the Power of Demurrage: the Wörgl Phenomenon

(left: Michael Unterguggenberger, the man who ended the Great Depression in Wörgl)

The velocity of money is a badly neglected aspect of monetary theory. It is far more important than people realize and both in past and in the present depression, sluggish circulation played a major and negative role. The most obvious way of increasing the velocity of money is Silvio Gesell’s demurrage, a negative interest rate, in effect a tax on holding money. This is not just theory. There is a famous case in which it was implemented. The Wörgl experiment showed truly extraordinary results and is legendary in Interest-Free Economics.

It’s relevant today too, with the Danish Central Bank this week setting a negative interest rate for the first time in history.

Wörgl is a small town in the Austrian Tyrol that would be completely inconspicuous, were it not for an amazing event that transpired almost 80 years ago.

At the height of the Great Depression some 4500 people lived in the village. It was suffering badly from the catastrophic policies of the Austrian Central Bank, which had brought down the money supply from 1067 million Schillings in 1928, to 997 million in 1932 and 872 million Schillings in 1933. Unemployment stood at 1500 and 200 families were completely destitute.

The town owed 1,3 million Schillings to the Innsbruck Savings Trust and had to pay 50,000 per year in interest over that debt. The council was owed 118,000 in taxes, but it was all but impossible to get at it, with the result that the town was lagging on its own obligations to the regional government.

Meanwhile, there were plenty of public works that needed to be done. Roads had to be repaved, Street lights were necessary, water distribution needed to be extended and trees had to planted along the streets.

Enter Michael Unterguggenburger, the burgomaster (mayor) of Wörgl. He had been studying economics for the better part of his life and lived through the difficult times of the 1907 depression, the Great War, the associated inflation and now this massive deflation. He believed in Socialism’s big idea of ‘ending exploitation of men by men’, but not in their methods, most certainly not their nationalization of the means of production.

He did however read Silvio Gesell’s book ‘the Natural Economic Order‘.

In this work Gesell introduces his ideas about the circulation of money and how to improve it: through demurrage. A tax on holding money, a negative interest rate.

And Unterguggenberger, desperate at the situation in his town, decided to give Gesell’s ideas a shot. He created ‘Certified Compensation Bills’, in denominations of 1, 5 and 10 Schillings. These would devalue at a rate of 1% per month at the end of the month, and those holding the bill at the time devaluation needed to buy a stamp of 1% of nominal value to extend it.

(One of Unterguggenberger’s certificates. On the right the stamps representing the hoarding fee)

Quoting from Fritz Schwarz, who originally documented the Wörgl case:

“On the 31st of July 1932 the town administration purchased the first lot of Bills from the Welfare Subcommittee for a total face value of 1000 Schillings and used them to pay wages. The 1000 Schilling official money paid to the Welfare for the Bills were deposited at the local “Reiffeisenkasse” (where they were held until someone offered the bills to convert them back to Schilling, which could be done at any time at a cost of 2% of the nominal value of the bills, AM).

The first wages paid out, to the amount of 1000 Schillings, returned to the coffers of the community almost on the same day. Taxes were being paid! On the third day somebody came running and shouting, “Mr. Mayor! Our Bills are being counterfeited. We have only issued 1000 Schilling so far, but the amount of overdue taxes paid with them has already reached 5,100 Schillings! Somebody must have counterfeited the Bills!”

The Mayor smiled forgivingly. He knew that bigger men would make the same mistake. Even Professor Dr. Bundsmann, lecturer of macro-economics at the University of Innsbruck and honored with the Austrian title of “Honorary Civil Servant” would call the success of Wörgl with its fast circulating money a hoax, because he could not understand how 5100 Schilling in taxes could be paid from an issue of only 1000 Schillings. That was beyond the expectancy of the Mayor himself. But every Schilling coming as Bill was re-circulated right away to pay an invoice, and was back and out again in short order, because this money attracted a penalty when idle. At that time the National Bank of Austria kept in circulation a constant amount of about 914 million Schillings for a population of some 6 million, or 153 Schillings per person. At the issuing peak, the value of Wörgl Bills was 7443, less than 2 Schillings per person. But these 2 Schillings gave more income and profit to each person than the 153 Schillings of the National Bank. Why? Because they were designed to entice people into using them, which is what money is for: to pay, to do business, to exchange. A. Hornung, who was against this “free money” and the whole experiment, reported grudgingly: “The issue of relief money was back in the coffers of the municipality within days. From there it could be re-used for payments. The total average in circulation was: August 1932 3675 September 3375 October 3525 November 6350 December 5725 January 1933 5450 February 5650 March 5625 April 5750 May 5675 June 5875 July 5800 August 5825 September 5825 Average: 5,294

How ludicrous is the thought of people with no inkling of the importance of money’s velocity of circulation for the economy.

AM: the total amount of trade financed by the certificates amounted to the equivalent of 2,5 million Schillings. While only about 5,500 worth of certificates were circulating on average. Meaning that the small demurrage of 12% made the certificates circulate at least a hundred times faster than the Schilling.

An eye witness report by Claude Bourdet, master engineer from the Zürich Polytechnic.

“I visited Wörgl in August 1933, exactly one year after the launch of the experiment. One has to acknowledge that the result borders on the miraculous. The roads, notorious for their dreadful state, match now the Italian Autostrade. The Mayor’s office complex has been beautifully restored as a charming chalet with blossoming gladioli. A new concrete bridge carries the proud plaque: “Built with Free Money in the year 1933.” Everywhere one sees new streetlights, as well as one street named after Silvio Gesell. The workers at the many building sites are all zealous supporters of the Free Money system. I was in the stores: the Bills are being accepted everywhere alongside with the official money. Prices have not gone up. …… One cannot but agree with the Mayor that the new money performs its function far better than the old one. I leave it to the experts to establish if there is inflation despite the 100% cover. Incidentally price increases, the first sign of inflation, do not occur.”

Aftermath

As a result of the incredible success of Unterguggenberger’s experiment, hundreds of Austrian towns planned on implementing the scheme. As a result the Austrian National Bank panicked and forbade the experiment. Vienna crushed the resentment with the threat of military intervention. Within a short while Wörgl was suffering again.

Famous men noticed the experiment. John Maynard Keynes and Irving Fischer payed homage to Gesell. French Prime Minister Edouard Daladier visited the place to check the experiment for himself. And Ezra Pound visited Unterguggenberger twice, the last time just before the good Burgomaster died in 1936.

Conclusion

To this day the Wörgl case stands out as the classic example of the need for monetary reform. It vindicates Silvio Gesell’s powerful analysis of the monetary and his demurrage.

A notable aspect of demurrage is that it offers a clear incentive for interest free loans. Sitting on it would lose value, value maintained by lending it out.

The simple fact is that even today a demurrage instead of interest on the money supply would radically transform our economies overnight.

Related:

Don’t hoard the Means of Exchange! (Part 1)

Don’t hoard the Means of Exchange! (part 2)

Regional Currencies in Germany: the Chiemgauer

Here is in interesting interview with FOFOA on the differences between the store of value and means of exchange functions of money. He offers a number of interesting insights (Thanks Transparent Unicorn):

Interview with FOFOA

Afterthought on Sluggish circulation

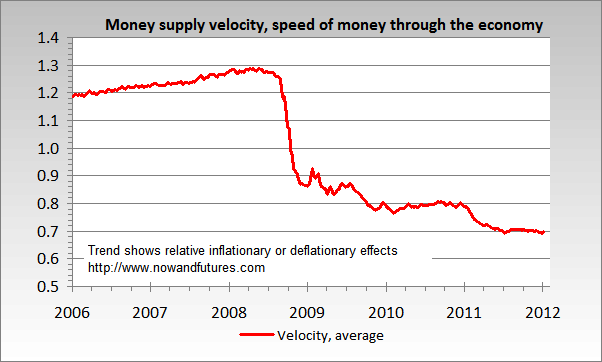

It seems that deflation is closely linked to sluggish circulation. Consider, for instance, this graph:

Quite a catastrophic decline in circulation and good proof that hoarding cash is detrimental. And also that a deflationary crash is closely related to hoarding. This is not an attack on those who save money. In the way the system works, it’s rational behavior. It just shows that the system is not working properly.

Although I don’t have figures about the velocity of money in the thirties, Michael Unterguggenburger most definitely assumed that hoarding was the problem, because he had this printed on his certificates:

“To all whom it may concern! Sluggishly circulating money has provoked an unprecedented trade depression and plunged millions into utter misery. Economically considered, the destruction of the world has started. – It is time, through determined and intelligent action, to endeavour to arrest the downward plunge of the trade machine and thereby to save mankind from fratricidal wars, chaos, and dissolution. Human beings live by exchanging their services. Sluggish circulation has largely stopped this exchange and thrown millions of willing workers out of employment. – We must therefore revive this exchange of services and by its means bring the unemployed back to the ranks of the producers. Such is the object of the labour certificate issued by the market town of Wörgl : it softens sufferings dread; it offers work and bread.”

Trackbacks & Pingbacks

- the Power of Demurrage: the Wörgl Phenomenon « Real Currencies « dysviz

- Subotaisbow

- Debt Free Money alone does not solve Compound Interest « Real Currencies

- Snabba Cash III – Hastighet & Inflation | Peak SWE

- A Free Money Miracle? | Anything Voluntary

- El Blog de Alejandro Muyshondt - ¿Un milagro de moneda libre? – Jonathan Goodwin

- Baffling Bitcoin | Real Currencies

- How they beat the Great Depression in a small town in Austria in 1932 | speakerscorner2012

- The Daily Bell: Usurious Commercial Banking is Freedom, Interest-Free Government Money is Tyranny | Real Currencies

- Usurious Commercial Banking is Freedom, Interest-Free Government Money is Tyranny | showmethemoneytbone

- The miracle of Wörgl | Bristol Pound Blog

- Social Credit with Demurrage | Real Currencies

- the Power of Demurrage: the Wörgl Phenomen...

- The Difference between Debt-Free Money and Interest-Free Credit | Real Currencies

- The Difference Between Debt-Free Money And Interest-Free Credit | Barnaby Is Right

- Chris Hedges: “It’s time to grab our pitchforks.” | Exopermaculture

- The Silly Pseudo Science That Is ‘Modern Economics’ | Real Currencies

- The First Post | sundry fringes

- 13,5 ΜΗΝΕΣ ΕΛΕΥΘΕΡΙΑΣ : Το «αληθινό» νόμισμα του Woergl. | ΟΒΟΛΟΣ

- Silvio Gesell – A Brief Overview – SamBacha.pw

- Can We Do Without Money? | Real Currencies

This is a great post, Anthony. I actually learned something new.

It seems a bit backwards from what we are used to, but it makes perfect sense. And if the currency loses just 1% of value over a period of time, it seems like that all it takes for people to spend their money. What is interesting is that I think that would really push up employment rates

and everybody wins. This isn’t the case in our current system.

I’m going to read this again.

thanks Al, great to hear!

Does anyone know how I can see the full width of the

comnments here? I find this site and it’s topics very

informative, but unfortunatly many of the postings are

cut off on the right side, and I have to guess at

what is being written.

Hi Teddy33,

Yes, it’s a bit of an annoying WordPress ‘feature’.

Hit reply to read squashed text.

Anthony,

Hoarding is a function of the definition of money as a scarce resource. Demurrage is a response to that definition and therefore it is an acknowledgement of it. But as we point out here: http://www.bibocurrency.org/English/The%20Scam%20short%20form.htm such a definition is insane.

Besides once you decide to have demurrage then you need to create an elite to govern how much and why.

Lets just do away with the false paradigm altogether the science, math and logic of the matter says so. Why not follow that.

Hi Marc,

As you know I favor mutual credit based units. However, the circulation issue is quite important and demurrage not only gives interesting hints on the how and why, it also is a practical solution to a bad system, so even though I’d agree BIBO compliant units are probably best, I still have great respect for Gesell and his methods!

Anthony

Hi Anthony,

Of course all the historical steps taken to lead people to realise that something is wrong with the current money system have their importance. The circulation issue is where one spots that something is not right. How can it be that there is insufficient access to number? I used to ask myself.

There is a world of difference between negative interest and positive interest. In fact negative interest is Passive BIBO Stable is the lower limit of depreciation is zero. However, I have trouble with money being a central power, to me money must be relegated to an auxiliary function to the creation of value. Value is what circulates and money just keeps track of that value whose embodiment cannot be divided to effect trade.

Note that we don’t need money to measure everything that is traded only that which cannot be bartered or gifted.

Marc

Great post, Anthony.

Very practical advice, keep it coming!

…and I assume ‘burgomaster’ is Dutch for ‘Bürgermeister’ (=german word for mayor)?

thanks much wogaut!

To be honest, burgomaster was a new word for me too. The dutch word would be ‘burgemeester’. So burgomaster is quite close to both dutch and german.

Is there a possible downside to demurrage? I have in mind the computerized high velocity wash and spoof trades that occur on wall street with banks and hedge funds, wherein money is generated by a high number of trades without an actual economic exchange. Would such a scenario trigger inflation or devaluation of the money supply?

good question. I’m not sure what the implications would be in the international casino, which, btw, is suffering from a horrible contraction at the moment.

However, I’d say we’d have to shut all that up anyway.

I do believe that a demurrage could cause a devaluation/inflation kind of scenario. In the Woergl case it did not happen, because the experiment lasted only some 15 months or so. But had it been around longer, the money supply with such a high velocity might have been too big and prices rises might eventually have occurred. But this would have been no problem were people not hoarding cash, but burying their money in real assets!

And again the sluggish circulation that played a key role in depressions was not due to personal savings levels but due to intentional contraction of the money supply by corrupt private controllers of a usurious monetary system. A tax on holding money is indiscriminant, outright theft. It’s absolutely unnecessary to induce national prosperity

The real purpose of the demurrage is to make it impossible by decree for individuals to hide their wealth. This is an elitist’s tyrannical doctrine… If you can’t hide your wealth then those who want it will know where to go to steal it. All of these theories including Austrian are just different methods of plunder.

I’m a really a bit surprised by your strong attitude towards these concepts Tammuz. It’s quite clear from your comments you have a good understanding of the issues, including the vital interest issue, and I believe we would agree on most things. But for some reason you can’t really seem to get your head around this one.

Well, I’ve done my best, so we’ll just have to agree to disagree on the hoarding issue!

by the by, I think the graph in the article shows that massive deflation like we’ve been seeing the last few years is closely associated to slowing velocity. That should give some pause: you were asking for proof that hoarding and depression were associated and I believe the graph at least gives strong anecdotal evidence. Combined with the astounding effects of demurrage in the Woergl case methinks something’s going on.

Anthony, I understand the negative effects of what you call, “slowing velocity” and yes this slowing is a result of a contraction of money but this contraction was never, and I repeat, NEVER, the result of high levels of cash savings among the general citizenry, or what you call “hoarding” cash, but it has always been the result of the private money powers intentionally contracting the money supply either by calling in loans and reducing loans or by what they are doing now: hoarding it among big finance using QE2, QE3 to promote the illusion of inflation and threats of hyper-inflation while intentionally keeping this money out the real economy. Artificially keeping prices up at the pump as advertisements for inflation also helps support this illusion. Adding more lies saying that the price of gold reflects the devaluation of the dollar from all this “printing out of thin air” when in reality all major commodities and currencies each have a separate lever which the elite use to control the price of each independently from one another.

You may believe what you are promoting is right but I have one Teacher upon which all my views are based. And this Teacher has taught me that stealing is wrong no matter how it’s disguised or dressed up. You do not realize it, and I do not mean to be harsh, but you are teaching the art of theft. Whenever you get into the subject of controlling money you are getting into the subject of controlling people (government) and this is the most sacred responsibility entrusted to man. This is not something that God gets butted out of when it’s convenient as most economists do.

Nebuchadnezzar, leader of the world’s first empire, learned that lesson and said, “Now I, Nebuchadnezzar, praise and extol and honor the King of heaven, all of whose works are truth, and His ways justice.”

“And do not be called teachers; for One is your Teacher, the Christ.”

Well, Tammuz, in all fairness: the Christ, whom I love dearly, and I don’t like to fight over Him, would certainly not approve of hoarding of any kind………………

Anthony, hoarding is when you are holding on to something that doesn’t rightfully belong to you… that’s theft. Saving is when you are saving something that rightfully belongs to you because you paid for it with your labor and intelligence.

It’s easy to see what this is really all about like I mentioned earlier, it’s about exposing wealth so when the time comes for the robber barons to steal it they’ll no exactly where to go to get it. So if you save it they’ll steal it… and if you convert it to visible holdings it will remain under their watchful eye until they decide to take it. This can be the only reason you keep promoting this because there is zero evidence of high savings among the citizenry being detrimental to any economy.

If you promote a scheme that intentionally confiscates someone’s savings it is you who are promoting the practice of theft. Who is more righteous in God’s eyes, the person who saves what they rightfully labored for or the person who uses an elaborate scheme to steal what others labored for?

But where do you see the confiscation of savings? That’s what I’m wondering about. I’d certainly would not support anything even remotely close to that, not knowingly, anyway!

Anthony, when you reduce the value of someone’s rightfully generated wealth either by taxing that wealth or forcing them to reduce a portion of that wealth through a monthly fee for holding it you are confiscating (stealing) their rightfully earned wealth. You are also promoting slavery. When you steal someone’s wealth earned by their toil and sacrifice you are essentially forcing that someone to allocate a portion of their labor for you with no compensation which is equivalent to slavery.

It transpires that people actually lose very little to demurrage, compared to the turnover in the economy (per unit).

the incentive is to spend the cash and use other means of storing wealth. This, as the example shows, is very much compensated by the far better chances of obtaining wealth (by finding a job in a 33% unemployment economy, for instance.

The example clearly showed that people avoided the ‘tax’ by simply spending the money (instead of sitting on it, to the detriment of the community).

the total income through demurrage was 2,5k, whereas the total turnover of the units circulating was 2,5 million. This means the price the community payed was only 0,1%. This cannot be considered ‘theft’ or outrageous in any sense.

So the small amounts people might lose indivdually on their currencies via demurrage would be made up exponentially by the amount the govt collected as a multipler effect of money velocity, which in turn could be returned as expenditures on on public services?

If what i said made any sense, then demurrage would not be stealing at all, but the contrary.

Taking property that does not belong to you that you didn’t earn for any reason is theft. All godless control freaks rob from groups under the pretense of benefiting the collective… I believe that’s called tyranny.

If this monetary system could be arranged by a popular vote then it wouldn’t be theft. Especially, if laws could stipulate how the money was to be spent that would accrue to benefit everyone individually and collectively. Taking 1 dollar and returning 100 in goods and/or services is an honest business practice by most peoples’ standards.

Taxes that follow the same formula of providing for a necessary and public service is not a theft either. This is this austrian deregulation of the free market taken to an extreme. Most people that go around calling taxes and govt safety net programs are misanthropic elitists, or their libertarian dupes.

Anthony. It’s robbing people of their property and their freewill. It violates the “Golden Rule.” God doesn’t force people and micromanage them through theft to force them to buy things for the benefit of “the community.” This is evil control-freak satanic stuff. What right do you or I have to threaten another with stealing their property if they don’t buy something? I’m afraid you economists have driven yourselves to the brink of madness with all your theories

@pm

When the “popular vote” is to harm the innocent for the benefit of the collective,

that law is null and void. God dealt with nations who had such perverse “popular” votes…

Sodom and Gomorrah are just a couple of examples.

The solution is clear wealth has value money is only a record of that value and should never become a surrogate of that wealth. The whole problem of “controlling” the circulation of money arises because of that fundamental confusion about what money really is.

The idea that money circulates is fundamentally nonsensical what circulates is wealth and accounts (money) simply record the ins and outs of that circulation. To now make the record circulate as an object of value is totally unnecessary UNLESS THERE IS A GRATUITOUS IMPEDIMENT TO ENTERING RECORDS in the first place.

That I think is the point, we have been bamboozled into believing that we need to share our personal scores, because somehow we are prevented from scoring freely in the first place!

@Tammuz

You do make a good point, but what about taxes? That is just theft by violence. And you have usury which is another form of stealing. In fact, if this worked one time, why not try it again. In fact,

maybe you can have a few other currencies to compete against it. What we have now is a bad joke.

Yes … most taxes are theft especially taxes on labor. But as I mentioned above, what worked was increasing the supply of debt-free money… it was a supply problem which the dumurage remedied and had nothing to do with so-called “velocity.” Any debt-free legal tender injected into that scenario increasing the money supply would have solved the problem.

I haven’t studied this as much as some of you on this list. I’m a newbie on this issue. But if the usury is gone, most of the problems will go away.

If We Discover Aliens, What’s Our Protocol for Making Contact?

Well, i think we should blast them with our most powerful weapon: usurous fiat currency. Should wipe them out like the microbes did in H.G. Wells’ “war of the worlds” in no time.

hah! that’ll teach them!!

there’s a few lively ‘Hoerspiele’ (radio dramatizations/docus – in german), here’s one:

Silvio Gesell – Die Krankheit der Welt liegt im Zins – YouTube

‘with usura’ — Canto 14, read by Pound himself in 1939

http://www.youtube.com/watch?v=l9URm-y_ASQ&feature=g-all-u

3.17m

BASURA!!!!!!!!!!!!!!!!!

many years ago i discovered someone claimed

“SEXUAL CONNOTATIONS THAT Shakespeare claimed usury had. Forgot who. Could look it up. Hpoe someone else will. Who knows if BillySpakeshear was playing for laughs at the time, … speak up or forever hold your silence.

i expected this to be clarified, tossed about and clarified at rest, ease and leasure to see how the sizes shook out and settled but nope. Zip .. besides deep disappointment, i am reluctant to even bring/dredge this up again for fear of either being hurt or find out about hurtful choke and cover up methods people who point at me in derision use .. ‘liberally’ .. till my liberating and volitionizing potential is riddled with the exudates of such pointy fingers.

I know not about Shakespeare Piet, but thanks much for the Pound bit. Incredibly touching piece of work. One can really sense his drive to oppose the Money Power for all he was worth.

The proponents of the demurrage are blaming the victims of the Great Depression in Wörgl and not the instigators which was the result of the catastrophic policies of the Austrian Central Bank that dramatically reduced the money supply and had nothing to do with high savings levels of the general citizenry. The Austrian Central Bank was obviously under the control of the same private banking cartel that plunged the entire world into depression. Therefore the demurrage worked not because it penalized savers but because it injected a new supply of debt-free money at a time when it was badly needed.

Canada was going through the same problem at the same time and got themselves out of the same depression by decoupling itself from the usurious private bankers’ and their gold standard and issuing debt-free notes from the newly created Bank of Canada, a publicly owned central bank.

There is no need to penalize savers because it’s the usurers that are a detriment to all economies not the savers. Savers have never been proven to be a detriment to any economy.

The results of the “Power of Demurrage” and the “Power to inflate the money supply” – due to fiat-money and credit expansion – are pretty much the same: The units of currency one holds will buy less goods and services in the future.

This is theft. Pure and simple.

Why anyone would peddle such a concept – apart from the more obvious reasons – is beyond me.

What makes the dumurage similar to “fiat-money and credit expansion” is that it charges a fee for using non-debt based fiat money but the fee is less than the usurious charges of debt based fiat money because most users spend it before they have to pay the fee. Hence, both systems are theft but one is theft by charging a fee and the other by charging interest.

However, injecting non-debt based fiat money into a system where the private banks have intentionally contracted the debt-based fiat or gold backed money supply (credit contraction) creating excess capacity of labor (unemployment), idle capital/machinery and overstocked supplies/inventory… will not cause the currency to “buy less goods or services” because productivity of goods and services will increase as the underutilized labor and capital responds to the injection of new money.

Money is just a tool that induces and facilitates the flow of the true source and generators of wealth… people. Which is why God said to the people He created, “Be fruitful (generate wealth) and multiply (expand that wealth)”. Thus, non-usurious money is in cooperation with God’s decree.

.

Great discussion, hope I’m not too late to weigh in with an opinion. It seems that the scarcity of money is a chronic problem with all debt money systems. No doubt, the velocity of money can help mitigate the scarcity but that alone doesn’t seem an adequate solution.

“Hoarding” (saving) reduces velocity as does repaying bank debt. In the U.S. for example, if the national debt were repaid, we’d have no money in which to conduct trade and commerce. Equally, if people repaid their debts, we’d be broke. The governments of enslaved states must continuously borrow without repaying in order to have an economy.

I suggest that instead of incurring debt, nation states should spend debt free money into the economy by building and enhancing infrastructure. This should be done at the most local level as is practical in order to empower the people. There should be no shortages of money. I think people would be better off repaying their debts and saving money but our zany system would implode under such circumstances.

Good points Larry. However with regards to “velocity”… the “velocity” of money does nothing to mitigate the scarcity of money. In other words, “velocity” will not increase the supply of money therefore it will not reduce its scarcity. When money is scarce there is no money to fly around, thus “velocity” is a non-issue and describes an inaccurate understanding of the problem. The problem is scarcity and issuing more currency solves the problem of scarcity. “Velocity” is a misnomer as well as a non-issue.

“velocity” will not increase the supply of money

THis is a fundamental error Tammuz: the Real money supply is amount in circulation times velocity.

I don’t agree Anthony. “Velocity” is not a “supply” of money but its movement. The only reason I can see it being of any significance is to promote this theory.

Money will always move. No need to disbalance the circulation per represented wealth with either positive or negative interest. It´s both theft.

No. There is a fundamental difference. Interest on credit is almost impossible to avoid, particularly because producers pass on cost for capital, amounting to 45% of prices we pay, even if we have no debt.

Demurrage is easy to avoid, by spending the cash.

The costs of demurrage compared to total economic activity is negligible: in the Worgl case it was 0.1%. So there is none to pass on for producers.

The benefit of demurrage to the wider public is major and well worth the marginal cost to users.

the theft argument is ridiculous. there is no motive of enrichment, there is just a systemic rule, costing very little aimed purely at creating positive behavior. Speeding tickets are not considered theft, are they? They help prevent stupid maniacs speeding around little children.

“a systemic rule, costing very little aimed purely at creating positive behavior.”

No one has the right to force people to buy stuff under threat of confiscating their property. No one has the right to change the behavior of others unless that behavior is harmful to others… and stealing people’s property is harmful behavior therefore it’s the Dumurragians that need a change in behavior.

it’s basic economics Tammuz.

volume times velocity is the real money supply, go look it up.

Also: just look at the graph in the article: it clearly shows that velocity crashed. Do you really believe it has nothing to do with this recession?

Look: you’re not being rational on this one: I’ll grant I handled this subject a little provocatively, with the title (don’t hoard!) as it was. But the truth is: saving money is a vice and you’ve been brainwashed to believe it is a boon. And why?

Because the banks need your savings as deposits for their fractional reserve con. And also consider this: while saving was inculcated as ‘sound’ behavior during the nascent gold based economies of the 17th and 18th centuries: who were the ones ‘saving’ back then: the rich or the poor.

Anthony, the money supply is the total quantity of bills, coins, loans, credit and other instruments that can be easily converted to cash that is traditionally reported by the Fed in 3 categories, M1 (coins, dollar bills, and checking accounts), M2 (M1 plus savings accounts, money market funds, and other individual or “small” time deposits), and M3 (no longer reported by the Fed) which is M1 and M2 plus large institutional and American dollars circulating abroad. There’s nothing about “velocity” in that definition. The word velocity can only be used as a consequence resulting from changes in the supply or quantity of money.

The problem facing Wörgl had nothing to do with the people of Wörgl “hoarding” their cash and causing “velocity” problems but had to do exclusively with the Austrian Central Bank reducing the “supply” of money and the 1500 unemployed and the 200 destitute families were not “hoarding” cash thus severely reducing the “velocity” of money. The “velocity of money is a badly neglected aspect of monetary theory” because it’s a non-issue and only important to those who need terminology to craft another scheme (“theory”) to plunder the commoners.

Well, in the face of all I’ve offered you I must simply conclude this is pigheadedness.

Let’s agree to disagree!

Debt free money in itself is not sufficient to eradicate Usury though, Larry.

with a demurrage on the debt free unit, however, you’d have a built in incentive to loan out money interest free (because it would prevent the loss of value through the demurrage).

Or, of course, the debt free money should be combined with an interest free credit facility.

Adding a dumurrage to debt-free money essentially converts it into debt-based money. Meaning, the longer people hold it the greater the cost of the money just like the longer people hold borrowed money the greater the cost of the money. It puts a price on money. Both have the same effect… siphoning off wealth from the productive class to the unproductive class (the parasitical thieves).

And adding a fee to holding debt-free money (a dummurage) will not prevent anyone from loaning it out with interests, (even though lending and borrowing among private contract is not the issue here but it’s government borrowing)… they will just add the dummurage fee on top of the interests.

What is damaging to the economy is not private finance companies lending non-debt based money to their customers through contractual agreement at interest, but it’s governments borrowing money instead of creating it themselves and using it interest-free that is the problem. You’re mixing up private contract with non-debt based government (public) issued currency. There’s nothing usurious about companies investing (lending) their rightfully earned debt-free currency through private contract for a fee whether that fee be a stake in the success of that investment or an interest charge.

¨non-debt based government (public) issued currency¨

Debt is not the issue. The issue is interest. Money has to be issued into circulation as a debt but free of interest..

Debt money is the result of interest. Money becomes debt when it’s issued through the sale of interest bearing bonds and the creation of interest bearing loans.

what?

You are defending interest bearing loans? while claiming demurrage is theft?

that’s nonsense tammuz: now you’re losing it: you’re making the case for the monied classes, pure and simple.

We can have interest free credit, there is absolutely no need for interest at all. go read the On Interest and Budget of an Interest Slave to see how despicable the effects (in terms of cost to the borrower) interest really is, whether it’s on the money supply or on ‘normal’ loans.

Again: demurrage costed a very paltry 0.1 % of total turnover. Interest costs have amounted to 45% of total turnover already.

If you want to resist demurrage, which is simpleminded, first get rid of this strange idea that interest bearing loans are either fair or necessary.

In fact: even if there were no interest free credit possible, like 100 years ago, demurrge would have solved that, because it would have given the monied classes a clear incentive to lend out interest free. If you resist that notion, you are still pretty engrossed in the magical thinking the banker has invested so jmuch effort in making you believe in.

“Interest bearing loans” within the private sector that’s lent from existing deposits is not the same as money being created out of thin air via fractional reserve lending at interest. If I am wealthy and I want to lend or invest some of my money for gain under private contract that’s called business and involves a calculated risk. I am not creating money out of thin air.

Your dumerrage on the other hand is theft by decree… it charges individuals for holding money without their agreement… in essence, what the money represents, their property, is confiscated (stolen) by the Dumerragians. This has the same effect as debt-based money, instead of the government issuing debt-free currency it borrows the currency through the sale of bonds and saddles individuals with debt that they did not agree to thus stealing their property. Whether the private banks or the dumerragian ringleaders steal the property makes no difference.

No, you’re wrong. And christ would certainly disagree also. Lending out money at interest surely is usury.

It’s important to realize it’s completely unnecessary too: we could create all the credit we need interest free. So defending your position is intolerable on two counts.

This is private contractual investment by mutual agreement within the cities of modern Babylon. This is not at all the same as robbing the masses of their private property against their freewill which is what you’re promoting.

It’s absolutely absurd to expect someone to take the risk to invest his or her property in the business venture of a complete stranger for zero return either by sharing the profits of that venture if it is successful (and bearing the losses if it is not) or by charging a fee (profit margin) for the sale of capital (personal wealth in the form of currency).

In your view all return on personal investment of private property is usury… that is absurd and the last thing a nation needs is a gang of thugs imposing these draconian policies on its citizenry.

This velocity crap is just another excuse to steal from us. None of us will deserve or preserve a justice we will not even bother to understand. The stars of the last days of usury will well scatter the arguments of singular solution, understanding already that nothing less will deliver us from the perpetual consequences of the present abuse of power. The rest? Sitting on your hands, advocating false solution, sowing division, or actively promoting pseudo-science with its very consequences manifesting everywhere about us, you Judas are the vehicle of liberty’s demise.

what nonsense.

Velocity is a very important aspect. I’m not saying demurrage is the ideal solution. It just shows how critical velocity is. And why?

Because the ‘real’ money supply is amount in circulation times velocity. Simple.

Even in an interest free credit environment like MPE velocity would be a factor, even though Mike may not see this.

There will always be velocity. No need to disbalance the circulation per represented wealth with either positive or negative interest. It´s both theft. You also incurage people to consume more which has further negative effects on our planet and sociëty. Besides that we already have a fine for not spending, it´s called inflation!

In a passive bibo stable money system there is no inflation

I know. Neither in MPE 🙂

@ Anthony Migchels

“Well, in the face of all I’ve offered you I must simply conclude this is pigheadedness.

Let’s agree to disagree!”

Anthony. What did you offer me? You offered me no historical or current evidence even after I requested it. Your article doesn’t even provide any evidence that the depression in Wörgl was due to the citizenry of Wörgl “hoarding the means of exchange.” In fact all your article does is support my view that the problem in Wörgl was due to the reduction of the money supply due to the “catastrophic” policies of the Austrian Central Bank and had nothing to due with the citizens of Wörgl saving (“hoarding”) their money. You’re the one that’s being pigheaded by continuing to promote a theory based on zero evidence. My conclusion is that your theory is just another ploy executed from the exact same source as the Austrian proponents to use the means of exchange (currency) to rob the commoners of their property.

And I’ve always agreed to disagree.

Hi, Anthony.

A very interesting article.

Doesn’t this system mean that anybody receiving payment at the end of the month would have to pay for the stamps, even if they intended to spend the Certified Compensation Bills shortly afterwards; whereas somebody who had held the Bills from the start of the month until nearly the end would lose nothing?

Thanks Invictus!

That’s a worst case, but it could happen. Experience in Woergl shows that people dumped the cash asap.

Nonetheless: it’s not entirely elegant and users of stamp money do slightly complain, especially in the beginning, when they do not yet see the benefit.

In a modern system this would work out differently: most money would be in bank accounts and the demurrage would be calculated on a daily basis, or even hourly.

This would require continuous electronic monitoring/tracking of all corporate and individual bank accounts and time and place of every single purchase/transaction (on a global scale if it were a US dollar type world reserve currency) down to the last nanosecond because of the potential loss on large-scale transactions. This is Big Brother on steroids. And “Certified Compensation Bills” means an individual’s reward for his/her labor must also be licensed by Big Bother. This is some pretty sick control freak stuff. Perfect to get the NWO minded types running into the trap of the Austrian school.

I agree wholeheartedly! But please correct me if I am wrong. Demurrage is not needed and requires authoritative overhead to implement while having no scientific basis to determine the rates of demurrage that need to be applied. It represents a control mechanism in hands of “experts” that requires relativist and opinion based criteria to “caliber” the demurrage rate. Finally, such decisions are capable of altering the behaviour of the economy as a whole and therefore represent a nest bed for corruption.

http://www.bibocurrency.org defines stable money mathematically and once and for all, with respect to satisfyiing the following requirements:

Definitions for the “ASTA3” acronym

Note: please refer to the Specification document for further terms and definitions that for convenience and to alert the reader to specific meanings will always be capitalised as will be the new terms defined in this document for more definitions please refer to:

http://bibocurrency.org/English/standard.htm. B.I.B.O. is an acronym used in Control Systems Engineering that refers to “Bounded Input Bounded Output” the sine qua non requirement for stability in the types of systems that include money systems.

Abundant: Currency Units shall be available to any compliant Passive BIBO Transaction.

Stable: The Currency System shall be stable according to the scientific definition of stability as applied to money systems to find out more about BIBO visit: http://cnx.org/content/m34515/latest/

Transaction: The process by which Wealth is transferred and Accounted for in @ (Passive BIBO Currency symbol) resulting in a Credit to the provider(s) of Wealth and Debit of equal magnitude to the receiver(s) of Wealth.

Anyplace: Access to the Transaction unit is automatically available for any Transaction where ever the parties may be geographically located.

Anytime: Access to the Transaction unit is automatically available for any Transaction whenever the parties desire.

Anyone: Access to the Transactions unit is automatically available for any Transaction to any human being or group of humans.

ASTA3 Requirements:

The following Currency requirements are met by the ASTA3 definitions given above and reflected in the corollaries of the Rule set in: http://bibocurrency.org/English/standard.htm.

1. The Currency shall be Stable:

A BIBO-Currency is a Passive Stable System because both Input and Output have bounded values and Output never exceeds Input.

The stable currency unit theorem:

A Passive BIBO Stable Currency System by definition implies that all of the system’s component Transactions are also necessarily Passive BIBO Stable. Therefore, it directly follows that if every Transaction is a Passive BIBO Stable process and all currency created is necessarily a product of such Stable Transactions, then, all such currency maintains a Bounded ratio with the wealth input to the system. Thus the unit is also stable by definition!

Also, magnitude of @ Debits at all times is equal to that of @ Credits and the sum of all existing Balances equals zero at all times.

2. The BIBO-Currency System shall serve Transactions not determine them:

A BIBO-Currency System is inert as it has no effect on the creation of Wealth, i.e. its use cannot deter or provoke the creation of Wealth rather it is the creation of wealth and the free spontaneous desire to trade that wealth that generates @ unit Debits and Credits.

3. Passive BIBO-Currency Transactions shall be free of coercion by virtue of availability of @’s.

No side of any Transaction may derive an advantage over the other by virtue of availability of @. No Member can exercise control over access or use of @ by other Members. Both sides of any Transaction have equal and opposite influence over Price in terms of availability of the @. All Transactions in @ are fully voluntary and free of any coercion.

4. Use of @’s shall be uniquely for the representation of the value of Wealth in Transactions

Creation and transfer of Wealth does not depend on @ but rather use of @ depends on previous existence of Wealth.

5. @’s shall not be subject to counterfeiting or falsification

Only @s resulting from identifiable transactions by authenticated users are recognised.

Poor attempt to copy Mathematically Perfected Economy. You haven´t covered all categoric faults or explain how to implement.

No copying whatsoever, never have read or referred to MPE in the thirty years prior to the publishing of BIBO, neither is it required all necessary references exist independent of MPE. The specification is the modus operandí of an implementation. All that is required for an implementation is simple account entry records according to the system rules and corollaries.

Your just re-inventing the wheel with bad intentions or not, I don´t know. What´s the point? I don´t care myself who get´s credit for it as long as we replace the current system with an immutable currecny, but it seems obvious to me Mike should be given credit as he has been doing this since 1968. Your just another eleventh hour reformer. No hard feelings, just dissapointed due to more division.

@Anthony You evidently want to pretend that velocity isn’t already, virtually instantaneous. It isn’t whether your ability to pay can be determined fast enough to execute vital transactions; the whole issue is whether you have access to sufficient funds or credit-worthiness. You should complete your interview with Mike if you want to establish your purported fact of velocity.

You know, my impression is that you are substantially deficient in integrity. “Maybe mike doesn’t realize it,” conveys nothing but pretended superior analysis. If there were such an analysis, that analysis would be your argument. What’s the matter with you? I see right through it, myself. What you hope to convey is the impression of integrity, not its substance.

This is wrong on many counts Jake. Immense sums are withheld as long as possible, especially by big business and government to maximize their liquidity positions. You have worked in major corporations, right? Then you must know this.

Again, check the graph: velocity has tanked since the depression started because everybody is acting according the old wisdom that during deflation cash is king.

Why don’t you get your head out of Mike’s ass and start doing some thinking for yourself. Mike is good, one of the very best, but he ain’t no saint, he didn’t invent it all, MPE is not perfect or complete and Mike’s wrong routinely, just like everybody else in this business.

I consider all these theories just controlled opposition coming from the same dark priesthood. The black arts of deception financed by the illuminists money powers. They confuse so the plunder can continue. Look at all the stuff in your post. Who on earth is supposed to understand that stuff? If the butcher, the baker, the carpenter, the fisherman and the farmer and those of such can’t explain it or understand these theories then that means those who invented it and promote it don’t want those sorts to understand it either. And it just so happens that those are the sorts who produce the majority of the world’s wealth. Now aint that a coincidence.

All these word games. When good responsible people within a government prove to successfully manage the issuance of a nation’s currency that government now becomes a “state.” When honest hardworking people save their money “saving” now becomes “hoarding”. This is nothing but deceptive word games from a dark priesthood posing as truth bearers.

Jimi Hendrix put politics (or political economy) in the right perspective when he said “it’s the art of words which means nothing.”

If there was a modicum of truth to your hysterical claims that demurrage is theft and would be used to exploit and enslave men with debt, the banker cabals would have used it long before Michael Unterguggenberger (or whomever) was an idea in God’s mind. That they haven’t more than suggests that this monetary system cannot be used for evil ends. All of your complaints are centered on theoretical and casuistic quibbling that vanishes in the light of practical experience and application. Just look at what happened in Austria. It was discontinued, like all of the debt free fiat banking systems, not only at the hight of its success, but also because of it.

re “Burgomaster”

“Burgermeister” is conventionally rendered as “Burgomaster” in English, although the equivalent English word would be “Mayor”.

thank you for this Invictus! Another little riddle solved1

@Contrarian Rex

“If there was a modicum of truth to your hysterical claims that demurrage is theft and would be used to exploit and enslave men with debt, the banker cabals would have used it long before…”

So because the banker cabals didn’t use the dummerage method of plunder that proves it wasn’t plunder. Way to spin… more word games from the political economy spinsters… Keep em comin because that’s all you Illuminists agents with your staged opposing theories have when you don’t have “a modicum of truth”. However, it does have educational value with regards to the intricacies of the Black Arts.

lol 🙂

What proves it isn’t plunder is that actual application of demurrage in the real economy. Were the Austrians plundered or was there economy resusitated with finanacial prosperity for all?

Grief. First you try to prove that the dumerrage isn’t theft because the bankers didn’t use that method of plunder, now you try to prove that it isn’t theft because the economy resuscitated as if economic recovery proves the absence of plunder. Any national currency, debt-based or holding fee-based, issued into the real economy during intentional contraction resuscitates economies. Debt-based plunder and holding fee-based plunder work exceptionally well at plundering during economic recovery.

The economic prosperity demurrage generates is real and merely appearance or ponzi scheme generated bubble. More real wealth and jobs were created. If this can be maintained indefinitely, and it certainly looks as though it could be, then your notions of plunder has no actual merit. For there to be plunder, there must be a victim. I don’t see any beyond your doctrinaire, and by now i would have to say contentious, speculation. Show me how the Austrians were headed for exploitation in the long run based on the data and maybe i’ll consider your view.

The economic prosperity demurrage generates is real, and NOT merely … [ is how my first sentence should read.]

Anthony,

I cannot agree with you, demurrage cannot generate prosperity. Prosperity is the result of individual autonomy and freedom to satisfy needs in an economy, it is the production of goods and services in an economy that produces prosperity and NEVER can it be the money system.

You have fallen into a fallacy by allowing that theories of money create the fantasy that money is power, that it is therefore a scarce commodity of indisputable value. Numbers and pieces of useless metal and paper with numbers inscribed on them, DO NOT AND NEVER WILL GENERATE PROSPERITY, in fact it is PHYSICALLY IMPOSSIBLE FOR THEM TO DO SO. It is this that is at the core of the false paradigm of money.

Demurrage is an interference that to be useful, depends on there being an incorrect definition of money as a thing that flows through the economy. Money does not flow, the economy is like a highway and the toll booths are like accounts, each keeping track of how many cars enter and leave the highway at their position, It is not the numbers that flow through the highway but rather it is the cars.

This whole idea of having to do things to records of value (money) in order for real life events to occur is bullshit. The only advantage of demurrage to interest is that everything tends to zero all the time, but it is a theft that serves no one directly other than acting like a cattle prod, because people will be forced into spending for the sake of it to not get zero value back.

Demurrage is not necessary and if we get to zero interest there is no need to continue to negative interest.

In any event the only requirements for stable, limitless and accessible money are here:

http://www.bibocurrency.org/English/stable%20money.htm

Please tell me where we are wrong and if no one can, why are we wasting time with such theories that confuse a band-aid solution within a false paradigm with requirements for a correct paradigm. Do you see the difference?

Because a faulty furnace fills the house with soot I need to control the air flow and use filters. Therefore a good system requires control of air flow and filters.

This is a fallacy, rigth? But this is the way you are reasoning on this issue.

Because there is a problem with money flow in a society that thinks that money retains value we control the “flow” of money by applying demurrage. Therefore since it is good to solve the flow problem then demurrage must be good as a standard feature of any money systems.

Wrong!!!! The problem is ONLY solved when people let go of the idea that money has value other than a record of value and that it flows.

Finally, the argument that demurrage forces wealth to flow is correct, but not desirable as the only reason to move stuff around is because of need not a monetary

cattle prod.

Marc

I’d say the facts on the ground are not favor of this Marc. Unterguggenberger’s notes DID create prosperity!

I burn the wood and dampen the fire with a cloth, I then remove the cloth and the fire grows anew. What makes the wood burn oxygen or removing the cloth?

“The economic prosperity demurrage generates is real and not merely appearance”

Where did I say the prosperity generated from the dumurrage wasn’t real? You just keep repeating yourself using different word arrangements, “word games”. But I will repeat myself using exactly the same words because truth doesn’t require to be continuously re-cloaked with different word rearrangement:

“Any national currency, debt-based or holding fee-based, issued into the real economy during intentional contraction resuscitates economies.”

What do you see in the above comment that suggests “merely appearance” of prosperity?

“For there to be plunder, there must be a victim.”

More deceptive word games: If you get plundered during economic prosperity resulting from the robber barons increasing their quantity debt-based or user fee-based currency you’re not a “victim” of plunder?

Please… keep spinning… I find your commentary and all the staged opposing commentary quite amusing and a typical display of Black Art as shown by the following opposing comment:

“…the fantasy that money is power, … NEVER WILL GENERATE PROSPERITY …”

If money has no power and never generates prosperity then why is it that when central banks reduce its supply (as in the example of the Austrian Central Bank) prosperity is negated? If it doesn’t have the power to generate prosperity then it certainly wouldn’t have the power to reduce it.

And look at the utter volume of spinning words of emptiness required to make white appear black and black appear white, plunder to be victimless and bank accounts full of money to have no more power than empty ones: the language of the parasitical class.

“If money has no power and never generates prosperity then why is it that when central banks reduce its supply (as in the example of the Austrian Central Bank) prosperity is negated?”

In the present system money is power because it is treated as a scarce resource coupled to the vital function of measuring and recording value, rather than just being a record of value. The distinction is subtle but ever so important.

By the way there is no staged opposition, my comments are mine alone. I resent that remark.

@ Marc

“Sorry but you didn’t understand what i was saying, the point is that in reality money only is a record of value, it is not anything else.”

I understood what you said Marc and my apologies for being indiscriminate but I have no interest in the array of opposing, long and drawn out, complex theories clouding the simple nature of money.

A “record of value” of and by itself doesn’t have purchasing power thus money is more than just a “record of value”. Many things and methods can be used to record value (a pen and paper) but that doesn’t give those things or methods purchasing power. So the evidence that money is endowed with value (by fiat and agreement) is the fact that you can buy stuff (wealth) with it.

The last thing a sovereign nation’s commoners need is a body of money “experts” telling them that their sovereign money they toiled for is just worthless “records of value” or that their money is just “certified compensation bills” that are the property of the “commonwealth” thus all the peoples’ wealth is licensed by the “state.” They don’t need “experts” using complex word games deliberately confusing the simple nature of their money.

I believe the power in money is used to concoct a lot of these complex word games (theories) to convince people that their money has no power. In my opinion these theories demonstrate what the power of money can do: monay has the power to make people say it’s powerless. Is it no wonder that the time tested and proven method (not theory) that the banking cartel fear the most, the responsible central issuance by a sovereign government of lien-free legal tender, seems to be mysteriously absent from all these different schools of monetary theory?

“the banking cartel fear the most, the responsible central issuance by a sovereign government of lien-free legal tender, seems to be mysteriously absent from all these different schools of monetary theory?”.

You picked this up somewhere, and now you’re just as enthralled by it as you were previously with the current system, before you partly woke up.

Marc has been in the monetary field for longer than he cares to remember. Do you really believe he does not intimately understand debt free money printed by the sovereign?

Try to listen tammuz. Your still a green horn. There is more to the issue than you think.

Simple as that.

Exactly! You have illustrated for everyone what the problem is. You think money has purchasing power, but that only shows how subtle the brainwashing is under the current money system and the importance of math to break that spell.

What you have missed is that the whole notion of purchasing is an extension of the definition of money, the definition of money is arbitrary and that transacting wealth beyond mere barter, DOES NOT REQUIRE THAT THE RECORD OF WEALTH GIVE ANYONE PURCHASING POWER.

Or is it that you are in favour of using money as a means of limiting peoples purchasing? Which would mean that you are in favour of the idea of using money as a means of control of people and society. Because if as you say money must provide “purchasing power” then you must believe that peoples needs desires and wants are not enough “purchasing” power. Is that what you are saying?

What so many forget when they talk about money is it is 100% arbitrary and the current definition of money is absurd, but by using that definition to try to talk about it even in sincere attempts to reform it, we fall in the trap of trying to build logical and valid arguments on the basis of an initially insane proposition.

Everything that tammuz has said about money being purchasing power etc. is an extension of the need forced on the users of the current false paradigm to reconcile the absurd notion of money being both a scarce commodity and a unit of measure. No one ever NEEDED to invent that notion, there is no definable functional benefit in doing so (that anyone would admit to being good). What there is however, is a logical confusion between the functions: transaction, measuring and recording value. Each of these are functions that can be performed independently of each other and there is no need to amalgamate them into one function or object and doing so just proves that the designer is not very good and is either a crook mathematician or an erred non mathematician.

So to conclude:

1) We all know that we can transact without money, so we have “purchasing” power without money, it is called barter.

2) It is trivial to create a means by which to measure value in a stable fashion, that is proven and provided at bibocurrency.org, measuring value is orthogonal to purchasing power i.e. you don’t need purchasing power to measure value. And even more trivial it is to record such values.

3) “Purchasing power” can be determined by any number of other rational criteria such as whether or not someone is qualified to purchase a certain object that may present a risk to third parties.

Money being “purchasing power” is just a circular conclusion of a insane proposition whose only function is confuse everyone about trivial functions. Humanity was hoodwinked into this scam either by error or design but the whole thing is bullshit.

What we need, is to realise that all theories that are based on this insane notion are useless. We need to realise how simple it is to provide reliable liquidity through the stable measure of value and its divisions in a way that is always accessible to all for any transaction and that it is insane to endow money with any power at all. We must cease to confuse social governance with the management of records of value.

Building control of the economy into a money system is an idiot proposition or a devil’s prank.

Immutable (currency) is the word your looking for 🙂

I use “inert” but I like immutable

@Marc

“In the present system money is power because it is treated as a scarce resource coupled to the vital function of measuring and recording value, rather than just being a record of value.”

Money has power in all systems that use it, past and present, because the money derives its power from the consensus of its users, namely, that it represents all wealth generated by those same users. The problem is not the practical idea of an agreed upon medium of exchange. The problem is that a small amount of the users of that medium who themselves don’t generate any wealth (parasites) conspire and promote all these theories to control the manner of its distribution in order to siphon off the generated wealth it represents for themselves.

“By the way there is no staged opposition, my comments are mine alone. I resent that remark.”

In my opinion much of the opposition, wittingly or unwittingly, is staged. The comments may be their own sincere views but they are formulated from controlled sources as evidenced by the rigidity and inflexibility of these different schools of thought. Which is why these are the last sorts the commoners need looking after the management of their money. Honest management of money is flexible, dynamic, changes and adapts as it learns and refines its management by continuously tweaking it closer towards perfection to enable that particular citizenry to generate the maximum amount of wealth and prosperity achievable. Rigid monetary theories that are founded upon debt, holding fees, taxes, complex theories understood only by the priesthood or restricted by a commodity inaccessible by the majority only serve to enrich the few and impoverish the many.

Sorry but you didn’t understand what i was saying, the point is that in reality money only is a record of value, it is not anything else.

The only function it provides is that of measuring wealth and its divisions for the purpose of trading a piece of value of an indivisible piece of wealth for an icecream cone.

The fact that people agree to a common unit doesn’t endow money with any other property but to record value. The value can only reside in the wealth (goods and services) nowhere else.

As for managing money, there is no need to manage money when it is just a record of value, there is no need to control the volume of money in circulation providing the following two requirements are met:

1) All units are generated by transactions

2) All transactions are Passive BIBO stable

That is the all of it. Essentially, money that follows these two requirements acts as a ruler to measure value with and in a sane world everyone has their own ruler, no need to borrow meters and repay them with bigger meters, which describes exactly the stupidity of the current money paradigm.

What matters are the quality of measurements made with a stable ruler not whether or not one has access to one. Of course, if you don’t have one (or its equivalent) you will have a hard time measuring in sync with those that do.

There is nothing more to all this. No need for demurrage no need for interest, no need for experts and money managers. Stable money trivialises the function of money and lets us all get along with really living.

@Anthony

“Marc has been in the monetary field for longer than he cares to remember. Do you really believe he does not intimately understand debt free money printed by the sovereign?

Try to listen tammuz. Your still a green horn.”

I know that Marc and just about everyone else here knows about sovereign lien-free money. All have been in the monetary field longer than I have because I’m not in the monetary field. I consider it to be one of the many disciplines of the Black Arts. Like all disciplines in the Black Arts it wasn’t constructed nor is it executed to bring understanding and clarity but confusion leading to ignorance. This is evidenced by the fact that all the long-time monetarists, as well as the non-greenhorns present here, can’t even come to a consensus on what money is. Thus perfectly sustaining and promoting the illusion of confusion and ignorance, which is precisely what this Black Art discipline was designed to do.

I recommend to those that are not in the monetary field to not even listen lest they have there understanding about money warped into complete ignorance.

There is no black art here, there is a lot of misunderstanding about what money is everywhere because we have all been brought up with a false paradigm around money. At bibocurrency.org we propose a rational and logical definition of money that I would love you to prove is invalid, just because I don’t like being mistaken and not know it. But you will have to do it with math and logic no opinions and conjecture, we are dealing with a man made device not a natural mystery.

What I find unfair on your part, is to try to smear efforts here on the basis of there not being agreement on what money is as if elsewhere there is. Come on 99% of humanity is confused about money!!!

And there is a lot of agreement here about basic concepts such as the effect of interest and the need for money to be neutral I like to say inert. The fact that some of us have taken it further, to the point of exact mathematical analysis only helps to engender greater clarity and therefore consensus at least in the long run.

99% of humanity doesn’t need you or anybody else to tell them what their money is just like they don’t need anybody here to tell me what their shoes are. The only difference in money and shoes is that nobody gives a crap about people’s shoes but they sure as coming hellfire give a crap about their money because they want to control it in order plunder their property.

99% of humanity is not confused about money and they don’t need elitists know-it-alls concocting up schemes to rip them off. All these word games have one thing in common: the control and plunder of people’s wealth by controlling their money. There never has been a consensus among you know-it-alls and there never will be a consensus because like the Black Art of the political party system, there’s not supposed to be a consensus only a confused, enslaved and plundered public.

I have seen our enemy and he is us!

Exactly what the cartel want commoners to believe.

Tammuz, you are off the mark. 99% of humanity have been brainwashed about money, I am not and i don’t think many others on this list are. But I am not going to waste anymore time discussing it with you until you are more composed.

@Marc

“Tammuz, you are off the mark. 99% of humanity have been brainwashed about money, I am not and i don’t think many others on this list are. But I am not going to waste anymore time discussing it with you until you are more composed.”

Not so Marc. It’s the other way around: Well over 99% of humanity doesn’t understand you or many “others on this list”… who are you’re synthesized opposing counterparts. And that’s precisely the way it’s intended to be for reasons already mentioned. And just because I don’t cooperate with any of the brainwashing programs listed here doesn’t mean I’m not composed.

Tammuz, 99% don’t understand the conventional definition of money was my point. What we know is that definition is garbage. No one knows what % understand mutual credit but by the number who support it compared with when I started out 30 + years ago, it seems that the majority are capable of grasping the idea.

But rather than waste time with such speculations, tell me where at http://www.bibocurrency.org we are wrong and “incomprehensible.” It might be the case that it is you that doesn’t understand.

But before we go there lets get some basics straight:

Tammuz: “Debt money is the result of interest. Money becomes debt when it’s issued through the sale of interest bearing bonds and the creation of interest bearing loans.”

That statement is utter nonsense, money becomes debt not as a result of interest but as a result of Principal loans. Interest makes debt grow as a function of time either in a linear, quadratic or exponential fashion, all of which are unstable according to control systems theory. The problem is not that money is debt it is that debt grows as a function of itself, and that is what destabilises the economy. The whole point of money is to represent debt even when it is issued debt free from the moment someone is paid in that “debt free” money, that money becomes a receipt for wealth i.e. a debt. If there is no guaranty of redeeming value with money to cancel the debt to the bearer then no one is going to want the money.

The world is facing debt growth that has completely outstripped availability of principal to pay it at any rate, to the point that it is simply impossible to pay ever under the current false money paradigm, so either it is written off or whole countries are foreclosed on.

You confuse basic concepts and yet you have the nerve to smear others who know much more than you do about this along with a host of other areas you would do well in brushing up on, like basic math. What astounds me is how we live in a society where people believe that they can comment and opine about math based systems, without having to understand the most basic math concepts relevant to the subject! What do you know about the math of money?

As for your loss of composure, smearing others as you have is not only not productive it is the mark of those who insist on participating when they don’t know what they are talking about.

You feel intimidated Tammuz and a natural reaction is to deny what is so obviously presented. Stop digging yourself a hole. It´s no more than simple arithmetic

“That statement is utter nonsense, money becomes debt not as a result of interest but as a result of Principal loans.”

Are you saying that if governments didn’t borrow their money through the sale of interest bearing bonds and instead printed it and spent it into the economy with out borrowing it that they would still incur debt?

Did you read my post! I wrote:

“…money becomes debt not as a result of interest but as a result of Principal loans…”

……

“.. Interest makes debt grow as a function of time either in a linear, quadratic or exponential fashion, all of which are unstable according to control systems theory…..”

……..

“..The whole point of money is to represent debt even when it is issued debt free, from the moment someone is paid in that “debt free” money, that money becomes a receipt for wealth i.e. a debt. If there is no guaranty of redeeming value with money to cancel the debt to the bearer then no one is going to want the money…”

Your question was already answered.

Marc

Isn’t it obvious that debt is principle loan. Noboby thinks that is a problem. The problem that everyone associates with perpetual criminal debt has to do with the interest attached to it. That is all tammuz, or myself for that matter, is referring. Your technical parsing is just making a mountain of confusion over a molehill of an issue.

@Marc

“..The whole point of money is to represent debt even when it is issued debt free, from the moment someone is paid in that “debt free” money, that money becomes a receipt for wealth i.e. a debt. If there is no guaranty of redeeming value with money to cancel the debt to the bearer then no one is going to want the money…”

Marc this is all semantics. Because there’s no absolute guarantee that Canadian government issued non-borrowed legal tender (debt-free) will be accepted, even though it has always been accepted, therefore it’s equivalent to debt is just word speak.

If governments issued the money themselves and spent it into the economy they would incur no debt. What is crippling nations is the interest on money that doesn’t need to be borrowed. If governments stopped borrowing and issued the money themselves that would solve the problem.

Tammuz;

“If governments stopped borrowing and issued the money themselves that would solve the problem.”

No, it would not solve the problem, because the solution lies is not in who issues the money the issue is what money is designed to do. It is not as simple as saying “debt free by the government”, because the problem is that people confuse money with wealth and once they do that they hoard money and once they do that they lend at interest and voila, the whole happy party is over and bankers as they did in the past will say: “governments can’t do this job” and we come back to central banks gumming up the works until they fail and the whole stupid cycle repeats itself.

The problem is that people don’t realise that the only useful and benign function of money is to measure wealth and its divisions and record those measures in accounts. Wealth is not money bank balances are not wealth, they may refer to wealth they may support claims to wealth BUT THEY ARE NOT WEALTH.

Once humanity realises this, the problem will be solved and the simple math will lead to stable currency specification because the math says so.