Exciting Times!

Two interviews, one with Mike of Rethinkingthedollar.com, and one with Marco Janssen of the Janssen Report.

The first interview focuses on the threats to the dollar, and the monetary system, how it really works. Mike is used to talking to people coming from a more Libertarian perspective, with an emphasis on Gold and ‘money printing’ (instead of Usury) as the core issue.

The second is with Marco, my colleague board member of the Florijn Foundation. Marco has come on board earlier this year. He has been researching the financial system and Usury for years now and has been reporting on the economy on his Youtube channel.

In this interview we discuss how the financial system is the underlying source of really most problems we are facing. From about 16 minutes onwards we discuss solutions and the Florijn/Talent.

Another status update

We’re moving on splendidly with our payment app. We’re also implementing ‘pay per SMS for the 30% or so folks who don’t have a smartphone (yet). Combined, this will guarantee a simple and seamless payment experience for all mobile phone users.

It’s going to be very soon now, that we can at last launch officially!

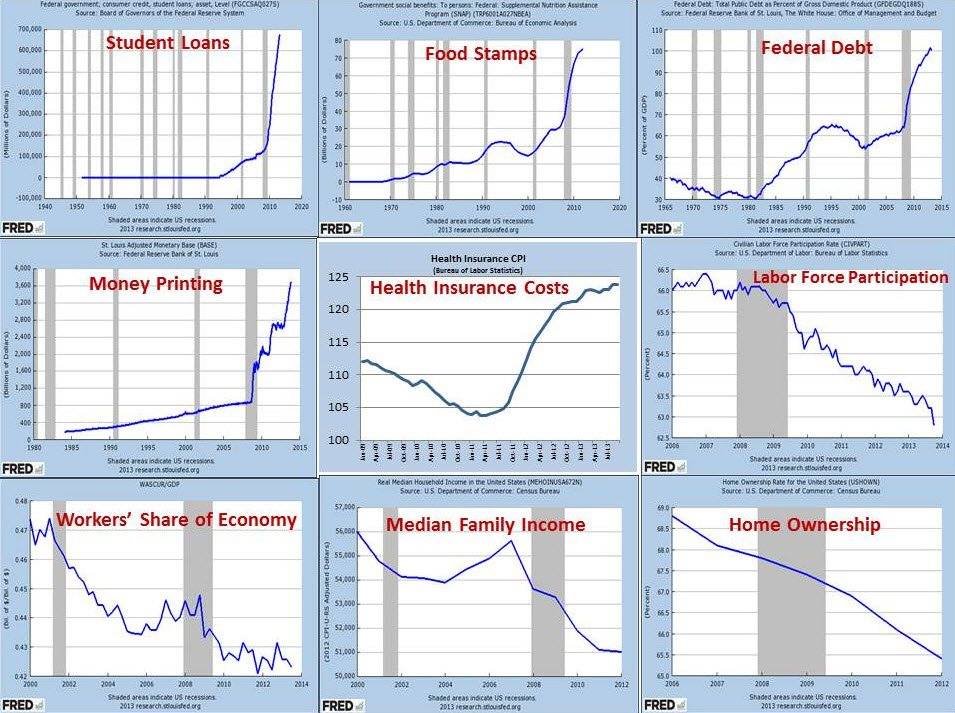

And a little reminder of why we need monetary innovation:

As we can see, any notions of ‘economic growth’ and ‘recovery’ are just complete baloney.

All these ‘journalists’ out there, all these ‘economists’, they should be profoundly ashamed of themselves for plugging all these lies.

There is no economic recovery. There is only wholesale money printing and deeper and deeper indebtedness of both sovereigns and private borrowers, including corporations.

Real incomes and asset positions of normal people are plummeting. All the ‘economic growth’ of last few years was just putting extra liquidity in the economy and making sure only the insiders would share in it. The incomes and asset positions of the 0,001% have been ballooning over the last 8 years.

The only way this is heading is further South.

We’re getting tired of waiting for the next round, it’s wearying with this sword of Damocles over our head, and with all the fear porn out there.

But the fact is, the West is doomed and we need solutions now more than ever.

Related:

More On The Talent

The only actually valid economic solution to overwhelming indebtedness is monetary Grace as in the free gift of money directly to the individual, and the wise and balancing answer to an economic system that inherently produces more costs and so prices than it simultaneously produces in individual incomes is a price deflationary discount to retail prices…which is subsequently rebated back to participating merchants so that they can be whole on their margins of profit and overhead payments. These policies are the component parts and definition of monetary and economic equilibrium.

Reblogged this on TheFlippinTruth.

I am so glad and grateful for your conscience and focused efforts.

Here is some very interesting Jesus information that may surprise you, and it could be very helpful as we all join forces against the target, the beast, the banking system.

YouTube “spiritoftruth123”

Regarding the works of Silvio Gessel.

Please listen carefully and grounded.

Peace brother

Thanks Russel, I’ll have a look!

Reblogged this on The Stoker's Blog.

Sir, I’m from Pakistan and I’m really interested in your work.It helps alot.You have shown us a new world that we were totally unaware of.Sir can you please tell me if you have written any book so that I can get all the knowledge of yours at one place? I listen to your interviews and write them down to explain it to others.It sometimes get difficult and very less comprehensive.I really want to learn more. ________________________________

Thank you Siraat. No, I have not written a book. Yet.

>>>>> There is no economic recovery. There is only wholesale money printing

wholesale printing of interest-free money, at that….. so why do these advocates of interest-free money complain ? (because they want to get in on the action)

and the solution of the ignorant groupie to this problem of money printing is: to conjure up some more figment units, exchange them for real value while the going is good

That is exactly what the bankers of the 19th century did, printed wothless conjured up banknotes, exchanged them for real value, at whatever rate, and enriched themselves

As we know, and it has been stated by Migchels on this forum, for his own personal storage of wealth Migchels recommends silver……. Not drunken sailor money (Silvio Gessel Margrit Kennedy), not conjured up electronic units, not paper, but hard tangible grains of precious metal…..

%$#@!+=*&==========

“God Almighty, for some reason of His own, has separated the races of the earth by a deep and impassable gulf, and it does not lie within the power of a few misguided alleged humanitarians to bridge this gulf. Just so surely as I believe in the existence of God, just so surely do I believe that He has decreed that the Caucasian is the highest type of being in all the realm of creation. These United States have been established by the Caucasian race, and in the providence of God this is, and must forever remain, a white man’s country.”

” The student of world politics who does not realize the impending and irrepressible conflict between the races of the earth has expended his brain force to little purpose.”

“Amalgamation [of negroes] with our people, Mr. Chairman, is absolutely unthinkable to a real white man –one who has red corpuscles in his veins. The white man who for one moment would allow himself to consider this as a solution of the negro problem in the United States is a degenerate who has fallen far below the mental and social standard of the vilest cannibalistic specimen of the African fresh from the jungle.”

~~~Representative Frank Clark of Florida, in the House, on September 11, 1913, (the same day Lindbergh spoke for close to an hour) during the debates of the federal reserve bill (for which he voted)

Ohohohohoh………..

Must I really rebut all this, after all that I have written on this blog!?!

– Interest-free money is NOT meant as a store of value, but as a means of exchange, two wholly different, and opposite functions, that CANNOT be combined in one unit.

Either you will have a good store of value, OR a good means of exchange, not both.

Low interest credit has been printed by the Trillions, and the (Central) banks have been very careful to make sure by far most ends up with their buddies in the shadow banking system, and NOT On Mainstreet, where it’s actually needed.

And while I share your concerns about white folk, I’m not going to into the supposed superiority of a race that goes down in a blaze of porn and illicit sex, while refusing to make babies of their own, or face up to their shackles.

“Either you will have a good store of value, OR a good means of exchange, not both.”

Incorrect. My bank account is securely encrypted on my computer and securely backed up, gets about 150% interest per year on average and allows me to send money to anyone anytime anywhere without asking anyone’s permission. It’s an amazing store of value and an amazing means of exchange. It’s called bitcoin.

Secondly, your comments in the interview about the bankers destroying the dollar are ignorant of the SDR substitution accounts. Dollars will not return to the US casing hyperinflation because substitutions accounts will allow large holders of US dollars to substitute those dollars for SDR which will be recycled into Treasury or SDR bonds. This is what the bankers are planning. The article below explains substitution accounts or read philosophyofmetrics for more in-depth info.

https://next.ft.com/content/75cb5f2e-a729-11dc-a25a-0000779fd2ac

Well, with such (unearned) speculative rise in value you probably consider the Bitcoin a ‘good’ store of value.

But how about it as a means of exchange?! How much trade does it actually facilitate?!

“According to Tim Swanson, head of business development at a Hong Kong-based cryptocurrency technology company, in 2014, daily retail purchases made with bitcoin were worth about $2.3 million.[251] He estimates that, as of February 2015, fewer than 5,000 bitcoins per day (worth roughly $1.2 million at the time) were being used for retail transactions,[30] and concluded that in 2014 “it appears there has been very little if any increase in retail purchases using bitcoin.”

Compare this to the multi billion value of Bitcoin outstanding.

Thus the point stands: you cannot combine a good store of value with a good means of exchange.

Anthony! Fantastic work.

Please could you weigh in on the Brexit debate? In or out the bankers win, but I am sick and tired of the pyschotic left raving about the virtues of the EU.

Anthony please blog on steemit.com, we need you there man.

Anthony please say a few words on brexit, or is it irrelevant? Thank you

This monetary system and U.S paper money is fraudulent. Bogus money!

Anthony, forgive me if you’ve already written about this somewhere, but I wonder whether you differentiate between interest charged on newly created money vs interest charged on loans of surplus (saved) money?

I ask for two reasons.

First, I’m aware that interest free banking initiatives such as JAK Bank struggle for capital. Commercial banks largely source their capital, which is newly created money, from central banks – but this is a loan with interest, meaning that if a commercial bank wanted to offer clients a zero interest loan, it would have to charge borrowers in a different way to make enough to repay the interest bearing central bank loan (herein lies an issue for some Islamic-friendly loans which are-technically – interest free).

If centrals were prohibited from charging interest on newly created money, then banks like JAK could obtain interest free funding without having to resort to full reserve banking as at present.

Secondly, I think some of the opposition to interest free money comes from people who focus on the (pitifully small) interest that they’re earning on their bank savings. If they have saved some money and choose to loan it at interest, I think this is morally a different story to banks creating trillions of new money ex nihilo and charging interest on that.

Interested in your thoughts..