The Case for Regional Currencies

Regional Currencies are an integral part of comprehensive Monetary Reform. Areas like the United States and Euroland are far, far too big for one monopoly unit. Not only does it allow irresponsible and dangerous power centralization in the hands of those that control the currency, the Euro crisis shows another forgotten problem: regional imbalances.

For most in the United States the dollar seems an inevitability. But it was only in the aftermath of the Civil War that Lincoln’s Whig party got what they had been aiming for for decades: national currency. Up to then all sorts of currencies had circulated. First the various scrips of the colonies, later competing banking currencies. Then already the main aim of a ‘national’ currency was not well being, but centralizing power in the hands of a few.

However, it relegated the more remote areas of the United States to eternal depression.

Regional imbalances

As we have seen with the euro crisis, in large currency areas regional imbalances are inevitable. Greece imports more from the North than it can export to its suppliers. As a result it has a negative balance of payments and loses euros to Germany, Holland and a few other countries. This means deflationary pressures (a dwindling money supply) that can only be solved either by going deeper and deeper into debt to maintain a healthy money supply, or structural redistribution from North to South through Brussels. The latter, of course, was the plan of the Eurocrats when they implemented the Euro. But while the Germans like importing Euros from Greece, it does not like giving them back. And who can blame them? They delivered goods and services for them.

This pattern is clearly recognizable in Europe through the Euro crisis and at the time it was predicted by a number of economists. But few realize this is always going on any national economy that is more than a city state.

For instance: the economy of the small nation of Holland is basically centered around the West, where Amsterdam is still at the heart of it all, complemented by a number of lesser cities. However, the North and South have forever known depressed economies, with difficulty getting full employment and structurally lower price levels. It is exactly the same issue: negative balance of payments with the core, in this case the West of Holland, net outflow of money (earlier Guilders, now Euros) and deflationary pressures as a result.

In every economy, even in a mature currency area like that of the United States, every region still generates most of its production through trade with regional partners. Yes, under the pressures of globalization and the ongoing onslaught of Transnationals against local economies, less and less is regional trade, but it still is quite substantial. There is basically no reason why this trade should not be financed with regional currencies. It basically is completely unnecessary and actually insane to allow these economies to wither away just because they cannot cope with (inter)national competition and as a result have too little money circulate locally to finance its regional economy.

The same is going on in the US where regions like Arkansas and rural States are under-developed and often actually quite poor.

Economists and bankers will explain ‘structural adjustments’ are necessary: people must give up natural rights to accommodate international corporations so that they can compete with core areas. Labor markets must become ‘flexible’, meaning lower wages, fewer worker rights. Of course, in the minds of these people, regions exists to provide optimal return on investment for capital.

But the simple truth is that economies only exist to provide the people with what they need for a decent life.

Centralization of Power

The Civil War delivered a death blow to State Rights and local independence and paved the way for the American Empire. National Currency, created and controlled by Washington, instead of by the States, was instrumental in this. As we know today, the Federal Government is corporation, owned by its shareholders in London and has very little to do with the American People.

The same thing is now going on in Europe. With typical banker logic the debtor nations, to be saved, must first be destroyed. They must give up control over their budgets and all fade away in the grandiose idea of Europe. Otherwise they will marginalized by the USA and China. We must all compete, of course, or go down. It has nothing to do with what the people really need. Nobody is interested, except some Eurocrats and other megalomaniacs.

The trend is clear: the Euro was a major step forward to World Currency. Where the US could still be plausibly, though not factually, be presented as one Nation, in Europe this is impossible. Power is being centralized at ever higher levels, in ever fewer hands.

Regional Currencies

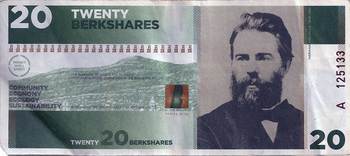

Regional currencies come in many guises, with many different monetary architectures, but by their very nature they only circulate in a regional area and are controlled by people actually living in the region.

So they both decentralize power and end regional imbalance. Local trade can always be financed, there is no dependence on (supra)national scarce currency.

If something goes wrong, through either mismanagement or abuse, the controllers will have to answer to their neighbors, instead of hide behind a police state.

This is not to say governments or even international bodies cannot create their own units. In fact, monetary stability is closely linked with the presence of different units: if one fails (usually because of corruption) than the others continue. Why should the economy be destroyed if the money men mess up? It just makes no sense.

Besides Regional Currencies there is also much scope for international cybercurrencies. Bitcoin is an example, although still rather primitive from a monetary perspective.

What would happen if Facebook created its own unit? I think everybody can answer this question for himself. The only reason it has not happened is because Facebook is part and parcel of the control grid.

Conclusion

The monopoly on currency must go. Why offer dozens of brands of crisps at a supermarket and call that ‘consumer choice’, while insisting on one size fits all currency controlled by those proven guilty?

The good news is that there is no legal monopoly. There are only legal tender laws. These give Fed Notes and the Euro its power, but it is not a monopoly. And well managed private party currencies of all sorts have managed to find a place under the sun.

We don’t have to wait for either the banks or the government to clean up their act. They never will.

Comprehensive monetary reform requires local and regional units, to combat imbalances associated with too big currency regions, while ending excessive power centralization.

Dedicated people can create fully viable currencies chipping away at the Money Power’s domination and interest slavery.

Related:

Take your Money out of the Bank NOW! (Video)

Bitcoin, Impressive, but Flawed

Regional Currencies in Germany: the Chiemgauer

The Swiss WIR, or: How to Defeat the Money Power

i remember from my school days at Brandeis University in1970’s my student adviser’s words that when he was growing up that his parents used the term “‘goyishe kup,’” meaning that the “Non-Jews are Stupid”

I learned that of “GOYISHE KUP” means that the “Cattle are STUPID”.I agree with the Jewish saying that American “GOYISHE KUP” are indeed” Stupid” as they believe that Muslem Kids who were unable to Fly a Cessna plane took it upon themselves to FLY a Boeing 767 & outwitted the US Military & Civilian authorities. The “Jewish Lightning Insurance Scam” of the 1960’s is still alive and well has been put to use by Larry Silverstein in putting 15 million cash down and comming out with 7 billion dollars for buidings where it would have cost a billion dollars to remove the asbestos The Americans believe that they decide who is elected President or for that that actual VOTE is really counted in deciding who represents them in the White House and congress.

http://www.bing.com/videos/search?q=911+missing+links+watch+movie&view=detail&mid=51A7141F33FBB715D84C51A7141F33FBB715D84C&first=0&qpvt=911+missing+links+watch+movie

bollyn.com

http://www.youtube.com/watch?v=rVTXbARGXso http://www.911missinglinks.com/

http://www.youtube.com/watch?v=DxnpujfanUM whatreallyhappened.com

Yeh I agree that the AmericanNon-Jews are indeed “GOYISHE KUP” or “STUPID CATTLE”!

The Israeli Defense Firm That Tallies The Iowa Caucus

By Christopher Bollyn

1-1-8

The Iowa caucus is only a few days away and the nation’s attention will be directed to the results, which signify the beginning of the U.S. presidential race. But does anyone watch who tallies the results of the Iowa caucus?

The Iowa caucus results were tallied in 2004 by a company that is headed by a man whose company was bought by Elron Electronics, the Israeli defense firm. I suspect that it will be the same this year. Don’t expect to see any grassroots political activists doing the tally in Iowa. The Israeli defense establishment takes care of that part of the American “democratic” election process.

VOXEO

In the summer of 2004, I first learned that a foreign and out-of-state company using Interactive Voice Response (IVR) technology tallied the Iowa caucus results.

The system used to tally the 2004 Iowa caucus results was provided by a company called Voxeo, which was apparently based in Orlando, Florida. (Yellow flag goes up in the mind of those familiar with Orlando and electronic vote fraud history. See Bollyn article on Wang below.)

The calls from the nearly 2,000 caucus centers in Iowa went to a Voxeo call center in Atlanta, Georgia.

On January 31, 2005, I wrote to Michelle Bauer, Iowa’s Secretary of State with some questions about the use of Voxeo, a foreign company located in Florida, to tally the results of the Iowa caucus:

Subject: How was the Iowa Caucus Tallied?

Dear Sirs,

When I visited the headquarters of the Democratic Party in Des Moines last summer, I learned that the tally of the Iowa caucus had been “out-sourced” to a company in Atlanta, Georgia.

What this means is that the tallying of the Iowa caucus results was done over the telephone, using the touch-tone buttons, to enter the results from each caucus locationS

I am interested in how this was done, and why. Why did the Democratic Party allow the crucial tally of the caucus results to be done by a company in Atlanta? Don’t they trust their own math skills?

Can any of you provide any information about this matter?

Kind regards,

Christopher Bollyn

A person named Mike Milligan wrote back on behalf of Secretary of State Bauer:

Mike Milligan wrote:

Dear Christopher:

The Secretary of State forwarded me the email you sent to then on Monday, January 31, 2004 [sic] regarding the Iowa Caucuses.

Unfortunately, you either received some incorrect information in your travels or are confused. The Iowa Democratic Party completed all of the caucus night tabulations in Iowa, in the Des Moines/Polk County Convention Center, which was the Caucus night HQ. In fact, our tech staff wrote the software that tabulated the results.

To answer your second to last question, we feel we have a comfortable grasp of mathematics.

this seems a little off topic, no?

Comprehensive money reform would put money in its place….equal with toilet paper. Comprehensive Economic reform would destroy all that paper created by the Khazars for cementing their grip on and ownership of the terrestrial real estate and contents. Reform will also rid us of the chosen elites who order the world so that they are the big cahunas. No kind of cahunas are necessary!

You cannot have comprehensive reform, yet retain the organizations and relations that caused the problem in the first place. Reform isn’t the change we want! Can we displace the Elites completely and not allow another set of ‘chosen by god’ in their place? Can we have a society where money is not important because it is guaranteed on birth? If possible, then all the current concern about debt, interest, regional currencies etc would not exist. The current economy is a fabricated structure. It can be destroyed and rebuilt in OUR image and likeness. An economic system is not their prerogative by right…it is ours.

absolutely David!

I believe regional, usury free currencies are an important in the right direction, and not the end game. But there is plenty of reason to believe that an end to scarce money could mean an end to money altogether, strange as it may seem.

Fiat money, yet another violation of our rights. The gov’t constantly violates our rights.

They violate the 1st Amendment by caging protesters and banning books like “America Deceived II”.

They violate the 4th and 5th Amendment by allowing TSA to grope you.

They violate the entire Constitution by starting undeclared wars.

Impeach Obama, support Ron Paul.

Last link of “America Deceived II” before it is completely banned:

http://www.amazon.com/America-Deceived-II-Possession-interrogation/dp/1450257437

Hi Nick,

‘fiat’ money is a bit of a bogeyman in the alternative media, due to Austrian economics and the many gold dealers out there. But actually there is a great many systems that hide behind ‘fiat’, many of the purely free market. Have a look at this article if you want to find out what different systems are out there.

This essay suffers from knowledge of a properly managed Medium of Exchange can work.

http://toddbmarshall.blog.com/2012/08/28/a-case-for-regional-currencies/

Thanks Todd. Could you elaborate a little on why you believe it does?

I agree with the article upto a point. But regions within a nations became propourous because of geogrophy. Amsterdam is a stunning port. If Europe did not exist, then Britains capital would be Bristol or Liverpool!!

The last article I comented on was about interest rates and how this was huge cost in any product or service. I thnk we got a 200k house down to 90k and 99k with interest. What we might need is one currency and reginal interest rates…low interest in poor areas and high in wealthy areas.

In France, you still get rich areas and poor areas, but no one is actually poor in the poorer areas. Most of France looks the same. Its not like the UK and US where poor areas are just poor and decaying.

I think Max Keiser`s idea for Greece is good. He suggests the Greek leaders (if they we free. lol), sell part f their sustantial gold reserves and buy silver. Then issue a silver coin, but no value on the coin, just a weight stamp. As Max points out, the US silver dollar went out of circulation, because the silver was worth more than one dollar. So as the bankers screw Greece, the people can fight back by buying these silver weight stamped coins. We have all heard of the idea/plan to buy silver and bust JP Morgan.

The problem that capital will always flow to prime locations…usually where the corporations say, can only be countered by people making hard choices and not giving then their business. In the last article I suggested that a nation who banned corporations from existing within its borders or owing businesses in that nation, or importing goods into that nation, will soon see huge investment pour into regular business which provide manufacturing jobs and an end to the globalisation catels.

Hi Carl: “The problem that capital will always flow to prime locations”

that’s one of the key advantages of regional units: they can’t leave the region. Moreover; typically transnationals will not accept them. And even if they would, they would be forced to pay locally with them, instead of taking the capital out of the region.

Komen er ook weer tolhuisjes langs wegen en kanalen? Hoera, terug naar de middeleeuwen. Geldern wordt weer hoofdstad van Gelderland, zoals het hoort, dat Arnhem dat zou zijn is historisch gezien natuurlijk een monstrum.

Laten we de gilden ook weer in ere herstellen!

En de trekschuit en de postkoets!

How so gene English? Local tale for local guild!

Ja, en dan gaat de 21e Maarten van Rossum weer Den Haag plunderen en ik word de nieuwe Hertog van Gelre!! Jij snapt het Ruud!!!

….. I have elaborated. Take my link below (and included with my comment) to my blog. It links to your article with my comments interspersed as annotations.

Todd B. Marshall

Todd Marshall permalink

This essay suffers from knowledge of a properly managed Medium of Exchange can work.

http://toddbmarshall.blog.com/2012/08/28/a-case-for-regional-currencies/

0

0

Rate This

Reply

Anthony Migchels permalink

Thanks Todd. Could you elaborate a little on why you believe it does?

I’m in favor of regional currencies as long as they can provide 0% loans. I’m also in favor of a national currency issued by a sovereign government and I think both can co-exist. In fact, I think it is accurate to say that a nation cannot be sovereign unless it exercises its power to issue its own money.

Today, once sovereign nations have become client states to those who hold the power to issue money. Damon Vrabel did a nice job of explaining this:

“Today I want to clear up one of the most important lies reinforced by the media–the idea that we have sovereign countries. No doubt most of you have heard of the sovereign debt crisis that so many countries are facing. We hear endless economists, reporters, and billionaire hedge fund raiders talk about it. But the phrase they use is fictitious. It is a fabrication of the Ivy League, Wall Street, and erudite periodicals like the Financial Times of London. Sovereign debt is an impossibility. It cannot exist.

“It seems ridiculous to point this out, but sovereign debt implies sovereignty. Right? Well, if countries are sovereign, then how could they be required to be in debt to private banking institutions?”

One big advantage with having a national currency issued by the sovereign government is that debt free money is possible to help mitigate the fact that we have much more debt than money.

For example, in the U.S.; if Congress wanted to, they could create $2.5 trillion to repay Social Security and Medicare (intragovernmental debt). The plans would instantly be fully funded and the phony debt (how can we owe ourselves money – we are both the lender and borrower!) would cease to exist.

Social Security and Medicaid would become the largest sovereign wealth fund on the planet, dwarfing the big funds in the middle east and China.

I was told about your website by a friend who is also in monetary reform.

Are you aware of the IMF economists who admitted fractional reserve banking is a bad idea. Their paper was called The Chicago Plan Revisited?

I also favor decentralization of financial power. You can read about it here.

IMF Economists: ‘We Were Wrong.’ Will Someone Please Tell The Press And The Politicians.

http://vidrebel.wordpress.com/2012/08/19/imf-economists-we-were-wrong-will-someone-please-tell-the-press-and-the-politicians/

Hi Horse,

Nice seeing you here. I’ve visited your blog on several occasions!

I was not, and I’m happy I am now, good ammo.

Anybody supporting FRB is either stupid, doesn’t understand it, or living off it.

Hearings before the Committee on Banking and Currency, United States Senate, 63rd Congress, 1st Session, on House Resolution 7837 (Senate bill 2639) a bill to provide for the establishment of Federal Reserve banks, for furnishing an elastic currency, affording means of rediscount commercial paper, and to establish a more effective supervision of banking in the United States, and for other purposes.

Thursday, September 25, 1913.

Irving Fisher speaking:–

“Now, the greatest problem, it seems to me –the greatest defect in our present system– is the inelasticity of our banking reserves; or, to put it another way, the inelasticity of the deposites which are our chief currency in this country, based on those reserves. As it is now when the bank, which is required to keep 25 per cent reserve, gets down to 25 per cent it is required by law to stop discounting. As a matter of fact, the law is often violated, and the violation permitted because the law is altogether drastic. There is this rigid limit of 25 per cent which can not be transcended theoretically at all; but it has to be, as Mr. Hulbert has just said, and therefore it is and its violation is winked at.”

“We have an inelastic volume of silver certificates, because that is based on silver purchases that have been completed. That is more or less unsound.

“Then the unsoundest spot of all is the greenbacks, of which we have $346,000,000 out, the residue of the inflation of the Civil War, and which are compulsorily kept in circulation by the act of May 31, 1978, which, it seems to me, ought to be repealed in connection with your measure.”

The Fed Res Act dealt with this ‘in-elasticity’, in Section 4, clause 8th:

“except that the issue of such notes shall not be limited to the capital stock of such Federal reserve bank”

Mr. Fisher should have been happy, but no; 25 years later he comes up with another bright idea.

Zarlenga and everybody else should consider well where this class-room computer model was hatched, before they present it as some sort of new solution (and discovery)

No. Subnational currencies are a bad idea. Nation-states should have a currency which covers the whole nation-state. Subnational or regional currencies are the starting place for division and discord, both politically and economically, which ends up being the same thing.

That is one proposition of currency reform which is no better than private currencies or private central banks.

If you want strong, sovereign, and independent nation-states then currency should be national in scope.

Interest free, without creating debt: Good.

Currency systems which encourage division within countries: Bad.

Regional currencies needn’t replace national units. They can circulate side by side.

Many people also feel deeply connected to the city they live, or the region. The Nation state is a artificial construct, although real now. But 300 years ago nobody cared about ‘france’ or ‘britain’ or the ‘US” or even ‘Holland’. They cared about the far smaller regional unit they were part of.

We express ‘identity’ on many levels: I live in Arnhem, so I’m an Arnhemmer,a Gelderlander, a Dutchman, a European, A global citizen and a member of the Galactic federation.

Anthony Migchels, a sure recipe for domination by a world government (or ‘world goverance’) is the weakening of the nation-state and all aspects of its sovereignty & independence.

Again, sub-national, or ‘regional’ currencies would weaken the nation-state.

300 years ago, the nation-state was fairly well developed in Europe, say in 1712. The Peace of Westphalia in 1648 established the principle of sovereignty for nation-states (only after a third of Central Europe’s population was killed by a primitive type of transnational war of religion).

A nation-state is generally defined by common language, customs, and founding events, or even founding myths.

At this time, it is the nation-state which has the ability (not always exercised) to physically defend your personhood from outside aggression.

This article’s attack against the results of the American Civil War has the unmistakable smell of Libertarianism.

Side by side currencies would have bad currencies chase away the good or vice versa depending on the circumstances.

Don’t let a pet idea (regional currencies) blind you to the dangers of a weak or nominal nation-state system where the strong impose on the weak (yes, I know that is already happening now, but don’t let it get any worse than it already is).

Anthony Migchels, it is strange you would down-play the nation-state — that is exactly what the Libertarians want (thus, the article’s attack on the results of the Civil War) and the ‘global goverance’ crowd wants. Libertarians also want multiple currencies or side by side currencies, a competition of currencies, if you will.

To have any chance of interest free currency (debt free), your only realistic chance is through the nation-state.

Do you want interest free currency or currency competition? Because I don’t think you can successfully have both in the real world as opposed to utopian fantasies which will never happen but will keep individuals preoccupied and not contributing to the real world of practical endeavor.

To me this article has the smell of Libertarianism — a controlled opposition piece of advocacy that plays into the hands of the Libertarians and ‘world governance’, transnational crowd.

Don’t fall for it.

The Peace of Westphalia was also the culmination and end of the 80 Years War between Spain and the Dutch Republic, where Dutch independence from Spain was formally recognized. So, this is the founding event for the Dutch nation-state.

Hi Jim,

Well, if you take a look at the faux ecoomics page, I think it is fair to say that there can be little doubt about my anti libertarian credentials, so I hope you will give me some slack.

The fact that libertarians are wrong most of the time, does not mean they are wrong all of the time.

Power centralization into strong national governments is always the plutocrat’s wet dream. He owns the state.

Lincoln is badly overrated, you can read all about it in an article I wrote about him a few weeks ago. His greenbacks were interest bearing and led to eternal indebtedness.

I think you must start to look at the situation realistically: the US may have had a reasonable government until about Lincoln. After that, it was a nightmare. The Money Power created a massive tyranny that it used to conquer the world. It was abe’s job to make it so and he did. They had been planning it for a hundred years or longer.

Just look around you: where on earth do you see a government that you believe is close to, sympathetic to, debt free/interest free money?

Just name me one. Even North Korea, Syria and Iran have abusive monetary systems. Only lybia was probably close to a real popular monetary system.

The idea that government is on our side or that we can reclaim it is really very utopic.

We need to take matters in our own hand. Leviathan, either in the market or in the massive empires of Washington, Brussels, Beijing and Moscow are owned lock stock and barrel by the same people.

It is not sovereignty of the Nation State that will save us. It is Sovereignty of the Christ working through free men, that is going to rid us of Satan’s children.

Anthony Migchels, I do give you slack, that is why I write, here, because your idea (along with many others) of interest free (debt free) currency is good.

I know you are against Libertarianism and I respect your position, as I share it, but I point out what I do because you may not be aware of all the subtle permutations or levels Libertarianism works on. One of those is an attack on the nation-state.

Anthony Migchels wrote: “The fact that libertarians are wrong most of the time, does not mean they are wrong all of the time.”

Yes, I agree. It is their ultimate conclusions and objectives which I disagree with most — their utopian views — but, yes, I also agree with certain specifics of Libertarianism, but not as an all-encompassing ideology. As an American, who believes in limited government. there is an overlap.

Anthony Migchels wrote: “Power centralization into strong national governments is always the plutocrat’s wet dream. He owns the state.”

Yes, I agree, that is the paradox, I support the nation-state and its sovereignty & independence vis-vis other nation-states and transnational organizations (including transnational corporations) and ‘world governance’ schemes. But, and this is very important, I believe in a decentralized power within the nation-state, a limited government in relation to the constiuent states (the ‘states’ within America) which is closest to the average citizen, so that the average citizen can control and has ultimate sovereignty over the government.

Anthony Migchels wrote: “Lincoln is badly overrated, you can read all about it in an article I wrote about him a few weeks ago. His greenbacks were interest bearing and led to eternal indebtedness.”

Yes, I did read your article and commented why I thought your conclusions were wrong — essentially, you bought into the Libertarian rational. Libertarians ignore or are indifferent to “saving the Union”, the continuation of the nation-state known as the United States of America. But I agree with Lincoln, saving the Union was paramount. Libertarians do not believe that.

As opposed to what Libertarians say, the American Civil War was about slavory, its expansion into the western territories and the impact on free farmers in those territories (slavory would economically out-compete free farmers, not to mention the moral component — free farmers believed they would lose to slave plantation economics).

Yes, Lincoln, initially disavowed an interest in ending slavory because he didn’t think that was a powerful enough rational to motivate the North to fight to quell the Rebellion. “Saving the Union” without reference to the issue of slavory. But looking at what Southerners said, at the time of Succession, makes it clear, they thought “succession” was about slavory.

The increased centralization as a result of the Civil War, was by necessity to win the war and, thus, “Save the Union”. I regret that increased centralization of power, but not the result which “saved the Union” and elminated slavory — nationally guaranteed individual rights (not perfectly implimented by any means, but the principle was established).

Lincoln’s green back policy was part of that necessity to finance the war. Again, not perfect for the reasons you state (issuance of debt bearing currency), but it also established the principle that the nation-state was the supreme author of the nation’s currency — Lincoln understood the potential benefial effect which this could have for the national economy — and, that private bankers in Europe didn’t want the U. S. government to control its own issuance of currency; they wanted to control it. (Not to mention the evidence that Great Britain and its Rothchild Money Power played a part in fomenting the Civil War and in the assassination of Lincoln at war’s conclusion.)

Anthony Migchels, I understand for you, “Saving the Union” is peripheral concern, but for an American, such as myself, it is a central event in the American Experience, part of my nation’s history (and I have ancestors which were on both the North and Sout side of the conflict — the vast majority of Americans, now, both North & South, are glad the Union was saved. Libertarians use the small amount of resentment still present in the southern states to popularize their Libertarian doctrines.

I do look at the situation realistically — I don’t appreciate your implication that I don’t — I see transnational bankers, the Money Power, using interest & debt to enslave the People and I say, “It is wrong.” Is it likely to change? Not if there isn’t somekind of crisis, but evidence points to the strong possibility of a crisis, possibly brought on intentionally by the transnational bankers, themselves, or because they are simply greedy beyond their own self-control. And, in that event the People need to know there is an alternative to the present system, that doesn’t rely on those same transnational bankers to “be our savior”.

In suggesting I’m not being realistic, aren’t you condemning your own efforts to get out the information you think is important? I simply disagree with the concept of ‘regional currencies’.

Anthony Migchels wrote: “The idea that government is on our side or that we can reclaim it is really very utopic.”

Did I make that statement? No, that’s a strawman argument. You know better than that.

I share your concern that the national government is out of the People’s control.

But the People, at least here in America, are theoretically sovereign, at least that’s what the Declaration of Independence and the U. S. Constitution are based on and so state.

I take that statement of the People’s sovereignty seriously and so did Lincoln and that’s something which is totally lost on the Libertarians, and, apparently, you, as well.

It was the preservation of the Union, which guaranteed the People’s sovereignty. Lincoln knew that and he also knew it was the Slave Power backed by the Money Power which wanted succession to further their interests in opposition of the average folks in the South.

A whole Union and its constitution was the best instrument to preserve “Government of the people, by the people, for the people,” and that it “shall not perish from the Earth.” as imperfect as its execution was, yes, there is always room to improve the Union, but because it is not perfect doesn’t mean it should be jettisoned in favor of some Libertarian utopia which likely will lead to some ‘world governance’ nightmare or anarcho- Law of the Jungle.

Lincoln understood that and many Libertarians don’t.

>>>> “Lincoln’s greenback policy”

It was not Lincoln’s policy –no matter how many times the conspiracist invetion is repeated; and other than repeating this dogma, none of ye is able to offer anything substantive to support the wishful fantacy. It was Samuel Hooper’s, John Sherman’s, Portland Chase’s, Gerry Spaulding’, and future national bankers’ policy.

The National currency instituted in 1863 was not issued by the nation state (for one thing, the United States is not a nation state, member States –of the union for common defence and mutual benefit– would/could have been nation states), and the “principle it established” was the same old same old principle of private banks issuing their notes which act as the country’s currency. Lincoln signed into law what he advocated in 1839:

the gifting of the general government’s credit to private banks, then borrowing it back at 6 percent. That was the potential that Lincoln understood. The national currency bank bill –heartily supported by greenbackers in the House and Senate, including Thaddeus Stevens– re-established the control of European private bankers over the currency of the United States, which control was so rudely interrupted by the southerners and their Independent Treasury Act.

The money power wanted a war of subjugation of southern member States, and in 20 years they organized one; Lincoln was a willing tool of the money power, and when he served his purpose he was thrown into the garbage –as he should have been (under better circumstances Lincoln should have been charged with and executed for crimes against the nation; just as tsar Nicholas should have been charged with crimes against the nation)

On Thursday, July 8, 1841, John Sergeant of Pennsylvania –in 1832 Henry Clay’s running mate against the Jackson/Van Buren team; Clay and Segeant started life opposing the Bank of the United States, but soon their mind was changed and became tireless advocates of the concept– in the House of Representatives, in a low, quiet tone that the record keeper could not properly hear him informed the representatives of the opponents of the central bank that they are going to get a war if they don’t stop standing in the way of progress. Not a war for splitting up the U.S. into two (as conspiracist book-peddlers impress their ignorant readers), but a war of extermination and conquest. Representative Hunter heard John Sergeant clearly and noted:

Instead of building a theory based on McGeer’s day-dream, take a look at reality some time; and what Lincoln accomplished for the international money power.

“Sir, other nations have emperors and kings, and titles of nobility, and established churches, as well as national banks; but is that any reason why the people of the United States should abandon their Republican principles, and imitate these foreign forms of Government ? Although the Senator from Kentucky may not, and I believe does not desire such a change, yet he may virtually accomplish it sooner than he anticipates. If he can create this great National Bank, and can ally it with the Government in Washington city on terms of the closest intimacy; if he can thus concentrate the money power here, and render its interest identical with that of the political power, he may succeed in establishing for this country not a monarchy, but the very worst form of Government with which mankind has ever been cursed. A hereditary aristocracy has acquired this infamous pre-eminence; but the Government of a moneyed aristocracy would, if possible, be still worse. From interest and from habit, a landed aristocracy has always cherished some feelings of kindness for the people; but an upstart moneyed aristocracy has no heart to feel for them, no desire to promote their welfare. It looks upon mankind as mere laboring machines for its own benefit. It never indulges in those kindly and Christian sympathies which make us feel that all men are alike created in the image of their Maker, and are brethren. This is the kind of Government which may be established by an intimate union of the political with the money power. We may approach nearer to the Governments of the old world, by establishing this Bank, than the Senator or any of his friends imagine. If this should be the case, corruption will insinuate itself into the sinews and nerves and very vitals of the body politic. The people would still attend the elections and be flattered with the idea that they still enjoyed all their liberties, whilst a secret, controlling, all-pervading influence, would direct their conduct. The corpse of a free Government would then only remain, whilst the animating spirit had fled forever.” —20 years later this was exactly the kind of government Lincoln and the Whig crew instituted

4th of July, 1861, Galusha A. Grow [speaker of the House]: “No flag alien to the sources of the Mississippi river will ever float over its mouths till its waters are crimsoned with human gore; and not one foot of American soil can ever be wrenched from the jurisdiction of the Constitution of the United States until it is baptized in fire and blood.”

The origin of Lincoln’s National Currency

(take it now the easy way ! or we will make you take it later ! the hard way)

In the House of Representatives

September 10, 1841.

–On the (second) veto of President Tyler (of a bill to establish a central bank, this time called Fiscal Corporation of the United States):–

President Tyler prevented the people of the United States from receiving the blessings of this National Currency and stood in their way of enjoying the benefits this Fiscal Corporation which would have bestowed upon the nation this benevolent Bank Paper.

Twenty years later Mr. Tyler naively went to Washington with the delegation suing for peaceful settlement. He did not understand, or could not bring himself to believe, that the scum of the Earth Whigs (Lincoln, Chase, Fessenden, Seward, &c.) who took the mantle from the previous generation, meant to carry out the threat of the Halcyon Summer: they meant to give the South a servile war, they meant to make the South (and West and North) take the shaft the hard way (and permanently). H.A. Lincoln, the hero of Sarah Emery and Ellen Brown (and everybody in between), wouldn’t even see the man who vetoed two central bank bills —some opponent of bankers this Lincoln was.

600,000 war dead later the United States was a safe place for National Currency, National Banking, funded debt and 200million acre land give-away.

How could the people of the U.S. have done any better without this “great leader” of Sarah Emery’s vagary of the imagination ?!? If she had only bothered to read the history of the United States, she would not have picked a psycho killer for her knight.

Emblazoned on our banners high

Behold the legend grand,

Attracting by its honesty

The millions of our land

To once again proclaim the truth,

In accents loud and bold

“Mankind cannot be crucified

Upon a cross of gold.”

This legend is our battle-cry,

Will guide us night and day;

‘Twill lead our hosts to victory,

Our foemen to dismay.

But friends from every rank of life

We welcome to that fold,

“Where man cannot be crucified

Upon a cross of gold.”

What though the power of wealth ordains

The people to deride ?

Enough true manhood yet remains

To sweep that power aside,

And in its place again proclaim

That truth so nobly told:

“Mankind cannot be crucified

Upon a cross of gold.”

Night’s sable mantle disappears,

The morning beams are bright;

The cherished hopes of waiting years,

Triumphant, loom in sight.

Then nail our legend to the mast,

Let every eye behold:

“You cannot crucify mankind

Upon a cross of gold.”

All hail the advancing hosts of right,

All hail the hero grand

Who bears our legend through the fight

Which shall redeem our land —

When class and caste shall cease to be,

Nor men be bought and sold,

But live for higher aims in life

Than worshippers of gold.

=============================

Character of Imperial or National Money.

National or imperial money, as the name imports, is that form of legal tender which derives all its conventional value from the authority of the state which calls it into existence. It is the monetary servant of the community, not its master. Its special function is to circulate at home, and it should be deprived of all power of travelling abroad. Being essentially a credit instrument, it need not possess any intrinsic value. To secure it against depreciation, provision should be made for its periodical redemption. Its proper limit is the amount of annual taxation voted by parliament. The method by which this legal tender would be brought into circulation is the following:– The crown would pay all its creditors with this money — as the army and navy, official salaries, pensions, the dividends of the fund-holders, and indeed every outlay which it incurred. As it would be legal tender from man to man, every recipient of it would be enabled to purchase with it what he desired to possess; it would discharge all fiscal duties, as customs and excise, and every description of tax. When paid back to the crown in liquidation of taxes, the notes would be cancelled, which would prevent the issues being cumulative from year to year; and they would be so received back at the same conventional value at which they were originally issued. A single case will illustrate the operation. Let the admiralty advertise for a supply of beef and pork, to be furnished to the victualling department of one of the royal dock-yards. Let it be assumed that the contract is taken for £100,000. The treasury gives that sum in national notes to the contractor, who lodges them with his banker. This being done, let a distiller go to the same banker, wanting his bill discounted for £100,000; the banker hands to him the £100,000 paid in by the victualling contractor, and with it the distiller discharges his duties to the excise. The notes are then forwarded to the treasury, where they are cancelled. Thus the government would get all that it wanted — provisions in the dockyard — first, by advancing national money to the contractor, and then receiving that money back in the form of taxes from the distiller. This would be effected without the intervention of a single ounce of gold, which would not be required. All other transactions would partake of a similar character. Soldiers and sailors would pay the butcher and baker with these national notes, and with them they would pay the tax gatherer. They would, in fact, pass from hand to hand as freely as sovereigns now pass, and for every purpose of buying and selling as sovereigns now pass, finally to be absorbed by the collectors of taxes. The security on which national money would be based, would be the whole property of the kingdom which called it into existence and put it into circulation.

Against such a system it is frequently but unreflectingly urged, that taxation might be indefinitely expanded through the facilities afforded by national paper money. Were this a valid objection, it could not apply to the monetary instrument, with whatever force it might be brought to bear against the construction of Parliament, for the amount of notes would be exactly proportioned to the amount of taxation voted by Parliament. An unskilful or unprincipled engine-driver might run a railway train down an embankment or over a bridge: this would be proof of the incapacity or criminality of the driver, but it would be no argument against the usefulness of railway travelling. The remedy would not be a return to stage coaches, but the dismissal of an untrustworthy servant. In like manner a Ministry that violated its duty ought to be cashiered.

But the vague dread of excessive and indefinitely augmenting taxation is groundless. National money is designed to express taxation; and, by its use, the prices of all produce would necessarily rise as much above the barter price as the scale of taxation demanded; therefore the purchasing power of money would fall proportionably to the rise of taxes, so that if the richer classes, who sit in Parliament and make the laws, wantonly increased the taxes, they would, precisely in the ratio of such increase, diminish the effective power of their own incomes. This is a conclusive answer to the objection.

National paper money would not bear any interest. At present when the Government wants money it borrows it from the Bank of England. This is the process. Government deposits with the Bank exchequer bills bearing interest, receiving in exchange Bank notes, that is an inferior for a superior security; for the exchequer bill is guaranteed by the whole property of the country, while the Bank note has no other basis than the credit of the Bank corporation. Thus the nation pays interest to the members of a joint stock corporation, which only exists by the permission of the nation, and that interest is an addition to taxation. National paper money would be in the nature of a small exchequer note, issued directly by the Crown, without the intervention of the Bank.

It must be observed that under this system taxes raised within the year would be wholly discharged within the year; consequently there never could be any outstanding liabilities, or any addition to the national debt.

National money would have much of the character of the postage stamp, which has no intrinsic value, but only a conventional value. Both are national credit instruments. Many small debts, fractional parts of a pound, are now paid in postage stamps, which thus become a currency. Why are they taken? Not for their intrinsic value, because they possess none, but for their conventional value; and on what does their conventional value rest? On faith — on the conviction that the Queen’s Head placed on a letter will carry it all through the United Kingdom. The stamp indicates the tax we pay to the Post Office, and the national paper money indicates the general aggregate tax we pay annually to the government. We get possession of both by giving a portion of our time or labour for them. It is idle to say that we give a copper penny for a postage stamp; for the question returns how do we get the penny? and the only answer is, by our labour.

===========================

Money is a term properly applicable only to that sort of circulating medium which is constituted a universal legal tender in the country where it is issued; which depends for its value not on its intrinsic worth as a commodity, but on the circumstance that the government which issues it at a certain rate in discharge of its obligations to the people, will receive it again at the same rate from the people in discharge of their obligations to the State. In this respect, coins of the genuine stamp, however deficient in weight, and that paper money also, which is issued by the authority of the STATE, are money. They are entitled to be universally current, and will be so among the people of that country to which they properly belong. All such money it is within the province of a government to interfere with and regulate. On the other hand:– 1. All coins which depend for their acceptance as a legal tender, on the condition that they shall be of full weight, are not money, but bits of bullion, estimable in all countries according to their intrinsic value, and deriving no advantage in any way from privileges conferred by the STATE. 2. All promissory notes to pay on demand those same bits of bullion, of a certain weight and fineness, are not money, but evidence of a contract entered into between man and man. 3. All promissory notes to pay a certain sum in that legal tender which is money, are themselves not money; they are merely an acknowledgment of debt, of the claim to which debt they constitute a transfer when they are endorsed and paid away. With all such commercial currency, improperly called money, a government has no more right to interfere, under the pretext of regulating its quantity, than it has to interfere with the manner in which men conduct their own affairs of business, and manage the concerns of their own families.

Most American libertarians are simply white collar criminals interested in destroying government so they can operate without fear…..and the ones that aren’t are naive academics who know nothing about how the markets and the real world operate. It is an alliance of the clueless and the corrupt.

Please dig a little more. You will find criminal activity behind all these outfits you name.

But be careful. These are very dangerous people.

They would think nothing of killing you or terrorizing you if they thought they could get away with it.

Your piece needs a lot more work and evidence but you are on the right track.

DisgustedLibertarianInsider

Could you be a little more specific? I sure would appreciate some input. Email me at info(at)gelre.org if you’re interested!

Thanks!

Regional currencies eh? That would break up a lot of the Bankster control of the world.

It seems that “regional currencies” would accomplish the same goals as the two maverick IMF economists who set the ‘net ablaze today, Oct 24, 2012, with their report called “The Chicago Plan Revisited” {here > http://tinyurl.com/958au4j

Their idea is “to replace our system of private bank-created money — roughly 97% of the money supply — with state-created money.”.

No more Banksters printing up money without any backing, creating wealth out of thin air, built on debt?

A system that would start creating prosperity instead of DEBT.

Link 2, commentary article on the IMF report> http://tinyurl.com/8vro6wl

again, same link to IMF report [PDF file] > {here > http://tinyurl.com/958au4j

OH, I see you are way ahead, Sept 6th is when you discovered the IMF report.,.. brave… delete my post if you like, OOPS. I am a newbie, just getting to the right hand column, very impressive!! [what would I know…]

Thanks Edna, welcome and enjoy the articles!

Thanks for this article Anthony. You may want to check out our book “People Money – the Promise of Regional Currencies” I co-authored with Margrit Kennedy and Bernard Lietaer, published by Triarchy Press in England in 2012: http://www.triarchypress.com/pages/Regional-Currencies-People-Money.htm

It is the first English edition of a 2004 book published in German and is fully updated, including 16 profiles of the world’s leading local currency systems, based on interviews with organisers.

Oh, interesting!

I met Margrit a couple of years ago in Amsterdam, we both spoke there. I love her work. Lietaer has also been important to me.

I’d be interested to know what you think of my plans for convertible units based on Interest Free credit:

Mutual Credit for the 21st century: Convertibility

http://realcurrencies.wordpress.com/2012/01/10/mutual-credit-for-the-21st-century-convertibility/