselves into believing that there is some greater evil than the Money Power. If there is a greater evil than the Money Power, than the Bible is lying.

To say that the Money Power is at the very top of the evils that we need to work against basically overwhelms people. They want something else to fight.

Christians would be flabbergasted if there was a whorehouse for them down the street, but if there is a whorehouse called a bank, they are not only not flabbergasted, they are probably working there!

And then they are going in as social justice people who are concerned for the poor they are going to go along and palliate the wounds of those people who have been injured by interest on debt. There is a satanic level of mockery there. It is satanic ridiculing of us. Because Jesus intended that we would be overcomers here, that we would be a light unto the world. Instead we make a mockery of the Gospel by these shortcuts that we take….The inability to have faith in God.

And to proceed as we have proceeded (by allowing Usury) , is to reject Grace, not only do we reject the Law, we also reject Grace. Meanwhile, we’re playing the part of hypocrites, we say ‘we’re Christians, we’re Catholics, we’re the reforms, we’re the evangelicals! Come to us world and learn a new way of being’. A new way of being that is based on Compound Interest???

How many Catholics follow the Von Mises institute? How many Catholics follow Ayn Rand?

We reject the weaponization of the love of money as it is represented by interest on loans of money(!!!!!!)

Jesus was not born on December 25th, Santa=Satan, Political Correctness is making it a ‘happy holiday’, gluttony is one of the mortal sins (and the food is poison anyway), commercialization is messing it all up and then there is family………

……But Goodwill Prevails!

Dozens of new units are being launched as we speak: Freicoin is one, Wayne Walton’s Mountain Hours are showing the way forward in popularizing the method, Usury has been firmly put on the agenda.

We at Real Currencies wish all our readers, supporters, contributors, donators and those spreading the word and acting upon it all the best for the coming days, and indeed, the coming year!

May the Spirit bless you and yours!

While the self-declared ‘awakened’ claim victory through the ‘Internet Reformation’, the Money Power continues its relentless drive towards a long term global depression, setting the stage for the collapse of the American Empire. The West is to be ‘realigned’ to submit to deindustrialization and living standards comparable to that of the BRIC nations. The ‘Fiscal Cliff’ is just a good excuse to force through destructive austerity measures that will further the deflation in the economy.

The ‘Fiscal Cliff’ is a set of mandatory spending cuts and tax hikes if Congress does not raise the Government’s statutory spending limits. The debt ceiling will also have to be raised to allow the Government to borrow enough to finance its budget for 2013.

Of course, in itself this is not very exciting. But if the GOP folks do not work with the Democrats, the Government will be forced to cut spending drastically overnight. This would mean a substantial drop in demand in the domestic economy and economists expect a 3% decline in economic activity as a result, which would be pretty disastrous.

More important is the deficit that needs financing, which is projected to be about 1 trillion over 2013, or 5.5% of GDP. Is that deficit a problem?

Yes and no.

It’s a problem because it is caused by some truly insane spending.

Medicare is just a subsidy to the diabolical pharmaceutical cartel that is making trillions per year world wide with poisoning people with vaccinations, chemo therapy, radiation poisoning and many more terrors. It is killing as many as 760 thousand Americans per year in the process. Natural healing based on spiritual wholeness, diet, exercise and energy therapy would heal 99% of the sick at a fraction of the cost.

Worse still is the maintenance of the American Empire, costing about 1 trillion per year. The United States spends more on war and Imperialism (‘defense’) than China, Russia, France, Germany, Japan, Britain, Israel, India, Brazil and scores of other nations combined. Hence, presumably, the ongoing need to ‘rebuild America’s defenses’.

True, the Empire is far less lethal than allopathy, but it is an abomination nonetheless.

Furthermore, the Government pays 450 billion per year in debt service to the Chinese, the Japanese and the International Banking Cartel. While it could refinance the debt overnight interest-free and inflation-free via the Federal Reserve bank. Of course, that would damage the business case of Barclays, Bank of America, Citi Bank and others, who happen to own the Federal Reserve Bank.

But purely financially speaking, there is no problem. The Federal Reserve Bank buys up about 90% of whatever the Treasury is offering the Bond Market. There are no other buyers. The Asians are tired of America and the banks are not lending. This means that all new debt is financed interest-free. The Federal Reserve takes a very low interest rate on the Treasuries at the moment, and the Fed, since the sixties, pays back all profits it makes to the Government anyway, meaning any interest the Government pays is reimbursed.

This means that the Government can continue these deficits basically indefinitely.

But….but….musn’t our kids pay this debt back?

No, the debt will never be paid back, because it is our money supply. If we pay off the debt, we would lose our money supply. Furthermore, the problem is not debt, it’s Interest. Even Greece could pay off all its debts in 20 years if it used what it loses to debt service now to repay the debt.

If we ever chose to pay off the debt, we will simply print enough debt free money to pay it off. This would maintain the same money supply, but debt free.

True, all the serious looking pundits are now explaining for the umpteenth time that ‘everybody knows you cannot spend more than you take in’ and while they do not explain why they did not think of this before they incurred all the debts, this narrative does have a certain allure to the common man.

The problem, however, is that if the Government seriously diminishes spending this just feeds the deflationary spiral that we are already in: it would mean even less demand in the economy. For instance: the recent budget cuts of 16 billion that the Dutch Government recently promised, have been calculated to imply 12 billion less income for the State next year because of declining economic activity as a result of the cuts. It is the same nonsense that has destroyed Greece and Ireland. That’s the insanity on steroids that Ron Paul was selling as ‘the power of ideas’.

And inflation? Does all this borrowing not lead to rising prices?

Ah, yes. Inflation……

Throughout the 19th and 20th centuries the bankers have been scaring us with the inflation bogey man, hiding that money was and is actually scarce. And since the Money Power’s gold dealers took over the ‘Truth Movement’ (which they are now renaming the ‘End the Fed Movement’) through all the libertarian outlets masquerading as the ‘Alternative Media‘ they have been badgering us with the same drivel too.

To begin with: inflation does not mean ‘rising prices’, it means ‘a growing money supply’. A growing money supply can lead to rising prices, but rising prices can also be caused by other problems. Supply shocks for instance. Oil comes to mind when thinking of those.

Similarly, deflation means a declining money supply.

And the fact is: there is no inflation. We are in a crushing deflation. The money supply is crashing.

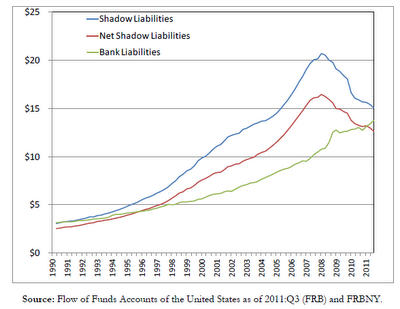

This graph shows the decline in credit flowing through the shadow banking system. A truly crushing deflation.

This graph shows the decline in credit flowing through the shadow banking system. A truly crushing deflation.

There is a massive deleveraging going on. People, both in the real and financial economy, are paying off debts, and every dollar repaid to the bank is a dollar less in circulation. That’s one of the implications of a debt based monetary system, after all.

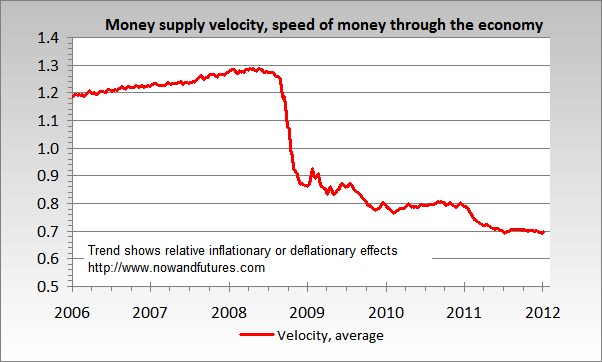

Worse still: the velocity of circulation has imploded since the crunch started. This means that every dollar in circulation changes hands less often, making them less effective. A dollar spent twice finances 2 dollars of trade per year, if it goes around just once, it pays for only 1 dollar of trade. Have a look at the data on velocity below and try to grasp what this means for the economy:

As you can see velocity almost halved (!), meaning a slump of almost 50% in the ‘real money supply’, which is defined as money supply times velocity.

Don’t tell me prices are not rising!

Prices are not rising.

If you look at housing and financial assets, they’re all down big time since their peak in 2008.

However, prices for energy and food are rising, there is no doubt about that. This is not caused by inflation (a growing money supply) but by speculation by that special breed of Satan’s critters we call ‘speculators’. Billionaires, Hedge Funds and investment banks, driving up prices for commodities, especially oil and food. This is a double whammy for the economy: strapped for cash and credit, and rising prices in the primary sector (agriculture and mining) that eventually force their way throughout the economy. Oil prices are further pressured up by the Zionists in the Gulf of Hormuz, which just shows how elegantly the broader Money Power strategy comes together in its various projects.

This combination of depression through deflation (a crashing money supply) and rising prices through speculation in the primary sector is called ‘stagflation’ and we discussed it here some time back.

But aren’t the Fed supposed to be some soulless ghouls?

Of course they are.

But in the scenario under discussion, the Fed is just doing what one expects from a normally operating national bank.

The real depravity of the Federal Reserve Bank and the Cartel at large is shown in the astounding 16 trillion in easy credit it handed to hundreds of major international banks at close to zero rates in the aftermath of Lehman’s demise. Citigroup alone got a mind numbing 2,5 trillion in credit lines, only a small fraction of which apparently has been repaid since.

This is where the crime is and also where real inflationary pressures might come from, although much has gone to simply prop up busted balances, and thus not adding to the money supply.

Conclusion

The Money Power wants a massive, global depression. In Europe it’s organizing it through the Euro ‘Crisis’, ‘forcing’ the Governments into self defeating austerity, aggravating an already catastrophic deflationary nightmare. The United States is in a much better position, because the Federal Reserve is just buying up all the US debt for basically nothing. This, the ECB cannot do. Until recently, anyway, because it means Germany and the other northern nations are underwriting southern debt.

The ‘Fiscal Cliff’ hoax is exactly the kind of excuse they need to ‘look responsible’ while furthering the wider agenda. It’s completely bi-partisan. Whether you have a black democrat coke snorting, mass murdering sodomite banker stooge in the White House, or a white republican one does not matter.

Both are Goldman Sachs property.

At least Dubya was eligible…..

It does not matter whether they let the ‘cliff’ transpire, or whether they ‘compromise’ with drastic cuts for the coming year: the effect will be crashing demand in the economy, furthering depression.

They’re only bickering about the details. Whose voters will pick up the tab? The Democrats in California, or the Republicans in the South?

Eventually America will be busted in the Middle East and they will lose their petro-dollar based hegemony. This is when a new monetary system will be introduced. The only questions are how big the bang will be with which the US will go down and if the new system will be World Currency or the final preliminary one.

The ‘Fiscal Cliff’ is just one of those many non-issues facilitating the way forward.

Related:

We are in Stagflation

Inflation? Deflation? Stagflation?

the Problem is not Debt, it’s Interest

Phoenix Rising, the Return of the Gold Standard

The notion that Central Banking is the heart of the issue is the main idea behind the “End the Fed movement”. But although we at Real Currencies certainly sympathize with the idea of closing the Fed, we are also quite certain this in itself will not solve our problems. Memehunter takes a close look at who controls the money supply and shows Central Banks only to be a part of the control grid and that the banks themselves do most of the money creation.

By Memehunter for Real Currencies and the Daily Knell

Austrian economists have, since Ludwig von Mises, tended to blame central banking for almost all our economic and societal woes. According to the Daily Bell, a noted Austro-libertarian “alternative” media outlet:

“The boom-bust cyclicality of modern economies can be laid directly at the feet of central banking, with its monetary stimulation, which first expands an economy and then contracts it when the expansion has gone too far. Thus, central banking is responsible for the manifold disasters that have overtaken the Western world in the past century at least.

Wars, industrial collapse, recessions and depressions can all be laid at the feet of central banking and the great families that insist on its ongoing implementation.”

In fact, the “End the Fed” mantra has become so prevalent among Libertarians that they do not even bother to verify the Austrian claim that central banks are truly in control of the money supply. To be fair, the Keynesian school, the mainstream-approved dialectical “opposite” of the Austrian school, also promotes this idea, so much that this meme has permeated both mainstream and “alternative” thinking.

However, authentic truthseekers have a duty to inform themselves and seek confirming evidence before accepting the “central banking dogma” at face value, especially because it is a cornerstone of both the Keynesian and Austrian schools, two elite creations.

I should make it clear at the outset that my goal, with this article, is not to defend the institution of central banking. Rather, my aim is to confront the central banking dogma with facts and empirical evidence, in an effort to establish the truth about the control of our money supply.

Endogenous versus exogenous theories of money creation

According to the mainstream neo-Keynesian economic theory, money creation is an “exogenous” phenomenon (in the sense that it is exogenous to the economy), and the broad money supply is a function of the quantity of “government money” (the “monetary base”) and the money multiplier (the inverse of the reserve ratio) which constrains the amount of credit created by commercial banks. Interestingly, Austrian economists are for the most part in agreement with this statement. While some Austrians denounce the credit expansion generated via fractional-reserve banking, they generally consider “central bank printing” to be the main source of inflation.

On the other hand, several non-mainstream economic schools have suggested an alternative, “endogenous” model of creation, beginning with Knut Wicksell and “renegade” Austrian Joseph Schumpeter. According to this model, loans create deposits and private banks are not reserve-constrained in practice. The endogenous model, which predicts that central banks have little or no control over the broad money supply, is considered to be a “heterodox” economic theory associated with the post-Keynesian school. Offshoots and associated schools include Chartalism (or Modern Monetary Theory), Circuit theory, and Horizontalism.

A few prominent bankers, no doubt based on their practical experience, publicly rejected the exogenous theory. Already in 1969, Alan Holmes, vice-president of the Federal Reserve Bank of New York, ridiculed the exogenous model, noting that it “suffers from a naive assumption that the banking system only expands loans after the system (or market factors) have put reserves in the banking system.” According to Holmes, “in the real world, banks extend credit, creating deposits in the process, and look for the reserves later… the reserves required to be maintained by the banking system are predetermined by the level of deposits existing two weeks earlier.”

Post-Keynesian economist Basil Moore, associated with Horizontalism, was perhaps the first researcher to provide extensive data suggesting that bank lending was not reserve-constrained, leading him to propose instead that loans “cause” deposits which then lead to increased reserves. However, the most convincing debunking of the exogenous theory was unexpectedly provided by neoclassical economists Kydland and Prescott, co-winners of the 2004 Nobel Memorial Prize in Economics. In an article titled “Business Cycles: Real Facts and a Monetary Myth”, published in 1990, they found “no evidence that either the monetary base or M1 leads the cycle, although some economists still believe this monetary myth”. In fact, they observed that “the monetary base lags the cycle slightly” and that the “difference of M2-M1” leads the cycle by “about three quarters”, prompting them to conclude that:

“The fact that the transaction component of real cash balances (M1) moves contemporaneously with the cycle while the much larger nontransaction component (M2) leads the cycle suggests that credit arrangements could play a significant role in future business cycle theory. Introducing money and credit into growth theory in a way that accounts for the cyclical behavior of monetary as well as real aggregates is an important open problem in economics.“

More recently, Carpenter and Demiralp (2010) have shown that “changes in reserves are unrelated to changes in lending, and open market operations do not have a direct impact on lending”, concluding that “the textbook treatment of money in the transmission mechanism can be rejected”.

The tail that wags the dog?

According to the available data, it seems that the endogenous model is a clear winner: the evidence strongly suggests that loans are created first by private banks, and that the central bank then adds reserves to match loan creation. The statistics also show that, contrary to the textbook model, it is private banks, rather than central banks, that create most of the additional purchasing power “out of thin air”. Finally, this newly-created purchasing power is achieved by nothing more than double-entry bookkeeping: credit expansion does not require prior savings. Schumpeter offers a clear summary: “It is always a question, not of transforming purchasing power which already exists in someone’s possession, but of the creation of new purchasing power out of nothing”.

As noted by Moore, central banks have to accommodate the need for reserves if they want to avoid a credit crunch: “once deposits have been created by an act of lending, the central bank must somehow ensure that the required reserves are available at the settlement date. Otherwise the banks, no matter how hard they scramble for funds, could not in the aggregate meet their reserve requirements”. This means that the money multiplier is a poor control mechanism: increasing the amount of reserves will merely decrease the money multiplier ratios (for instance, the M2 to base money ratio).

In fact, this is what has happened since the Federal Reserve embarked on a reckless program of quantitative easing in 2008: the ratio of the broad money supply to the monetary base has decreased tremendously, meaning that in spite of all the “central bank money printing” so virulently denounced by Austrians, the effect on the broad money supply has been surprisingly limited. To put it simply: no matter how much they print, central banks cannot force commercial banks to lend.

Central banks still retain a modicum of control over the money supply through interest rates, but the impact of the official interest rate is mostly limited to the quantity of reserves held by private banks and, indirectly, the relative profitability of privately-created loans. Furthermore, this is mostly a one-sided tool: while high official interest rates may effectively induce private banks to increase their reserves and reduce the quantity of private credit, the recent crisis has shown that even zero or near-zero interest rates have little impact on commercial bank lending.

In conclusion, commercial banks, rather than being simply the “distribution arm” of central banks, are truly the “tail that wags the dog”. The broad money supply, 97% of which corresponds to credit created by commercial banks, is in fact modulated according to the market’s demand for credit rather than by government or central bank intervention. This turns the “money multiplier” mechanism on its head and renders the entire concept of “reserves” irrelevant. Although Austrians may wish to blame “paper money” for this situation, claiming that this would not happen if we used a commodity-based currency, credit created by commercial banks had already replaced notes as the most important form of money in the 19th century, while the United States were still under the gold standard, according to Congressman Wright Patman’s Primer on Money.

The role of the central banking dogma in the Austrian-Keynesian dialectic

The obvious question to ask, after considering the evidence in favor of the endogenous model, is why both Austrians and mainstream Keynesian economists are still defending the exogenous theory, although it is unsupported by the data. My view is that Keynesianism and Austrianism are two poles of an elite dialectic, focusing mostly on four dualities:

| Keynesianism | Austrianism | |

| Government | Big | Small or none |

| Currency | “Soft” | “Hard” |

| Control of the money supply | Central banks | The “free market” (ideally) |

| Causes of recession | Excessive saving | Government intervention |

This is evidently an oversimplification. Nevertheless, I think that it captures the essential dichotomies between these two theories. However, while these dichotomies are important and meaningful, they do not reveal what is obfuscated by both schools. In that context, it is remarkable that both schools want us to believe that central banks play an important role (good or bad), a claim that is debunked by the available evidence. It is likely that the goal of these apparently competing elite memes is to conceal the role of private banks and the importance of commercial loans behind the false “central banks versus free market” dichotomy.

Moreover, although both schools make a sharp distinction between central banks and private banking, the data tends to support the idea that the banking system is one (which as we know is controlled mostly by the same people), with central banks acting simply as a backstop to stabilize the system and justify the legal monopoly on currency. Viewed in that light, proposed reforms to the banking system, such as the BIS raising “capital reserve requirements”, can be seen as mere posturing: a pathetic effort to maintain the illusion that reserves and the “money multiplier” effect actually matter.

Finally, let us not forget that each school ascribes the cause of economic recessions to a phenomenon which is actually endorsed by its “opponent” (Austrians support “excessive saving” while Keynesians favor government intervention), but both ignore what is likely the main reason for our economic problems: usury.

Thanks to Anthony Migchels

Related:

One of the key issues that is still under debate in the Mutual Credit community is the management of the money supply. Are rising prices a threat with Mutual Credit?

In the discussion on the JAK Bank an interesting point was made by John Turmel and Larry:

“John Turmel: Yes, how stupid to limit your chips in your game to old chips saved when you could have brand-new interest-free zero-reserve poker chips. How stupid to run a piggy bank dependent on finding scarce funds for the loans when you could run a casino-style bank dependent on only the collateral for the loans. How stupid an interest-free model is a piggy bank model compared to a casino bank model? Really stupid those JAK people.”

What Turmel is saying is that in a Mutual Credit environment all the credit required could be generated without having a need for savers. Larry reacts to this with the key reason why this is a popular notion with the MC community:

“I agree, there is no need to limit the creation of new money as long as the creator (borrower) backs the new money with collateral and adequate credit-ability.

In this scenario, we are simply “changing the state” of wealth like fluids change from a solid state (ice) to a liquid state (money). A person’s equity (assets) can be converted to chips (money) just like in a casino.”

So this is the basic idea: because MC will be backed by assets, there is never a problem with value of money.

The question is: is this really true?

Consider this.

In an MC environment we would have interest free mortgages. When buying a house the situation could be that the borrower has absolutely zero assets.

This is actually the case today also. It is the house to be acquired that will function as the asset backing the newly created money.

Yet it is true without a shadow of a doubt that we have real estate and other asset bubbles. How come? Because if both the banks and the people believe that prices will continue to rise, they will fuel these price rises by going ever deeper into debt when buying a house, creating an (price) inflationary spiral.

This would happen in a MC environment also. Prices would start to rise because people would have vastly increasing purchasing power (no interest!) and they would fuel these price rises because they can afford it: they can simply say: this house is going to cost this or that and use that as collateral for ever bigger loans.

Asset bubbles are a real risk under these conditions.

The point is that value is not static. It is not absolute, but a function of the volume of money. Stable prices can be expected with a stable money supply, but if the money supply would be allowed to grow indefinitely value would erode.

So how should the volume be managed?

It should be both stable and flexible. Credit based units provide that: loans being payed off deflate and new credit inflates, providing flexibility that, well managed, more or less evens out.

This means there is a limit to the amount of credit that can be offered by MC facilities. They can lend out no more than the required money supply.

This also creates the question: who gets the credit. Credit-ability can hardly be the only criterium: it would favor the affluent.

So it would have to be shared evenly. For instance: every American has the right to 100k interest free credit every so many years. Something like that.

Stable does not imply the money supply must remain the same for ever. It should grow as fast as the volume of transactions in the economy. Otherwise the net effect would be deflationary, with all the negatives that that entails.

In this way the money supply would provide stable prices while allowing full economic growth related to population growth and technological advances.

This scenario, however, means that there probably will be a greater demand for credit than can be provided with new money. This is the case in the current system also: every dollar in circulation has been borrowed not only when it was created, but a few times more after that. Of course, in the current system a large part of this process is fueled by usury and the fact that there is never enough money to finance both all necessary trades AND interest payments. Meaning every dollar has to be borrowed ever more often, combined with an ever growing money supply.

However, even in a non-usurious monetary system, there is probably more need for credit than there is for money.

It is for this reason that I believe that the JAK system is important: it can provide a non-usurious way of relending already existing ‘chips’.

Conclusion

Mutual Credit implies management of volume. It cannot be left to the market’s devices: it would lead to ever growing volume, with rising prices as a result.

Asset bubbles would be difficult to avoid.

A modern monetary system probably needs to be a hybrid: several tools are at our disposal, none of them are complete or comprehensive and thus we should discard none of them, but look for ways of combining them in the search for a Grand Unified Theory of Money.

The JAK Bank: Interest Free Full Reserve Banking!

Mutual Credit, the Astonishingly Simple Truth about Money Creation

Forget Schools of Thought: Study them All and then Create your Own

Why is Gold not rising?

As we have discussed time and again, the main driver for Gold’s rise in the last decade has not been fear of inflation (mainly because there isn’t any) but uneasiness with the prospects of the Dollar and the Empire and ‘speculation’ Gold would be money again. But if this is the correct analysis, why has Gold stopped rising for 18 months now?

While this question is impossible to answer, there are a number of issues worth discussing to get a better picture.

The reports pointing in the direction of a Gold Standard have been mounting massively over the last months. Here’s yet another from last September by Business Insider on a paper by Deutsche Bank, that made some waves in the Gold community. It contains some interesting points, most notably Deutsche Bank addresses the most important Mainstream argument against a Gold Standard: that the economy grows quicker than the World’s Gold supply. Meaning that there is a structural decline in the amount of Gold compared to total economic activity, which is deflation. Deutsche Bank says the problem is real, but smaller than thought: part of the economic growth of the last decades was due to unmerited credit expansion and that would not happen under a Gold Standard.

According to Deutsche, Gold supplies grow at 1.6% per annum, while the economy, corrected for artificial credit induced growth, grows at about 2,2%. Deutsche considers this manageable.

However: this is true of the US economy, the World economy at large grew much quicker over the last decades and since the move to Gold is clearly global, Deutsche seems to be doing what vampires usually do: spin reality into oblivion.

Another interesting point in the paper is that Deutsche Bank says the market is wrong to handle Gold as a normal commodity. Gold is already money, says Deutsche, because it is held by Central Banks as part of their reserves.

Obviously, Interest-Free Economics has another definition of money: that which is agreed upon to be a means of exchange.

Gold is not money. Until we agree it is, of course.

But it is quite typical, the way wealth and store of wealth is automatically mistaken for money.

Gold is wealth. Like every other commodity. It represents value, because people want it. The amazing thing about Gold is, it is good at only two things: looking pretty and being expensive. This fact is even used as a rationale why it should be money. But in this regard it is quite similar to diamonds. And we don’t consider diamonds money, do we?

Very few people consider Gold money. But clearly we are being ‘educated’.

Gold is being sold as a solution to debt. The narrative goes: we’re all crack whores wanting ever more easy credit. But alas, reality is reality and that’s why it’s good to have Gold, because it cannot be printed and thus there can be no more debt than money.

Forget all that. The problem is not debt, it’s interest. Should we stop paying interest on the debts and use that ‘debt-service’ to pay off the principal instead there would be no debt left in 20 years.

But let’s not get into that now. Because the whole idea of ‘steady volume’ (of money) when on a Gold Standard is so…

Volume

There are a few issues to keep in mind, when considering the volume of Gold and thus the volume of the money supply when under a Gold Standard.

In the first place, the official numbers about volume. You hear these numbers: 150 thousand Tonnes. Wiki mentions 171 thousand.

Forget about that too.

Nobody knows how much Gold there is, but I’ll tell you this: there is much, much more than that. In fact: this is one other way Gold resembles diamonds. It is well known that De Beers and the Russians share only a small fraction of what they’ve got. For obvious reasons.

Remember Peak Oil? They do everything they can to create ‘artificial scarcity’. That’s what monopoly does.

As a reminder, here’s how the Protocols put it:

22. YOU ARE AWARE THAT THE GOLD STANDARD HAS BEEN THE RUIN OF THE STATES WHICH ADOPTED IT, FOR IT HAS NOT BEEN ABLE TO SATISFY THE DEMANDS FOR MONEY, THE MORE SO THAT WE HAVE REMOVED GOLD FROM CIRCULATION AS FAR AS POSSIBLE.

Mining

Recently National Geographic reported on 150 Trillion in Gold in deposits in the sea. Imagine the inflation that 150 trillion worth of Gold would bring!

These will not be mined, or reach the market. Not in time to stop the long term deflation that we face with resurgence of Gold as currency, anyway.

The role of mining is not very important. Sure, some Gold enters the market. But the world’s acknowledged Gold supplies grow only a little each year and the price is based on the inventory that we have.

Perhaps this is one reason why Gold mining shares have not been doing quite as well as many expected. Losses of 30% have been reported. Many have been burnt while buying Gold mining stocks, automatically assuming high Gold prices would be good for them. But other dynamics in Gold mining might be much more important than its impact on Gold prices, or vice versa. Nonetheless: the Rothschilds are getting back in mining again, so perhaps a new dawn arises for Gold mining after all. Or is it yet another of their diversions, suckering even more investors? That’s the problem with market gazing: they will fool you all of the time.

Paper ‘Gold’

The other thing about volume is, that because of paper Gold, which is the standard at the current Gold market, there is much more ‘Gold’ in circulation than these 171,000 Tonnes wiki mentions. So we have a double bind: real Gold is artificially scarce, but paper Gold is artificially plentiful.

How much more paper than Gold is there outstanding?

I don’t know, but it’ll be much more.

As we know, paper Gold is manipulated to the core. One of the early Internet heroes was Bill Murphy, still going strong today with www.gata.org, exposing how the big banks rule the paper metal market and keep bullion down. To prevent exposure of their fiat empire through Gold appreciation. Or so the story goes. Conveniently.

For the time being, everybody is still holding their breath and playing along in the paper Gold scheme. Meaning paper Gold is still priced the same as physical Gold. But at some point the landlord always comes and the rent is due. So it is with all that paper. People at some point are going to want to know who’s who. And this is a moment of truth that the Gold community has been waiting for for quite some time now.

Notwithstanding its suppression, Gold rose, from $250, to $1800. And now it has been stuck at that level for about 18 months. What drove its rise to begin with? Mainly speculation it would be money again.

We’ve seen how the money supply is tanking and that we are in deflation. Many say prices are rising, especially for the basics, but we’ve pointed at Money Power managed speculation in the primary sector (commodities, mining, agriculture), forcing prices up, which is not the same thing as an increasing money supply, which is inflation. We have stagflation, not inflation. Clear proof of that are not only the money supply statistics, but also tanking housing- and paper assets. The Dow should be at 5,000, this 14,000 nonsense is entirely a Fed fabrication. The Fed has only been fighting deflation in the financial economy, not in the real one. Just look at the pressure on wages and the massive unemployment because wages are not going down quickly enough to match supply and demand. Should the rising prices for basics that we see be a result of monetary inflation, wages would be rising too.

So it’s not inflation that is driving Gold and deflation normally speaking leads to automatic Gold suppression too. No, the growing monetary role of Gold is what is driving it. It seems Gold needs to be at $40,000 per ounce to mop up all fiat currency. That is the promised land of Austrian Economics and Gold buggery.

But the Powers that Be managed to suppress Gold for so long, was it just ‘investors’ making it go up? I guess not. The involvement of ‘small investors’ is just a whitewash. The rise of Gold has been a carefully orchestrated affair. And its current stagnation is undoubtedly also a part of that. Perhaps it was going too fast. Or there are tactical reason. There are all sorts of dynamics behind the scene that we simply cannot know of.

But all the believers have their eyes on the ball and it’s coming. No doubt.

The paper Gold empire is built on the dollar. It’s built on the credibility of the US Empire and it is a cornerstone of the US Empire. The fall of Comex, the paper Gold bourse ‘par excellence’, will coincide with the rest.

‘Fiat’ has nothing to do with it

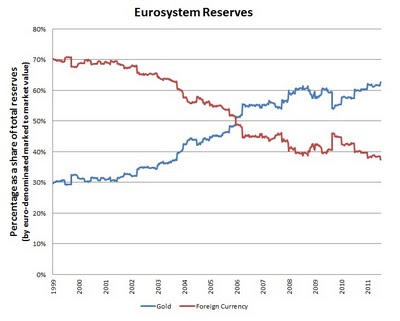

Blue represents Euro Gold reserves, red paper assets. As you can see,they more or less balance each other. Everything the reserves lose to paper ‘inflation’, is compensated by the rise in their Gold assets.

Blue represents Euro Gold reserves, red paper assets. As you can see,they more or less balance each other. Everything the reserves lose to paper ‘inflation’, is compensated by the rise in their Gold assets.

It has little to do with ‘fiat’ money as such. The Euro, for instance, will live. Here’s a cute stat courtesy of FOFOA.

Meaning Frankfurt is ready to back the Euro by Gold at any time. The Euro will not have many problems in the coming transition. This is no coincidence of course: the Euro cannot fail. If the Euro fails, there can be no World Currency. FOFOA rightly maintains Gold backing was always the plan for the Euro.

There is no such graph for the Dollar. There are two reasons for this. Officially, it is because all Gold the Fed holds is still priced at $45, because the Fed’s accountancy rules ‘force’ it to book it at the price it was bought. The Euro reserves are ‘marked to market’: they are booked at current market prices.

The real reason, as we know, is that there is no Gold at Fort Knox. It is not for nothing that Nixon ended convertibility. And what was left then, has been pledged a thousand times since.

This does remind of another glaringly obvious fact of life. Most of the known Gold reserves are held by Central Banks. Maybe not the Fed, but the others do hold much gold. This is reported every day by the ‘Alternative Media’. So why would these banks hate Gold?

This is just one of those many cognitive dissonances that we are continuously bombarded with. Of course the (Central) Banks don’t hate Gold. The reason they own it all (that we know of) is because they love it so much.

Conclusion

I’m not worried about the prospects of Gold. I don’t have any, but those that do needn’t lose sleep over their investments. Gold is becoming money and the whole rise of it has been painstakingly planned and executed over decades. The wealth transfer from the have nots to the haves will be legendary. It will further the deflation the Money Power wants. It is easily combined with supranational units like the Euro and what is being developed elsewhere. In fact, Gold IS World Currency. If everybody uses Gold to back their units, what difference does it make whether they call it a Yuan or a Yen?

If you are looking to ‘preserve wealth’ and strike it rich in the process, get as much Gold as you humanly can.

Related:

Why Gold is so strongly deflationary

Phoenix Rising, the Return of the Gold Standard

The US Empire is Not the Money Power!

Bloomberg, the dying Fed and the birth pangs of the new Gold Standard

Germany, the Money Power’s Golem in Europe