Is there enough money to pay off debt plus interest? A closer look

The elegant P<P+I equation points in the right direction but it is incomplete and needs further analysis. Not only does it ignore the velocity of circulation, but also the question whether the interest is spent back into circulation. The issue is important, both in terms of truth-seeking and Austrians and the Mainstream subverting the argument.

Can all debt be repaid in a usurious credit system? The P<P+I (P=Principal, I=Interest) equation suggests it cannot. For the longest time we have been maintaining that the principal is created, but not the interest and thus eternal indebtedness is part of the system. A closer look shows the problem is more complicated and the original proposition not per se correct.

Interest-Free Economics has always assumed that P=Money Supply (MS) if the money supply is debt-based. This ignores the crucial factor of velocity, the number of times the money supply changes hands in a given time span. The effective money supply (r(eal)MS) is Principal x Velocity: rMS = P x V.

Another vital issue is the question whether the interest is spent back into circulation. If it is not, it is bound to cause problems.

Here’s an analysis of the implications of these two overlooked factors:

A: slow circulation.

Let’s say P=100 and I=10 and velocity is 1. We are in an economy of two players. Let’s say the loan is for a year and that it has to be repaid at the end of the year. My partner gives me the loan so we don’t need a third party.

We pay the other participant 100 at the beginning of the year. Velocity is 1 and P=MS, so he’ll buy something worth 100 from us at the end of it. It’s easy to see that at the end of the year we will have 100 income to pay off the principal, but we will have to borrow an extra 10 to pay off P + I.

So in this example the original proposition is correct.

B: Good circulation, interest not spent into circulation.

Now let’s see what happens if velocity is 20. I go into debt, pay my supplier and he buys with me. I save 1 because I know I need to pay interest at the end of the year, so I buy 99 worth with him. He buys 99 with me and I save another 1 for the interest payment. In the final transaction, I have saved 9, my partner buys 91 with me and I collect the remaining 1 for the interest payment. I have the interest, but only 90 for the principal.

It matters not, whether I save to settle the interest payment at the end of the year, or whether I pay the interest immediately, while the lender does not spend it. If the interest is not immediately circulated, no matter the speed of circulation of the remaining money supply, there will be a shortage of money. I will not have enough to pay off P + I.

Again: P < P + I still stands.

C: Good circulation, interest spent into circulation.

Now let’s say I pay the interest immediately and my partner spends the received interest back into circulation. Velocity is again 20.

So I buy 99 worth + I pay 1 interest. He buys back 100 worth of goods. I again buy 99 worth + 1 interest. Etc.

In this example, after 20 (10 buys and sells each) transactions, I will have paid off the interest during the year and at the end of the period, I will have 100 to pay off the principal.

The conclusion is, that if velocity is high enough and the interest is immediately spent into circulation, the P + I > P equation does not mean that debt plus interest cannot be settled with only P as the money supply.

However, these are two big ifs. In fact: they both don’t fly.

Getting to the bottom of the issue

In the first place, velocity. As it happens, Usury is a key factor in destroying velocity of money. It greatly encourages hoarding, especially in the current banking system. Postponing paying your bills nets you income through interest. So Here’s a graph, courtesy of wiki, the green line shows velocity, the left axis shows the relevant scale:

As we can see, velocity is very low in the economy, money changes hands a little more than once every two years. It went down even further during the last few years, because of the depression. Considering the the example above, it is clear that velocity is far from sufficient to allow interest payments on the money supply, meaning we have serious deflationary pressures because of interest payments.

Then the other issue: is the interest spent back into circulation? The answer is: far from all the interest payments are spent back into circulation. Sure, the banks pay their people massively bloated bribes (‘bonuses’) for their handiwork and to control their conscience, and they build major citadels (‘office buildings) everywhere, but banking is an incredibly profitable business and this profit is not spent back into circulation.

In the first place, banks use profit as capital reserve requirements for more lending. Basically this means the money is lent back into circulation, not spent. Because it is lent back into circulation, even more money is needed for interest payments, aggravating an already grim situation.

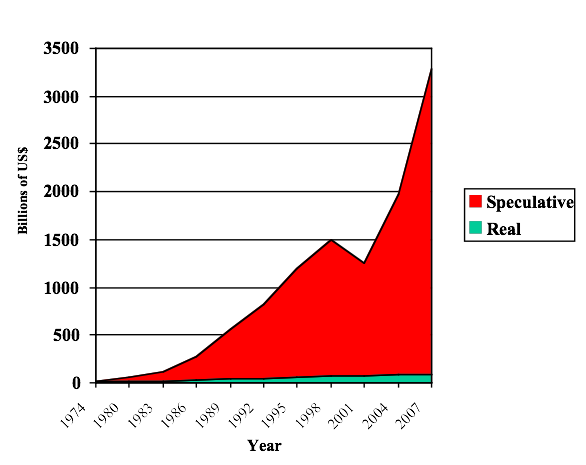

Secondly, there is the two loop economy. I discussed it in an article on stagflation. There are two economies. The real one, where we operate, actually producing all sorts of stuff. Then there is the financial economy. A large part of it is accessible only to insiders and the financial industry. Normal people can access it only via the Stock Exchange, where their assets are disowned through insider trading. Turnover in the financial economy dwarfs that of the real one. Most of the money out there is in the financial economy. This, I venture to suggest, is another reason why velocity is so slow: in the real economy money circulates much quicker, but most money is in the financial economy which is not counted in the GDP figures. Meaning only a small percentage of our money supply is used to finance the real economy. Here’s a graph of the financial economy:

Make no mistake: the two loop economy is real. Recently insider Mark Faber actually mentioned it, it’s the first time I ever saw it mentioned in the media.

The financial economy is where the big bucks are being made by the vampire class. Their derivatives, forex, insider trading. It’s where all their gains from the stock market and other fleecing of the non-sophisticated investors is going. Unfortunately for them they cannot really use this money in the real economy, because it would cause an immediate hyperinflation, but it does give them full control over the real economy and it is an important part of their domination. It also explains why QE1, 2, 3, x have not led to rising prices: There was a massive deflation in the financial economy as a result of the busted Mortgage Backed Securities hoax and Bernanke slyly fixed only that, while not adding any money to the real economy, which needs to be strangled with austerity, sequestration, the fiscal cliff and whatever tool they have to aggravate the depression.

The point is: much of the interest is siphoned off to the financial economy. Meaning it is not circulated back into the real one. Meaning usury does deflate the money supply and interest + debt can never be settled.

Conclusion

It’s an important issue. The Mainstream and the Austrians have been getting to terms with the original P + I > P equation. The argument in its original form is no longer operable. More importantly: we owe it to ourselves and the people we talk with to get to the heart of the matter and take both truth and their arguments seriously, if they have merit.

In an ideal scenario, when velocity is sufficient and the interest is spent back into circulation, principal plus interest can be repaid.

But for other reasons, the basic problem still is the same: velocity is very low in practice, making it impossible to pay for both and the leaking of money to the financial economy, the ‘upper loop’ is probably even worse.

I hope this article can lead to further discussion, perhaps the experts can shoot a hole in it, making it irrelevant or better. I’m not a mathematician, and I’m pretty sure people like Gauvin, Turmel or Montagne would put it more elegantly, but I hope to have made the point clear.

Please comment if you have anything to add and share this article with those you know are into this line of thinking.

Related:

We are in Stagflation

Debt Free Money alone does not solve Compound Interest

Why the Economy MUST Grow

Dick Eastman is the main thinker on the two loop economy, a phrase he coined. Unfortunately he does not operate a website, so he cannot be found on the web and there are no archives of his previous work to be searched. But Dick is one of the most outstanding economists out there, and he sends out emails on a daily basis, you can contact him at oldickeastman(at)q.com if you want to get to know his work.

Very well articulated on THE MOST important topic on the planet. Agreed, under optimal conditions interest can be paid. However, we must admit that psychopaths control this system. The “den of thieves” engineer loan defaults and usury is an asset confiscation scheme. Through this fraudulent mechanism they have confiscated and gained title to all the land on the planet. Interest isn’t about profit, it’s about control. Interest is the silent destroyer where few notice that they are being warred upon.

Additionally, expanding the definition of “usury” is useful. Usury is not simply ANY interest. It is the privatization of humanity’s sovereign barter system. Through cartels of control like: Federal Reserve Notes, gold, silver or Bitcoins the elite hijack our energy exchange system. The “use” our energy to USURP our sovereignty. This would occur under a “perfect” Greenback system as well even without interest at the time of issuance. An elite few would “use” our energy and not necessarily produce something of value to humanity. Perhaps, the Greenback technology would be used for genocide like Lincoln and Hitler did.

The optimal solution appears to be decentralized usuryFree barter scrip and mutual credit.

Having a number of different complementary interassociated local currencies would be ideal, but getting there on a nationwide scale seems impossible, like herding cats. The notion is just too far beyond most people’s intellectual horizon. It’s the only reason i prefer to nationalize the Fed and assign control of regulating the volume of the money supply to the individual states. It’s an shorter route politically to convert the end-the-fed ppl than to ask them scrape the whole system and to join what must seem like a Robert Owens style monetary movement. (btw, who did Lincoln commit genocide against — landed plantation gentry?)

Are you still doing a radio show somewhere? I didn’t see your progrram listed on Republic broadcasting last time i checked. If not maybe you can team up with Anthony. I think he’s ready for prime time based on his last interview with tony stark.

Why can’t you name these “psychopaths”? They’re Jews. Jews have been the orchestrators of all our ills.

Till we start naming the culprits nothing will change. Well that’s not true. Things will only get worse, and eventually we will all be dead along with any descendants.

Are Rockefeller, Morgan and Prescott Bush Jews? The European and later American ruling elite always had a cosy relationship with Jewish bankers and tax collectors. So it is more accurately a problem of ruling classes working together to suppress the majority of people. By hating JEWS or any other group not your own, you help the dividers and rulers as that is what they want. A divided humanity us much easier to control.

I don’t ‘hate’ Jews, I just don’t deny Jewish Supremacism and its pervasive influence. Masonic WASPs definitely are a huge part of the problem too.

When I hear “velocity of circulation” you are listening to an economist whose POV is with the Friedman school. And when you say: “Interest-Free Economics has always assumed that P=Money Supply (MS) if the money supply is debt-based. This ignores the crucial factor of velocity, the number of times the money supply changes hands in a given time span. The effective money supply (r(eal)MS) is Principal x Velocity: rMS = P x V.” you are rediscovering Keynesian economics.

“Another vital issue is the question whether the interest is spent back into circulation. If it is not, it is bound to cause problems.”

You are using Milton Friedman’s mathematics to rediscover “The Liquidity Trap” which is this very situation where investors don’t spend money from their income back in the communities they draw the money from.

Great Job!

I don’t claim any of the issues that I discuss Christopher. My job is to transcend all schools of thought and create my own by taking the best of all and forgetting about their many mistakes.

When you write about the case “Good circulation, interest not spent into circulation.”

“Now let’s see what happens if velocity is 20. I go into debt, pay my supplier and he busy with me. I save 1 because I know I need to pay interest at the end of the year, so I by 99 worth with him. He buys 99 with me and I save another 1 for the interest payment. In the final transaction, I have saved 9, my partner buys 91 with me and I collect the remaining 1 for the interest payment. I have the interest, but only 90 for the principal.

It matters not, whether I save to settle the interest payment at the end of the year, or whether I pay the interest immediately, while the lender does not spend it. If the interest is not immediately circulated, no matter the speed of circulation of the remaining money supply, there will be a shortage of money. I will not have enough to pay off P + I.

Again: P < P + I still stands."

And this is precisely the case that small communities face with large monopolies and conglomerates. The money generated by local commerce goes to pay for groceries at (say) Walmart — and that money goes to make the owners wealthy and to the gated communities and HQ communities where they and their fellow ultra-rich live.

But the shortage of money is not the only problem generated by that scenario. A shortage of money creates a vacuum that others notice. Monsanto and General Foods will come in and start buying up farmland, developers will close down the local stores and bulldoze them trying to figure out what to replace them with, and the ability of local people to keep their property will also go down because now they cannot pay off the loans they took out. Often those loans were to finance opening (for example) Walmart stores locally on the premise it would create jobs.

indeed.

“It’s an important issue. The Mainstream and the Austrians have been getting to terms with the original P + I > P equation.”

And Keynesians and their successors have been talking about this problem for more than 80 years now. Our man here has just used Friedman’s mathematics (which he refers to as “Mainstream”) to prove Keynes was right.

“The argument in its original form is no longer operable. More importantly: we owe it to ourselves and the people we talk with to get to the heart of the matter and take both truth and their arguments seriously, if they have merit.”

Welcome to the light. You’ve now rediscovered a dirty little secret that was excised from the textbooks in the 80’s, but never stopped being true.

“In an ideal scenario, when velocity is sufficient and the interest is spent back into circulation, principal plus interest can be repaid.”

It can also be repaid if the Government makes the offending kleptocrats repay enough of their takings through taxes. But otherwise it creates financial collapses as it is completely drains local economies. And since the wealthy self-segregate, even local taxation won’t do it, and at this point, efforts to rectify things at a country level lead to migrations of wealthy people to other countries.

“But for other reasons, the basic problem still is the same: velocity is very low in practice, making it impossible to pay for both and the leaking of money to the financial economy, the ‘upper loop’ is probably even worse.”

Yep, welcome to Keynesian economics.

“I hope this article can lead to further discussion, perhaps the experts can shoot a hole in it, making it irrelevant or better. I’m not a mathematician, and I’m pretty sure people like Gauvin, Turmel or Montagne would put it more elegantly, but I hope to have made the point clear.”

Or John Maynard Keynes.

I never heard JMK resist Usury Christopher, nor propose interest free units. He was a brilliant man, but also an important pawn of the Money Power.

Sure, you can “repay” interest, “even if the money supply is constant…” but a) *IF* we did [by bank spending back into the general circulation], is it right that a mere publisher of further representations of our promissory obligations merely launders so much wealth into their possession. b) DO we actually sell so much of our production as principal + interest, as allows us to actually “repay” falsified debts; and, c) is it even mathematically possible to do so, being as our production only equals the principal. Only Mathematically Perfected Economy solves all these issues. http://www.perfectedeconomy.org, Mike Montagne

ALL ORIGINAL MATERIAL, including resolution of the only justifiable purposes and states of money; intrinsic determinations of disparity and cause; original proof that any rate of interest which requires re-borrowing interest is inherently terminal; determinate rationale of solution; original demonstrations of categoric faults; resultant proof of singular solution; invalidations of all deviating theses; and original explanations of the present obfuscation of our promissory obligations to each other… are COPYRIGHT 1968 to present by mike montagne, founder of PEOPLE For Mathematically Perfected Economy™ and original 1968 architect of mathematically perfected economy™. ALL RIGHTS ARE RESERVED.

TRADEMARKS: PEOPLE For Mathematically Perfected Economy™; PFMPE™; PFMPE+ACR™; PEOPLE For Perfected Economy™; [COUNTRY/LOCALE] For Mathematically Perfected Economy™; [COUNTRY/LOCALE] For Perfected Economy™; Mathematically Perfected Economy™; MPE™; absolute consensual representation™; ACR™; mathematically perfected economy and absolute consensual representation™; MPE+ACR™; MPE+ACR Perpetuation Trust™, [its IBC] PFMPE+ACR In Perpetuation Society Anonyme™, Mathematically Perfected Currency™; MPC™; OBFUSCATION OF THE CURRENCY™; OBFUSCATION OF THE PROMISSORY OBLIGATION™; mathematic perfection of economy™; perfect economy™; perfected economy™; names, logos, and distinguishably original, intrinsic terms; the various slogans of these pages; and the unique meanings of terms and expressions as established by this work… are trademarks of mike montagne for the common purpose of establishing mathematically perfected economy™ without division or compromisation of vital principles by eleventh hour impostors.

Well, in all fairness, the Swiss were doing it already in the thirties Jake……

Oh, and by the way, the US Treasury was already doing it in the mid 1800’s……..

Doing what Anthony?

providing interest free double ledger bookkeeping based credit. Aka Mutual Credit, of which MPE is a subset.

In my opinion Mutual Credit has become a subset of MPE given MPE´s solution for inflation/deflation. Demurrage is also non existent in MPE (not necessarily existing in MC either). But the thinking is along the same lines for sure.

Hello! Money is credit in circulation. This is the secret of the Red Shields. Credit is belief of one person in another. The mechanism for regulating the circulation is the bank. Often called the second temple but is really the first temple was the origin of credit money circulating in a market. Your guy in the diaper with thorns on his head wrecked the place for good reason. You should not ateempt to regulate life by money arithmetic ie usury. Thanks Rduanewilling.

You have hit the core of this ‘delimma’

Why keep trying to pay off a debt that NEVER existed?

Just dump the creators of the debt lie and reset a national currency without any members of any international flavor.

A call to ACTION

EXCERPT:

This corporate US makes laws which apply ONLY to those areas and peoples over which the Constitution gives the federal government sovereignty (See US Constitution, Art 1, Sec. 8, and Art. IV, Sec. 3, and Downes Vs. Bidwell, 182 U.S. 244). The ignorant sovereign people (the free natural American Citizen of the constitutional united States of America), began to submit to and obey laws which were legally applicable only to “subjects” of the corporate federal US. We were also tricked into legally volunteering to all become “federal persons” by the promise of old age security… that’s right…Social Security…the ever tightening noose around the throat of We the People. This explains why Congress can pass laws about guns and other “protected” topics, and not have such laws declared unconstitutional. They are not legislating for the 50 states or the Citizen of one of those 50 states. If you submit to a law, however, you are judged to be under that law. If you become a “federal person” through application for a social security number, or other federal benefit program, you have traded your birthright for a bowl of pottage (see Esau in the Bible). WE THE SHEEPLE have been voluntarily sheered by our own ignorance! Notice that there is still gold and silver coin being minted today (constitutional money)…but its value is calculated in federal reserve notes, falsely called “dollars”.

WE MUST NOW reassert our sovereignty! It is time for “We the People” to declare the corporate US to be bankrupt, remove the Federal Reserve from the U.S.of A., and require Congress to turn on the presses and begin minting lawful coins (or Silver and Gold Certificates) which have no debt attached to their creation. Lawful money which is backed by gold, silver, and the productivity of Sovereign Americans. If you have understood how the debt is created, you know that it has been a fraud from the outset. It is no more a legal debt than Federal Reserve Notes are legal money. It is a “Corporate debt” of the federal corporation known as the “UNITED STATES”, which is NOT the constitutional entity established in 1791.

Theunjustmedia.com

You’re right to want to eliminate our submission to admiralty (eg., banker) law and all of its fictions, most notably our strawman, but I also hope that you do not also advocate an elimination of safety net/retirement programs and return to the commodity backed money. Social security in particular is not exactly a benefit but more of a contractual obligation since the worker is owed a return on their money taken out of their wages over the span of their working lives. The problem of commodity money is as old as money itself: fractional lending. It has always devolved into it and always will — simply because it is inherently possible to do so. The only real solution is debt free credit or fiat.

Thhis is so and no I do not advocate jumping into a malestrom to get off the spit.

Once the International Bankers are routed out of ALL government beginning with the Fed Res a system must be in place immediately to stop the current SS addiction and trust people have in it being the great life jacket with umbrella drinks in a warm pool.

We would have to vet every SS recipient ( now THAT would create massive jobs ! )

and remove all payments from illegals for a start and everywhere there are one person getting multipla payments under various IDs

I could write a chapter on that after living in Brooklyn for 25 years ! and where is all that medicaid money going on its pathway to telaviv.

But thats not here and now

What I can envision is all workers pay into a retirement account that keeps a portion for the state and most of it they are requested to invest . My best idea here at present is into the very employers for a SHARE in the whole as workers who own even a small share do worker better, harder, longer and are willing to keep learning about their own skills and possible new ones offered by those employers along with annual paid two weeks vaca for any employee on board for more than three years. A company owned cruise ship and a resort with high end accommodations so all expanse can be held down and the employees will not be wont to destroy steal or overuse the goodies as they have been shown they are part owners of said ship, resort, mountain retreat near fine trout streams.

Once such a system is being set up and businesses great and small see the benefits of these arrangements all those people who would have entered the destructive SS system wil happily join those businesses or corps that have such stabilizing contracts with their employees who have elevated status to co-owner

In my world view most thralls do need supervision and guidance

Where best to offer such is via their necessary skills and talents that the state needs

workers are the base upon which the nation is built

Under this sort of system any employee who has above average skills and work ethic would be taken into higher education to move up in responsibility in the company.

This needs open hearted and intelligent people to plan, create and implement

It cannot be done until we totally divorce by whatever means the current greed and hate motivated controllers of all our futures and our grandchildrens hopes for any life other than deeper slavery than we have yet known

when all the legal members of the state have vested interests in production and integrity

the whole state rises in job creation, harmony among the folk and greater production.

This is only my own little thinking process well informed by a state that did much of this to huge success about 70 years ago, 😉

This is predicated on two major moves

one) remove all bankers and their acolytes from all offices and govt positions

two) close all borders and begin removing the MILLIONS of illegals getting benefits from every existing program

The next step must be decided by local activists and AND national wise ones all co-operating to get a program into works that benefit the workers. retirees, and the state

Retirees have their shares of their former employers company as well as a guarantee by the state in case of any unseen emergencies

The state would also guarantee assistance to any employer who was in a slump so it maintained its share payments to those retirees.

Tax monies would have been invested over the broad spectrum of business’ so as to keep the base solid as well as investments in friendly and prosperous foreign nations keeping TRADE lines harmonious and healthy

There would be only one bank ala Andrew Jackson that would be duty bound to oversee all investments to keep it solid. Those sitting in the advisers posts have only five yer terms and must be approved by each state .

carry this as far as you want. I am not hidebound to any part except getting rid of the current FedRes and all those who have been part of the deceptions

and all illegals who are bleeding America dry under false pretenses

any other ideas are of course most welcome and no we cannot toss older persons over board on the way to a better system. ( I am one of them 🙂 )

`

I agree with your ideas. I think a reform in banking will naturally create so many jobs that many of these safety net programs will not be needed. But in the meantime, there is will be no other choice but to honor them. I just wanted to make sure you were of the Malthusian sort that believe the poor enjoyed being depend upon entitlements and were committing fraud as a means to escape work. That is the banker shill republican and Austrian school lame excuse for committing economic mass murder.

Since you live in Brooklyn NY maybe you know about Randy Credico’s candidacy for mayor? If not, I wouldn’ t be surprised as the mainstream media have run a complete blackout on coverage of him. He proposes a wallstreet sales tax as well as a new deal style program to get New York and new Yorkers out of debt and into full employment. He is infinitely better than Deblasio. http://www.credico2013.org/

Regardless of the outcome he has also started up the Tax Wallstreet Party and is asking people from all over the nation to begin their own chapters in their respective cities and states. You need not be tied to partisan affiliations either. As long as you agree with the core program of anti austerity, and nationalizing the Fed for the purpose creating jobs and prosperity for all with interest free credit, any political orientation can get involved. http://www.taxwallstreetparty.org/

Been outta Brooklyn for six years, some of it I sorely miss, most of it I never think about. It,

IS a powder keg of multi culti ready to implode and those cousins of the tribe are prime targets of the black , Asian, Spanish communities BECAUSE they have been victims and relate personally to being cast into the role of slave to the sidecurl cabal.

Street lingo is often directed at those thieves, and los que están sucios perros! 😀

You wrote: ” the poor enjoyed being depend upon entitlements and were committing fraud as a means to escape work ”

No I have seen with my own eyes that many people of all races want to work and take care of their families and have a weekly BBQ or mini fiesta but are unable as money is so scarce down in the thrall level

I am way out of Brooklyn and sink deeper yearly now surviving week by week and see increasing poverty all around me.

I do not see ALL assistance recipients as slackers but it is a growing philosophy especially among non English speakers who are often also illegal holding three or more IDs getting support under many names and doing a job or crime for more cash money

This is hugely degrading all levels of social order even up to the Ocean Parkway ELITE who teach illegals to stay illegal so they can pay them less for nanny, yardman, housecleaner etc.

If you know Brooklyn at all see between these cryptic remarks, lolz.

The revolushun is THIS CLOSE and it will start in a spot like Brooklyn between Crown Heights and east NY or similar over some venerated rabbis vehicle entourage running down a little black kid and not taking the black kid to hosp so he died right there.

Dinkins was mayor back then and race tensions were rife at the least

It WILL blow up and spread across this once pristine land.

We can see this as opportunity and as so many have called for UNITE and clean out our own national Agean Stables bringing in fresh water and new hay to fuel the engines of our recovery.

In this process all the slackers ala Malthus will be vetted out and sent to camps to await deportation to wherever they came from or where will take them if any where

Or a life inside the camp farms raising food for the nations people to buy GROWN

in America. not China or Brazil or over oceans using petrol and creating openings for fraud and baksheesh at every turn

Yes u see too that from this many jobs will be created and more people paying a share into company retirement funds and state guaranteed funds AND personal investment accounts in American job creators

As a great Statesman of the last century said ” jobs for the workers, paying a decent wage because they are the very foundation on which the state stands.”

HWR! ( u kno )

Hi. I tried reading this but, unfortunately, the way it is laid out, the right hand side of the text is cut off from view. Can you please remedy this? Thank you.

By the way, I entirely agree with the points made by Holland4MPE below. It is a simple and elegant solution which is simply based upon the actual facts of how money is truly created.

Sorry, I have to remedy my english skills first. Just ignore my post.

Only by speaking your mind will you learn the language Dark Dirk and your words are usually completely comprehensible!

I don’t have this problem earthlinggb, and I don’t hear others complain, nor have they ever. That is: you are talking about the article, right? Some comments can have that problem if they are deeply nested. In that case you can hit ‘reply’ to read the squashed text.

Otherwise you may have to look at your browser settings, or perhaps a higher resolution?

Great article. I think it is correct. I also think that money in real economy circulate fast. I receive my salary and spend it over the month. In financial economy money just sits on accounts. And people in financial economy need big quantities of money in their accounts, because they live on interest. They do not produce something real to offer on market. The only thing that they can offer is money, and they want to profit from this. And other people allows them, gets loans from them and pays them interest.

The only conceivable way that money could move fast enough to repay compound interest imho would be if the money powers allowed free energy tech to be realsed for public global use…. fat chance.

Otherwise its back to the repayment in the faux sense. The unreapayable portion generated by interest just gets rolledover into a larger loan in the next fiscal budget, ad infinitum. The truth to this no win dilemma is that to actually pay off the debt would just make things worse. Our money supply would simply disappear.

Jct: I’ll see if I can a video at http://vonvo.com this weekend with a critique of the errors in this analysis. My fingers are tired of typing. Maybe you’d like to participate and defend your analysis?

No offense meant to my friend Anthony but… Kudos John!

I would very much enjoy an engineer as elegant as you explaining the mortgage “death gamble.”

Despite having an MBA in finance–I’ve given-up on the number crunching. There’s an agenda which supersedes fundamental analysis. The link is a blog site by Clint Richardson. Clint and Walter Burien are experts on the CAFR report–a report that each US municipality reports to the Fed Gov’t. While California discussed a $16 billion budget shortfall in 2012–the state’s publicly available CAFR report posted $533 billion in liquid investments, alone. the game is rigged brother and now [Canada, New Zealand, England, Russia, US, etc.] are going after depositors [bail in]–redefining them [double speak] as “unsecured creditors”. Will the sheeple take it???

http://realitybloger.wordpress.com/2012/05/25/california-government-hides-billions-from-taxpayers/

The agenda currently is maintenance of the double entry ledger, and its ability to hypothecate money into being: Prior to double entry ledger emergence on the world scene (Venice?), was other machinery of falsification, such as Gold with bank notes riding on top. Today, private bank’s network with each other, so their bank credit money can find its way home, returning to individual ledgers. What emitted from the ledger must return to the ledger. This is not something that is taught in economic textbooks, and as far as I know, I’m the only one speaking on this subject. But, ledger mechanics are critical to understand why we have a financial upper loop, which holds capital usury pools, formerly base money.

Banker credit (BM) is something like Salmon returning home to their birthing/breeding grounds. The ultimate network of course, is one big World Bank. The fiction of double entry bookkeeping has as its root function a legal mechanism, such that any BM issued forth, must return to that same ledger. All BM must swim in the money supply and return to THAT singular ledger. Networking and consolidation of banks is then a prime directive output function of double entry design. Base money as issued by Government, becomes banker reserves, and helps to intermediate imbalances in the bank system, while BM returns to the ledger to balance books, and then disappear.

BM from a single bank travels in a closed loop like a train closed in on its own rail system. But, BM can jump tracks when banks network, making it more “universally acceptable.” When government sanctions BM as acceptable for taxes, it has added more tracks that “switch” and allow BM to loop further afield. In this way, the banker’s “ticket” to ride the train, gains currency. This desire to own the falsification machinery repeats itself through history:

According to Dr. Henry Makow, Hitler had to be stopped; he had sidestepped the international bankers and created his own money. Makow quotes from the 1938 interrogation of C. G. Rakovsky, one of the founders of Soviet Bolsevism and a Trotsky intimate, who was tried in show trials in the USSR under Stalin. According to Rakovsky, Hitler had actually been funded by the international bankers, through their agent Hjalmar Schacht, in order to control Stalin, who had usurped power from their agent Trotsky. But Hitler had become an even bigger threat than Stalin when he had taken the bold step of printing his own money. Rakovsky said:

[Hitler] took over for himself the privilege of manufacturing money and not only physical moneys, but also financial ones; he took over the untouched machinery of falsification [This is my point – the falsification is the double entry ledger, or other mechanics, such as Gold base with paper debt receipts] and put it to work for the benefit of the state . . . . Are you capable of imagining what would have come . . . if it had infected a number of other states . . . . If you can, then imagine its counterrevolutionary functions.

Mutual credit is honest money, where the tracks circulate among the ticket holders of its system. Honest system design is such that there are no hidden wealth transfer mechanisms. Mutual type banking, such as that advocated by Bagehot, Kitson, and Name, divides up wealth (of altruistic wealth holders) and issues correlated tokens to float in the supply – to the benefit of the public. In this way, the double entry ledger mechanism is thwarted, yet the ticket is a form of credit based on wealth. My personal view is that a sovereign people should own their money power, and government should tax and recycle monies received from the people. This money is issued and controlled scientifically. It is long past the time that humanity should be held hostage to usury mechanism and falsification techniques owned by pride defective individuals.

Yes, we can pay off our current private debts (in the real economy) by simply issuing debt free greenbacks. But, that thwarts the falsification machinery.

Read economics professor Anthony Sutton’s books downloadable at archive.org. His basic thesis is that Wall Street bankers (Jews and Gentiles like Presscot Bush, Harriman, Rockefeller and JP Morgan) provided the funds for Trotsky, Hitler and Rooseveldt to create big socialist governments which they control and allows them to form monopolies / cartels so they can eliminate competitors and enjoy unlimited profits. Of course, any war is highly profitable for those who fund the war economy. If you fund both sides you make money from both and are guarrenteed to also back the winner who will then need you to fund the reconstruction of countries of allies and enemies. He backs his statements by copies of documents from USA government archives.

P > P + I But, what happens if P shrinks, as in the case with banker credit money, what I call BM? When P shrinks on both sides of the equation, all that is left is usury.

Usury becomes more pronounced, because the velocity cycles are cut short. BM does not want to spin at high velocity because it implodes and destroys itself every month as the loan is paid down. Money that has disappeared cannot be spent.

This is the key feature of 100% reserves. This money type doesn’t disappear, and will tend to stay in the supply allowing transactions to mediate at a lower usury take than BM. Of course, fully reserved money will effectively disappear by hoarding, and hence it needs some compelling force to move. Demurrage on floating money is an ideal to my mind.

Consider that the financial economy has floating money, not under compunction to move, except for maybe inflation. Usury, once it is paid into the banking system, does not need to leave the system until the holder chooses to spend. In this way, usury money behaves a lot like Gold, waiting its time to buy assets from depressed goods and services providers of the real economy.

The three borrowing sectors, Government/Household/Business are all under usury drain and principle destruction to endogenous BM banker money (M1,M2). To make the borrowing sectors come into balance, Keynes suggested governments borrow and spend, rolling over their public debts forever. This deficit spend money ultimately becomes savings of the household and business sector, as well as usury of the banking financial sector.

Lately, the financial class has allowed a lot of M0 (floating base money) to come into being, especially with quantitative easing. If we think of financial class usury being floating without having compelling forces acting on it, and we also look at base money, they are the same.

Looking at Mortgage Backed Securities, for example: They were created by tranching mortgages, with securities having high leverage ratios based on nothing. MBS were then sold to short term buyers, some of whom were banks. They went on to become reserves in the banking sector, and of course now we know the FED swapped cash for this trash. The financial class then gets a quality type of money at even higher rates that the equation above suggests.

The financial class also multiplies their advantage due to the inherent drain bias designed into the system, as their floating money acts like gold.

If money is regarded as a credit note and a unit of accounting and not a commodity in itself, the monetery system becomes very simple. There is never a shortage of money, the “money” supply matches goods and services exchanged a 100%. Velocity of money is then also not important as a credit note is destroyed when the issuer receives it back and issues whatever was promised in credit note or something of equal value acceptable to bearer of credit note. The issuer of the credit note should be entitled to stipulate a time limit in which he/she will honour the credit not as goods or services should then be reserved to honour the credit notes issued.

Any legal group or individual should be able to issue a credit notes as long as they have the means to honour the credit note. So the money supply can never contract as money is created on demand per transaction. If you are in possesion of an accepted non-fraudulent credit note, you have money to pay whatever you need to purchase.

Governments or city councils can do exactly the same as anyone else, issue credit notes for services or goods they recquire. The government will be able to honour their credit notes through taxes as long as their spending does not exceed taxes. Of course there should be no corruption and a governement should only offer services which citizens need and agree to. Citizens should only be required to pay taxes in proportion to their use of a service.

Credit notes.

Should money be backed by gold? No, that only makes the money system expensive as gold first needs to be purchased before a monetary system can be created. However, a country that does not have gold will be wise to buy some gold if it is a high demand commodity as it will be easy to purchase other goods from other countries. But gold is not at all required to have a monetary system. The sum total of the real economy is the goods and services that can be sold, nothing more.

No interest should be allowed. Profits can be made through your own sales or from profit share in someone elses business you help fund.

Of course, to ensure that the system of credit notes work, rules should be made which ensures the proper functioning of the system.

See https://www.community-exchange.org/docs/what%20is%20money.htm for info on money as credit notes and a unit of accounting.

How do you repay 11 tokens when only 10 are created?

And don’t forget as the 10 tokens (principal) are repaid, the money is destroyed – it ceases to exist.

You hope other tokens will be created so that you have the opportunity to capture the 11th. Of course, other tokens will be created (as interest bearing debt) and more and more and so on and so on. But the basic problem remains – debts can only be fully repaid (P+I) when other debts (P) come into circulation. Plato explained this problem as money, unlike rabbits or cattle, does not reproduce and we cannot repay more than we borrow.

Empirical evidence – Dr. Chris Martenson wrote a great article entitled “Death by Debt” in which he explained the following chart:

http://media.peakprosperity.com/images/credit-market-doublings.jpg

“There’s a lot going on in this deceptively simple chart so let’s take it one step at a time. First, “Total Credit Market Debt” is everything – financial sector debt, government debt (federal, state, and local), household debt, and corporate debt – and that is the bold red line (data from the Federal Reserve). Next, if we start in January 1970 and ask the question, “How long before that debt doubled and then doubled again?” we find that debt has doubled five times in four decades (blue triangles).

“Then if we perform an exponential curve fit (blue line) and round up, we find a nearly perfect fit with a R2 of 0.99. This means that debt has been growing in a nearly perfect exponential fashion through the 1970′s, the 1980′s, the 1990′s and the 2000′s. In order for the 2010 decade to mirror, match, or in any way resemble the prior four decades, credit market debt will need to double again, from $52 trillion to $104 trillion.

“Finally, note that the most serious departure between the idealized exponential curve fit and the data occurred beginning in 2008, and it has not yet even remotely begun to return to its former rajectory.

“This explains everything.” — http://www.peakprosperity.com/blog/death-debt/58941

To repay the debts requires exponential growth which cannot be sustained in a finite world. Defaults are an integral part of such a monetary system. Dr. Martenson on the problem with exponential growth: “We found an identical pattern in our debt, total credit market, and money supply that guarantees they’re going to fail. This pattern is nearly the same as in any pyramid scheme, one that escalates exponentially fast before it collapses.”

A “pyramid scheme” sums it up quite nicely. Margrit Kennedy explains the interest- debt money system in the following video (she begins at around 2:20):

https://www.youtube.com/watch?feature=player_embedded&v=QuBy3BzCXwg#!

I think there are two great failures with many monetary reformers. First, many do not understand the terminal problems associated with interest.

The second failure is in not being able to offer alternatives to the charging of interest. Are we so regimented that we cannot grasp concepts like “handling fees” and “service charges” in lieu of interest?

Hi Larry,

As you know I’m aiming at a completely usury free economy and never settle for less. I also agree, I work that out in detail in the article, that in practice the debt can never be repaid. For reasons that the P + I > P equation hints at, but does not prove, as I showed.

If the interest is not spent into circulation, no matter what the velocity, the debt can never be paid. Even if the interest IS spent back into circulation, the debt cannot be paid with current M2 velocity.

However, IF velocity is sufficient and the interest is immediately spent back into circulation, the debt can be repaid. But, as I showed, these are two big ifs that simply don’t stand.

It’s really very important to get the complete picture. Our friends of the Austrian persuasion (see here for instance: http://www.tomwoods.com/paper/) have managed to subvert the argument in the most optimal situation (scenario C of the article). Scenario C does not exist in practice, but it does in theory.

This is damaging the credibility of Interest-Free economics.

Not only that: most of what I’ve learned about money is by listening very carefully to what everybody (and I mean everybody) has to say. Our biggest opponents are our best teachers. This is just another case in point.

I’d invite you to have a closer look at the three scenarios I work out in the article and see if you can find a fault in it, not because I want to be right, but because I want to get it right.

Thanks, it’s great having you at Real Currencies sharing your knowledge!

Anthony

Hello Anthony,

Thanks for your response. You raise some interesting points in asking “Is there enough money to pay off debt plus interest?”

Coming from you, a champion against usury; I think we have to explore the various assertions as there is not anywhere near a consensus or some mathematical proof that is obvious to all. Is the interest debt money system economy a pyramid scheme – mathematical suicide?

Here are several observations to hopefully further your discussion:

1 How can the debt be repaid?

We’ve all read the explanations as to how Principal + Interest may be repaid in full. Examples:

The bank spends the interest back into the economy – the bank spends 100% of the interest back into the economy and those needing to pay interest, capture all of that that money – proportionately.

Or, those that owe interest, work for the bank and receive the interest as pay.

In these scenarios the banks are obviously in total control – inescapable? We rely on their benevolence?

2 Can the velocity of money (times money is re-spent in a year) be great enough to satisfy the interest requirement?

We place two demands on the required amount of “new money” that must be created at regular time intervals. Unfortunately, the demand ever accelerates for two reasons. First, money is destroyed everyday as people repay principal on loans to banks. New money must be created at an equal rate to prevent the money supply from shrinking. The economy MUST grow and in the U.S.; the Federal Reserve suggests the rate of growth should be at around 2%/year.

Second, interest payments must be quickly re-spent into the economy where they may be captured by those in need. I think you make a good point in your article that constantly increasing the velocity of money cannot be sustained.

3 Static or dynamic analysis?

We have been discussing single tier interest charges whereby people borrow from banks and must repay that amount. In actuality, interest is charged on interest through multiple transactions in the economy. I think that interest charged on interest is by definition – compounding (exponential/ quadratic growth?).

For example, a manufacturer may pay interest in financing their operations and a wholesaler may pay interest in financing their marketing operations. A retailer may pay interest on inventory and warehousing. Is it safe to say that compounding is unavoidable thus unsustainable; in an interest based economy? (See Margrit Kennedy for detailed analysis)

4 What about the exponential growth of interest collected on bonds, etc?

If one is in the position to continuously roll over bonds (principal + interest) or re-invests interest proceeds; the money will eventually grow exponentially. Can any economy long endure this growing parasitic load?

I have no problem with people investing money in stocks but think that bonds were created so that many may be legally siphon from the productive economy. Bonds are simply that – bondage – there is no salient reason for government or individuals to ever pay interest. The borrower alone endows the new money with value through collateral and the “credit ability” to repay. Of course, handling and transaction fees are in order.

Larry

Thanks Larry, great input.

“In these scenarios the banks are obviously in total control – inescapable? We rely on their benevolence?”

I couldn’t agree more. I intend to follow up on this because I believe it is very important to not be satisfied with one argument against usury, even very strong ones like the fact that the debt is unpayable (although not only because of P + I > P). We need exactly this kind of thinking as you mention here too: the power issue is very fundamental. It’s very important that people grow up and get rid of the ‘oh but they’re just guys, we can trust them with our lifeblood’ Stockholm Syndrome driven kind of attitude.

The other issues you bring forward are certainly very much on target also.

btw, I also am very happy with the way you insist on the simple truth that the money system can easily and equitably be financed with the handling fees and service charges. So important to keep spelling out the very real alternatives.

The real economy in my view grows mainly, amongst others, in the following ways:

1. Business profits based on value add to raw materials (extracting raw materials, conversion into usefull forms, producing products / systems, services provided with and for products), natural growth of biological products (1 seed produces a plant that produces many seeds or animals and off-spring), distribution of products / services and final sale of products or services.

2. Population growth (more hands for work, more mouths to feed)

3. Existing services and products are produced more efficiently.

4. New services and products that does not replace existing products and services.

With regards to banking and usury it is important to know what money really is. There is the main stream theory that it is a medium of exchange (a token representing value) or that it is credit issued by a supplier to a buyer. See the article by By A. MITCHELL INNES in The Banking Law Journal, May 1913 on this issue at https://www.community-exchange.org/docs/what%20is%20money.htm. The definition of money as credit can also include the definition of money as a medium of exchange as credit notes can be exchanged as a form of payment. It is a matter of moving the right of credit from 1 person / entity to another.

The following is a simple example that can be imagined to take place in a small town. The chicken farmer goes to the dairy farmer to buy dairy products. Instead of taking chickens / eggs to pay for the milk, the chicken farmer signs a credit note stating that the dairy farmer can collect poultry products to a value equivalent to value of dairy products taken. The diary farmer can in turn go to the baker and buy bread with the poultry farmer’s credit note and the baker can then in turn go to the the chicken farmer to buy eggs to the value of the credit note. The chicken farmer should then destroy the credit note in front of the buyer so that both know that the original debt has been repaid. It will be in the chicken farmer’s own interest to do so as if the credit note gets into other hands, he might end up paying twice in poultry products for the original amount of milk he bought. As this is a small town, where everyone knows each other in terms of the credit worthiness, this system can easily work.

In a larger town where not everyone knows the other, this method is open to fraud and non-payment of debts e.g. the poultry farmer left town or does not have enough produce for all the credit notes issued. This is where a trusted third-party is required to facilitate trust in credit notes. In this case, the dairy farmer takes the chicken farmers credit note (e.g. cheque) to the chicken farmer’s bank and gets a bank credit note which if accepted in the city or town by all others, he can then pay for any product or service. What is very important is that the bank should now subtract that amount from the balance that the chicken farmer has at the bank. The merchants in the end take the bank credit notes they received back to the bank who should then destroy the credit note in front of the merchant and at the same time add the total amounts of credit notes the merchant gives to the merchants account at the bank. In a city with different banks there should either be a central city bank where all the banks have accounts and where each of them can take the other banks credit notes they received to be credited to their balance and debited to the balance of the bank that issued the credit note. And in each case the credit notes should be destroyed or cancelled in front of both parties. Of course, all the banks can have accounts at the other but in that case one bank will have to got to all the other banks to ensure that the accounting is done correctly

So money in this case is then a token of credit and a medium of exchange of credit.

As a town or city will have a town / city council which provides general services to the public, they in turn can produce credit notes for the amount of services they provide to the populace of that town. If this is a council for the people by the people which serves the interest of the coummity, then individual members of the community will only pay for services they use or for services they know benefits them in proportion to the benefit they receive. These taxes should then be paid in credit notes issued by the government of bank issued credit notes. In the small towns case personal credit notes can be used too.

Now in all cases where a services is used, a service fee should be paid and the bank is entitled to charge a market related service fee. Should they also be able to raise interest? The question of interest should not be dismissed immediately without exploring where the concept comes from and then deciding when interest is valid and when not or not at all. Now if someone is unable to honour his own credit note e.g. the chicken farmer cannot deliver all the poultry products he has issued when people purchase chicken’s with his own credit notes, then the trading community is probably entitled to demand a penalty of some form and increase that penalty if it is not paid in an agreed period. Otherwise they can of course exclude the chicken farmer from using the credit note system by refusing his credit notes or to provide services or goods to him until he has paid his debt and penalties in full by either providing poultry goods or other services like working for his creditors. The penalty should be in proportion to the loss of business by affected members of business community and should be distributed to the those the poultry farmer is indebted too in proportion of what he owes them. But this penalty cannot be regarded as interest on a loan, more as a deterrent to ensure that people live within their means and don’t cause hardship or harm to others.

Now their is the case that the chicken farmer loans a hen to a new start up chicken farmer. As the hen will lay eggs which can be sold or hatched so that the chicks can either be sold, slaughtered or lay eggs, it is clear that the start-up chicken farmer has benefited more from the hen than just getting a hen. In my view, the borrower should be entitled to an agreed share of profits. As this is a share of profit not turnover, the start-up farmer will be compensated for the fact that he has to ensure that the investment is profitable. But this is more profit share than interest or usury. Of course the community bank described above will hopefully prosper and can use their honest profits to provide the start-up farmer with a bank credit note to buy the hen from the existing poultry farmer. In this case the bank is entitled to the share of the profits. A wise and astute banker, who knows the business acumen of all the suppliers and buyers in the community will be able to invest wisely in the right people to make the banks profits grow through profit share. This is I think basically the Islamic banking principle as well as investment banking.

Of course, if anyone doesn’t need to exchange the supplier credit notes they got from other suppliers, they can take it to the bank which can then increase their bank balance by the amount that they deposit. If the banker then needs money to invest in a new business, then they can make agreements with those who have credit at the bank to use their credit for an agreed share of profit. So again a way for a bank to increase profit without raising interest.

So in general interest / usury is not necessary for a bank to increase their profits. For people to ensure that they can retire when to old to work, they can in turn invest their profits in other businesses where through profit share they can still receive and income at a stage where they retire from their own business. The banks is obviously in an ideal position to serve as a broker for other people and to aggregate smaller investments into larger investments. In this type of situation anyone can prosper through innovation, effective work and insight, the banker even more so than others. There is no need for interest or greed. If the whole community support each other and help those who struggle, the community as a whole will prosper compared to a community where there is a lot of distrust, envy and strive. The whole is a bigger than the some of components and is as effective as the individual components AND their effective co-operation in effective functioning of the whole. The PTB seem not to get this to their own detriment and those they rule or control.

For a properly functioning economy which provides maximum benefit to a country or community, trust, individual ability and health as well as effective co-ordination of group efforts and health of the group, is essential. Abuse decrease trust, loyalty to each other and effectiveness. As cancer/parasites decreases an individuals ability, so does community “cancers/parasites” decrease the community effort. By draining the energy and trust of the community / country the unearned interest of banks and unfair taxes of a government, in the end destroys and not uplift the community / country.

A loan in general can be regarded as deferred payment it is an acceptance of credit notes for payments in future e.g. when the maize is harvested. An agreed profit share in the harvest is a more acceptable way of

Interest is an unfair parisitical taxation on a bank’s debtors. Interest is basically a no-risk profit share. With regards to fractional reserve banking the two major problems are interest earned by banks, especially compound interest, first paying the interest then the principal instead of a paying both simultanuously in proportion, in the case of default not taking into account that the interest has been payed so no more interest can be added to an outstanding loan, and non-payment of loans which often relates to unqualified loans or credit mechanisms open to abuse like credit cards.

The fractional reserve system has merits if loans are properly qualified (the debtor has either means to pay back loan or collaterol to offer) and no interest is raised as it simplifies the whole system of credit notes by suppliers and banks. The reserve part should rather be regarded as an ensurance of the ability of the bank and assets it has acces to in order to provide the service they do. And as long as all the debts are paid, the system will work. In this case the bank is only a provider of credit notes and should not be entitled to interest as the one that is really providing the credit is the seller. There is also no profit sharing so banks should has no proper claim to raise interest on loans which are not really loans but an exchange of individual credit notes for the bank’s credit notes.

In the scenario provided a bank has the functioning of an exchanger and provider of credit notes (payment system), deposit storage and investment in profit share. In order to ensure that reckless or fruadelenters banks do not endanger deposits which are not agreed to as profit share investments, it is probably better to split banks into banks for deposit taking payment providers and investment banks.

With modern electronic systems the deposit taking and payment system provision of a bank can be done by non-profit electronic service providers paid for by merchants as this will lower the cost of the payment / money system which will increase the profits of the merchants as more money will go to them for goods and services they provide and less to parasitic interest-seeking banks as the buyer / consumer will have more money to spend. Mobile payment using smart apps or USSD / SMS systems on older mobile phones, will be ideal for this. In fact, a lot of complimentary payment systems can be created e.g. loading a mobile purse which can be used at community market and large events to pay small merchants who in turn pays a percentage of turnover to market owners or event organisers.

Another way of improving banking practices would be to form community / cooperative banks where every account holder is also a share holder in proportion to their usage of the payment system and size of deposits. It is the corporate nature of banks with a hierarchical undemocratic ownership and management as well as external shareholders which turns banks, which can be a valuable and apreciated service to a community, into a parasitical power hungry profit seeking money making machines distrusted and reviled my many in the community. Banks aims should be to nurture and assist a community, not to destroy and exploit. The more the whole community prospers, the banks will prosper.

This whole system described is in essence a huge communal accounting system and money is then only a unit of account i.e. a number used to track debits and credits for periodic reconscilliations. It is important that the accounting practices of the economy is sound and accurate. I am sure if one digs deeper into the accounting practices of most banks that a lot of malpractices will be revealed. A governments role with regards to banks should be as a referee that guards the interest of the nation against malpractices of banks. Therefore it should enforce the rules required by the nation for the banks and also have a mechanism to ensure that banks are audited at least annually.

This is my humble opinion on the topic of interest. But in order to change the banking system into a fair and honourable system, the political system of a country needs to ensure that banks do not control government or have undue influence on government policy. The modern history of the United States and European democracies have shown that representative democracy is nothing but a front for the rule by rich and powerful oligarchs. The only difference between a “democratic” oligarchy and an autocratic own run by a dictator and his crownies are the fact that in an autocratic system the citizens know that they are oppressed and that their opinions on the political system is not important or only becomes important when they riot or threaten the power structures in some way. In a representative democracy the citizens are under the total illusion that they have a government for the people by the people that serves them. In my personal impinion the only true democracy is a system of direct democracy or a representative democracy with a large proportion of direct democracy mechanisms used to ensure that representatives do not abuse their power.

That is my favorite Margrit Kennedy’s movie.

“Are we so regimented that we cannot grasp concepts like “handling fees” and “service charges” in lieu of interest?”

Unfortunately, yes. Many people, with who I have spoken, think that “handling fee” equals robbery. These are equally capitalists, who says that interest is the basic of economy, and socialists who says that I want to rob saving of the poor with that tax. Capitalist profits from interest, and socialist just do not understand the hidden redistribution system of interest.

peakprosperity.com is one of my favorite websites also. I have encountered it before I have Learned about Silvio Gesell. The Chris Martenson’s Crash Course made me think about money, exponential growth and feature of humanity.

Hi Anthony.

actually paul grignon (money as debt documentary) also mention about this issue. He states that we can pay the interest if money (principal) is spent. But then he concludes that the problem is not only because of unspent money but also the creation of money as debt itself.

http://paulgrignon.netfirms.com/MoneyasDebt/Analysis_of_Banking.html

Anthony, there was a good proof at BIBOcurrency.com showing interest driven instability, but I cannot find it. Positive interest adds costs at every chain of production. This added cost is refinanced again and again by both manufacturing and consumers; this chain of borrowing causes the original positive interest to compound. Anytime usury is rolled over by compounding, it becomes exponential (unbounded) and hence not payable.

The usury can be paid when debt contracts are cancelled with asset grabbing. (Assets are not money. Usually housing is on the ledger…about 70% of all loans.) Any former BM in circulation now is set free by bankruptcy law. Those former BM dollars, which had a force vector compelling return to the ledger, are now free to float. Their liability association has been erased. This new debt free money is now also free to pay usury; financiers have gone through their grabbing phase canceling debt contracts, and hence the system goes back to temporary equilibrium. A new debt cycle may now begin anew.

Gold is no better, because by its nature, it is positive interest. Gold’s fixed volume cannot match the exponential of usury and hence paper or electronic digits must be “created” to make it a workable system. The created paper digits will pretend gold convertibility, and during inevitable depressions real gold will be confiscated as an “asset”, concentrating said Gold into financier hands.

So, between BM principle destruction, usury exponential compounding, and the upper loop financial economy(concentrations of stagnant usury capital), there is no way the Austrian scenario can ever work.

I’m glad you hold your nose and debate the Austrians, though it must be frustrating!

Thanks REN, we agree, of course.

The only thing frustrating about debating the Austrians is knowing the non-initiated are easily fooled by their antics. And also that they and the mainstream media control the flow of information, so their silly nonsense is so overexposed compared to rational thought.

But with a clear grasp of the issues it is actually often very funny. I’ve always seen the bright side of stupidity in the sense that it’s an endless source of smiles and even outright joy and laughter.

I don’t know, I mean Jews and their brainwashed cattle say some pretty humorous things once you can see through to the core, and it’s amusing to a point, but when you realize that the end result of all this will be a global slave world where all who resist Jewish domination shall be tortured and murdered, and only a mongrel slave race that does not resist shall remain, with a few whites and other resistors kept around for various forms of torture including ritual crucifixion and rape, followed by the inevitable destruction of the remnants of the human race as Jews turn on each other once they’ve defeated all those who resist them, it’s hard to have “outright joy and laughter” about it, especially considering so few are willing to hear the facts, and we are pretty much alone in this knowledge.

Perhaps you have faith that we will be victorious merely by following the word of Christ and exposing the truth, but I’m afraid that isn’t enough for me.

I know, it’s basically a wicked sense of humor, and I think I don’t have to explain I take the whole issue rather…….seriously.

I indeed have all the faith in the world that following the Word will not only lead to victory, but is the only viable strategy to victory.

This is incorrect. In the above example, there is already 100 P in existence. It appears to be non-interest-bearing, because the holder of P — the one who loans the money– does not owe P+I to a bank. The holder of P does not create new money and issue it out as debt plus interest.

In our system, there is more debt than money. In the example above, there is 100 dollars of money and no debt; And at no time is new money is created.

The premise is inaccurate and, possibly, deceitful. The above scenario describes a system wherein there is free, honest money.

MMT people try to play the same sort of trick with respect to the purchase of treasuries bought by the fed. Because interest on the fed treasury holdings makes it way back to the treasury, the MMT people say it’s not important. However, they dismiss the fact that the Fed issues less money than debt to the treasury, so that the treasury must get the difference from the private sector, who must get it from demanding loans from banks, which belong to the fed!

This is incorrect. In the above example, there is already 100 P in existence.

Jct: No, no one on the island has any money when we start our example. We’re starting up a new banking system is the premise, not that someone was born with the original $100 P. Besides, why would we call it P if it isn’t the Principal of the Loan yet? P represents Principal in the equation. Get it, it represents the loan of new chips. P is not how much old money was around. And so, if the premise is off-target, I’ll leave the rest of the analysis to miss too.

I see. And the money isn’t destroyed as it is in the current system?

Jct: Gee, you got that basic premise wrong too. No, the chips are retired from circulation (if not destroyed) when cashed out just like chips are put into circulation (not created right then) when bought in for. What is it about poker chips that you find so difficult to grasp?

Dark Dirk: That is my favorite Margrit Kennedy’s movie: “Are we so regimented that we cannot grasp concepts like “handling fees” and “service charges” in lieu of interest?”

Jct: Thanks Dark Dirk, I hadn’t noticed. It’s now my favorite Margrit Kennedy quote too. Back in the early 1980s, I asked the Supreme Court of Canada 5 times to restrict the banks computers to a pure service charge and abolish the interest charge.” Nice to see someone so noteworthy also put it so simply. “Are we so regimented that we cannot grasp concepts like “handling fees” and “service charges” in lieu of interest?” Those judges certainly were so regimented. But the billion-plus souls whom they could have saved but croaked due to their inaction have formed a gauntlet the banksters will have to run trying to get into Heaven! Har har har. They could have saved a billion souls over the past 30-years and said no!

Economic Growth is killing our planet, making our products “cradle-to-cradle” and focussing on renewable, clean energy for the world is impossible because of our current system.

Get rid of interest alltogether, it must become illegal to ask ànd offer interest, worldwide. This will put banks out of business, or they will specialize in real trading and stockmarkets. No more loans, mortgages and savings. This will be taken care of by Interestfree state banks (without meddling from politics!) They will have a saving-secton (money not to be touched, no interest, no trading, no growth), and an interest-free credit and mortgage section. The few people employed there (everything is digitalised) will be working for us all, the people, and will get a normal salary like any civil servant, paid for by “the people” through taxes. There will no longer be a profit in lending money, or in keeping it out of circulation longer by saving at high interest rates. The state banks will provide loans for houses or businesses based on feasability, solvency, and desirability.

The money that’s created from scratch (at first) gets its economic value when it’s paid off, and will be recycled for new loans. For this to work, the whole world would have to adapt this system. It will ensure the possibility for either socialism OR a free market system to really work, or to have a nice mixture of the two. It should create the possibility for a great deal of freedom for inventive entrepreneurs, while making sure the ones who need more help, can receive it, without some bank trying to suck the life out of them, and out of the real economy.

My explanation about this utopian “Mononomy” can be read in Dutch (I still haven;t translated it yet) on my blog (“Mononomie”) or maybe you can paste in in Google Translate to get an idea 😉 The best part is: There is no need for countries to be poor anymore, with this ONE world currency, there’s also no more trading of “stronger currencies”, no more need for loans from the richer countries, making them poorer and poorer, while more dependant on thèm. These countries can create exactly the amount of MONO needed for their country to develop and thrive, based on great ideas to make their land furtile, their energy green and renewable, their water supply enough to feed everyone, while hiring the best people and machines they may need, from all over the world. The mono that is invested in such enterprises will slowly come back to their own Monobank, where it will be used again, if needed, feasable, and necessary.

Life will be so simple, economists won’t know what to do with themselves 😉 But no worries: Work will become something we do because we like it, no longer because we HAVE to, to survive 🙂

From the 31st December, 1789, to the 31st December, 1835, the United States paid for

interest on the public debt the sum of $157,629,950.69;

and for the principal the sum of $257,452,083.24;

together making the sum of $415,082,033.93.

All in coin.

Prior to the Nevada and California discoveries, there may have been 100,000,000 coin in the United States………

During these 35 years how much personal debt (principal and interest), how much business debt (principal and interest) was also paid off ?……

On January 1st 1830, the population of the United States was 12,866,020…….

We rent the money that we use from a private group of bankers who have no money of their own.

The alternative to create our own money for free, like the banks do, and circulate amongst ourselves – free from rent!

If that is not illogical enough; here’s the clincher:

We rent the money that we pay in rent – interest on interest in a giant pyramid scheme.

So, was it ‘loop’, was it ‘velocity’, or what was it that paid off $257million in principal and 60% in interest ?

Quite right name. The intrinsic instability of the system is a useful argument, but the problem is the 60% they payed in interest.

>>>>but the problem is