The Basic Income

The call for a Basic Income is both old and mounting. Success of the scheme is dependent on funding. If it’s some sort of National Dividend, sharing the bounty of the Commons, it’s necessary. If it’s a Marxist tax based redistribution scheme, it’s worse than the disease it’s supposed to heal.

A Basic Income, in whatever form, is very much on the agenda at the moment. And it’s eminently transparent why: growing desperation for economic justice in the face of the blatant centralization of wealth in ever fewer hands. Through Usury, badly exacerbated by the crunch, which saw huge increase of wealth for the 0,001%, while the rest continues to suffer badly.

The idea is very simple: give every adult a guaranteed monthly income. On average proposals foresee an income of about EUR 1000 ($1300) per month, which comes down to about $15600 per year.

No means test, no requirements, for every citizen.

$15600 sounds like a big sum, but a Canadian study showed that the State at this point pays $7800 per head of the population in welfare, which is already half of what is required. Part of the Basic Income scheme is that it would replace all current welfare, including the bloated, humiliating, expensive and ridiculous bureaucracy that welfare has spawned.

The Basic Income would alleviate the worst excesses of wage slavery. In this day and age ‘finding a job’ is considered a success, but it’s not long ago that the common man scoffed at the idea of working for a boss. Men that did were frowned upon, suspected imbeciles. This was still the case in much of the US of the 19th century, for instance. It was certainly the norm in Antiquity and much of the medieval era.

Furthermore, with the now quickly escalating robotization, it’s becoming more and more difficult every day to conjure up more and more ‘bullshit jobs‘ to keep the illusion of ‘inclusiveness’ and ‘the American Dream’ and ‘the work ethos’ going. There is simply no way that we will have enough ‘jobs’ (as we know them today) in the decades ahead to have all able bodied men (let alone women, who are taking over the labor market anyway) work for 40 hours a week. Already many 40 hour jobs are sufficient for the survival of only one person.

Earlier this year, an initiative in Switzerland was launched, aiming at a referendum giving the Swiss a ‘guaranteed income’ (not exactly the same, but much in the same direction) of SF 2500,- ($2800) per month. A substantial amount in the world’s most affluent country. And while it’s unclear whether a referendum will take place, it was an important development.

The idea is at the moment widely discussed and promoted by many think tanks around the world, both on a national and global level.

The Good and the Bad Basic Income

Whether the Basic Income is positive or not is really all up to the way it’s financed.

If it’s to be done by ‘taxing the rich’, Marxist newspeak for gutting the Middle Class with income tax, it’s bad. ‘Tax the rich’ in reality should mean a progressive tax on wealth, including the wealth stored in special purpose vehicles like trust funds etc. This is most certainly not part of the plan.

But the good version, which is definitely necessary, is paying out to the people the proceeds of the exploitation of the Commons

For instance, a Georgist Land Value Tax all paid out to the commoners in equal shares. This hits two birds with one stone: we’ll have Land Reform and the basic downside of the LVT (empowerment of the State through extra taxation) is solved, because the proceeds are handed back to the people.

Such a tax would also aim at the proceeds of natural resources associated to the land, which are also part of the Commons. Enough of Transnationals bribing politicians to get their hands at resources and then ripping off everybody ‘ad perpetuum’! Just look at what they’re doing to Oil. We can do without all that kind of mayhem.

This is close to the idea of a National Dividend, as also promoted by Milton Friedman. Social Credit, printing money and giving it to the people to spend it into circulation, also has the practical effect of a ‘Basic Income’.

On principal, all profits acquired by exploiting the Commons, including Land, should be returned to its owners, the People. If people want to call that a Basic Income, that’s grand.

Is the Basic Income any good?

Some sort of National Dividend, provided by the wealth of the Commons is necessary, but financing of the scheme is not at the heart of the discussion and many Marxist/Globalist outfits are promoting the Basic Income. There is little doubt the Basic Income can easily be coopted by the Money Power to nuke the Middle Class with it. If a Basic Income comes with extra taxation for the Middle Class, it should be rejected.

While every individual has a right to his share in the Commons, he does not to the fruits of others’ labor.

The Welfare State is a key Marxist goal. It comes with redistribution, centralization of power in the State and dependence. The idea that a man should be dependent on the State for income is clearly against Nature. The idea that another man should pay for it is even much worse.

Furthermore, ‘the State giveth and it taketh away.’ There is only one State guarantee that has stood the test of time: that you will be taxed.

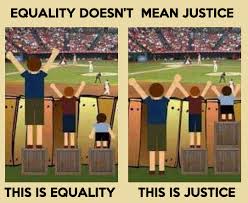

In fact: there can be no Justice with ‘equality’. Some take a bigger place in life than others. The old precede the young and merit is what counts among men. With ‘equality’ the weak are empowered at the cost of the strong. With Justice, the strong take their responsibilities towards the weak and receive higher status in return.

It must be also understood that there is no ‘right’ to sustenance. So there is no ‘right’ to a handout, if someone else is sweating for it.

We have a clear mutual interest in making survival as easy as possible. We have a sense of Charity, wanting the best for all. The wealth of the Commons must be shared. But these are quite different issues.

In reality, Humanity is slowly erecting itself from the mud and this is associated with struggle, not with ‘rights’ as such. It’s not for nothing that the Bible rightly states that ‘he that does not work shall not eat’.

The Basic Income is very much about ‘equality’ also: everybody the same income. ‘Equality’ is contrary to Nature and Justice and very Marxist. Especially if it proactively hurts the Middle Class.

The Basic Income based on taxation does nothing at all against the ongoing plundering of everything and everybody through Usury and the wider monetary system. It does nothing against Plutocracy. A National Dividend through for instance the LVT would, however.

The main thing is, people are clueless about the kind of abundance we would create in an interest-free economy. We should think in terms of five times the current standard of living combined with a fifteen week working year. Combined with a Cultural and Architectural revolution that would be implicit in such a scenario.

Compared to this, the Basic Income just looks like a bone thrown to us by our betters.

There is also the issue, that all wealth is created through hard work. Every man should share in that. The fact that robotization is now replacing many jobs does not at all change that. The problem is not robots, the problem is that they are in the hands of the usual suspects, who get all the added value they produce.

Not only that, while it’s wonderful that much boring, dangerous and dirty work is being automated, this does not at all mean that there will be no work in the future: people by their nature are a creative force and creation is work. We will simply turn to different, more enjoyable and challenging fields of work. There will never be a shortage of work! Much remains to be built and undertaken.

That is: if we have a just monetary system that allows the commoner access to his fair share in society’s credit. Otherwise he will never be able to gain real independence from Plutocracy.

It is for these reasons that the Basic Income is widely promoted by all sorts of shady ‘Green’ and other leftist/Marxist outlets. These are typically funded by Globalist institutions like the UN, Governments and leftist ‘social justice’ funds.

The Marxist Globalist Super States that are now slowly manifesting everywhere in the world have little to fear from current Basic Income schemes.

Conclusion

The Basic Income in the form of a National Dividend based on the commonly held wealth of the Nation is definitely a very serious proposition. It would go a long way in the liberation of the Commons, although the need for interest-free credit would remain pressing.

Obviously, this is not likely the way it’ll pan out. The focus is too much on wealth redistribution and too little on the how and that’s why the scheme is easily coopted by the Bankers.

Too much on a ‘right’ to sustenance, instead of the right not to be slaves.

Currently, it mainly deflects from the core issue: the right not to be robbed from the fruits of our efforts. We lose up to 90% of our income to Usury, taxation, rents and high prices through Monopoly and associated artificial scarcity.

Ending that would see a hard to imagine and sustainable spike in living standards for all but the very richest.

From a Marxist point of view, the Basic Income is clearly designed to obscure this and replace this fundamental right not to be robbed with a handout by the State. It will definitely also reinforce the ‘useless eaters’ meme as many people, disenfranchised and without funds, will do very little to add value to the Commonwealth.

As it stands now, we should be very wary that the Basic Income is not going to be used by the Powers that Be to further gut the Middle Class by taxing them for this purpose.

Related:

How Usury Encloses The Commons

Socialism is not the Answer to Capitalism

Social Credit

problem is even less people recognize usury’s twin, rent. any basic income will be quickly absorbed by rent-seekers (the real “useless eaters”), unless the law prevents it, such as with a 100% LVT. all rent should be taxed at 100%, because the basis of rent is the “use” of durable goods, in which the “use” of an object is magically distinct from ownership of the same, but this is absurd and imaginary. There is no labor or actual exchange of goods behind any rent payment, except incidentally–rent, like interest, is purely a function of time!

Yes, they both are unearned income.

You’re right with your basic point, that rents rise to suck up extra wealth. This is a downside of raising wages, for instance.

I’m not sure BI will lead to rising rents, since many people will have little more than the BI to spend. But if it’s done well, as with a national dividend, it will not be a problem.

“There is no labor or actual exchange of goods behind any rent payment, except incidentally–rent, like interest, is purely a function of time!”

this is false, there is conquest in it. Bloody wars, lot of sacrifice, defense costs.

Also the endeavor of people going to a distance land and open a place (tons of labor) to someone’s family.

distant*

If you factor in all the suppressed technologies in free energy(e.g., Tesla) and medicine (e.g., Rife), there should easily be enough surplus wealth to make working for basic necessities of life economically obsolete.

The charade of scarcity is maintained solely to keep 99.99% of humanity in slavery and from exploring their higher capabilities as human beings.

Agreed. But funding is the key issue. If the BI is a result of redistribution of the wealth of the Commons, grand. But if it’s used as Marxist egalitarianism, decapitating the Middle Class with income tax, they can keep it, for as far as I’m concerned.

As usual Anthony another deep an insightful article exploring an exposing the intentions of Money Power. Can you describe LVT in some further detail and how we can use this to produce an authentic Basic Income, and could this been seen as a positive step towards the holy grail of an interest free credit system for all?

Thanks Laurence and yes, I have something coming up!

Excellent article, as usual, Anthony.

Good to hear that this possibility is “being discussed”. However, is there any hope of an acceptable system emerging with the same people running it?

The reality is that wage work is not and will not be available in sufficient duration and wage amount to support any known middle class life style for the majority. Therefore some type of income method or money rationing will be required to support a semblance of the consumer economy. Just a fact not a rant.

Reblogged this on TheFlippinTruth.

Rents are costs above the real cost of production. Real costs are obscured by our money and finance system. Land Rents are a subset of rents. Usury by this definition is a subset of rents.

Flat income tax is a rent scheme: Through usury and other hidden schemes half my labor output is transferred to rentier. I’m taxed with flat tax on my portion, and rentier is taxed the same flat amount also on my portion. Therefore as a producer I’m double taxed.

If I own an apartment complex in New York, it depreciates at a “legal” scheduled rate. If my income is $1M/yr and my depreciation offsets that amount or higher, I pay no income tax. My income is tax free, yet my property actually appreciates. At the end of depreciation schedule, I sell my property to one of my in-group buddies, and he sells me his property, to start the cycle again.

I’m the largest Oil company in the world and I take my profits in Panama. No income tax there as it is “Flag of Convenience” country, yet transactions are in dollars. I jack up input prices of crude flowing into Texas refineries so refinery profits are minimal, hence lower income taxes will be assessed. On the ledger in Panama I take all the profits the market can bear and thus avoid taxes. Off-shoring to a subsidiary in a tax haven country in order to avoid taxes are rents. It is even more doubly a rent if the company used public commons and taxpayer funded largess to get its start. All high tech and internet companies benefited from tax funded public expenditure.

If I am a captain of industry working in tandem with Wall Street finance (loans) to ship jobs overseas, then I’m engaging in rents. I shift know how, which can be perceived as a commons gift from our laboring ancestors, over to foreign lands. Posterity, meaning the next generation, is screwed over by Wall Street as finance seeks today’s profits from wage arbitrage. Past know how was monetized to take profits today and screws the future. It is non trivial if you are one of the ones who cannot work or eat due to these rent schemes. You are denied basic existence – you are put into slavery.

Rental value on land is a great tax because all economic activity is derived ultimately from land, and land is a commons. However, man is a rent seeking animal, and we need a moral institution dedicated to ferreting out rent seeking in all it guises. A monetary authority, in service to the people and guided by law (not populism) is the key institution missing from all previous forms of republican governments. The former Republic of America passed away fully starting in 1912 with 16’th, 17’th, Fed Reserve, IRS, then WW1 and WW2 debt hooks. USA is now a democracy (the worst form of government) run by and for rentiers.

The U.S. has three large rent seeking monopolies that drive both public and private policy. The U.S. is a polity that no longer is servant to its people, and hence may be a danger to mankind. These monopolies formed as an outgrowth of 1912 Judeo Kaballah takeover e.g 16’th, 17’th amendment, FED, etc.,:

1] Extraction Industry: Farming, Oil, Gas and Mining, Power; these industries try to monopolize land commons. Land commons in turn are a gift from God, a birthright of all humans. The rise of GMO foods can be seen as an effect of rents as Farming becomes monopoly industrialized and distorted to the needs of distribution and profit rather than local economy.

2) Military Industrial Security Complex: This complex bribes politicians via Senators using money flows set up by the legal/money machinery system now in place. War and Fear are what they produce in order to steal your labor output. We get frisked at airports and have militarized police, so this group can profit and ostensibly protect you. Laboring for war and destruction means that labor is diverted from more beneficial activity.

3) Finance and Wall Street: This is the key linchpin and mother of all rents, as Finance is based on FIRE (finance, insurance and real estate). Credit money issued for FIRE distorts land prices and allows debt instruments to be concentrated into pyramid control. Therefore Wall Street and Banker Finance directs money policy via concentrated debts. These debts grow exponentially due to usury, allowing a slavery control mechanism as people run to grab vanishing credit money out of money supply. Private banker credit money due to usury and other rent schemes is always in short supply relative to what the debt instruments demand. In other words the ratio of debt instruments to money is always greater than 1. Debt instruments are no longer being haircut, or jubileed by law, nor marked to market realities. Instead these debts as “assets” are being propped up by QE which distorts the economy and benefits those who hold debt instruments. Those who hold the debts are those who created money/debts at moment of hypothecation – the banking/finance class.

Interest seigniorage is first use of money. When people pay back their usury in advance of principle this is yet another rent collected by finance at the expense of all others. This rent distortion alone can claim decades off of a laboring person’s life.

A proper money system would eliminate usury and have fiscal policy that taxes away unearned rents. The concept of what rents are has been normed out of our language, and to have a discussion is practically impossible because the language doesn’t exist. When one says the term “rent” others immediately think of rent as something simple, like renting an apartment.

Great post. One point of disagreement. You are all wrapped up with the evils of usury. I will readily capitulate that it is possible to operate an economy without interest but I don’t think it is practical to operate without a bank account and a business that takes care of our transactions. We call them banks and we want them. Those banks are a business and businesses want to earn a profit as their reason for being. Interest on loans is just a mechanism for gathering profits. You could do it by charging fees or come up with any other contortions you please but interest is just profit.

So here’s where people go wrong. We all realize that you can’t issue a dollar and demand repayment of two without creating the 2nd dollar. If it is unpayable, the debt compounds. You’ll get no argument from me that this is pretty much how banking works today and it is entirely the reason we are all debt slaves. So what is the apparent disconnect? It is simply the twisted notion that interest is bad. If you issue a dollar, give a dollar in social credit and demand repayment of 2, there is simply no problem because the transaction now balances! What is needed is balance! Everyone in the production value chain wants to get paid – including banks. What people fail to grasp is that our problem is NOT interest. The problem is THE GAP between prices and incomes. You could completely outlaw interest and the economy would fail because every other supply chain participant wants to meet their costs and all that is available in the economy to meet those costs is wages. The solution is so simple, it boggles the mind. Create the gap money out of thin air – DEBT FREE – and give an equal share to everyone in society. Solved! Done!

What we don’t want is to be screwed by the oligarchs. They have taken ownership of what is not theirs – the right to create money. The simple fact is – and here is where we agree – a dividend can be issued without negative consequences right up to the amount needed to cover the gap. By all reckoning, this is at least $30K/year per adult. You are absolutely correct that HOW this gap money is created is absolutely CRITICAL. It must be created out of thin air and equitably given to all. Is that fair? Hell yes! Who gets credit for inventing the wheel? Who gets credit for the fact that all our food needs requires only 1/1000th of our population when less than 2 centuries ago it required a few orders of magnitude more? This “increment of association” has been built up for centuries and is the property of the commons – just as surely as raw materials are. You always bear witness to social credit and I commend you for that. But I want to go one better. Social credit is simply the BEST solution because it solves the most problems with the least amount of blow-back. It fits best with how things already work. It will require the least restructuring of our economy to integrate.

You are also correct in pointing out that people should not benefit at the expense of others. Getting our fair share of the increment of association is not a handout and it diminishes nobody. This is simply the way a just society should work. I declare that in the fullness of time, this is how it will work. I encourage you to stop muddying the waters with talk about usury. It is true that those who charge interest are screwing us but it is not for the reason you offer. It is because they have proclaimed OWNERSHIP of the right to issue money and have created a deliberate shortage of it. Furthermore, they have DENIED the debt-free issue of the money needed to fill the GAP because that would cut into their PROFITS and reduce the amount of money people need to borrow and therefore their market share. Let’s get our heads on straight. The problem is not usury. The problem is THE GAP!

Unfortunately, Anthony has alway asserted, erroneously, that the so-called “gap” (i.e., the inherent, intrinsic and increasing excess of the rate of flow of financial costs and consumer prices relative to the rate of flow of consumer purchasing-power) is caused by the charging of interest, which he equates with something he calls “usury.” He has implied that this was also the Social Credit analysis, which claim is incorrect. C. H. Douglas discovered from inductive investigation the inherent deficiency of effective consumer purchasing-power–and analyzed it as deriving at base not from interest but from a fundamental error in the methodology of real capital cost-accountancy and the premature cancellation of credit by banks in respect of real capital.

In accordance with orthodox accounting convention, money is extracted from the consumer in retail prices in a manner which suggests that we physically consume our real capital at the rate at which we produce it. This is, of course, absurd inasmuch that real capital has a physical shelf life extending decades and sometimes even centuries into the future. Due to this error in cost accountancy we pay twice over for real capital–once by inflation when the money paid out during its creation inflates prices of existing consumer goods and again when capital costs are recovered as allocated charges additional to the income generating payments (wages, salaries and dividends) in consumer prices. Allocated charges do not distribute purchasing-power in the costing cycle in which they appear and their equivalent exists nowhere as available unattached purchasing-power. As the capital component of price rapidly exceeds the human labour component as cost, the chasm between final financial costs and prices relative to distributed consumer incomes rapidly widens.

In his book, “The Veil of Finance”, Social Credit author Arthur Brenton, Editor of the intellectual British journal, “The New Age”, says of the bankers’ premature cancellation of purchasing-power: “The fact that such actual cancellation of money goes on as an invariable practice of modern banking is the crux of the whole economic problem, and no person who does not grasp it and its significance is in a position to contribute any assistance whatever to the solution of our industrial and social troubles.”

Stated very simply, the major financial problem resides in the proper charging of consumers with capital depreciation while simultaneously failing properly to credit them with capital appreciation, which greatly exceeds capital depreciation. The introduction of real capital means increasing use of technology to achieve greater output of produced goods relative to input. This we rightly call increased efficiency which should result in rapidly falling financial prices if the financial system reflected reality–which increasingly it does not.

Under existing circumstance we are forced to contract ever-expanding bank debt in a futile attempt to overcome the growing deficiency of effective consumer income. But money created as debt does nothing to solve the essentially non- self-liquidating nature of the existing financial system. It allows us to draw from the stream of consumer goods emanating from the production line by transferring these costs as a financial charge against future production. It does not finally liquidate financial costs but merely transfers them as mortgage against future incomes. The pseudo-income created by bank loans is cancelled as purchasing-power when spent on consumer goods and business pays off its bank loan or places it to capital reserve.

Anthony has accorded some merit to what he perceives as the Social Credit position, without, however, properly comprehending that position. He has said (elsewhere) that Social Credit would assume a monopoly of control over credit. This is incorrect: Social Credit would assume the position of issuing money in respect of the rapidly expanding deficiency of consumer income which at present is serviced by “money” created as consumer debt by the banking system. Social Credit would break the existing Monopoly of Credit held by the banking system. It would end the need, on a macroeconomic basis, for consumer debt altogether and with it all of the interest charges associated today with consumer debt, which debt is unavoidable if production and consumption are to function under existing rules of finance.

The injustice of modern banking is not that banks create “credit money” as loans but that they claim the ownership of this financial credit which they issue against the real credit of the community, which productive capacity they, the banks, did not create. And, they issue production credits in a manner which ensures that the consuming public is increasingly short of adequate purchasing-power by which to buy the final product of industry and, in so doing, should otherwise be enabled finally to liquidate the financial costs of production.

Anthony refers to the real cost of production but appears to see the reason for inflated prices as attributable to included and accumulated interest charges. I have seen no evidence whatsoever that he understands the Douglas analysis of real cost as being consumption–said real cost being reflected not by accounted financial price but by the actual relationship of consumption to total production where the latter continually exceeds the former. Hence, he appears not to understand the need for compensation of retail prices at point of sale–nor for the creation of a properly constructed National Credit Account.

Anthony is rightly concerned to assure citizens rights of access to the “commons”. He does not seem to recognize or appreciate, however, the comprehensive manner in which the Social Credit National (Consumer) Dividend and Compensated (Retail) Price mechanism, accompanied by appropriate changes to national accountancy, secure such access by conferring upon each individual citizen beneficial ownership of the currently banker-appropriated communal capital, by right of access through inalienable inheritance, in the Cultural Heritage of mankind, as consumers to the final products of industry.

I refer the reader to Dr. Oliver Heydorn’s recent 550-page book “Social Credit Economics” which deals exhaustively with this overall subject: http://www.socred.org

Major C.H Douglas never seemed to understand that floating money is recalled by taxes. If you issue debt free floating money, it is not credit because it doesn’t have a debt instrument associated. If you have social credit you then need to pay close attention to fiscal policy – taxes. The tax is what pumps floating money (FM). Demurrage can also pump FM with velocity force, but no direction. Taxing rents and having a money supply of both sovereign credit and sovereign money would be an advanced money system with plenty of scope for dividend. (see link below for Sovereign type money)

Usury on floating money can be re-spent by taxing authority, and hence its “usurious” nature is diminshed, especially if respend path goes into the commons or households.

Douglas always assumed money had an accounting cycle – where the ledger wants to recall its credit. Douglas would talk about credit and FM in the same breath, when they are different units.

Debt Free FM can be considered off ledger. Some call this money type permacredit. Permacredit has no accounting cycle, it is simply available to be used for tranasactions relative to some base level of economic activity (60% of economy would be a good number maybe?).

http://sovereignmoney.eu/

The Gap is a function of usury and waste, as industry wants to recover their costs in prices. Limit rents (which includes usury) then prices fall. To my mind, the Gap may be considered another subset of rents.

That Said… A sovereign system is unlikely as banker parasites are dug into the body politic, and won’t let go of their easy and controlling rentier life. It is good to be GOD.

Anthony is on the right track to create an alternate system.

I agree.

Particularly also with ‘The Gap is a function of usury’. Douglas realized this too and before the war was quite open about it. But after the war things changed, for quite obvious reasons.

One more thought… How stupid is it to blame interest on our economic woes? It is as stupid as to assert that we must get rid of rocks on the road because it bloodies our feet. No, get a pair of shoes! Let’s fix the right thing. The rocks are interest. The shoes are a dividend that fills the gap. It buffers the pain and renders it of no consequence.

While I fully agree with some of your comments in the posts above and below; I wanted to first focus on what I think is a key.

The basic math of the system is both unsustainable and predatory as the interest on newly created debt money (with interest applied) will ALWAYS compound as a function of the math. It compounds both horizontally and vertically and the horizontal compounding is much more subtle. Horizontally; it compounds across the supply chain as products/services are routed to market with each link adding interest charges. Interest on interest.

Compounding will grow exponentially, no matter how it is compiled. It is happening in our economy as you can see here Death by Debt and here The Elephant In The Room: Debt Grows Exponentially, While Economies Only Grow In An S-Curve

Yes, agreed, some amount of “debt free” money must be injected into the economy in an attempt to provide the vast majority of the borrowers with enough money to repay their interest & principal. A balance must be maintained. For example, in the U.S. today there is somewhere around $57 trillion (not including INTEREST or unfunded liabilities) in public and private debt but yet the money supply; in the broadest aggregate (M3), is only around $9 Trillion; unofficially reported.

So yes, an injection of debt free money is needed to off-set the certain scenario of mass bankruptcies. But I don’t think that a Basic Income or a National Dividend is the best way. I prefer that money be spent into the economy in building and re-building the national infrastructure to provide jobs and build the “common wealth.” Decision should be made at the most local level possible.

Indeed, the ultra wealthy would continue to rake in the added value of society’s production at compounding rates. The economy would have to continue to grow to service that.

I’m not averse to injecting debt free money, but I do want to point out that we can also pay off all debts with interest-free credit. In this debtors would still be on the hook (rightly, as they acquired goods and services for the debts), but no longer for the Usury.

I think we should separate the debt into categories. First, the National Debt in broad terms and second, everything else: e.g. private and local government debt.

The national debt should be repaid with new, debt free money And I agree that the remaining debt should be replaced with 0% loans.

Excellent Larry, I’m quite happy to settle for this.

Thanks for the comment Anthony… good news indeed!

You overlook that the Plutocracy would continue to rake in Trillions in unearned income (Usury).

Rocks serve a purpose and are part of Nature. Usury serves no purpose and is contrary to Nature.

Usury is NOT profit and calling it thus was already exposed in the Qur’an, when Allah states that he has allowed commerce, but outlawed Usury. Profit is a function of commerce, where real services with added value are offered. Usury is just parasiticism, the Usurer adds nothing.

So while Social Credit to some extent alleviates the pain of the interest-slave, it in no way solves Plutocracy.

a ‘basic income’ provided by the government is ultimately no different than establishing a law dictating that a rise in the minimum wage must keep up with inflation.

today, the BI might need to be $15,000 – but tomorrow, it will be higher because inflation will require it to cross a higher threshold just to be ‘basic’. and next year it will again need to be higher.

the problem with an economy based on the exchanging of symbolic currency (for all and any purpose) is that these symbols of credit can be manipulated by those that create them. the most common scheme, of course, is to create more and more of them and then propagate the lie that these new units of currency have the very same value/power as the original units.

in an honest monetary system inflation needs to be regarded as a crime – a theft based on fraudulent misrepresentation. the ‘basic income’ which you so carefully describe only adds another veneer on this fraud under the color of ‘ social justice’.

for any unit of currency in an exchage economy to have utility it must be constrained by law and never be allowed to multiply. money, after all, is only a system of ‘relationships’ that evidence or publish the accounting of credits and debts. ‘relationships’ need a fixed reference to be interpreted. this fixed reference is a fixed amount of units in circulation. if the reference fluctuates over time then there can be no useful system – only chaos, which we have now.

usury is the seminal problem because it demands a fluctuating reference point in the supply of currency – just like injecting counterfeit currency into the money supply. if you outlaw usury you remove ‘the gap’ mentioned an earlier comment.

We are not in danger of running out of useful and important things to do anytime soon (or ever, actually). There are always and everywhere, millions of useful and important jobs to be done and millions of people who want to do them (some will require training, but…that’s just more jobs for trainers!).

We need:

– over a billion toilets so people don’t defecate i the open and spread disease and pollution

– rebuilt infrastructure in America, and built-for-the-first-time in much of the rest of the world. See here: http://www.opednews.com/articles/China-builds-infrastructur-by-Scott-Baker-American-Exceptionalism_American-Foreign-Policy_American-Hypocrisy_American-Terror-141125-643.html

– more and better teachers to combat astounding, and rising, tides of ignorance

– cures (plural) for cancer, heart disease, Alzheimer’s, etc. etc.

I’m sure you could add dozens or hundreds more jobs.

If people are rewarded for doing useless and even counter-productive things, like,say, running a hedge fund, or building armaments well beyond the need to defend the country, it is because of misplaced incentives, bad policies, and the like. We can all come up with a list of things we would like people to do, and things we wish they’d do less of. Many have argued that the GDP ought to be replaced by a more useful General Happiness Indicator for that reason.

A Land Value Tax would certainly establish fair taxation, whether it is used to fund government and/or as a citizen’s dividend. If only the latter, then one still has to confiscate money elsewhere, probably unfairly, to pay for essential government services.

Sovereign Money/Greenbacking would eliminate the need to get money from banks, as we do now, for government borrowing, a completely unnecessary and even unconstitutional practice (see: coinage clause), and would eliminate much of the power of the rentier sector to force us to do useless things. A B.I.G. then would make much more sense, since it could not be taken back as a new source of “rent.”

Scott – you use the terms “Sovereign Money/Greenbacking” as if they are interchangeable. Technically, I think they are quite different and maybe opposites. Sovereign money is created without incurring any debt to any entity – banks, private individuals, etc.

Greenbacks were instruments of debt and paid interest to the buyers of the bonds. Yes, the bonds were government issued but never the less instruments of debt. No nation can be sovereign and be indebted to others.

It is unnecessary for a nation to ever be in debt since they can create their own money, based on sovereign credit (common wealth). To go into debt is to yield sovereignty.

Greenbacks were our longest-lasting currency – 1862-1996, when Treasury burned their last stock, though they still appear on the Treasury’s debt report (251m). They appear on the report as instruments specifically NOT allowed to be used against the national debt, like silver certificates. They are debt-free money then, no matter what they were for the first year or two of their introduction (when they were supposedly redeemable in gold; that never happened either).

There is more to it. Here’s some input:

https://realcurrencies.wordpress.com/2012/08/02/lincoln-was-indeed-a-money-power-agent/

You must be kidding. I submit an historical fact which can be cross-checked in hundreds of places, including the Congressional record itself at the time, and you counter that with a nearly unsourced article full of unsubstantiated accusations and claims.

Yes, it’s true the original Greenback was backed by gold, but not for more than a year or so, and even then they were never redeemed for that.

Yes, it’s true that Treasury could issue zero-rate Treasury notes, but U.S. Notes are really not that (try exchanging treasury notes for dollars at parity, and see how far you get, or using them for all public and private debts, including taxes (directly), EXCEPT for foreign debt and national debt….they are almost the opposite).

Take a look at the Treasury’s Debt Report sometime. U.S. Notes are specifically excluded from being counted toward the debt. I document some of this in my article here: http://www.opednews.com/articles/Debt-No-More-How-Obama-ca-by-Scott-Baker-Banks_Constitution-In-Crisis_Constitution-The_Constitutional-Amendments-131018-391.html

but here are the operative lines form the Debt Report:

Other Debt (in millions):

Not Subject to the Statutory Debt Limit:

United States Notes………………………………………………………. 239

National and Federal Reserve Bank Notes assumed by the United States on deposit of lawful money for their retirement ………………………………………………65

Silver Certificates (Act of June 24, 1967)………………………………172

Other…………………………………………………………………………. 11

Total Not Subject to the Statutory Debt Limit……………………….. 488

And was Rep. Ray Lahood simply crazy when he introduced HR 1452, which reads:

http://thomas.loc.gov/cgi-bin/query/z?c106:H.R.1452:

“To create United States money in the form of noninterest bearing credit in accordance with the 1st and 5th clauses of section 8 of Article I of the Constitution of the United States, to provide for noninterest bearing loans of the money so created to State and local governments solely for the purpose of funding capital projects.”

and…

” The Congress hereby finds the following:

(1) As of the date of the enactment of this Act, money is principally created in the domestic economy by banks through the process known as `deposit expansion’ under which credit is extended by banks to customers in exchange for the assumption of an obligation by each customer to repay the amount of any such credit with interest.

(2) The creation of money through the extension of credit and creation of debt, a traditional banking function, preceded the establishment by the Congress of, first, the national banking system and, subsequently, the Federal Reserve System.

(3) The constitutional authority to create and regulate money does not limit the Federal Government to creating money through the production of coins or currency or the process of debt creation but, except for a brief period during the administration of President Lincoln, the Federal Government has not exercised such authority more broadly.

(4) The creation of money by the banks in conjunction with the Federal reserve banks does not limit the constitutional authority of the Congress to create Government credit funds in the form of noninterest bearing credit to fund a legislatively approved program or prevent the Congress from creating such funds.”

It is indeed, more complicated….

Are you saying that U.S. Notes show up in a debt report but are not really debt? The line item debt may not count against statutes like the debt limit but they aren’t they being tabulated as debt? Or are they like the social security “trust” – a “quasi-liability”?

Treasury notes are bonds solely secured on the credit of the United States and the banks simply use this leverage to create money that they never had — what did they lend? Sovereign credit can be used to create instruments of wealth – debt free money.

Treasury notes are created as debt; which is worth noting as this is a choice. Instead of issuing treasury notes, a sovereign may issue money.

Thanks for the article, it has some great stuff and I learned a lot. Love this part:

Ya Mon!

Yes, they are not really debt, though they were originally conceived that way. This is not too surprising when you consider that the very last thing the private banks want is for the gov’t to be able to print/inflate its way out of debt. That would effectively reduce the value of bank loans to zero. This exclusion goes all the way back to the original Lincoln Greenbacks. It wasn’t a problem for Lincoln, because he just wanted them to pay the northern troops during the Civil War anyway, not to pay off debt to the banks. Today, we could use Greenbacks to pay for infrastructure, or even Social Security (and eliminate the regressive payroll tax). SS actually returns $1.80 to $2.00 for every dollar spent on it via the money multiplier, so it’s not only a good investment ethically, it makes very sound economic sense. See here: http://www.opednews.com/articles/Asking-How-to-pay-for-Soc-by-Scott-Baker-Banking_Social-Security_Social-Security_Social-Security-Cuts-140330-949.html

your comment that ‘ it’s not for nothing that the bible states if one does not work, neither should he eat’ is taken way, way, way out of context.

the entire thrust of the bible is to display the magisterial wisdom of god as the author of FORGIVENESS. the opposite of forgiveness is to trade or exchange for equal value. to forgive is a relationship between two souls – not between a government and a citizen. a government cannot forgive because forgiveness comes from the heart. institutions have no heart.

An income that produces nothing will cause inflation to the point that the income will eventually buy nothing.

That depends Dugan. Redistributed income (whether it’s income provided by exploiting the Commons or by robbing the Middle Class) is inflation free as it does not in any way expand the volume of money.

Outside of a fractional reserve system, money created and offered as national dividend does not create inflation as long as it doesn’t exceed production capacity.

We have some experience with paper backed by other than gold and silver and not created with debt.

http://www.philadelphiafed.org/publications/economic-education/ben-franklin-and-paper-money-economy.pdf

“Manifestly nothing can be more absurd than to suppose that the abundance of currency produced the prosperity of 1863, 1864, and 1865, or that the want of it is the cause of our present stagnation.” —James Garfield (future President of US)

http://metchosin.wordpress.com/

🙂

please avail yourselves to the law (as it stands and as it evolved)

http://www.yamaguchy.com/library/uregina/act1868.html

regarding the united states notes

>>>>> Yes, it’s true the original Greenback was backed by gold, but not for more than a year or so, and even then they were never redeemed for that.

actual fact is: they were redeemed in gold if presented; following the reorganization of the national currency bank system (with which H.A. Lincoln blessed the Union) into FedRes the member banks presented $170milllion US notes for gold (and received)

Only the 1953, ’63, and ’66 US notes were not promises to pay (pure fiat)

>>>>which can be cross-checked in hundreds of places, including the Congressional record itself at the time,

what part of the Record have you read ? and recommend for us to read ?

~~Nicholas Biddle, President

Geo-politics and Recent Vatican Intrigues

http://jaysanalysis.com/2013/03/17/exclusive-report-geo-politics-and-recent-vatican-intrigues/

Malichi Martin was a fraud, philandered and a freemason — among other scandalous things. See the following http://mauricepinay.blogspot.com/2013/07/the-file-on-malachi-martin.html

Soviet Cold War Subversion, Illuminism and Psy Ops

http://jaysanalysis.com/2013/01/04/soviet-cold-war-subversion-illuminism-and-psy-ops/

Yankee Leviathan, by Richard Bensel, pages 262-267. Anthony, you have this book.

My addition: Money is a creature of the law and behavior is due to system design. Greenbacks flowed in a system much different than what we have today. Greenbacks could redeem bank notes but not vice versa.

Bensel: When Greenbacks were used to make deposits in banks, reserves automatically increased. When bank notes were deposited, bank reserves decreased relative to legal requirements (fractional reserve ratio). Most of the time, banks paid out bank notes and retained greenbacks.

The most important operating requirement relating to paper currency: in order for the financial system to work smoothly, the national banks had to have access to a ready supply of Greenbacks.

My addition: Sovereign system design provides this operational requirement as there are no separate loops for bank reserves and another for bank credit economy. Most of the money in supply is wealth based debt free monies, and credit is also available and used to its benefit. Properly used, credit would be instrument that flexes to S shaped economy coming into existence as needed and disappearing after its use has passed.

Bensel: A shortage of greenbacks would induce financial panic. Greenbacks would disappear from bank reserves during downturns in stock markets. A steep fall in stock prices would produce rapid liquidation of call loans. This liquidation would feed further selling on stock exchange and create a vicious downward spiral.

In practice, crashes on stock exchange were usually induced by stress that accompanied harvest/planting cycles and (banks) were seriously threatened during those periods.

My addition: Harvest/planting is S shaped economy, and the money system must flex accordingly. Enough money needs to be available during planting, and at harvest to buy produce. Greenbacks being pulled out of reserve loops had a multiplier effect on fractional reserve bank money, causing accelerated feedback e.g. downward spirals.

Hello Anthony,

I agree that conventional basic income proposals do not solve the problem (which, from a Social Credit standpoint, is the chronic lack or deficiency of real consumer purchasing power) and that they could very well be used via increased redistributive taxation to gut the middle classes.

I have written at some length on the key differences between Social Credit’s National Dividend and the basic income here: http://www.socred.org/blogs/view/the-big-difference-between-a-basic-income-and-the-national-dividend.

On January 15 the corporate entity of Canada, subservient to the Crown of England, will give way to The Republic of Kanata, constitutionally established by the people according to common law. To become a citizen one must “declare your formal citizenship within the Republic by taking a Pledge to the Republican constitution and receiving official identification as a member of the Republic, including a passport and citizenship papers. You can also take an oath of office as a sheriff or other public official, and become involved in your local branch and District, by contacting republicofkanata@gmail.com . ”

The aspect relevant to this discussion has to do with one its reforms to implement a basic income for all citizens of the Republic of Kanata:

“Prosperity: You are eligible to receive up to two hundred hectares of land formerly held by the so called “crown”, as well as a guaranteed annual income from the wealth formerly hoarded by the crown agencies and their super-rich corporate partners.”

All debts to the Crown will be abolished as well as income tax too.

http://itccs.org/2014/12/30/the-republic-of-kanata-and-its-common-law-the-facts/

http://itccs.org/2015/01/01/independence-day-is-january-15-republic-of-kanata-notice/

This is a game changing revolution and it’s occurring without any violence. It shows what power the people truly possess if they only stop depending upon authorities of a system (Admiralty Law) that does not have their interest at heart to save them. We can save ourselves if only we reclaim our inherent rights under common Law:

” The basis of all legitimate government and authority. It is inherent in all men and women and establishes them as unconditionally free, self governing and sovereign people whose life and liberty cannot be subverted by any power.

The common law is superior to and outweighs all government statutes and other legal systems such as church “canon law” and so-called “admiralty law” employed by governments to rule arbitrarily. “The common law is common sense written by God in the hearts of the people” (Justice Edward Coke, 1628)”

What you’ve said sounds very reasonable to me but there’s one snag I see. What do you do about Women that have numerous children while having no way to take care of them? In the US many Blacks would have extraordinary numbers of children if they got paid for each one. Same with Muslims in Europe.

“The Welfare State is a key Marxist goal.” – According to whom? To you?

Because I don’t think Marx defined the Welfare State as a key goal in his theory. Marx was mainly concerned with concepts and the theory of alienation from labour, theory of value and the critique to capitalism in a historical materialism (descriptive, not normative) way.

I am not saying that he never adressed the Welfare State in his theory but I think you should be a bit more carefull on generalizations that are confusing and misleading. After al:

“Karl Marx famously critiqued the basic institutions of the welfare state in his Address of the Central Committee to the Communist League by warning against the programs advanced by liberal democrats. Specifically, he argued that measures designed to increase wages, improve working conditions and provide welfare payments would be used to dissuade the working class away from socialism and the revolutionary consciousness he believed was necessary to achieve a socialist economy, and would thus be a threat to genuine structural changes to society by making the conditions of workers in capitalism more tolerable through welfare schemes”

So it might not be so dogmatic as you present it during this text.

The problem for the Marxists was, that they didn’t get their revolution after 1918.

They realized it was too early and started all sorts of projects to bring in Marxism piece meal.

The great advantage of welfare from the Marxist point of view is that it creates state dependency.

Someone said (i forget who) they would fund a basic income by introducing monetary reform and creating public service banking and taking the interest earned from the banking and dividing it among the citizens. The LVT you mention i think would raise around 2 trillion.

A reasonable article, Anthony.

I’m not sure that the champions of the UBI have considered (1) whether it would be inflationary, given that it would see nothing more produced overall than currently and (2) how any resulting inflation would affect the poorest in society. This latter group would include those whose sole income was the UBI.

The Australian professor Bill Mitchell has proposed a job guarantee (JG) scheme as an alternative to UBI. In this system, anyone physically capable of work (and ‘work’ could be broadly defined to include caring for children, for instance) would be required to work. They would be able to work in guaranteed jobs for up to 38 hours a week and would be paid at an hourly rate that would become the new de facto minimum wage.

In my opinion, this is a superior proposal to UBI. It will provide a higher income to those who are currently unemployed or underemployed. It will produce real benefit in terms of goods or services (there is actually a mountain of work which needs doing in any community – the problem is that our economy won’t pay for it). As such, it will not be as inflationary as UBI. It would do away with the notion of the unemployed as lazy and undeserving, since they would be working for their income. It will also give the unemployed skills and an opportunity to avoid the social isolation which commonly goes hand in hand with unemployment.

It could be paid for under a system, similar to MMT, where the state was the only entity which could create new money.